Сurrency trading is very beneficial, and the obvious reason is it follows the historical data. In addition, it is highly unpredictable.

Few currency pairs like GBP/USD, GBP/USD, USD/JPY are so volatile that witnessing 70-100pips in a day is not a big deal. This high volatility helps make money if the analysis goes right and the price moves in the desired direction.

Many traders and investors desire to make money from these wild moves in FX, but they don’t exactly know which currency pairs to use and leverage.

We have helped you by listing down all the chapters you need to know and the currency pairs to choose for profitable forex investment.

What is involved in trading currencies?

Currency trading involves exchanging the currencies of various countries. Talking about trading in the background, as you know, every country needs to do exports and imports. Thus, to do so, a country needs to convert its currency to the other country’s local currency.

This is not the only place it happens; this exchange also occurs when an institution or a big multinational company establishes its organization in other countries.

To pay their local employees, they again need to exchange their currencies to the country where they set up their business. Another way of currency exchange is traveling from one country to another and converting the money to purchase items or pay for expenses.

These significant changes move the currency market price, and retail traders like you make money with minor fluctuations. As two countries are involved in the exchange, there will be two currencies, one of each country, forming the currency pair.

What are the types of currency pairs that you can invest in?

A currency pair shows the value of one currency concerning the other. Or, you can say it shows the value of one currency quoted with the other. While investing in currencies, you may choose from the three types of pairs.

Majors

As the name suggests, majors are essential or, you can say, the most traded currency pair in the forex market. These pairs involve USD in them. There are seven major pairs: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD.

Minors

Minor currency pairs do not pair with USD, but they still have good volatility and are the right asset to be traded and invested in. Pound, euro, and yen see a large volume of trades. A few of the examples are: EUR/GBP, EUR/AUD, GBP/JPY, CHF/JPY, NZD/JPY, etc.

Exotic

Exotic currency pairs are major currencies with some of the emerging country’s currencies like Hong Kong, South Africa, Brazil, etc. A few of the examples are JPY/NOK, NZD/SGD, GBP/ZAR.

What makes a good currency pair?

Liquidity

A good currency pair should have high liquidity; there is no point in trading the pair without it. High liquidity means there is enough volume in the market to move the price.

Therefore, if there is sufficient price movement, traders can enter the market either by going long or short and profit this way.

The pair with the highest liquidity is the EUR/USD pair. This pair represents 28%, the most significant portion of the FX market volume.

Price stability

Maintaining low inflation contributes to price stability. It refers to the purchasing power of a currency. Price stability doesn’t mean that there is no price movement or change. However, it indicates that there is steady growth in the price and, therefore, moderate inflation.

Predictability

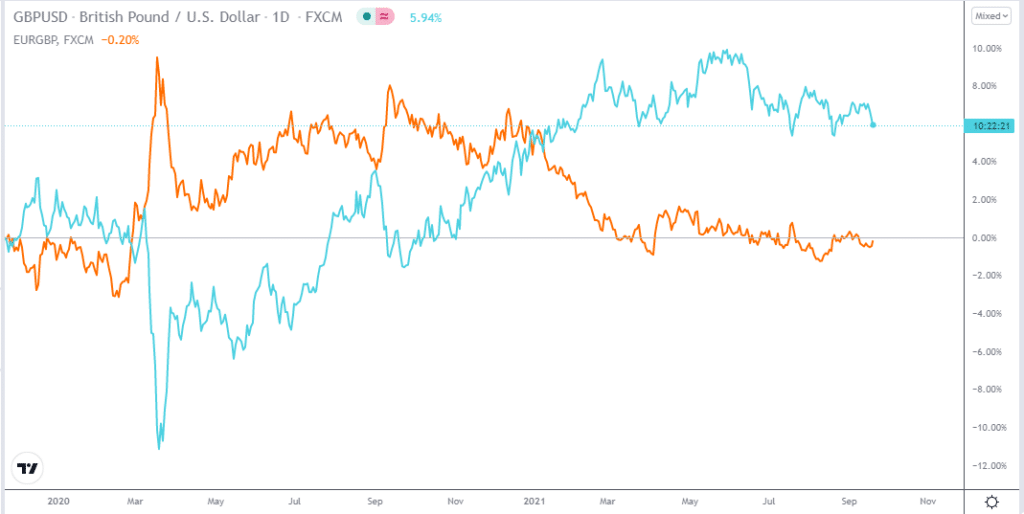

It is another crucial characteristic of a sound currency pair. An excellent way to find predictability is to look at correlated pairs or pairs correlated to stocks or commodities. The GBP/USD pair has a close negative correlation to EUR/GBP. If one pair is moving up, the other pair is going down.

In this daily time frame chart, we can see that when the GBP/USD (blue line) moves upwards, the EUR/GBP (orange line) moves downwards.

Most profitable currency in forex

You can choose to trade any currency pair. However, not all have the properties of the below pairs, which gives them an edge in the market. Most traders prefer these currencies since it meets all the requirements to make it profitable to trade.

EUR/USD

This pair has the highest volume in the FX market, making it the most liquid pair to trade. It is popular among scalpers, day and swing traders. More than 80% of traders chose to trade the EUR/USD pair.

GBP/USD

Often referred to as the ‘cable’, the GBP/USD is another very liquid pair. The pair can move 100 pips in a single trading session and is most volatile at the London opening hours.

USD/CHF

This pair has high daily trade volumes, and the interest rate differences between the Federal Reserve and the Swiss National Bank affect the pair.

If the Swiss National Bank increases interest rates, it makes the CHF stronger. The pair also shares a strong negative correlation to the EUR/USD and GBP/USD pairs.

USD/CAD

It is one of the most stable currency pairs. The pair’s volatility is higher during the US and London trading sessions. Furthermore, the pair displays recurring price patterns, and it is also highly liquid.

The Canadian dollar is also positively correlated to oil since Canada is one of the largest oil exporters globally. If the demand for oil increases significantly, the Canadian dollar gains strength over the US dollar.

USD/JPY

The last pair on our list is the USD/JPY pair. The export to import ratio primarily affects the Japanese Yen since the country has low natural resources.

The pair is highly profitable during the Asian sessions due to the volatility of the markets; however, it is tradable during the day like all currency pairs.

Pros & cons

Trading currency pairs can be highly lucrative, and many market participants make their living off trading currencies only. However, currency pairs have inherent risks, which we should consider by looking at the pros and cons.

| Pros | Cons |

| •Low cost FX investing is low cost; you do not have to pay a high commission like in the stock market. | •Increased volatility High volatility can be a good aspect for a currency pair, but abnormal high volatility creates an excess risk which is not good. |

| •Volatility It is the most significant reason why many like the currency market. More volatility means less trading fees and more income from big moves. | •Leverage Using excessive leverage can be damaging to your equity since your losses will be extreme as well. |

| •Decentralized The currency market is decentralized, meaning no single person, authority, or government is handling it. The market is open for all 24X5 Monday to Friday. | •Knowledge of fundamentals The lack of fundamentals knowledge in FX is one of the reasons traders fail to be profitable. Fundamentals can ruin your trading account if you are not aware of the impact. |

Final thoughts

You will need a solid broker that will allow you to trade currency pairs in the real markets. The currency market is all about being patient. Once you have entered the correct trading position, you need to be patient enough and trust your analysis.

Furthermore, you need to consider the pros and cons and upgrade your knowledge about the currency pairs.