Options are easy to buy and trade, so it is convenient for investors to understand their allure. It’s relatively more accessible. There is money to be made with some tricks. Investors and traders generally stick to equities since they are often more complex than other financial instruments.

Karan Kapadia is a well-known options trader who chose this career after leaving his CFO job. His investment grew to $41M from $100,000 in 2007. During 2014, he managed $390 million. Many other people are shifting towards this type of trading.

If you are also interested in learning the benefits of trading options, this section will explore how these can add value to your portfolio by examining the advantages they offer. Here are the few advantages of working with this type of investment.

Benefit 1. Cost-efficiency

Options are a powerful leveraging tool. In this way, an investor can take a stock position, unlike a common share, but at a significantly lower cost.

For example, to buy 200 shares at $80, an investor must contribute $16000. Alternatively, the investor could purchase two $20 calls and 100 shares per contract, with a total outlay of only $4,000 (2 contracts x 100 shares x $20 price). Afterward, the investor will have $12,000 additional funds to use.

As you can see, it’s not quite that simple. To create the proper financial position, the shareholder needs to pick the right call at the right time. Yet, direct replacement is both practical and cost-effective — a trader should consider some valuable strategy for this.

Example with the first benefit

Consider a scenario in which you wish to buy the equity of ABC company because you believe its price will go up shortly. A total of $26,200 would be required if you purchased 200 shares of ABC at $131.

It would have been possible to buy the August call for $34 instead of putting up so much money, with a strike price of $100, by going to the futures marketplace. Two contracts would be required to create the same position as the 200 shares referred to above.

Purchasing two contracts and 100 shares per agreement at a $34 average price would total $6,800, versus $26,200 with two contracts and 100 shares each. Among other things, you can invest the difference in a savings account to earn interest, or you can apply it to an opportunity that offers better diversification.

Benefit 2. Less risk

Options can be riskier than securities in some situations, but you can also use them to mitigate risk. Depending on how they’re used, they have various pros and cons. Investing in these can reduce the risk for investors since they demand less financial commitment than stocks. Also, they can be less risky because they are relatively immune to the adverse impacts of gap openings.

Example with the second benefit

For instance, you bought the stock of a company XYZ at $50. Your goal is to lose no more than 10% of your investment, so you place a stop trade for $45 to prevent this. When the stock reaches or below $45, the position will turn into a market order to sell the stock. Things like this work during the day but can be problematic at night.

Consider closing above $51 at night before going to bed. Then, on the morning of the following day, you awaken to discover that something important has happened to your stock. You find out that the company’s CEO has lied about the financial statements and reports, and embezzlement rumors abound. As a result, it is expected that the stock will open lower by about $30. As soon as that happens, your stop order’s limit price of $45 will be breached, and $30 will be the first sale below it.

As a result, you sell the stock at $30 when it opens, locking in a substantial loss. In this case, you couldn’t use the stop-loss order at times when you need them most.

Benefit 3. Strategic alternatives

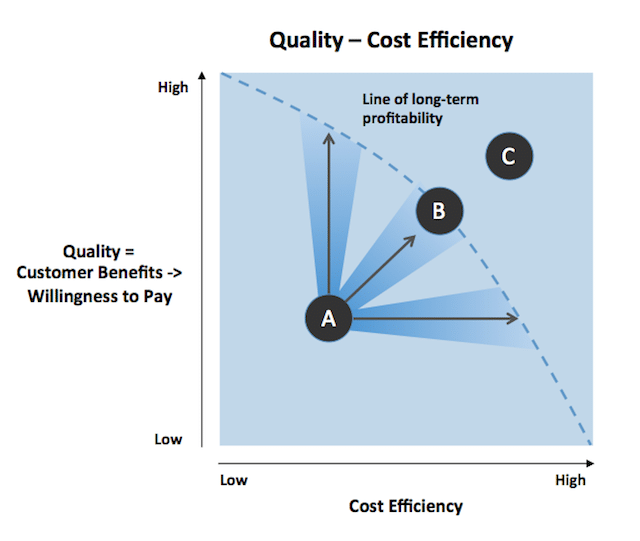

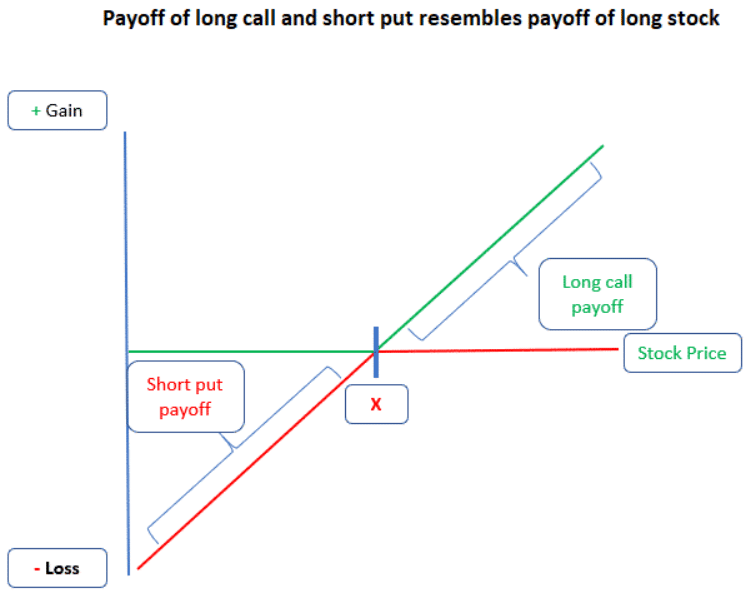

In addition to this, options open up more investment alternatives for investors that offer enormous flexibility. You can create many positions like this. Market gurus call these positions “synthetic positions”.

It is possible to obtain the same investment goals through different synthetic positions, which can prove useful for those who invest. Besides synthetic positions, options provide numerous other strategic possibilities.

Example with the third benefit

When an individual wants to short a stock, they use brokers who charge a margin. It can be expensive to use these brokers. Another type of client uses a broker who does not enable short sales of stock, period. Market participants must act when they trade in color and cannot play the downside when needed, effectively handcuffing them accordingly. The downside play is also a benefit of options trading that no broker prohibits; brokers allow it.

Additionally, a third dimension is available to the customer with options — none of the prices are directed. The individual has the opportunity to trade the movements of stocks and changes in volatility and time passage. It is rare to see securities move on a large scale. It has minimum chances that any large moves occur.

The ability to create opportunities for growth during a period of stagnation may determine whether you accomplish your financial goals or if they stay merely a pipe dream. Opportunities present the best strategic alternatives to help you remain profitable throughout a market cycle.

Pros and cons

Let’s find out some major pros and cons of options trading.

Pros

- You do not need the price of the asset when trading them. Instead, you have to pay a premium value equal to the price of the equity.

- Traders can use unique strategies that are applied before contract expiration to combat time decay or volatility.

- Financial professionals can fix an instrument’s value (also called a ‘strike price’) by using contracts about options.

Cons

- Low liquidity is often a problem for investors in options trading.

- The higher spreads associated with options trading are another challenge.

- A new trader may encounter many twists and turns during their journey.

Final thoughts

After reviewing their primary advantages, it is evident why options are such a hot topic in today’s financial circles. Because online brokerage companies offer direct access to these markets and their commissions are ridiculously low, retail investors now have access to the most powerful tool in the investment industry. Learn how to use options properly by taking the initiative and investing some time. An exciting era awaits those who want to invest on their own.