Options trading has skyrocketed recently, with everyone looking to create an extra income source. Indeed, options are a great way to diversify your portfolio.

But can they be a profitable source of income? Let’s find out if these assets are a lucrative venue for you.

What are the options anyway?

Before investing, it’s essential to know what you are investing in. Contracts that allow you to buy or sell an asset are known as options. It’s similar to stock trading but with a contract element.

Depending on the type, you can buy or sell a derivative contract, which includes 100 shares of stock. You must pay a fee for each contract. This is a premium payment.

If an option has a premium fee of $5 per contract, you must pay $500 ($5 x 100). The premium fee has a set expiration date.

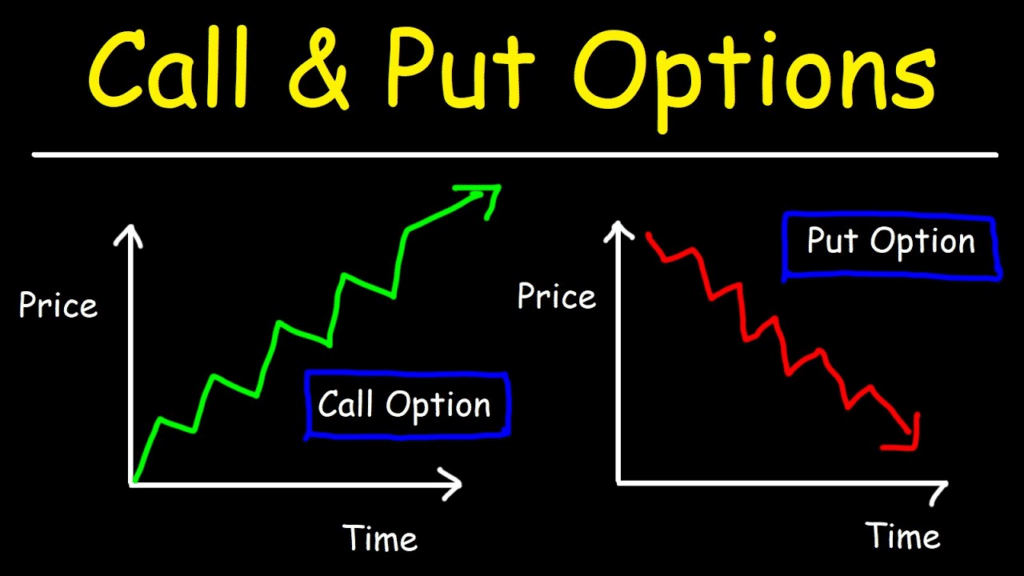

These assets have put and call options. The first one allows you to sell an asset at a predetermined price on a specific date.

There are two types:

- Buy put – you own/not own the asset, and you buy the option to sell it later for a specific price.

- Sell put – you own the asset, and you are looking for a buyer to sell your contract.

Call options allow you to purchase an asset at a specific price within a specified time frame.

There are also two forms:

- Buy call – this call option will enable you to buy an option at a specific price.

- Sell call – you already have the contract in this option, and you are looking for a buyer.

If you buy a call or a put, your maximum loss is the premium you paid, and you are under no obligation to buy or sell. If you sell, your maximum gain is the premium, and you must sell if the buyer exercises their option.

What is the “specific price”?

This is the strike price, which establishes the price for a contract to be bought or sold.

- The strike price of a call asset reflects the price at which it may be purchased.

- The strike price of a put asset shows the price at which it can be sold.

Let’s look at an example. Suppose you want to buy 100 shares of Apple Inc. for $10 per share. However, you don’t have that kind of money, or you are just a bit jumpy that the price will drop. So, you buy an option contract of $10 per share for $1000. This contract will last for a month.

A few days later, the price of Apple skyrockets because of their new phone release. The share price became $15. You exercise your contract and spend $10,000 to buy 100,000 worth of stocks. The profit you will have will be: $100,000 – $10,000 = $190,000.

Let’s see what’ll happen if you are on the losing end. The stock price of Apple drops to $5. You can let your option expire worthless, and you are only out the $1,000.

Are options a good investment?

The simple answer is you can invest in options for long-term profits. However, as the market creates its path, you need to consider a few things before dipping your toes in the pool.

Here are some of the things you need to know.

Bullish or bearish trends

- Are you trying to go long or short on a particular asset?

- If so, are you completely bullish/bearish, or do you fall somewhere in the middle?

- Which industry are you aiming for? Is the sector currently on a roll?

These questions will assist you in selecting your profitable options strategy, strike price, and when to enter the trade.

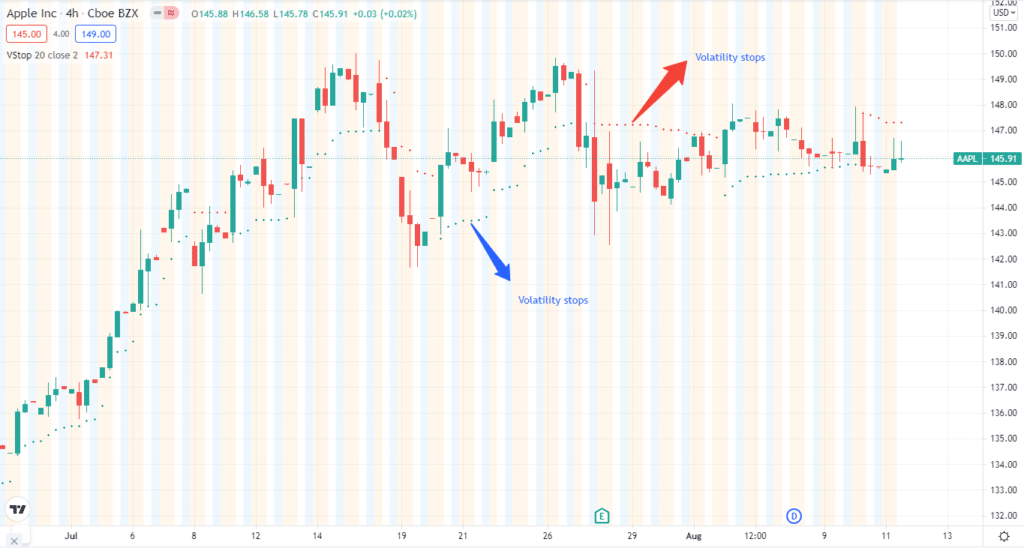

Volatility

Volatility is a crucial consideration in a profitable options strategy. However, we understand that the market does not always work in our favor. It decides in its way.

- If the volatility is excessive, you should avoid buying any options.

- If volatility isn’t too high, go for it.

Consider the following example. You’re trading a call option with a volatility of about 30%. Would you buy it? In this case, instead of purchasing calls, you could consider negotiating a contract.

Writing options comprises selling an option contract in exchange for subsequently buying or selling the contract. You get paid a premium as a writer.

Strike price expiration date

It is the most critical determinant for long-term profitability. However, as time passes, the strike price climbs. If you want to retain options for an extended period, expiration can be a headache.

For instance, you don’t want to spend more than $1 for the call option. So which option would you choose?

- The two-month asset with a strike price of $10 for your available $1

- The three-month asset with a strike price of $15 for your available $1

Of course, as an investor, you would choose the second one, but it is more expensive. This is most likely the single disadvantage of investing in long-term assets. As a long-term investor, you should seek out the option with the most extended expiry date.

Yes, we know it has a more significant strike price, but it will allow more time to work out your trade. Your profits will increase as a result. In addition, purchasing contracts for lower-priced assets can improve your prospects of long-term profitability.

What are the benefits of working with options?

- A good percentage of return, which is quite comparable to the return on the stock market. The high profit on operations is due to the leverage effect, which does not exist.

See for yourself. Suppose we bought an option with a strike price of $1000, spent only $40 on it, and exercised it at the price level of $1500 and with a net profit of $460. It would seem that the yield is 46%, but that was not the case. As a percentage, the profit will be 460/40 * 100 = 1150%. Not bad, huh? At the same time, the real value of the shares changed by only 50%, that is, from $1,000 to $1,500.

- An abundance of trading strategies, from conservative to aggressive.

- A known amount of risk, which is equal to the purchase price of the option.

- No need to pay the entire value of the asset when purchasing an option contract. It is enough to make the so-called guarantee security at 5-10% of the total cost. In this case, the profit on the option will be accrued in full. This circumstance significantly reduces the threshold for entering the market.

Final thoughts

Options are an excellent venue for investors looking to diversify their income. If you are new to options, you must understand the risks involved. Like other financial markets, there’s a make-or-break condition.