You often would have seen a sudden rise in the price of an asset, and it continues to go up for a while. Investors, in this case, can apply a momentum investment strategy and gain instant profits.

Momentum investing simply means buying the stock at its growing price and selling it at higher prices. Experienced momentum investors have seen 1-3% growth in their portfolio even in weeks.

Do you want to learn all about momentum investing and how you can ride the wave and uplift your portfolio? Let’s find out the answers.

What is momentum investing?

It works on the ideology of Richard Driehaus, an investor who is referred to as the “father of momentum trading”. Driehaus said investors could make more money by buying high and eventually selling at even higher prices. The main idea here is to follow the market trend.

Momentum investing is an investment strategy that encourages investors to buy stocks when it is following an uptrend and sell it when they see a sign of a reversal that could eventually go into a downtrend.

While investing through momentum investing, you must know if the trend is established correctly; if it is, the trend will likely go in the same direction. So, investing as early as possible helps bring in more profits.

How does momentum investing strategy work?

Trading is all physiological, and such investing works on the principle of cutting your losses and letting your winners ride. It is purely based on price action, and the momentum is high when it shows. The strategy begins by analyzing the trend as it helps to pick up the stocks that have already started rising.

The sudden rise then attracts more investors, resulting in higher stock prices. In the same fashion, when the price begins to fall, investors start selling their positions, and the price falls rapidly.

Reason to use

Along with many other reasons to use the momentum strategy, one of the best ones is that it is a simple strategy that even beginners can use. Investors buy an asset that is already moving upwards, which means investors will go with the trend, eliminating many risks.

Because the asset is already moving up, there is a potential for high profits quickly. The ROI also rises as the investors use the market volatility to their advantage.

How to use the strategy?

Momentum investing can turn into large profits for the trader who has the right qualities, can handle the risks involved, and can commit themselves to stick to the strategy.

Momentum in finance is driven by a few factors that an investor must consider before using the strategy.

- Volatility

It is how frequently the price of an asset changes. This is one of the most important factors for momentum investors.

- Volume

It shows the number of buyers and sellers currently investing in the asset.

- Time frame

Momentum investing requires you to take our profits until the trend changes; hence, time plays a vital role in monitoring the overall market phase.

In your trading, you may use a few of the commonly used momentum investing tools like:

- Trendline

- Moving averages

- Stoch oscillator

- The ADX

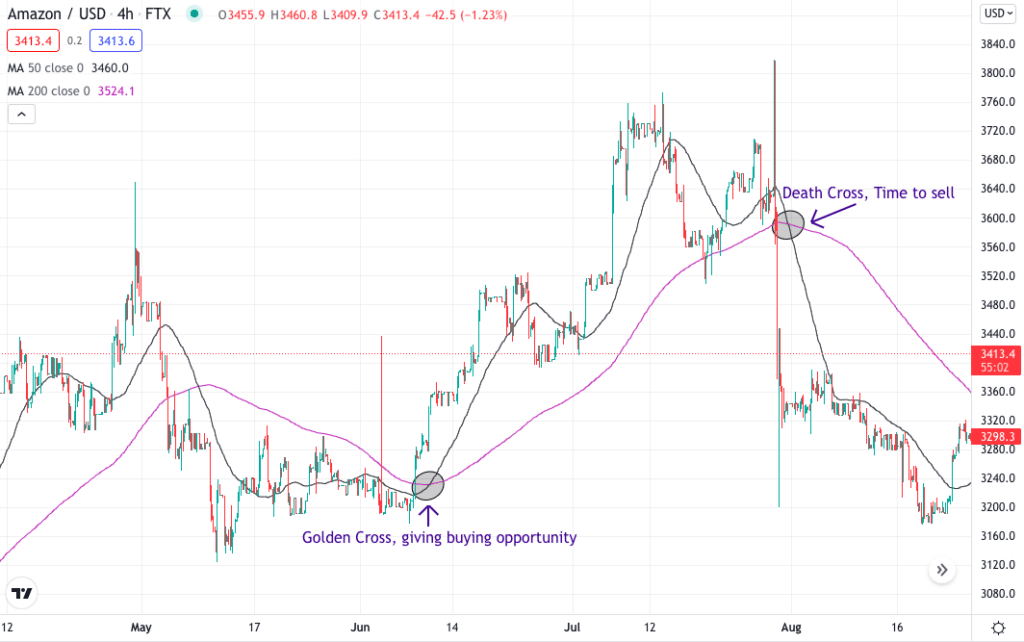

Below is a simple yet powerful strategy momentum strategy that can help you profit from the market. This strategy includes using two moving averages (50 and 200), and it’s a crossover to determine the entry. Here 50-MA is a fast-moving average while 200-MA is a slow-moving average.

A golden cross shows a bullish sentiment in the market and is formed when the 50-MA crossed the 200-MA moving up. It shows that the stock has more potential to go up, following the ongoing uptrend. A death cross, in contrast, shows a bearish sentiment and is formed when the 50-MA crossed the 200-MA moving up.

Here we will wait for the golden cross formation to signal us to buy in an ongoing uptrend and the death cross for a sell signal.

In the above chart of Amazon, you can see a golden cross formation, when the 50 MA crosses the 200 MA from down, moving up in an ongoing uptrend; this is a place where you can buy the stock as you will be following the momentum.

You will let the position go higher until the momentum tool confirms, i.e., moving average death cross. Moving forward, you can see the 50 MA crossing the 200 MA from up moving down. This is the point where you will exit your position.

Pros & cons

Momentum trading is good for achieving short-term profit, but it comes with some disadvantages that you must know before using it.

| Pros | Cons |

| Momentum investing can be significant and give you profits in a short period. | This type of investing is risky as the investors try to take part in the market, looking into the current scenario of the market that can change time. |

| Unlike long-term investors, experienced momentum traders have the potential to turn out profits on a weekly or daily basis. | It is prone to losses if you buy a stock when the market takes a dip, it may so happen that the dip is not the pullback but panic that brings the market more down. |

| In comparison to long-term investing and short-term trading, momentum is simple and can be learned easily, as there is very little buying and selling that leads to fewer mistakes. | Momentum investors use the volatility to make their profits; if the volatility is low, there is no use in entering the market. If the volatility is high, there is a risk. |

Final thoughts

Momentum investing is sometimes not a great choice compared to value investing, but the profit potential of momentum investing increases over time.

Yes, investors will agree that they see short-term good profit percentage, but it is also prone to risks as the market can reverse anytime if not entered at the early stage. You may need to research and find the most profitable investment strategy that works for you.

If you are new to momentum investing, you need to polish your technical analysis skills, market timing, and other strategies to profit from the market.