Due to their low price, stocks under $5, dubbed “penny stocks” owing to their low price, are frequently a high-risk, high-reward prospect. If you trade penny stocks or small-cap companies, you know how difficult to find stock prices under $5. Because there is a lot of volatility in this investment kind, it might be challenging to discover the optimal chances in the stock market.

We provide you with the top five high potential stocks under $5, so you don’t have to research.

Can you make real money with stocks under $5?

There are several reasons to invest in such stocks. Investors who acquire stock in fast-growing firms while still small benefit from far more stock prices than those who wait until the company has evolved into a giant.

How to earn with stocks under $5?

Investing in young firms with low share prices or depressed stock prices can yield high rewards. In addition, the value of startups can increase with time making them a good investment option. Besides, many penny stock companies provide dividends, so you can earn through it also.

Top 5 stocks to buy under $5

Now that you know about penny stocks and how to earn with them, it’s time to discuss some of the high potential assets.

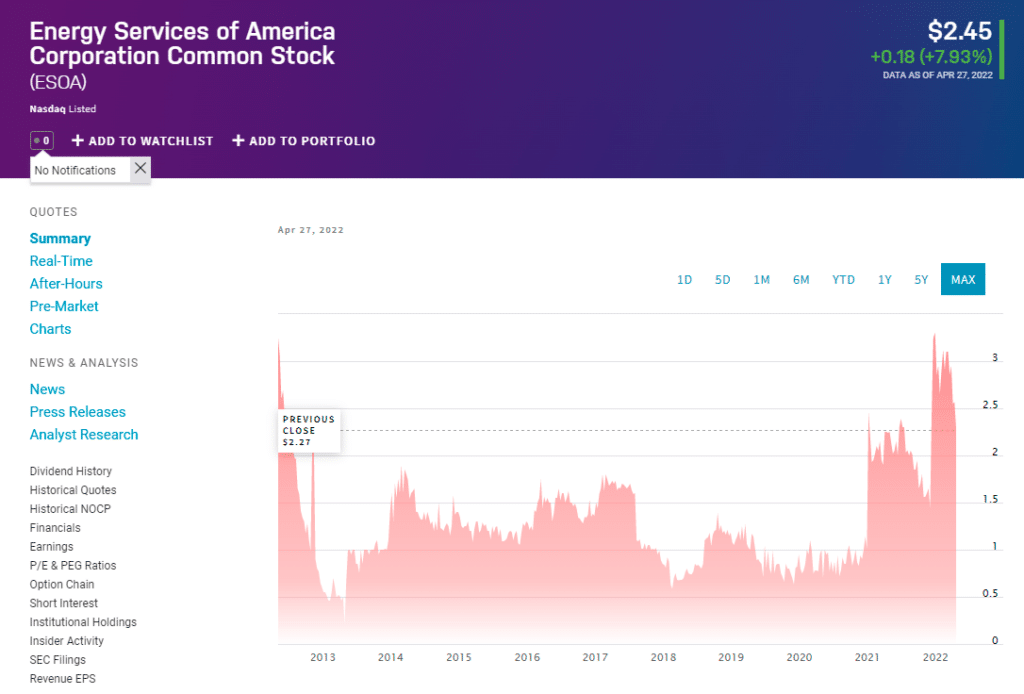

Energy Services of America (ESOA)

Energy Services of America provides natural gas, petroleum, solar, and other services to the US mid-Atlantic area.

Summary

Energy Services of America began trading on the NASDAQ under the ticker ESOA on March 22nd. ESOA is enjoying a successful year so far, thanks to a recent increase in share price. Furthermore, financial results for the fourth quarter of 2021 exceeded expectations and appear to be solid.

ESOA price forecast 2022

It has a median target of $3.0, with a high estimate of $3.75 and a low estimate of $1.45. The median forecast is a 29.31% increase over the current price of $2.32.

ESOA price forecast 2025

The stock price can reach $4 by 2025. This price prediction represents a 72.41% gain over the current price of $2.32.

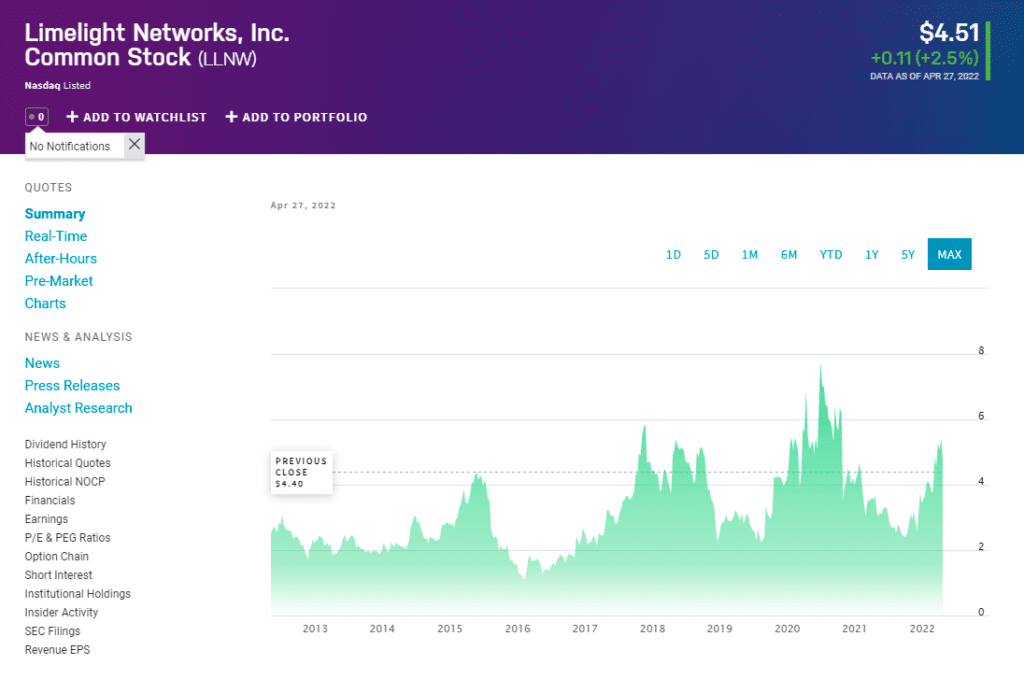

Limelight Networks (LLNW)

Limelight Networks provides content delivery network (CDN) services to businesses such as Disney to enable them to distribute streaming video to viewers.

Summary

The firm’s share price has fallen owing to revenue growth that appears unimpressive compared to competitors in the CDN field, but the company still has long-term development potential.

LLNW price forecast 2022

It has a median target of $5.0, with a high estimate of $5.50 and a low of $3.76. The median forecast is a 5.04% increase over the current price of $4.76.

LLNW price forecast 2025

The stock price of LLNW can reach $6.0 by 2025. This price prediction represents a 26.05% gain over the current price of $4.76.

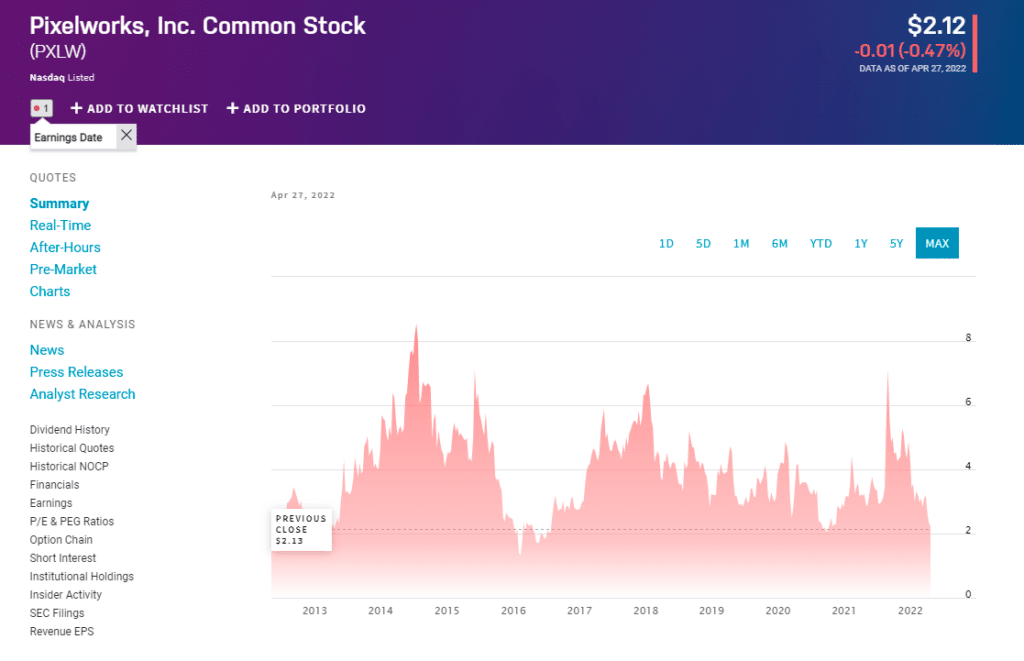

Pixelworks (PXLW)

Pixelworks aims to improve the video experience by implementing several novel picture quality advancements.

Summary

After a whirlwind season at the end of 2021, share prices soared to more than $5 per share on multiple occasions, and share prices have normalized. Its fourth-quarter financials show strong results as it pulls in sales and money. Pixelworks intends to be at the cutting edge of technology as video quality improves.

PXLW price forecast 2022

PXLW has a median target of $4.0, with a high estimate of $5.84 and a low estimate of $1.75. The median forecast is a 79.37% increase over the current price of $2.23.

PXLW price forecast 2025

The stock price of PXLW can reach $7.75 by 2025. This price prediction represents a 247.53% gain over the current price of $2.23.

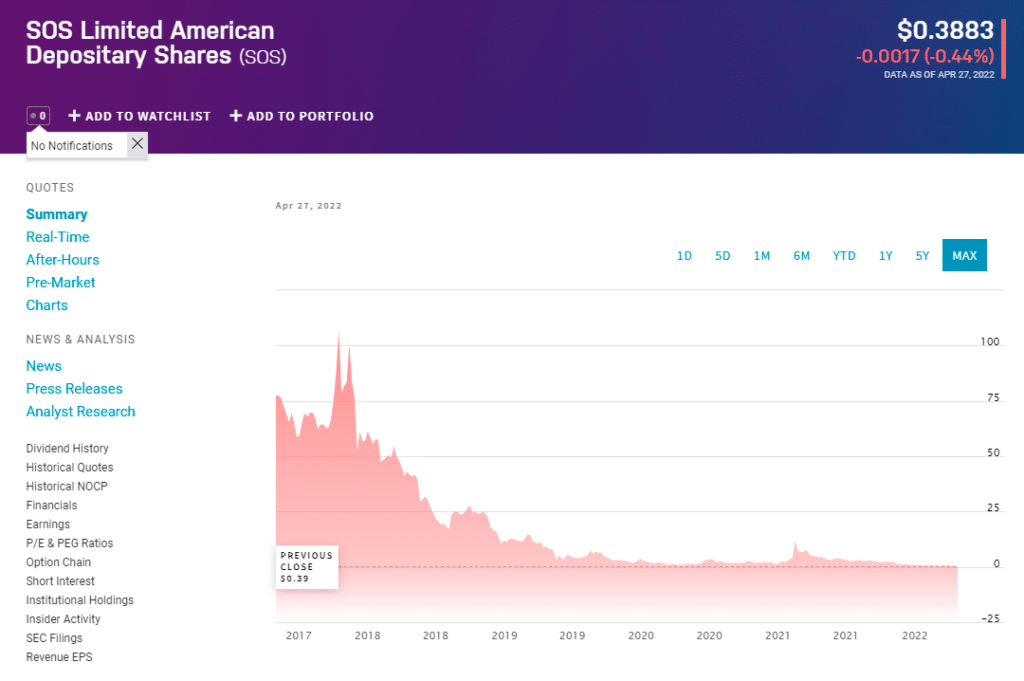

SOS Limited (SOS)

SOS Ltd. engages in various industries, with cryptocurrency being its primary focus. In addition, it provides blockchain-based services like cryptocurrency security and insurance.

Summary

Over the previous few months, investors have been extensively trading SOS. And it has a high growth potential due to its massive Bitcoin holdings and strong relationships with the sector.

SOS price forecast 2022

SOS has a median target of $1.0, with a high estimate of $1.56 and a low estimate of $0.20. The median forecast is a 150% increase over the current price of $0.40.

SOS price forecast 2025

The stock price of SOS can reach $7.75 by 2025. This price prediction represents a 590% gain over the current price of $0.40.

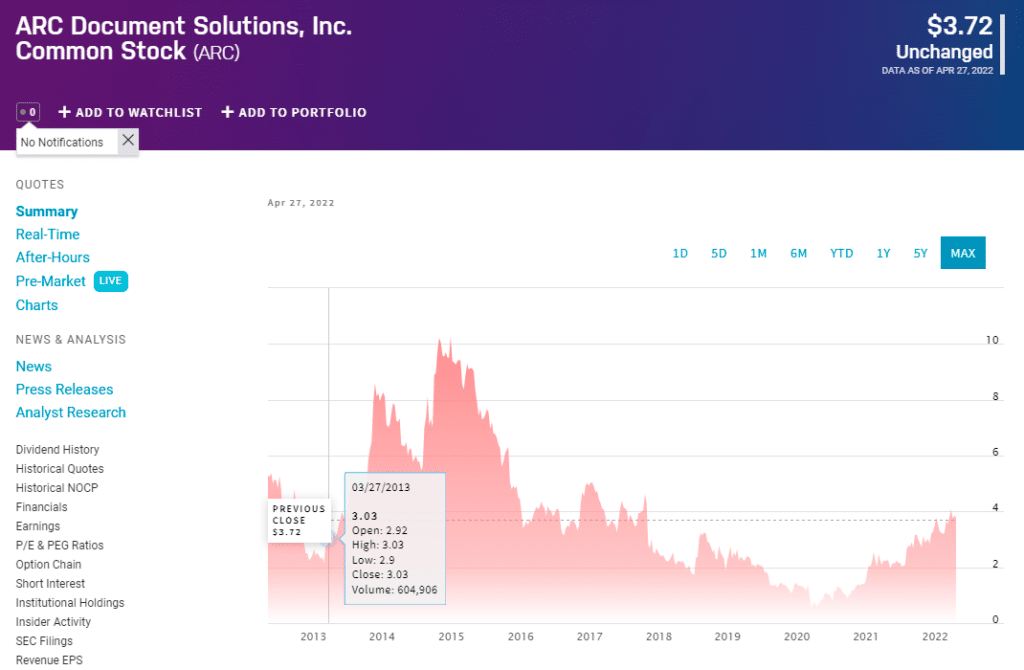

ARC document solutions (ARC)

ARC Document Solutions specializes in document imaging and visual design.

Summary

ARC’s share price has risen steadily over the previous year, growing by more than 70% since the spring of 2021. Revenue continues to increase as ARC expands its reach.

ARC price forecast 2022

It has a median target of $3.90, with a high estimate of $4.17 and a low estimate of $2.64. The median forecast is an 8.03% increase over the current price of $3.61.

ARC price forecast 2025

The stock price of ARC can reach $4.5 by 2025. This price prediction represents a 24.65% gain over the current price of 3.61.

Pros & cons

| Pros | Cons |

| Such stocks have a lower price value. | These assets are super volatile. |

| They can provide quick gains. | There’s a lower trading volume. |

| Potential for high growth on longer terms. | They are prone to scams. |

Final thoughts

Penny stocks are a volatile and risky component of the stock market. However, if you trade them with a proper trading plan, they are worth investing in.