Governance tokens are the first cryptos that delineate voting on a blockchain via giving out the power to make the major decisions about the platform in a centralized arrangement to a whole community. It takes place due to the ownership of the token holders. However, numerous protocols offer their governance tokens exceptional features that advantages the token holders.

The following section mentions some of the best governance tokens and their distinctive qualities.

Top 5 governance tokens to invest in 2022

Governance tokens work as the holders’ ownership in a decentralized protocol. The token holders get individual rights to influence the protocol’s administration. Holding the token will bring the right to give suggestions and opinions on how may any new features or products should be created, how the budget should be spent, and many more.

Governance tokens are unavoidable when safeguarding the community and the investors inside the mechanism of interest. Although holding a governance token will not bring you any power to influence the blockchain regardless, the other members are not in support of your proposal. However, users are permitted to invest in the project and invest in currency.

Below, we’ve mentioned the best governance tokens to trade and invest in.

- UniSwap (UNI)

- eCash (XEC)

- AMP (AMP)

- Curve DAO (CRV)

- Maker (MKR)

UniSwap (UNI)

Summary

UniSwap is a decentralized crypto platform that is automated and established on the Ethereum blockchain. UNI is UniSwap’s domestic token. It was intended to operate on the Ethereum blockchain to build a worldwide user network stimulation to perpetuate and swap cryptos directly by the traders through a collection of liquidity pools.

How much could you earn for one year?

Buying the UNI may bring the users to participate in the decision-making process on the network operations, thus making the token very significant for anybody’s portfolio. In January 2021, the value of the UNI was $4.7362, which increased to $15.70 by January 2022.

Consequently, for traders who had invested $1000 in UNI at the start of 2021, by January 2022, the invested money turned out to a value of $3314.9, which stands for three times more.

eCash (XEC)

Summary

eCash professes to be a cryptocurrency that functions as virtual money. It allows users to transfer the tokens among themselves effortlessly. Originally, eCash was familiar under the name of Bitcoin Cash ABC (BCHA), a subdivision of Bitcoin Cash (BCH). Interestingly, BCH itself was a subdivision of BTC.

How much could you earn for one year?

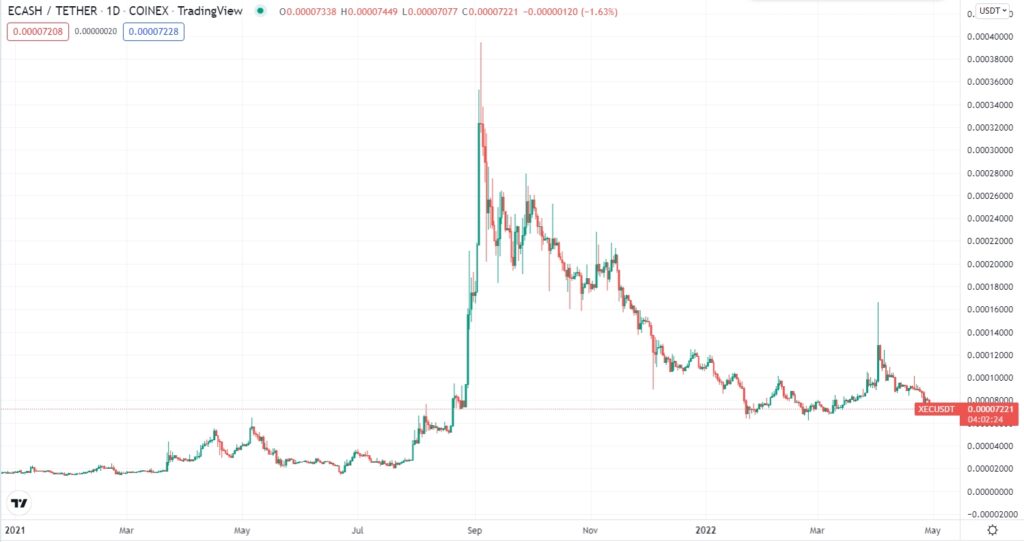

ECash started its journey with the tag of being weak crypto. In July 2020, it began to trade at $0.00002. In September, the value of the XEC expanded significantly and hit $0.0004 of value, and made a record.

AMP (AMP)

Summary

It is a token for digital collateralization. As per the Amp website, it may protect any asset users are willing to transfer, like fiat currency, digital payments, loan distributions, and yields from selling property. It secures the transaction via the staking method utilizing smart contracts to freeze the assets as late as the transaction has been substantiated. After that, the fund gets released for the party to receive. AMP allows the developers to build their applications to protect the transactions since it is open source.

How much could you earn for one year?

In 2021, the crypto managed to be in the headlines while around ⅓ of the prominent cryptos encountered a dip in their worth by approximately 50%. If you had invested initially, you could have been able to earn a decent amount of profit by the end of the year.

Curve DAO (CRV)

Summary

It is a governance token established on Ethereum, and it powers CURVE Finance. It is a decentralized exchange for stablecoins utilizing Automated Market Maker to manage liquidity. The project is intended to swap assets of similar worth means ERC-20 tokens, which may also add some value to the DeFi ecosystem.

How much could you earn for one year?

Curve DAO token’s price had steady moves throughout the crypto market fluctuations, making it robust crypto. However, in January 2021, the Curve DAO token had a worth of $0.6223, and as of March 2022, the price struck at $1.97.

Also, at that time, the market capitalization of the Curve DAO token was $911,777,283. If anyone had invested $1000 in January 2021, they have gained more than 3times of their investment by March 2022.

Maker (MKR)

Summary

Maker is a fundamental project that comprises the decentralized organization MakerDAO. Moreover, it is a software platform named Maker Protocol. The platform facilitates the users to issue and monitor DAI. It is established on the Ethereum blockchain. Hence, the MakerDAO and the software platform possess their domestic MKR, which is an ERC20 token.

How much could you earn for one year?

Investing in the MKR is worthwhile since it may help you generate around 3.5times of your investment in one year as per its historical performance data. The prime feature of the MKR token exists to make sure that DAI stays backed by the US dollar. It is a dual-crypto technique that benefits restrain volatility so that users may have a more secure project.

In January 2021, the value of the MKR was $582.22 and increased to $2,046.61 by January 2022. So as per the data, it is possible that if anyone had invested $1000 in the token in 2021, the value of the invested $1000 was $3515.2 by 2022. This means investors had earned around 3.5times more of their invested money.

Pros & cons

| Pros | Cons |

| It allows the users to work along, which may consequently get around to the new opportunities. | Big stakeholders may have the power to manipulate things towards themselves since the majority will win by the voting system. |

| Holding a governance token brings power to the users’ hands, expediting the community engagement. | Even after having the power in users’ hands, they always may deflect the blame to the majority. |

| Getting voting rights brings the opportunities to discuss the issues they encounter. | Sooner or later, egotism and self-dom of the users may affect the harmony of taking moral decisions for mass benefits. |

Final thought

To wrap it up, since the concept of the governance token is relatively new, there are some barriers associated with it. Still, there is much hope for the governance token because organizations establish cutting-edged concepts to resolve existing issues. Sooner or later, the blockchain will turn out to be more coherent and efficient, which will make it perform effortlessly along with the support of all of these concepts of governance tokens.