Risk management is the key element to get success in financial trading. Many crypto experts have already made millions of dollars from this market, although it is a new addition to the financial world. Their success came through choosing the right asset and holding it with proper risk management. When we seek the reason behind their success, there is no Holy Grail.

Most newbie crypto investors lose money for ignoring the risk management factors as the crypto market is volatile and involves risks like many other financial assets. The following section will discuss the risk management practice in crypto trading. Additionally, we will describe crypto swing trading strategies with chart attachments to better understand.

Risk management explained

The crypto marketplace is growing so fast as blockchain technology is booming. According to Coinmaketcap, in the first quarter of 2020 total market estimate was only $160 billion, surpassing $1.3 trillion in Q2 2021. As the market grows rapidly, many people forget that the market also involves risks alongside making profits. So it is obvious to follow risk management rules if you don’t want to drain your capital on the first day/week of your deposit.

The proper strategy will help you decrease the risk of potential losses and enable making huge profits from the marketplace. The risk in crypto trading is the possibility of losing funds. Therefore, risk management in crypto trading can control and predict possible losses from unsuccessful transactions. Investors often draw similarities between cryptocurrencies and other financial assets regarding risk management in crypto trading.

Why use risk management in crypto swing trading?

Like many other financial assets, risk management is unavoidable in crypto trading. For example, you may choose to invest in Ripple (XRP) as it is one of the most potent, relatively strong, and stable cryptocurrencies. Then it drops approx. 50% as crypto-assets are volatile, and you can check the XRP historical price chart from last year as it goes through ups and downs.

So, in this case, you can lose approx. 50% of your deposit by carrying out a single losing trade. Although it was a dramatic example, many newbie crypto investors go through similar situations. The bottom line remains the same if you don’t follow specific risk management rules in crypto swing trading, you can lose a significant portion of your capital within a short period.

How to use risk management in crypto swing trading?

When you follow risk management in crypto swing trading, follow some simple rules. The golden rule of crypto swing trading is never to risk as much you can’t afford. Smart crypto swing traders always use appropriate stop-loss parameters for each trade to mitigate risks on trades and their decisions before executing the trade while making trading plans.

Swing trading often requires holding positions overnight, so risk management or stop-loss on trades is important to save capital while you won’t be in front of your computer. Risk management is mandatory to protect your account from being entirely wiped out. Risk management in swing trading is essential to keep your losses manageable and small. So you can outnumber your losses by tour gains over a particular period.

Risk management swing trading strategy

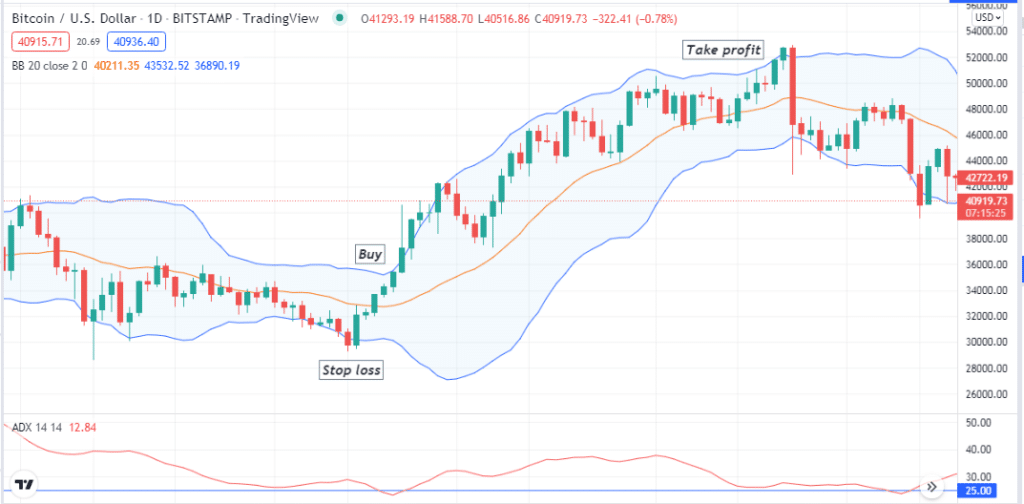

In this swing trading strategy, we use Bollinger Bands to sort out swing positions and the ADX indicator to confirm the trend’s strength before entering a trade. This method suggests swing trades when the bands of BB get closer, the possibilities of swing breakout.

Crypto swing trading buy strategy

- The bands of BB get closer.

- The price gets above the middle band of the BB indicator.

- Bands of the BB indicator get wider, and a series of bullish candles appear.

- The ADX dynamic line reaches above 25.

- Enter a buy trade.

- Place an initial stop loss below the current swing low.

- Never risk 2% of your capital in your open position.

- Exit from the buy trade when the uptrend finishes.

- The price gets to the upper band or drops near the middle band of the BB indicator after reaching that level.

- The ADX indicator reading drops below 25.

Crypto swing trading sell strategy

- The bands of BB get closer.

- The price gets below the middle band of the BB indicator.

- Bands of the BB indicator get wider, and a series of bearish candles appear.

- The ADX dynamic line reaches above 25.

- Enter a sell trade.

- Place an initial stop loss above the current swing high.

- Never risk 2% of your capital in your open position.

- Exit from the sell trade when the downtrend fades.

- The price reaches the lower band or rises to the middle band of the BB indicator after reaching that level.

- The ADX indicator reading drops below 25.

Key takeaways

- Plan your trades

Always estimate your risk-reward ratio before entering any trade. While making trading plans, measuring SL (stop-loss) and TP (take profit) levels are key ways, and successful traders always know the price they are willing to pay and the asset’s selling price before they enter any trade.

- Estimate your position size

Position size refers to the crypto or token amount that investors are willing to buy. Investors can invest 30%,50%, or even 100% of their capital to expect greater profits.

- Diversify or hedge

Try not to put all your eggs in the same basket. So diversify your portfolio by investing in different crypto assets. Don’t lose your capital in one trade like fools.

- Practice or demo trade

The golden way to master any trading strategy is to practice. You can learn the potentiality, winning ratios, and risk factors alongside mastering the concept by practicing more.

- Fees and costs

Crypto swing traders usually don’t trade frequently. They only enter when the price movement is in their favor. So it is mandatory to know the fees and cost involvement in trades.

- Education

Successful crypto traders always keep learning. So it is better to make time for educational purposes and use tools that may enable developing your knowledge on crypto trading.

Final thought

Swing trading is a profitable way to approach the crypto marketplace. Novice traders should practice mastering any swing trading strategy before starting live trading using it. Once they nail the basics, it becomes easier to execute constantly profitable trades through that crypto swing trading strategy.