Traders may use Robinhood to purchase and sell options as a means to diversify their investments. However, to accomplish so, they must first develop effective tactics that would ensure consistent outcomes. It implies they must sift approaches and select one that will assist them in achieving their objectives.

Options trading has been a lucrative avenue for traders. Especially if they want to expand into something that does not need a considerable investment to start and is not as stressful as crypto or FX. The process of buying options can be easily performed using the Robinhood app.

Robinhood trading options

When the platform initially entered the financial field in 2013, it started a trend that has since rocked the whole online broker business. It’s entry into the investment world caused a paradigmatic shift throughout the business.

It has no account minimum requirements, commissions, or fees, which pushed conventional stock market traders to engage consumers across all businesses.

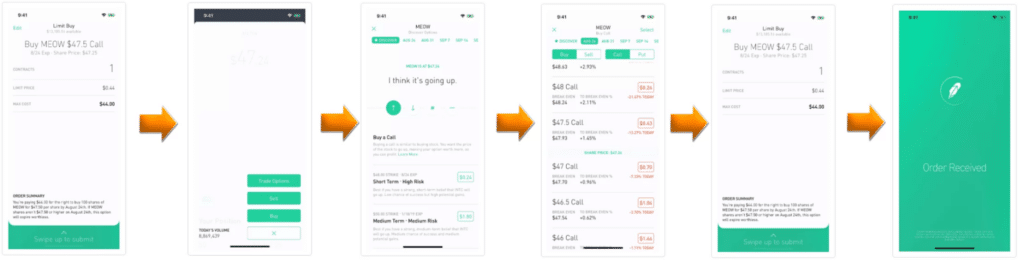

You can sell or buy call options simply by going to the site and tapping on the contracts. It would help if you then touched on trading and then clicked on selling. Following that, add the number of contracts you wish to buy/sell, choose a suitable contract, enter your selected limit value, and submit.

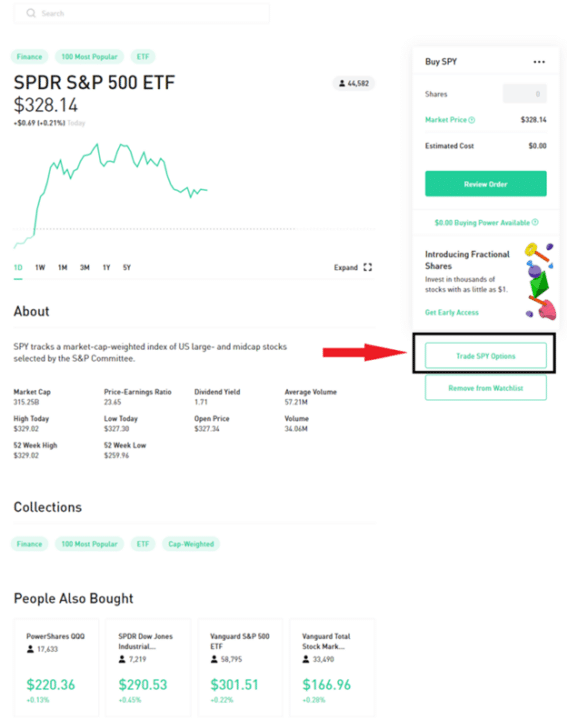

The default SPY arrangement is seen below. The button to access the SPY choices is located on the right side of the screen. For example, when we tap on the Trade SPY options button, we are sent to the comprehensive options page.

Call options

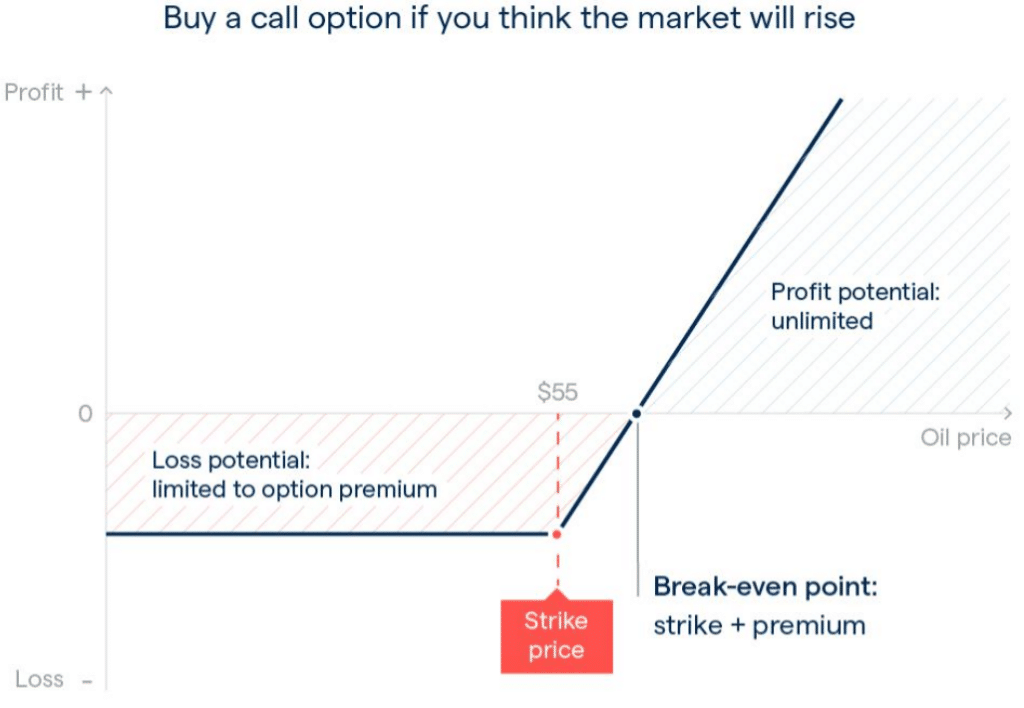

Nomenclature in many derivatives markets comes from the traditional trading pits. They give you the right to buy a certain amount of shares at a specific price over a certain period. Think of a call option as physically calling it over to you from across the room.

Robinhood, which recognized the idea of “gamification” investing, succeeded in doing what money managers had been trying to achieve for years: getting younger Americans interested in making an investment and long-term planning.

While options are transacted in the same way as shares, they are not interchangeable. While there is considerable overlap, they are different concepts with distinct goals.

Options are essentially a sort of convertible security. Their value is derived from the commodity with which they are connected. This means that choices do not have inherent worth in and of themselves.

As a commission-free platform that also includes the options market, Robinhood enables newcomers to increase their riskiness. Because they employ leverage, many traders finally determine their trading possibilities. Because of their no-commissions policy, trading options are now more affordable than ever. By purchasing them directly via options, you can get ownership of more shares than you could otherwise afford. Learning how to trade options on this platform is an excellent approach to becoming connected with the options market.

Put options

The inverse of call options is put. They provide you the right to sell a given number of shares at a defined price over a given time frame. Thus, consider a put to be the act of formally putting something saleable.

Who are Robinhood’s buyers?

It is particularly fit for beginners who wish to trade in relatively small amounts, such as stock and digital currencies markets. Robinhood’s simplicity makes the online services incredibly easy to use, and the fact that it charges no fees attracts particularly cost-conscious users who trade in small amounts. However, the offers are severely lacking in study and analysis, and there are major concerns based on the quality of trade executions.

How to use Robinhood to trade options?

You may or may not be informed, but it offers an updated platform. So let’s take a closer look at how to use the platform to execute trading.

A word of warning for those of you who trade options on more extensive platforms: Robinhood’s options platform is just as restricted as to their stock platform.

What to consider?

You must be aware of what you’re trading. Options are a monster in the trading world, and you should be aware of the risks – and it’s a good thing that Robinhood restricts access to the significant risk levels.

If you’re not attentive, the options market may offer a lot of gains but also a lot of downsides. According to several horrible stories, traders, investors, and even skilled traders have suffered more losses than their initial deposits in the options markets.

It should worry each new or existing trader in any market, reinforcing the significance of managing risks. Therefore, before entering the options markets, it is strongly advised to understand, analyze, and double-check your knowledge.

Pros & cons

| Pros | Cons |

There are no commissions or fees for trading options or ETFs. | You cannot market equity funds, stocks, or derivatives. |

| The minimum account balance is $0. | When compared to other brokerages, there are fewer trading tools offered. |

| The recurring investing feature was recently implemented, allowing customers to routinely plan recurring funds in different equities and ETFs. | When compared to other brokerages, the research and analytical capabilities are lacking. |

Final thoughts

A call option is a trader’s choice to purchase an investment product at a preset price. However, this is only achievable within a specified time frame known as a set end date. As a result, a call option buyer is a trader who has the right to buy stocks at the strike price as long as the contract’s expiration date has not passed.

Options can provide significant benefits if used wisely and with a long-term perspective. They provide leverage in your portfolio by allowing you to control more assets than you could afford to possess if you had to acquire them for your business growth. However, when you’re looking for small bets or lack the skills and ability to execute complicated transactions, you are not fit for options trading.