Many investors are continuously making immense profits by using pure arbitrage in the market. Warren Buffet started investing from an early age and was already using pure arbitrage strategies.

Pure arbitrage speculation is a straightforward strategy, and you don’t need to be an expert in the field of investment. However, you need to know when an opportunity arises and how to use it in your asset portfolio.

Surely you would want to make a decent profit from this simple strategy, but you need first to learn what it is and how you can gain from it.

Well, read on to learn everything you need to know about pure arbitrage and why you should start taking advantage of it today.

What is pure arbitrage?

This method allows investors to make easy and risk-free gains by taking advantage of market flux.

Thanks to pure arbitrage, investors can buy a specific asset on, let’s say, the New York stock exchange at a lesser price and sell it on the London Stock exchange, where the same asset is trading at a higher price.

Even though pure arbitrage may sound barely credible, no thanks to its profit method, it still provides investors opportunities to cash in on fluctuating market discrepancies.

Why do investors use pure arbitrage strategies?

Such strategies have many perks. Here are some reasons why investors opt for pure arbitrage strategies:

- Opportunity for low-risk profit

With pure arbitrage, investors can make quick and easy low-risk profits as they are basically buying and selling specific assets simultaneously to take advantage of market fluctuations.

- Sophisticated systems manage arbitrage opportunities

Some of the characteristics of pure arbitrage trading involve speed, huge volumes, and large sums of money.

To profit from market fluctuations, arbitrageurs use powerful computer software configured to spot opportunities by detecting the minor price changes and executing trades to that effect for quick and hassle-free profits.

- Hedging opportunity

Hedging is a strategy that most investors use, and pure arbitrage gives investors the chance to limit their losses by hedging positions at low risk.

Pure arbitrage investment strategies

There are different types of pure arbitrage strategies that you can use to make easy profits.

1. Triangular arbitrage

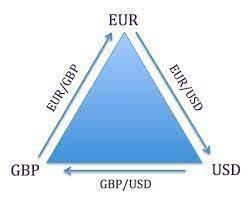

The forex market can occasionally provide an opportunity for arbitrage if a price discrepancy exists. An advanced strategy known as triangular arbitrage is perhaps not widely used. However, it can garner lucrative profits.

Triangular arbitrage is when a price discrepancy exists between three pairs. Furthermore, triangular arbitrage is more efficient if traded with an automated trading algorithm.

Let’s explain with an example.

You would buy or sell a specific amount of EUR/USD and convert this to EUR/GBP. Then finally, convert the EUR/GBP to USD/GBP. The overall gains would come from the difference in prices.

As an example, let’s assume you have $1 million, and the following pairs are currently at the following exchange rate:

EUR/USD = 0.8631

EUR/GBP = 1.4600

USD/GBP = 1.6939.

An arbitrage opportunity exists with these exchange rates, and you decide to:

- Sell dollars for euros: $1 million x 0.8631 = €863,100

- Sell euros for pounds: €863,100 ÷ 1.4600 = £591,164.40

- Sell pounds for dollars: £591,164.40 x 1.6939 = $1,001,373

- Subtract the initial investment from the final amount: $1,001,373 – $1,000,000 = $1,373

Your profit from this arbitrage trade would be $1,373 (excluding any transaction fees and taxes).

2. Risk arbitrage

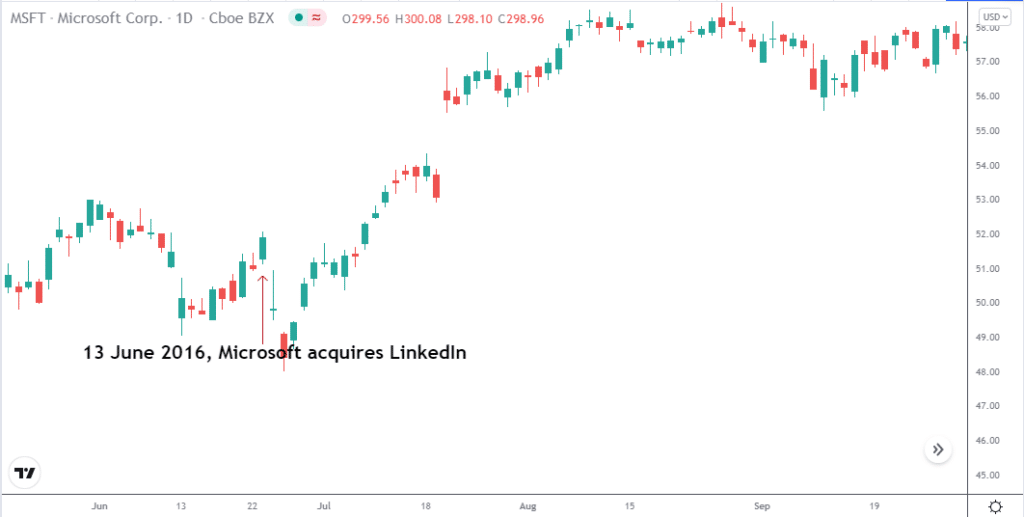

It is also known as merger arbitrage and is applicable during a corporate merger or acquisition.

The acquiring company would offer the shares at a premium rate to buy them lower than the market value. Usually, the target company’s share price will increase during the acquisition, and if you buy the stocks before the deal is closed, you can profit from the price rise.

When investors buy an asset at its current market price and sell the same asset for the minimal difference in price on an open market, they are primarily creating a risk-free arbitrage strategy.

Microsoft acquired LinkedIn in 2016, and the deal closed on 13 Jun 2016. The result of the merger caused Microsoft’s share price to increase on the day. Investors can use this type of arbitrage to buy Microsoft stocks before the merger and sell them afterward at a higher price.

Provided you buy when the asset is low and sell-off when the price is high, you can continue to profit using this arbitrage strategy.

3. Cash future arbitrage

This arbitrage is a brilliant strategy for buying an underlying asset’s futures contract and holding it until the contract expires.

This strategy is somewhat more complex, but we will use an example to explain it. It is an example of a futures contract that expires at the end of October 2021. The margin for profit is dependent on the future price increase of the contract. Therefore, this type of arbitrage is slightly riskier than the other strategies.

We will assume that an asset is trading at $1400, and the future contract, which has a duration of one month, is priced at $1500. Furthermore, the asset has a carrying cost which includes insurance, storage, and financing. And we assume this is $20.

The opportunity would be to buy the asset for $1400 and at the same time sell the futures contract for $1500. You then hold the investment until the contract expires after one month and make a profit of $80 ($1500 – $1400 – $20).

Pros & cons

Pure arbitrage might sound very easy. However, we need to look into the pros and cons of this strategy.

| Pros | Cons |

•Low to zero risk Pure arbitrage is a less risky investment, especially when you compare it to other investment opportunities. | •Pure arbitrage isn’t so profitable While pure arbitrage looks exciting on paper, many people forget to factor in transaction fees and taxes that come with buying and selling a particular asset. |

•Maintain decency across different market Pure arbitrage ensures that the prices of assets across different markets remain more or less the same. | •Arbitrage opportunities aren’t easy to come byIn real market situations, there are not a lot of arbitrage opportunities. Plus, you’ll need to have access to some of the most sophisticated tools to spot arbitrage opportunities quickly. |

•Allows market to operate at an optimum Pure arbitrage ensures that markets operate at an optimum. If there were no arbitrageurs, then stocks would trade at significantly different prices across different markets. | •The risks are significantly higher Without slippage, increasing spreads, and hefty commissions, the high-quality order execution is quickly becoming an elusive ideal. |

Final thoughts

There are not a lot of risk-free investments out there, but if you’re interested in a less risky investment option that guarantees profits, you’ll not be disappointed to give pure arbitrage a try.

Even though you may be new to pure arbitrage, the strategy is pretty easy to understand. Plus, we have highlighted all of the major selling points and downsides of pure arbitrage.