Nowadays, the common investor has many investment possibilities, ranging from NFTs to real estate to cryptos. And one of the most significant new ways to earn money is right on your feet: shoes.

Shoes are one of the few things on the market that are almost global. This makes shoe stocks relatively simple to comprehend. As a result, adding a few shoe stocks to your portfolio isn’t a terrible idea. So, what are the most significant shoe stocks to invest in?

This guide will talk about the top five you can buy in 2022.

Can you make real money with shoe stock?

You may think that investing in shoes is odd, yet the shoe resale business is expanding at a rapid pace. As a result, the shoe business is seeing rapid expansion. With worldwide footwear consumption approaching $500 billion each year and rapidly rising, there’s plenty of space for you to profit from shoe stocks.

How to earn with shoe stocks?

Many shoe stocks are good long-term investments. They are slower-growing enterprises that are profitable and occasionally pay a small dividend. Other smaller businesses that are on-trend and riding customer momentum resemble high-growth stocks. That is, there is a shoe stock to suit the needs of all investors.

How to start with shoe stocks?

To begin investing in shoe stocks, you must first answer the following questions:

- How do firms create money?

- What do they produce?

- What types of footwear do they have?

- Which countries do they operate in?

- What is their main product, and how well is it selling?

- Finally, do they have a reputation for being a thought leader in their field?

All of the following answers are easily accessible. First, visit the company’s website and learn more about them. You will get all of your answers there, and if you observe favorable aspects of the firm, you may easily buy its shares.

Top five shoe stocks to buy

Now that you know how to invest in shoe stocks let’s find out the top five shoe stocks you can invest in.

Nike (NKE)

The Nike swoosh, the unchallenged leader in worldwide shoe sales, can be seen on sports clothing.

Summary

The firm manufactures a wide range of shoes, from everyday casual sneakers to high-end luxury kicks. Nike is the parent company of the Converse and Jordan brands.

It isn’t the fastest-growing brand on this list, but it is rising steadily. Nike also provides a small but growing dividend for those looking for a steady source of income.

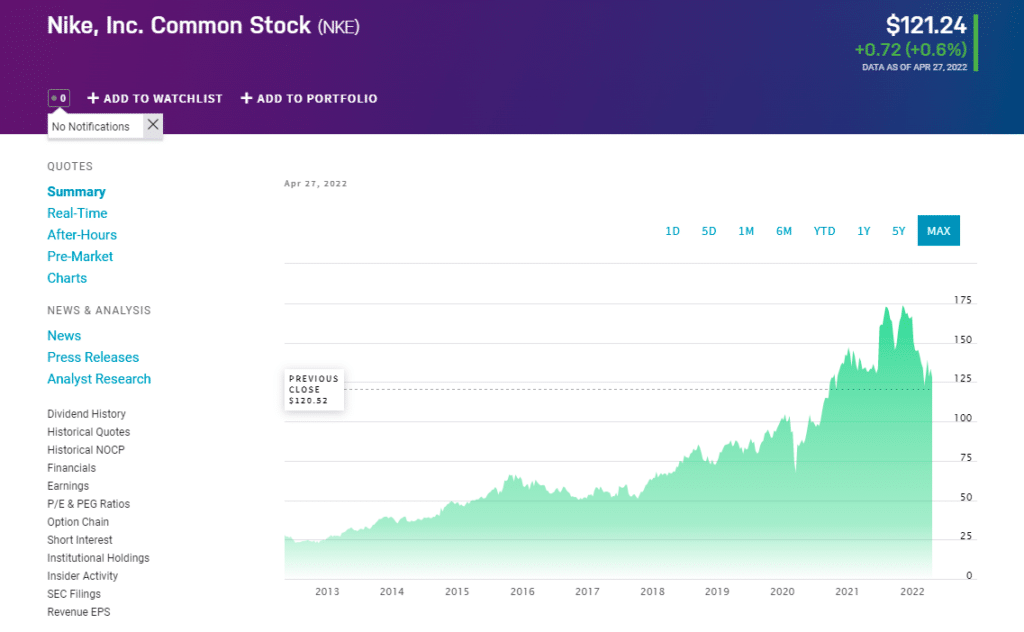

NKE price forecast 2022

According to the one-year chart, the median NKE price goal is $175.57, with a high NKE stock price projection of $213.00 and a low NKE price forecast of $144.00.

NKE price forecast 2025

In 2025, the share price of NIKE might hit $150. The average NIKE stock price projection predicts a 4% increase from the current NKE stock price of $129.07.

Crocs (CROX)

What if we tell you that Crocs’ stock outperformed Facebook, Apple, Amazon, Netflix, and Google over the last five years? Do you think we’re crazy?

Summary

Crocs aren’t everyone’s cup of tea. In the early 2000s, soft clogs were popular shortly after the firm was created. While the eccentric shoemaker’s sales remained stagnant for much of the decade, it had a devoted following, particularly among children and young people.

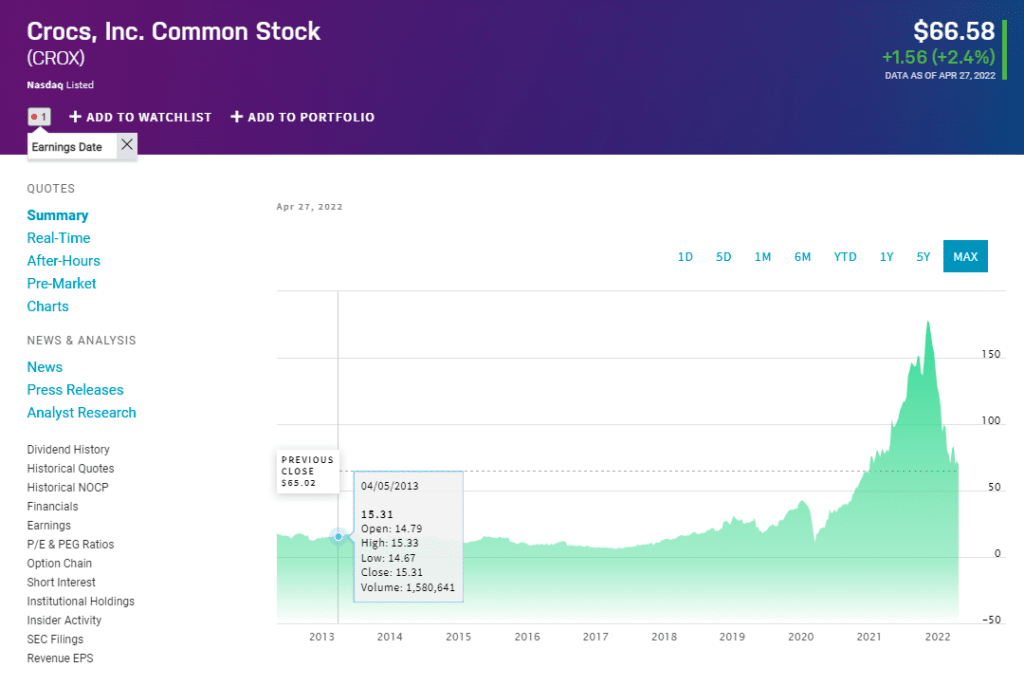

It makes no difference whether you believe it or not because it is true. Crocs’ shares recovered slightly more than 1,700% from late 2016 to late 2021.

CROX price forecast 2022

It has a median target of $166.50, with a high estimate of $246.00 and a low estimate of $80.00, according to the 1Y chart. The median forecast is a +133.98% increase over the current price of $71.16.

CROX price forecast 2025

The stock price might reach $200 by 2025. This price prediction represents a 178% gain over the current price of $71.8.

Deckers (DECK)

Deckers is another company that focuses completely on the design and marketing of footwear.

Summary

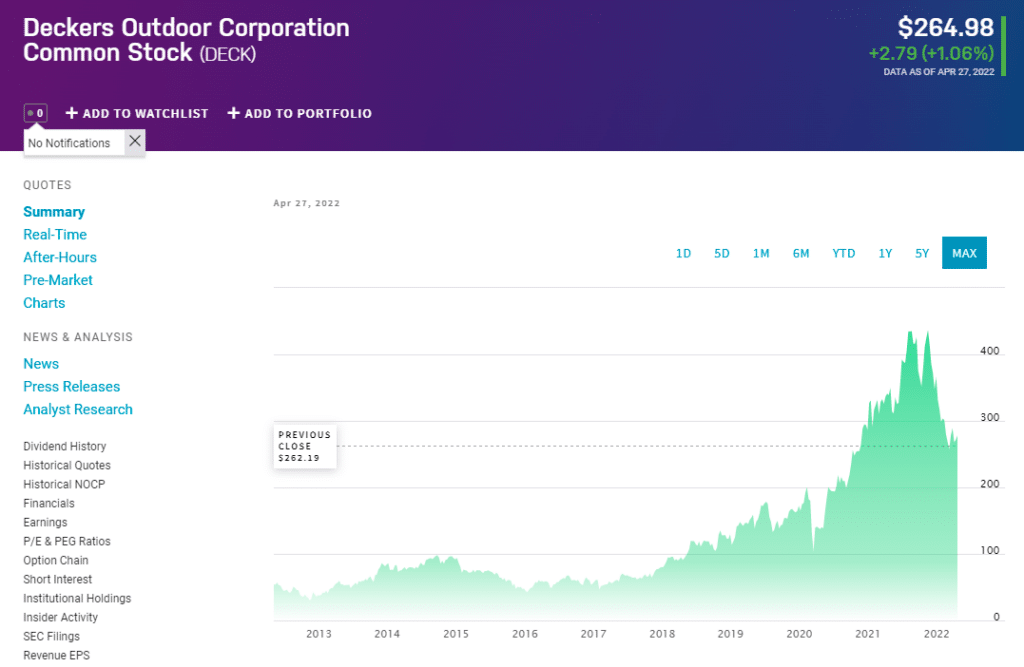

The company, also known as Deckers Brands, was founded in 1975 and went public in 1993. Deckers had already been expanding during the previous decade. However, sales skyrocketed during the pandemic because of their casual and outdoor footwear.

DECK price forecast 2022

According to the 1-year chart, DECK has a median target of $301.68, with a high estimate of $333.35 and a low estimate of $234.08. The consensus projection is a 10% increase above the current price of $273.96.

DECK price forecast 2025

In 2025, the stock price of DECK might reach $550. This forecasted price is a 101% increase over the current price of $273.96.

On Holding (ONON)

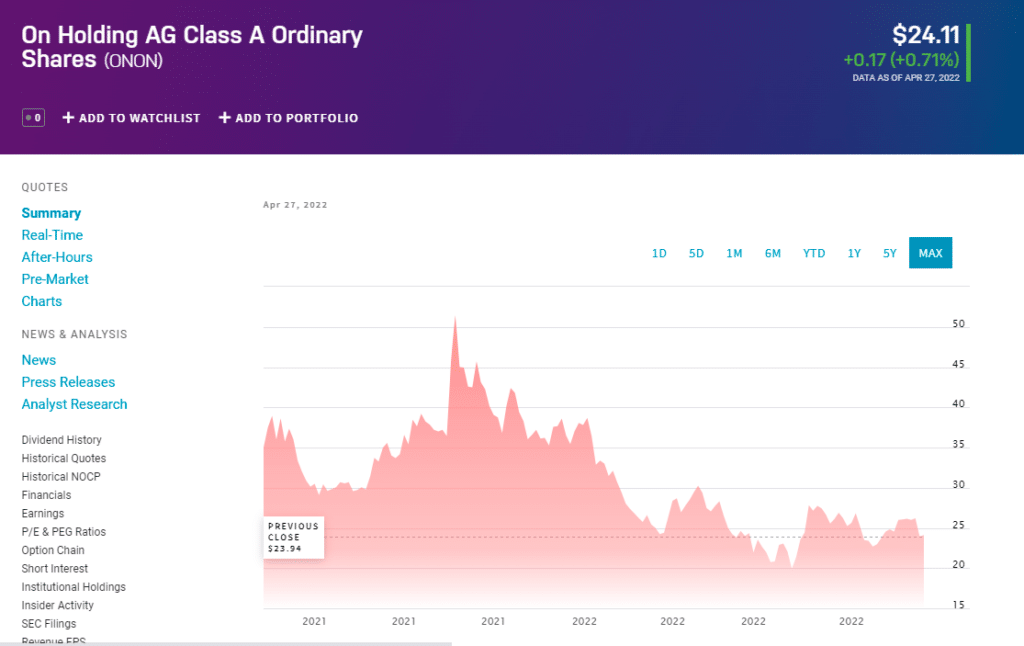

On Holding, which was founded in 2010, has sprung onto the worldwide shoe scene.

Summary

The Swiss brand has created a reputation by producing high-end running shoes and has appeared at elite-level running competitions worldwide. On Holding is also expanding its product portfolio to include lifestyle and outdoor footwear. If these new product launches are successful, this startup shoe manufacturer might have room to grow.

ONON price forecast 2022

According to the 1Y chart, DECK has a median goal of $18.33, with a high estimate of $30.00 and a low of $7.75. The consensus forecast is a 30% drop from the current price of $26.01.

ONON price forecast 2025

In 2025, the stock price of ONON might reach $30. This price projection represents a 15% increase over the current price of $26.01.

Capri Holdings (CPRI)

Capri Holdings, formerly known as Michael Kors Holdings, was founded in 1981 by Michael Kors.

Summary

Michael Kors Holdings bought the Jimmy Choo and Versace trademarks and relaunched them as Capri Holdings in 2017 and 2018. These brands are well-known in the fashion world and play an important role in the premium shoe market.

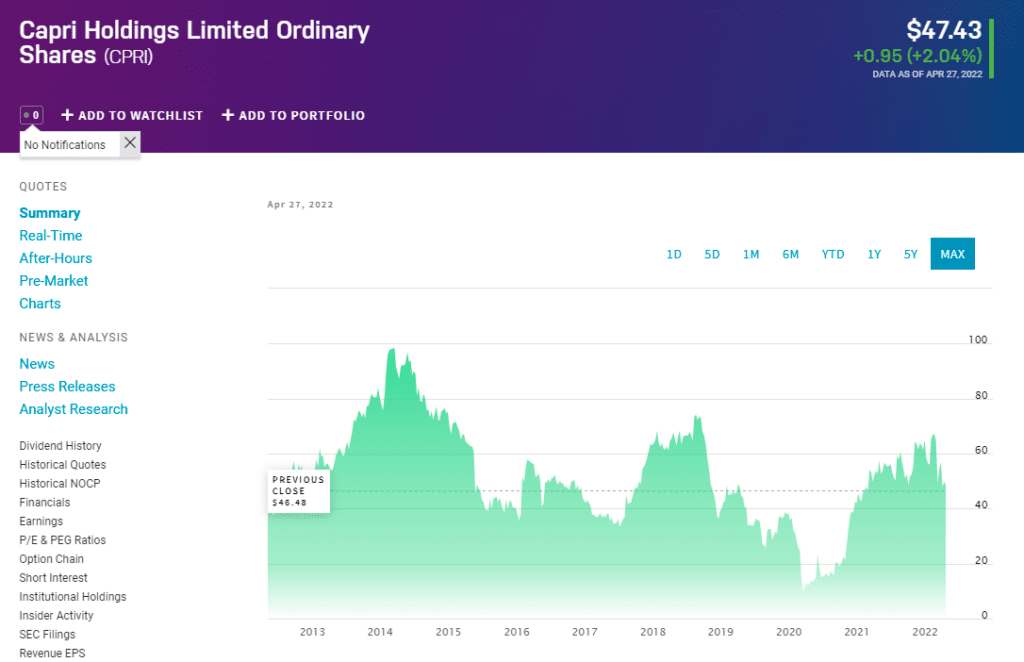

CPRI price forecast 2022

According to the 1Y chart, CPRI’s median goal is $50.95, with a high estimate of $62.18 and a low estimate of $49.53. The consensus prediction is a 6% drop from the current price of $48.54.

CPRI price forecast 2025

In 2025, the stock price of CPRI might reach $77. This price projection represents a 60% increase over the current price of $48.54.

Pros & cons

| Pros | Cons |

| With the shoe market expanding, shoe stocks provide a good portfolio diversification opportunity. | Shoe stocks have slow growth. |

| Shoe stocks have good long-term potential. | You need to research deeper about some shoe companies before investing in their stocks. |

| Some shoe stocks like Nike and Crocs have exploded during the past five years. | Shoe stocks are not good for short-term trading. |

Final thoughts

No revolutionary technology will diminish the appeal or demand for shoes in the coming decades. People may now buy the shoes they desire on-demand, thanks to e-commerce. Investors who get in on these hot shoe stocks early might reap colossal potential.