Liquidity is a significant factor when you seek to make money with any crypto asset to learn potential. That’s a significant reason to make the crypto market more attractive to individual investors. Making money with liquidity provider tokens is a noble way as it allows you to make passive income from crypto assets.

However, choosing the right asset is mandatory as every token has the same potential. This article will highlight the best five liquidity provider (LP) tokens and answer the top relative questions to choose any investment asset.

Can you make real money with liquidity provider tokens?

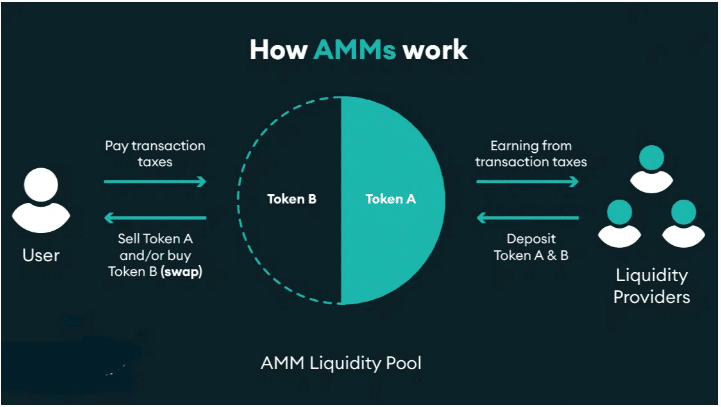

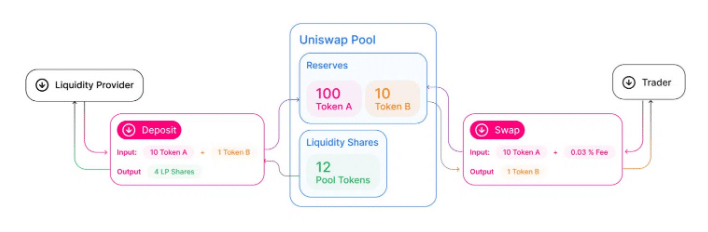

You can allocate these tokens on LP or the decentralized exchange (DEX) platform. These exchange platforms use an automated market maker (AMM) protocol that allows self-executing smart contracts. Several ways are available to own these coins and make real cash.

Usually, liquidity providers tokens share transaction fees with exchange platforms. The basic formula of LP tokens is.

The total value of liquidity pool / circulating supply of LP tokens = value of 1 LP token

How to earn with LP tokens?

The typical way is to purchase LP coins and deposit them to DEX platforms to get rewards. For example, Uniswap pays a nearly 25% annual interest rate on the Ethereum-USDC liquidity pool. Many also earn money from staking, trading, or investing in these crypto assets.

No need for any intermediary or middle man in these transactions. Meanwhile, individuals are responsible for managing private keys and wallets.

How to start with LP tokens?

You can start by signing up on a wallet and depositing your coins to a poll. When choosing any coin, check on the following factors:

Instruments

Try to choose assets that allow multi-asset liquidity combined with historical data and Fix protocol access.

Execution speed

Select a crypto LP that allows fast execution, slippage, and minimum requote, especially during significant news events.

Volume

Choose assets with a higher volume.

Price feed

Select providers with reliable and stable data feed.

Pricing

Select assets with low swaps, commissions, and competitive spreads.

Technology

Select an advanced crypto liquidity provider with a fixed protocol and integrate MT4, other APIs, and trading platforms.

Best five Liquidity provider (LP) tokens

Many LP tokens are available for individuals worldwide; the best five among them are:

- Uniswap (UNI)

- SushiSwap (SUSHI)

- Curve DAO token (CRV)

- Balancer (BAL)

- PancakeSwap (CAKE)

Uniswap (UNI)

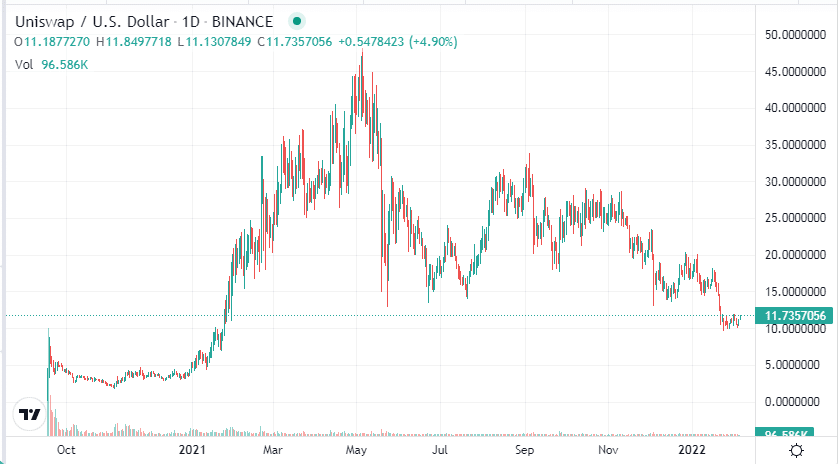

Market cap

Fully diluted market cap: $11,694,940,397

Live market cap: $7,380,831,770

The native token of this platform UNI price is floating near $11.73 today with a 24-H trading volume of $263,694,848.

Summary

The launching period of Uniswap is Nov 2018. This platform gained popularity quickly for facilitating automated trading of Defi tokens. Basic statistics of UNI tokens are:

- Circulating supply: 631,105,007.56 UNI

- Total supply: 1,000,000,000 UNI

- Max supply: 1,000,000,000 UNI

- Total Value Locked (TVL): $7,113,817,866

UNI price forecast 2022

Many crypto analysts predict the price of UNI can end up at $20.88 or above it by Dec 2022.

UNI price forecast 2025

UNI token price might be worth $85.00 by Dec 2025.

SushiSwap (SUSHI)

Market cap

Fully diluted market cap: $1,201,943,942

Live market cap: $611,762,750

The native token of this platform SUSHI price is floating near $4.80 today with a 24-H trading volume of $204,051,570.

Summary

The launching period of this fine AMM platform is Sep 2020.

- Circulating supply: 127,244,443.00 SUSHI

- Total supply: 239,952,673 SUSHI

- Max supply: 250,000,000 SUSHI

- Total Value Locked (TVL): $4,664,862,437

SUSHI price forecast 2022

SUSHI might reach near $6.54 by Dec 2022.

SUSHI price forecast 2025

Many crypto analysts anticipate the price of SUSHI might reach near $12 by Dec 2025.

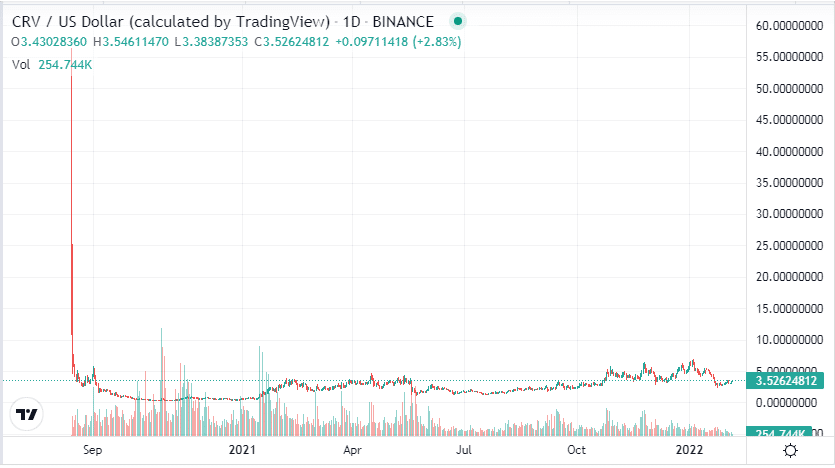

Curve DAO token (CRV)

Market cap

Fully diluted market cap: $11,650,141,600

Live market cap: $1,584,134,436

The native token of this platform CRV price is floating near $3.52 with a 24-H trading volume of $338,792,803.

Summary

Michael Egorov is the CEO and founder of this platform, and the launching period is Aug 2020.

- Circulating supply: 449,204,952.54 CRV

- Total supply: 1,683,863,610 CRV

- Max supply: 3,303,030,299 CRV

- Total Value Locked (TVL): $18,951,152,683

CRV price forecast 2022

CRV token can hit $10 by Dec 2022.

CRV price forecast 2025

Many analysts predict the price of CRV tokens might reach near $15.72 by Dec 2025.

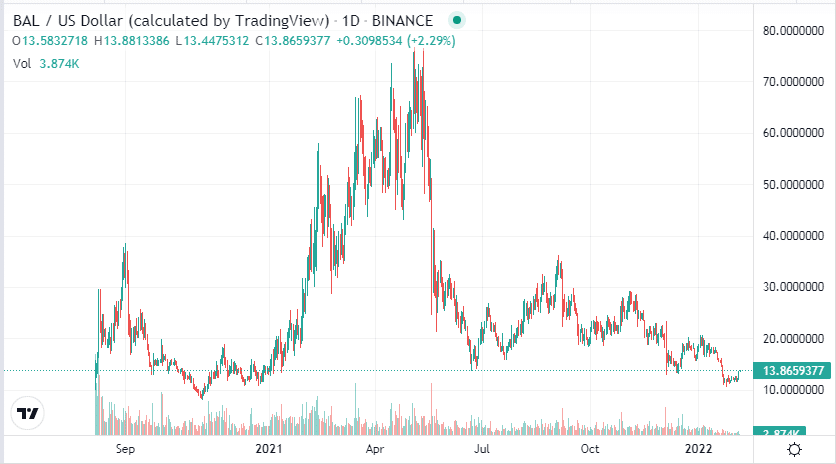

Balancer (BAL)

Market cap

Fully diluted market cap: $1,385,215,067

Live market cap: $96,186,993

The native token of this platform BAL price is floating near $13.86 with a 24-H trading volume of $31,549,588.

Summary

The launching period of this platform is Mar 2020.

- Circulating supply: 6,943,831.00 BAL

- Total supply: 35,725,000 BAL

- Max supply: 100,000,000 BAL

- Total Value Locked (TVL): $3,111,937,356

BAL price forecast 2022

BAL price can reach up to $18.21 by Dec 2022.

BAL price forecast 2025

BAL’s price might reach $55.31 by Dec 2025.

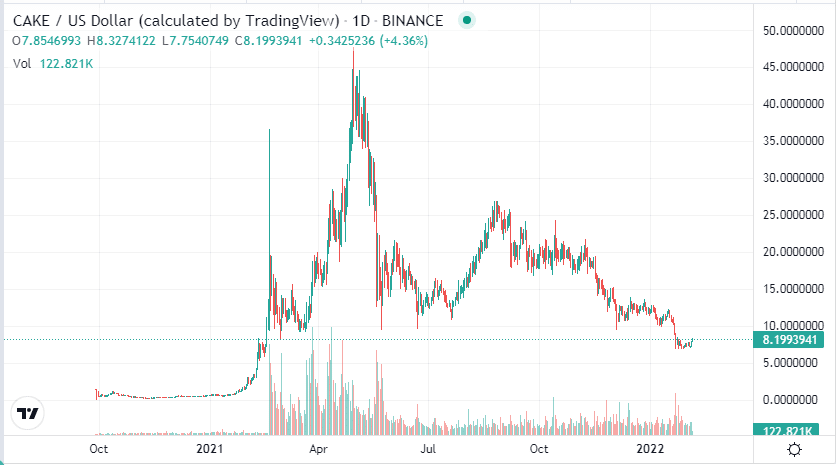

PancakeSwap (CAKE)

Market cap

Fully diluted market cap: $2,188,180,782

Live market cap: $2,173,366,394

The native token of this platform’s CAKE price is floating near $8.19 with a 24-H trading volume of $159,096,845.

Summary

The launching period of this platform is Sep 2020.

- Circulating supply: 265,117,148.70 CAKE

- Total supply: 265,117,149 CAKE

- Max supply: Not available

- Total Value Locked (TVL): $4,564,639,730

CAKE price forecast 2022

CAKE price can reach up to $35 per coin by Dec 2022.

CAKE price forecast 2025

Many crypto experts predict the price of CAKE can reach near $67 by Dec 2025.

Pros and cons

| Pros | Cons |

| Anyone can access the liquidity pool. | The breakdown and existing malfunctions in smart contracts involve the risk of losing coins. |

| Some coins provide captivating outcomes and fees in several layers. | You can have a temporary loss due to the change in deposited asset ratio. |

| Users are in control of digital assets. | There is no supervision over funds as these are decentralized protocols. |

Final thought

Liquidity provider tokens can be an effective way for crypto investors to earn passive income. We suggest checking on several unavoidable factors listed above when choosing any liquidity provider or LP tokens.