Every single person craves financial independence and an additional source of income. Dividend stocks provide an avenue to achieve the two desires to investors, provide regular income through dividend payouts and fast wealth accumulation.

However, before screening for the best dividend equities and investing, it is of utmost importance to understand the relationship between dividends and the price of their associated stocks, besides their historical performance.

Therefore, here we will demystify:

- How dividends work

- The dividend psychology influence

- Dividend declaration influence

- Payout ratio

- Dividend discount model

How do dividends work?

Dividends represent the share of a company’s net earnings doled out to its stakeholders. It is a way of showing gratitude to a company’s investors for believing in the organization and its management, evidence of a company’s profitability, and a way of encouraging investors to buy additional stake in the company.

The most common form of dividend payout is cash. In addition, companies can also issue additional shares as payout or any other agreed-upon asset. The value of the dividend payout is dependent on an investor’s stake in the organization.

Assuming an organization has 2 million outstanding shares and declares a 40% dividend payout, an investor with 250 shares receives $100 as dividend payout. On the other hand, if the same organization issued the dividend at 20%, this investor would get an additional 50 shares of the 400 thousand total additional shares issued.

Influence of payout declaration on stock prices

Before a dividend is shared with investors, the company is legally obliged to share:

- The dividend value

- Date of distribution

- The ex-dividend date

- Last viable day of purchasing dividends

The price of equities tends to go up close to the ex-dividend date as every investor clamors for a piece of the dividend. In theory, the price increase should reflect the value of the dividend payout.

However, stock prices are also guided by the market forces of supply and demand. Therefore the final price is the combination of all these factors.

On the actual ex-dividend date, prices tend to slump as new investors are unwilling to pay premium dollars without enjoying the dividends. In rare cases, the relevant stock might be such a hot cake that equities still trade at a premium even on the ex-date.

Stock dividends declaration

Similar to cash payouts, stock dividends once declared impact the price of their requisite equities. Declaration of stock dividends leads to a temporal increase in the value of stocks which then reduces to match the book value of the common shares as the increased issued shares don’t affect the value of the company itself.

The magnitude of the price change is dependent on the share dividends issued; a 4% issuance might fly under the radar but not a 25% issuance. Assuming stocks are trading at $225, a 4% issuance reduces prices to $216, which is not a huge difference. On the other hand, a 25% stock dividend issuance would reduce the share price to $168.75, which is hard to miss.

Impact of dividend psychology

Everyone loves a success story. Right now, everyone would love to be associated with Amazon, Tesla, Google, among other well-established and growing companies. In the investment world, the measure of success to stakeholders is the consistent and timely payout of their dividends and growth of such payouts year on year. It shows a company managed well and encourages more investment because stakeholders are guaranteed a return.

The common practice among investors is to analyze a company’s dividend payout and growth for a minimum of five years to be considered a worthy income investment equity. Companies that consistently paid dividends and showed growth are top-rated investment assets, resulting in increased stock prices due to demand.

Each declaration of higher dividends results in more investors jumping into this money-minting bandwagon. In retrospect, the declaration of lower dividends for a company with consistent growth is a sign of impending doom and results in lower stock prices. In truth, the lower payout might be due to more significant capital expenditure, but investor perceptions and beliefs drive the stock market at the end of the day.

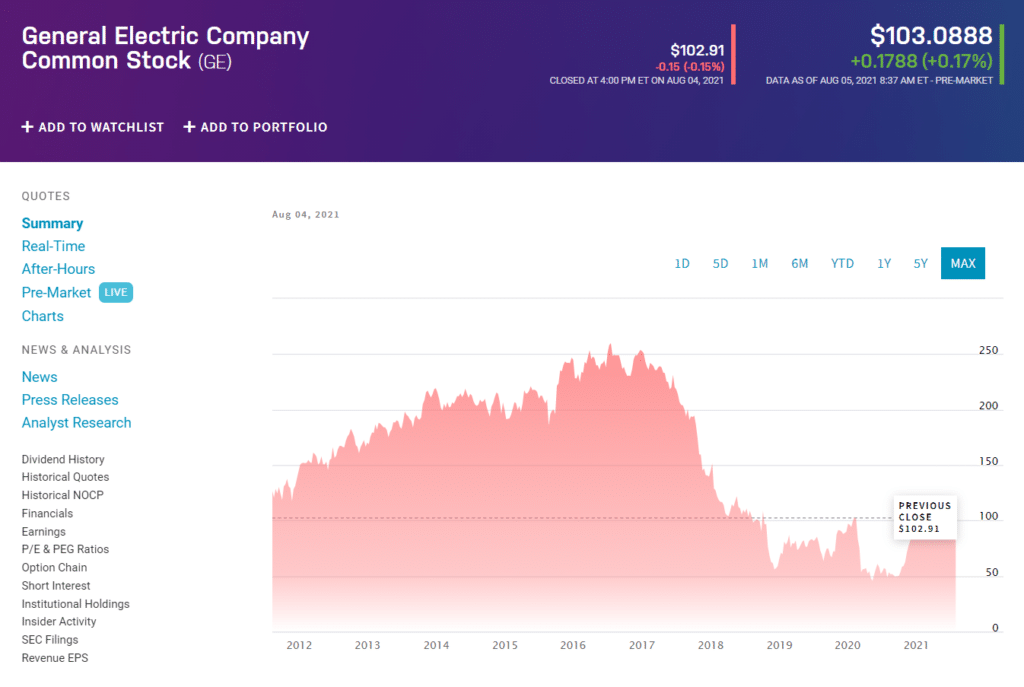

For decades, General Electric, one of the major players in the energy sector, started declaring reduced dividends in 2017, $0.12, compared to $0.24 in 2016. The reduction was a sign of the struggles the company was undergoing. Since then, its stock value plummeted from $228.31 to its current trading value of $103.6.

Impact of dividend payout ratio

DPR, dividend payout ratio, is a measure of the percentage of net incomes distributed as dividends. A high DPR shows a company that is not reinvesting and growing the shareholder value leading to reduced equity prices.

Investors are interested in a company paying dividends consistently but in a sustainable manner. It shows that its management has long-term growth strategies and is reinvesting earnings to ensure wealth growth for its investors.

Dividend discount model

Also known as the Gordon Growth Model, GGM, is an algorithmic approach used by investors to analyze the future growth and earnings of their equity investments. It is a formula that pits the anticipated annual dividend payout against the current dividend discount rate net of dividend growth rate.

Similar to the dividend payout ratio, the GGM model measures how well the management of an organization can reinvest its earnings to grow and create wealth for its investors. It identifies organizations that pay dividends consistently over the long haul, coupled with consistent dividend growth.

Value investors and buy-and-hold investors use this model to identify stocks for wealth growth and accumulation. Stocks with a high GGM value tend to be high-value stocks, while those with a low value tend to trade at below-market prices.