Investing in the real estate market is an excellent alternative to other investment forms. Real estate trading involves benefiting from an adverse economy to boom as the housing sector perfectly represents a country’s development. This process involves a deep knowledge about the macroeconomic factor of a country with a specific trading approach. You cannot just buy any real estate stocks or ETFs by looking at the price.

Deep financial market knowledge is essential for making any real estate investment. If you are interested in expanding your investment in the real estate sector, the following section is for you.

We will discuss everything a trader should know regarding real estate development with a specific trading approach. After completing the whole section, you can claim yourself as a pro to REIT investing with the opportunity of getting maximum benefit.

What is a real estate investment strategy?

It is a wealth maximization method like climbing a mountain. If you are an enthusiast about your investment career, you should include real estate investment in your trading portfolio. However, many real estate investors don’t have a clear idea about the business in the first place.

Therefore, before moving to the exact buying and selling method, investors should have a clear idea of the financial aim. Later on, choose one or two real estate investment strategies that suit your personality. Ensure that the strategy includes a sound risk management system with a higher accuracy rate.

How to determine the real estate investment strategy?

You should choose the reliable one that suits your personality among different strategies. In this section, we will see the list of profitable investment methods in the real estate industry so that you can find the reliable one.

- Rental properties

You can easily earn passive income if you have a property by allowing other people to live there and pay money as a tenant. It is the most effective and easiest method to earn money from rental.

For making investment perfect, you can allow any property management company to get a stable and guaranteed income from your property. However, the management company may charge a percentage from your income to reduce your profitability.

- Buying and holding

The HODLing approach is prevalent in the investment world, where people seek buying opportunities in a property where the economic condition is adverse. It allows people to buy with lower value and hold the property until the economy becomes stable.

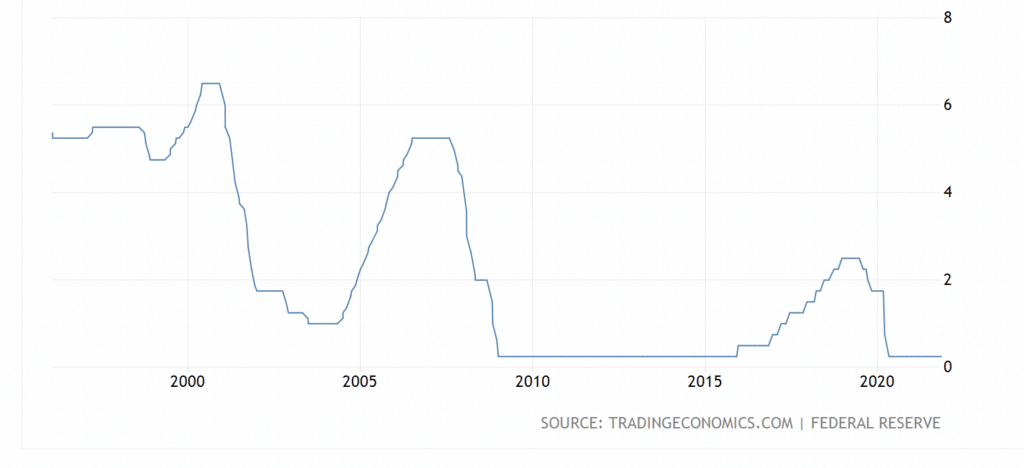

Investors should find how the central bank projects and set the economic outlook where consecutive rate cuts would signify a financial disaster, which is the perfect time for investment. On the other hand, if the economy becomes stable, sell your property with a capital gain.

- Flipping properties

It is something between rehabbing and rental. Later on, fix the place and sell at a higher price as soon as possible. In this process, you need to find a lower market value property. However, there is a risk associated with the property flipping where holding it for a long time includes the possibility of losing the market value.

Bullish trade setup

In the bullish trade setup, we will use a buying and holding approach that involves buying properties during the economic uncertainty and holding it for a capital gain. Let’s see the step-by-step approach in holding approach.

Step 1. Macroeconomy

First, identify the suitable economic environment where the interest rate and inflation suggest that the economy faces a negative momentum from a disastrous situation. One of the best ways to find such cases is uncertainty like a natural disaster, economic collapse, pandemics, etc.

Step 2. Verify economic indicator

During an adverse economic situation, the interest rate should be lower. Moreover, other indicators like inflation, employment, and GDP should support the interest rate.

Step 3. HODL

After buying a property, you have to hold the investment for a long time until the economy stables. Then, it should increase the buying power of people with an upside momentum in the property price.

Enter

Buy the property in a good position with the potential to increase the value. In that case, any property with a perfect communication system has a higher possibility of providing profits.

Take profit

You should hold the trade until the economy reaches any stable position. In this way, you can sell some portion of the property to achieve an early gain. Later on, book full profits when you see the economic boom has appeared.

The above image shows that the US interest rate is moving lower, providing a decent investing opportunity in real estate.

Bearish trade setup

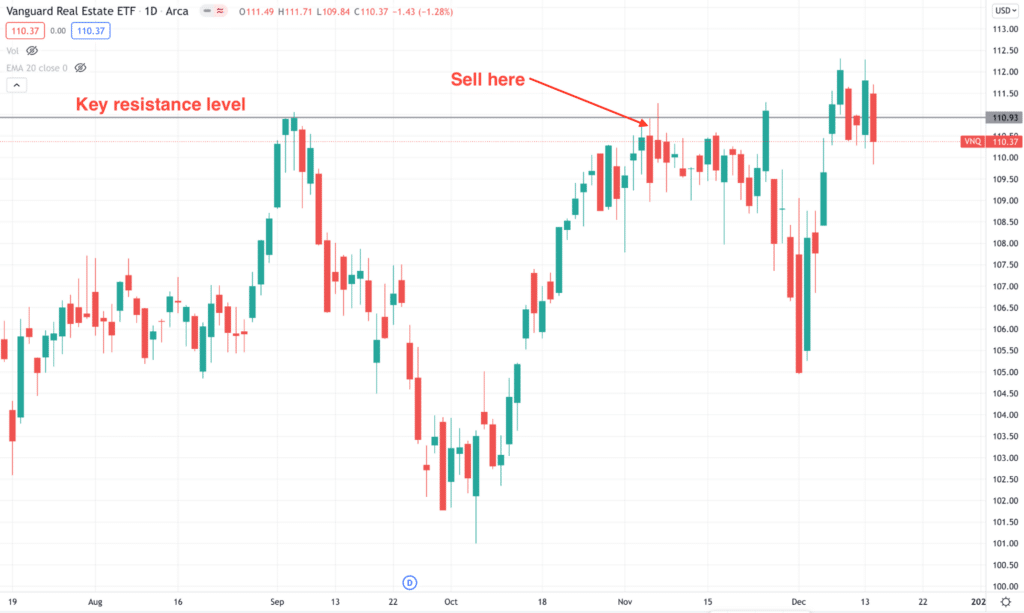

However, this theory applies to any trading asset. We will see how to sell real estate ETFs at a reliable price in the bearish trade setup. In that case, we will use Vanguard Real Estate ETFs (VNQ).

Enter

Before opening a buy trade, make sure that the following conditions are present in the price chart:

- The broader market context is bearish. The price is trading below the key level with at least one bearish structure break.

- Price reached any near-term event level or resistance level.

- A bearish rejection candle appears with a closing price below the previous candle’s low.

- Open a sell trade from the closing candle with the stop loss above the swing high.

Take profit

The ideal take profit is based on the risk: reward. Therefore, you can close the trade if it reaches a 1:2 risk: reward ratio or holds it for further gains.

Is the real estate investment strategy profitable?

Housing is the core need for people who make it necessary. It is a solid alternative investment opportunity due to higher profitability. Therefore, people need to buy properties in any case, which is the core strength of the REIT.

Pros & cons

Real estate trading is profitable, but the ultimate success depends on how you consider this investment method’s pros and cons in consideration.

| Pros | Cons |

| • Profitability |Housing and real estate are people’s core needs from any level that makes this industry profitable. | • Risk tolerance Such trading needs close attention to risk management. |

| • Portfolio diversification Investment in real estate is an excellent way to diversify the trading portfolio. | • Return on investment Trading in FX and stocks with leverage has a higher profitability rate. |

| • Macroeconomic factor It is easy to understand the real estate sentiment from fundamental indicators. | • Market uncertainty There is no guarantee that you will make consistent profits for a longer time. |

Final thought

The real estate sector is connected to the day-to-day needs of people. Therefore investing in this sector has higher profitability than traditional investment. In that case, close attention regarding the risk and uncertainty is needed to coin unexpected loss of money. People can achieve this by researching the country-specific economic factor-like interest rates, inflation, GDP, etc.