Quantitative investing uses mathematical patterns, computer systems, and data analysis to enumerate the most advantageous potential of implementing successful trades. It is a recent trend that market participants are extensively applying quantitative investment strategies in their trades.

Besides, the quantitative investment field has made remarkable developments in the financial world. It has been working on creating new technologies that will facilitate the investment process in the future.

Typically, the person who has special knowledge about math, computer science, mathematics, or statistics would be the better option for conducting quantitative investing. However, the result came from the quantitative analyses introduced in an inherent system that can be immediately available for all wanting to be quantitative traders.

If you are interested in having a basic knowledge of quantitative investing, the following section is for you. We will discuss everything a trader should know before starting quantitative investing, including trading methods.

What is Quantitative investing?

It is an investment strategy that can analyze data history that comprises numeric data and other countable evidence used as the analysis’s first-hand reference. Traders may perform data analysis and utilize developed patterns to define the potential and ideal timing for transacting in profitable trades.

Typically, quantitative trading belongs to the family of advanced hedge funds. Since its data storage and computational strength has been through a transformation, institutional traders have started to hire quantitative tools and techniques, advanced mathematical patterns, and alternative data machine learning. Traders use these tools and techniques to make asset allocation and trades decisions. But a few funds go for an entire quantitative method, and others utilize it to support the manual analysis.

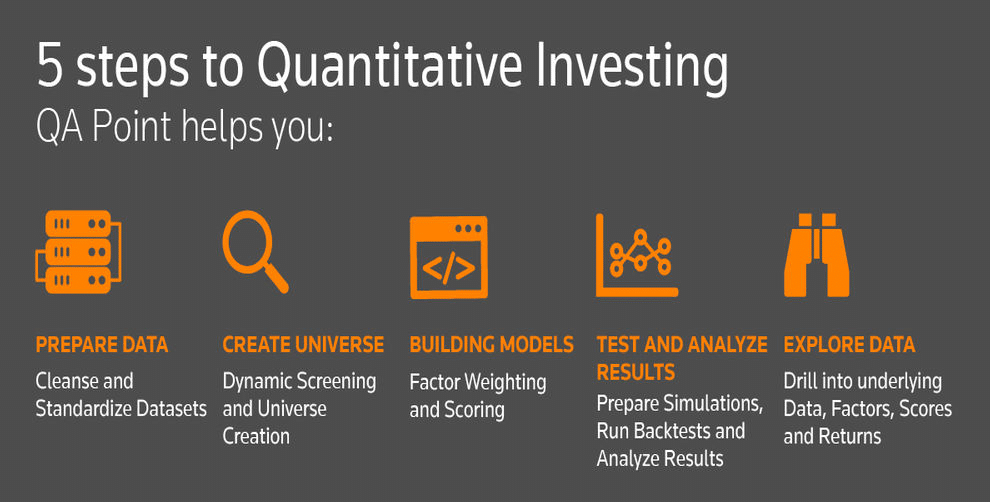

How does Quantitative investing work?

Quantitative investments utilize effectively programmed strategies to manage the trading funds and decisions. It is an algorithmic investment strategy where human fund managers do not directly intervene, such as with their experience, emotions, opinions, and judgments, or make decisions related to investment.

However, quantitative traders develop a mathematical pattern of their preferred strategy afterward utilizing historical data. Since the pattern is created to function better in a certain time frame and market condition that the process is tested for, the process is over-flourished and does not function well while activated. On the contrary, it performs better in bull markets, but it does not function as other common strategies in terms of the bear market.

Furthermore, quantitative funds utilize quantitative analysis, whereas traditional funds prefer fundamental analysis. Also, quantitative funds patterns are more dynamic and productive if large-scale data has been used because that makes the considerable data age a convenient period to supplement the advancement. Quantitative strategies are also called a ‘black box’ since their algorithms are secretive.

Buying strategy

The most common and profitable buying strategy is the Quantitative value strategy. This strategy is mainly based on the value of the stock, looking for the underprice organizations that relied upon to increment in esteem over the long run.

This buying strategy works by choosing the bulk of stocks and extracting those stocks with high risk. Moreover, the stocks are arranged for efficiency utilizing valuation multiples. The probability of their worth is not set in stone by analyzing benefit and monetary strength among different variables. However, the key factor in becoming successful in a value investing strategy is to rely on locating the undervalued stocks that will rise in price in the future.

Therefore, you have developed a program that looks at an enormous set of market data on the UK100 and separates its value moves by the entire day. Then you build a mathematical system based on this data. Let’s look at the example in which you conjecture that the UK100 may move upwards from a specific point in the trading day.

The model recognizes whether there are particular portions of the day when the UK100 trades in a specific direction. If the quantitative program finds a structure indicating that the stock has a chance of 60% or more to make an upward move at a particular time, you can utilize that data to place a buy entry.

Enter

Open a buy position from the bottom when the quantitative program finds a structure that indicates that the stock has a chance to move upward.

Take profit

Take the profit when the quantitative program indicates a reversal in the trend.

Selling strategy

Enter

Sell the stock when it’s overvalued or reached a psychological resistance level, and the quantitative program finds a structure that indicates that the stock has a chance to move downward.

Take profit

After selling the stock, you will get the profit instantly to your trading account.

Pros & cons

| Pros | Cons |

| • Cost efficiency Quantitative investments are a cost-effective strategy since they require few managers and analysts. | • Technology Quantitative investments can be costly and need large-scale capital in terms of the use of highly advanced technologies. |

| • Emotion It always conducts the programmed rules and does not drift over any emotional grounds; hence it does not miss the chances of having profitable trades. | • Drawback It does not point out any unexpected situations or circumstances that only humans are able to identify, and this drawback can lead to unsatisfactory results |

| • Human thought Compared to the human analyst, quantitative funds can focus on massive potential opportunities in a much smaller time scale. | • Data dependency Quantitative investments rely on a huge volume of historical and real-time data, competitive resources, and strong networks for depleting and analyzing it. |

Final thoughts

In short, quantitative investing is a systematically programmed technique. It utilizes real-time data for making trading decisions lowering the general investment cost with less effort. The best part is, the quantitative investing method weeds out the human emotion from the operation.

Though it is not an infallible strategy yet the vast data and advanced artificial intelligence signify the industry perhaps encountering some extraordinary potentials in the future.