Investors are optimistic about the future, and solid-state battery companies are gaining popularity. Solid-state batteries are the way of the future. They claim to address many of the shortcomings of traditional batteries.

Investment in solid-state battery stocks now is thus a long-term investment. This article will go through the five best solid-state batteries on the market.

Can you make real money with solid-state battery stocks?

Solid-state batteries are safer and less expensive and could transform the electric vehicle (EV) industry. These will account for 45% of the EV battery market by 2035, and better batteries would be difficult for carmakers to pass on, resulting in a fundamental shift in the battery sector.

However, it’s unclear if publicly listed solid-power businesses will be the ones to commercialize the technology effectively.

How to earn with solid-state battery stocks?

These stocks attract interest from investors who are enthused about the prospects. Solid-state batteries are regarded as the way of the future. They have the potential to eliminate many of the disadvantages of traditional batteries.

Some programs are run by established enterprises, while start-ups run others. Some businesses are directly involved in manufacturing solid-state batteries, while others focus on supplying materials.

How to start with solid-state battery stocks?

To start all you have to do is, search for the relevant battery and estimate the risks and losses invested in the relevant one.

Top 5 best solid-state battery stocks

Let’s look at the top five solid-state batteries in the industry, which continue to perform well.

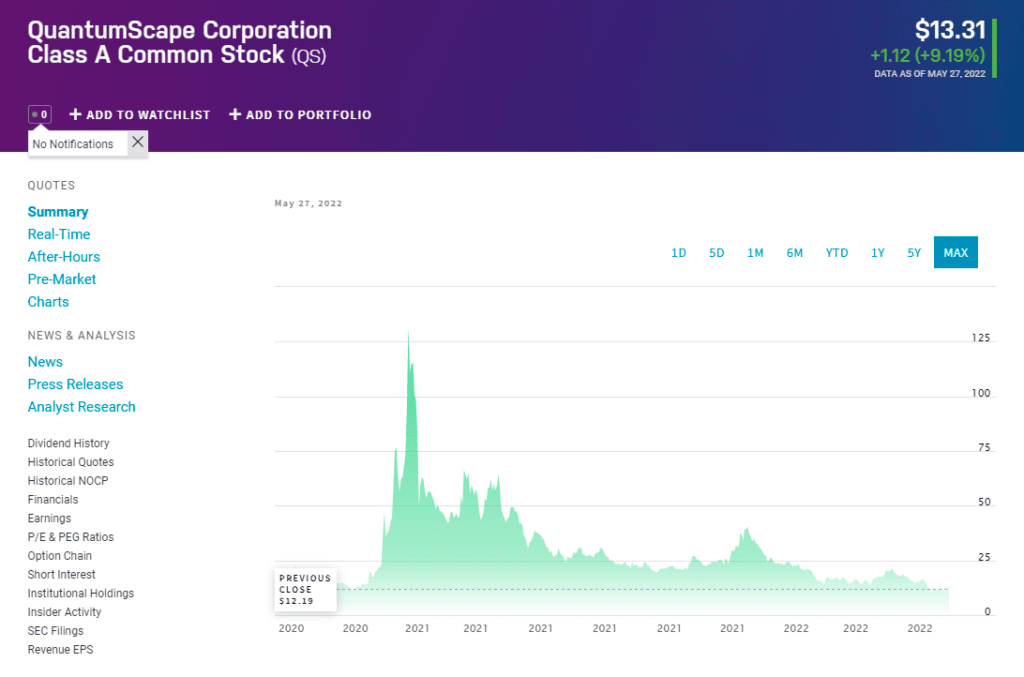

QuantumScape (QS)

QuantumScape was created in 2010 with a market capitalization of $12.8 billion. Its stock now has an earnings-per-share (EPS) of -3.85. Nonetheless, its battery technology is impressive, and it has evidence to back up its claims.

Summary

It is one of the most popular solid-state battery technology stocks today. The company is now working on lithium-metal cells that can last 1,000 charge cycles and preserve more than 90% of their capacity.

QuantumScape has obtained a $300 million investment from Volkswagen and was backed in its IPO by Bill Gates, demonstrating the credibility of its technology.

QS price forecast 2022

Analysts predict that QS’s EPS will be -$0.85 in 2022, with the lowest estimate being -$0.91 and the highest estimate being -$0.79.

QS price forecast 2025

The stock projection for Quantum Scape 2025 is $121.58, with a top of $126.21 and a low of $112.43. The Quantum Scape stock forecast for 2025 increases 888.44% from the previous price of $12.

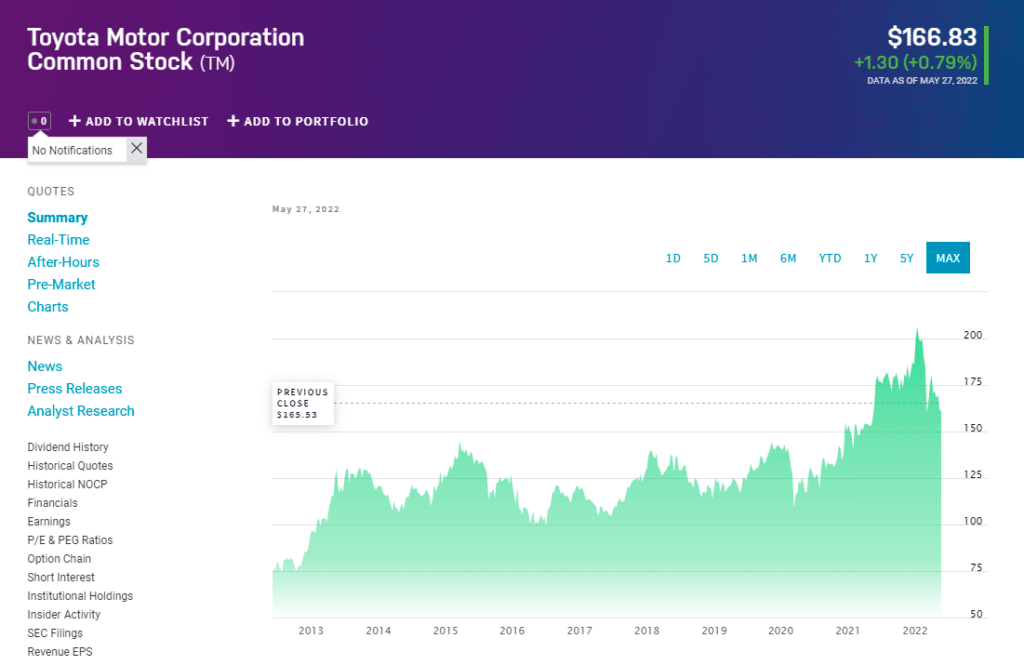

Toyota (TM)

Toyota is one of the world’s leading suppliers of automotive batteries. It also creates, tests, and produces batteries for electronic motors and marine and automotive applications.

Summary

A Toyota subsidiary manufactures and distributes gasoline-electric hybrid and plug-in hybrid automobiles. It also makes batteries and small electric vehicles. The corporation is involved in a variety of automobile industries around the world. The realm of batteries and their uses is one area where Toyota is making an enormous contribution.

TM price forecast 2022

In 2022, the weighted average target price per Toyota Motor share is $161.90. The $159.27 is the minimum level and $167.73 is the maximum target level.

TM price forecast 2025

In 2025, the weighted average target price per Toyota Motor share is $215.53, with monthly volatility of 6.141% possible. $205.57 is the pessimistic target level and $219.02 is the optimistic target level.

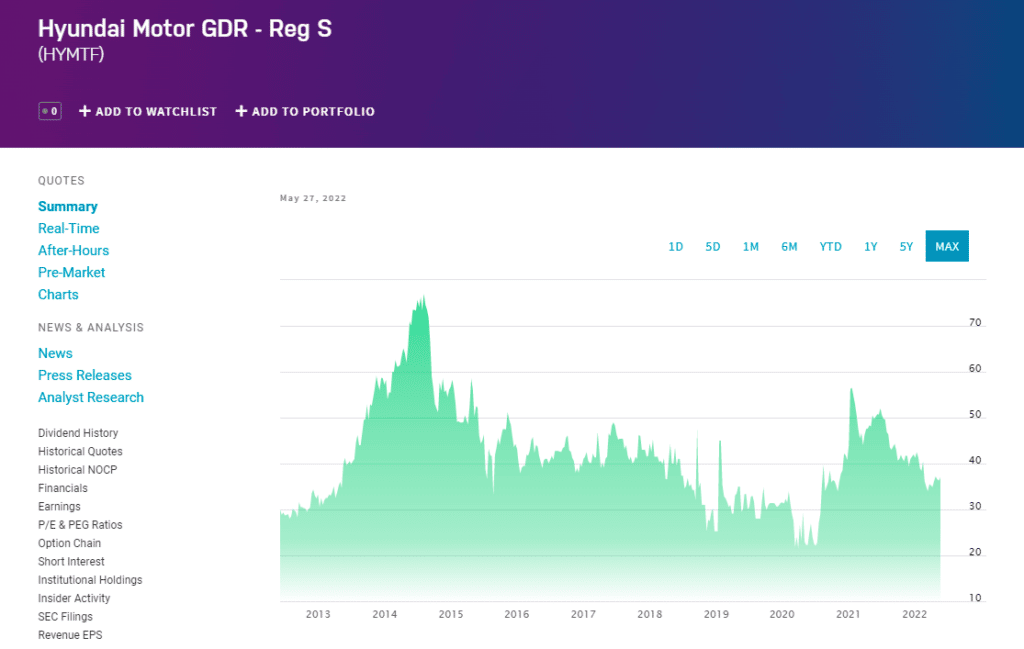

Hyundai (HYMTF)

Hyundai Motor Company produces and supplies automobiles and parts through its subsidiaries. It operates in three segments: vehicle, finance, and others.

Summary

Hyundai also released an electric car powered by solar panels in 2019. It has formed a strategic alliance with Factorial Inc. to collaborate on developing solid-state batteries for next-generation electric vehicles. It is also involved in real estate development, research and development, and investment.

HYMTF price forecast 2022

According to stock analysts, the average 12-month stock price forecast for HYMTF stock is $58.31, which predicts an increase of 56.33%. The lowest target is $27.71, and the highest is $72.02. On average, analysts rate HYMTF stock as a buy.

HYMTF price forecast 2025

The stock forecast for Hyundai Motor Company is $70.76.

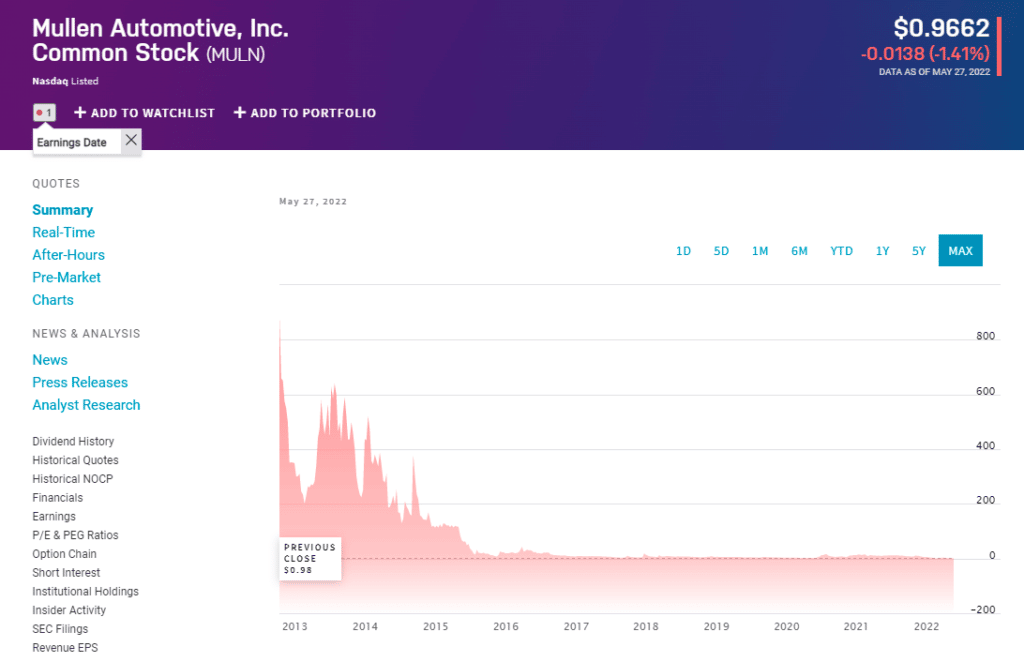

Mullen Automotive (MULN)

Mullen believes that technology, like everything else, should be adequate, cost-effective, and straightforward.

Summary

Mullen is designed to lower greenhouse gas emissions in all aspects of its operations. This involves utilizing low-carbon materials and developing technologies, such as readily available sulfur derived from by-products of oil refinery recycling rather than highly mined rare earth metals.

MULN price forecast 2022

Thus, $0.97 is the projected goal price for 2022 while $0.93 is the minimum target level. The $1.06 is the maximum target level.

MULN price forecast 2025

In 2025, the weighted average target price per Mullen Automotive share is $1.13, while $0.98 is the pessimistic target level. The $1.72 is an optimistic target level.

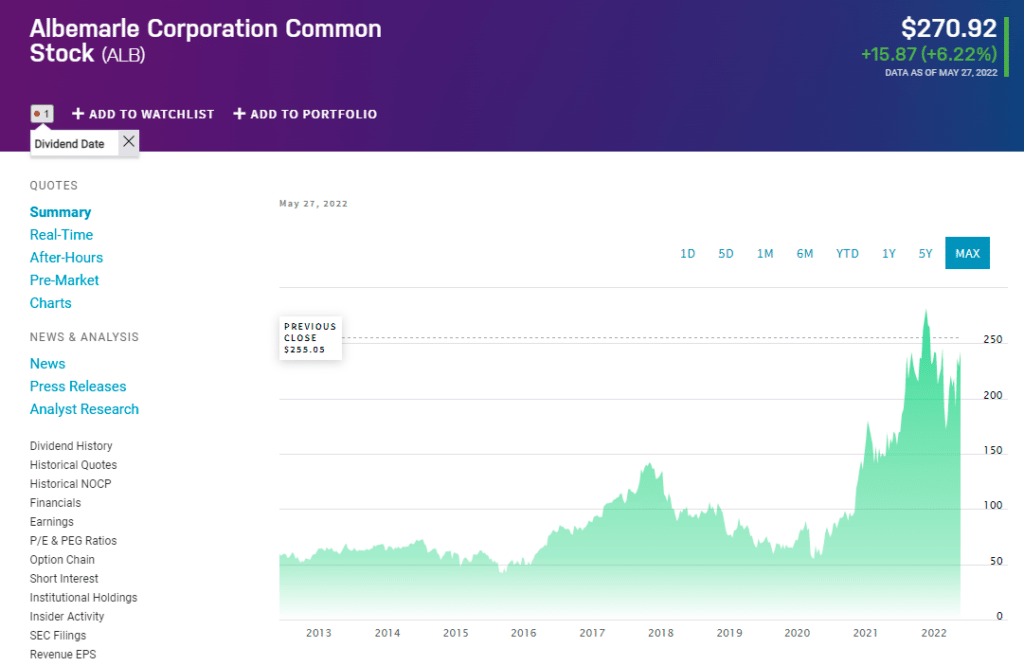

Albemarle (ALB)

If you need a high-performance battery, go no further than Albemarle. They specialize in the production of high-quality lead-acid batteries. Their batteries are built for maximum performance and don’t require a lot of upkeep.

Summary

Battery stocks from the Albemarle Company are used in various battery applications. Albemarle is a battery brand that provides high-quality, long-lasting batteries for various applications. The company conducts regular, stringent quality assurance tests on the batteries it manufactures to help increase battery performance and longevity.

ALB price forecast 2022

Analysts expect ALB’s EPS to be $12.51 in 2022, with the lowest estimate at $12.50 and the highest estimate at $12.51.

ALB price forecast 2025

Albemarle stock is expected to trade at $137.35 on average, with a high of $143.84 and a low of $135.58.

Pros & cons

| Pros | Cons |

| The battery industry has the potential to grow significantly in the upcoming years. | These stocks require a lot of research. |

| Solid-state stocks provide a long-term opportunity. | Solid-state stocks are prone to volatility. |

| They are a great way to diversify your portfolio. | These stocks don’t provide short-term trading opportunities. |

Final thoughts

To summarize, solid-state batteries can assist in overcoming the significant disadvantages of lithium-ion batteries. They’re smaller, safer, have a longer shelf life, recharge faster, and have a considerably more fantastic range. With the company growing, solid-state battery stocks can provide significant diversification for your portfolio.