Forex market is the largest financial platform that sees trillions of dollars in daily average trading volume. The high liquidity, leverage options, and easy access to this exchange market tempt millions of traders, novice as well as professionals, to gain significant profits even with limited capital.

George Soros, one of the world’s best forex traders, is known as the man who crushed the Bank of England by making a hefty profit of $1 billion in a single day through his knowledgeful and timely utilization of the available opportunity.

However, success only follows those traders who commit their time and efforts to study trading dynamics. So, are you wondering whether you can take advantage of the forex market and get rich?

Read this article to learn about a forex trader’s salary and the possibility of earning big by involving in forex trading.

What is a forex trader’s salary?

Individual forex traders do not get traditional ‘salaries’ as they are not employed. Their salary is basically the profits they generate on the initial account balance in a specified amount of time. FX traders work for themselves and hold complete control of their trading routine, account sizes, and trading strategies.

However, the monthly/weekly profits or payouts are generally not constant as they vary with every trader’s consistency and technique. There can be months or periods where the net profit could remain zero, negative, or exceed the targeted amount.

Determining factors of a forex trader’s profits

Some market participants trade for a living and others navigate the trading arena as a part-time hobby. Whatever the case, some crucial factors play a significant part in specifying the profit range of traders.

- Initial capital

Your invested capital is the primary component that determines the profitability level. Your starting capital is the force that propels your trades. The profit return can be very different depending on the existing money in the account.

For example, a trader with $1000 capital would gain $100/month on a 10% average monthly return rate, whereas a trader with $10,000 initial capital would get $1000/month on the same return rate.

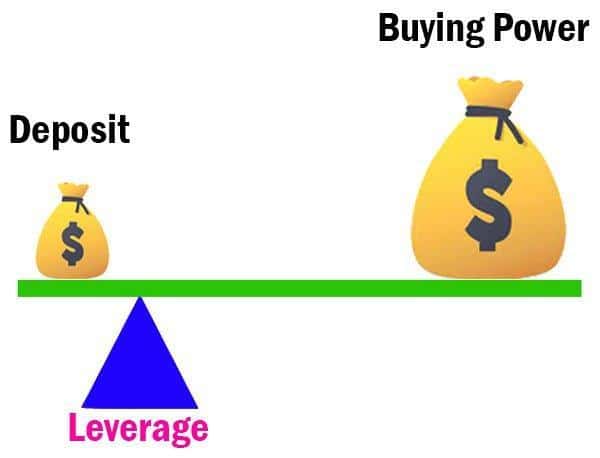

- Leverage

It is a major element that can provide compounded gains on limited capital; however, the loss chances become equivalent, making it a two-edged sword. Higher leverage can bestow the traders higher or more than average returns compared to their total balance.

Traders decide on a level of leverage or risk they are willing to take on each trade, which directly impacts their profits/losses.

- Trading technique

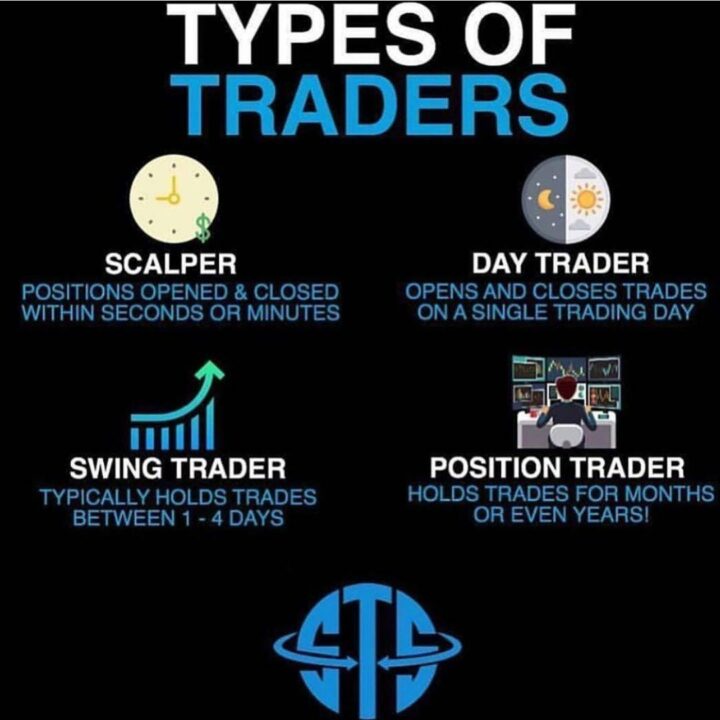

What kind of trader you are, your trading frequency, and what strategies you utilize affect your returns.

For instance, scalpers and day traders engage in short-term trades and target quick profits. In contrast, position or swing traders are relatively long-term players with different trading methodologies and targets.

How to get rich using forex trading?

Is it possible to get rich using trading? The fact is that there is no correct answer as FX trading is not a magic spell to earn big quickly. Traders need to manifest strong commitment, patience, and tactics to achieve stable success in this domain.

Moreover, they need resilience and strength to learn from failures and bounce back with a better approach. We have discussed five central elements in determining a trader’s success here.

Identify your trading style and personal capability

You should establish a trading method according to your personality and temperament. Specify your patience and stability level to determine whether you can be a day trader or a long-term trader.

Moreover, it is necessary not to be delusional about the profit targets and select a realistic trading approach with a reasonable risk: reward ratio. In addition, make up your mind beforehand about the best possible responses to unique scenarios and opportunities.

Emotional involvement and aggressive reactions are detrimental for traders and can lead to a losing spree. The critical point to understand is that not all trades can be winners as countless factors influence the price fluctuations.

Start with small capital

Trading is a susceptible and risky domain; therefore, it is sensible to start small. No matter how much knowledge and skills you gather, a gradual and slow capital increment is the best approach to remain safe.

However, do not drastically reduce the initial capital. The margin level becomes insufficient for executed trades to withstand temporary losses without a reasonable account balance.

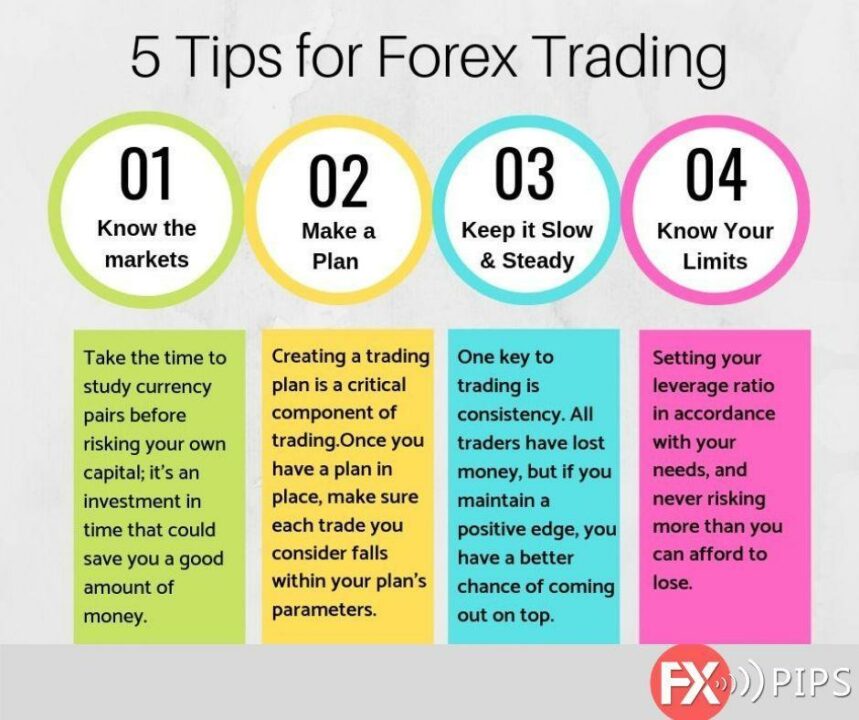

Keep learning and draft trading plans

FX trading is a highly competitive sphere with constantly changing dynamics and circumstances. It is better to continue learning and remain aware of the existing affairs to keep pace with the transforming factors.

Plan out your strategies and apply them to various currency pairs as each pair has different volatility and movement pattern. Pick out the forex pairs that are most harmonious with your trading plan and methodology.

In addition, simplify the application of technical analysis tools and indicators for avoiding complexity. Moreover, retesting strategies and setting two to three trigger rules to initiate trades can enhance the win rate.

Track your previous trades

Looking back at your winning and losing trades can demonstrate a comprehensive picture of the errors or faults. Identify the trading patterns that best complimented the market movement by devising maximum profits.

The most important thing is to maintain consistency in your trading routine; otherwise, irregularity and erratic behavior can be untraceable and lead to frequent losses.

Follow risk management and preserve capital

Never forget to set your stop-losses at the pivot points where the market could potentially reverse. Follow proper risk management and utilize reasonable leverage to play safe and minimize the losses.

In addition, discipline and patience are the core qualities of successful traders. It is more important to preserve your profits than generate them in the trading arena. In a nutshell, your ability to secure and maintain your gains would stipulate your long-term success as a trader.

Final thoughts

FX trading is not a shortcut to getting rich quickly; however, you can gradually build wealth by utilizing suitable analytical techniques, maintaining tolerance and restraint, following risk management, and avoiding emotional decisions. In addition, there are various golden rules, as discussed in the article, that can help traders settle on a profitable trajectory.

In conclusion, successful trading is about gaining relevant skills and knowledge, their correct implementation, and the maintenance of generated profits.