We all love to travel, and with the pandemic and restrictions eased off in many countries, many people are looking to go places. It’s a no-brainer that travel stocks will grow as we see further Covid restrictions ease off. These easing of limitations have put travel stocks in the limelight.

Let’s talk about the top five travel stocks you can buy and hold for 2022.

Can you make real money with travel stocks?

Even though the travel sector was severely impacted by the Covid-19 epidemic and limitations from lockdown measures, there is growing confidence that considerably larger tourism will occur in 2022. Following two years of losses caused by the pandemic, the ramifications of these new freedoms for travel stocks are considerable.

How to earn with travel stocks?

In 2019, the travel and tourism business contributed more than $9 trillion to global GDP, making it one of its largest industries. As Covid-related limitations continue to be lifted, travel stocks will be free of the influence they had before.

How to start with travel stocks?

If you’re investing in travel stocks, make sure to understand the sub-sectors of the industry. When we talk about travel stocks, there are four categories; airlines, hotels, bookings, and cruises. Some travel industry segments may have yet to price in a rebound, making them appealing investment prospects.

Top 5 travel stocks to consider

Now that you know how to earn and start with travel stocks, let’s discuss the top five travel stocks to HODL.

Airbnb (ABNB)

Airbnb allows consumers and property managers to market their homes, flats, and other places to stay on their website.

Summary

In mid-January, Airbnb CEO Brian Chesky stated on Twitter that he would be working remotely in Atlanta and other places throughout 2022 to grasp better the Live Anywhere movement that is sweeping the world.

Millions of individuals are now working while traveling worldwide, and extended-stay reservations were a priority development area for Airbnb in 2021. As a result, we may anticipate the stock to do well in the long run.

ABNB price forecast 2022

It has a median target of $163.50, with a high estimate of $175.58 and a low estimate of $146.00. The median forecast is a +4.7% increase over the current price of $153.09.

ABNB price forecast 2025

The stock price of ABNB can reach $245 by 2025. This price prediction represents a 56.96% gain over the current price of 156.09.

Booking Holdings (BKNG)

Priceline.com, which owns and manages Booking.com, is the world’s largest travel firm.

Summary

During the Covid-19 pandemic, Booking reduced its worldwide staff by 30% to save more than $300 million per year. It emerged through the 2020 ordeal with billions of dollars of cash on its bank sheet, ready to support the corporation during difficult times. Moreover, revenue and profitability both returned quickly in 2021.

BKNG price forecast 2022

It has a median target of $2050, with a high estimate of $2090 and a low estimate of $1915. The median forecast is a 5.5% decrease over the current price of $2213.

BKNG price forecast 2025

The stock price of BKNG can reach $2976 by $2025. This price prediction represents a 34.47% gain over the current price of $2213.

Marriott (MAR)

Marriott International is one of the world’s major hotel firms, with over 7,000 locations in over 130 countries.

Summary

Marriott is expanding in three important areas: luxury travel, leisure travel, and branded residential. Luxury looks to be the most set to take off in 2022. This year, Marriott plans to open more than 30 premium hotels. While Covid-19 variations may try all in their power to delay reopening, the writing is on the wall. And in 2022, travel stocks like MAR will gain from a more typical hotel business.

MAR price forecast 2022

It has a median target of $172.10, with a high estimate of $178.73 and a low estimate of $164.65. The median forecast is a 3.5% decrease over the current price of $178.46.

MAR price forecast 2025

The stock price of MAR can reach $200 by 2025. This price prediction represents a 12.06% gain over the current price of $177.46.

Southwest Airlines (LUV)

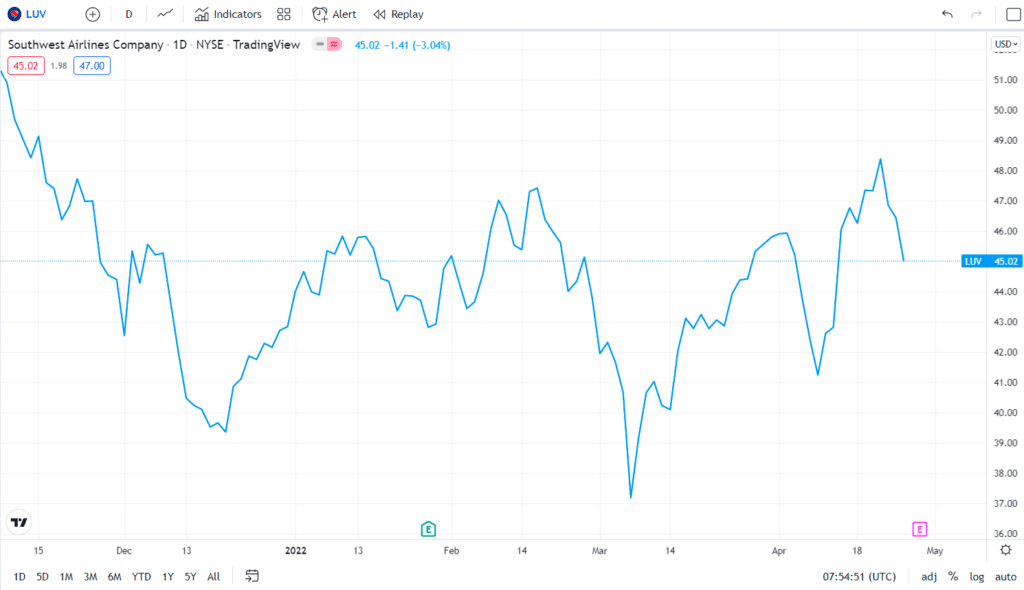

LUV chart

Southwest Airlines is the world’s largest low-cost airline, focused mostly on domestic flights inside the United States.

Summary

Southwest Airlines fared better than other airline stocks throughout the epidemic. As a result, it was the first big airline to recover and generate a profit in a quarter, and it’s well-positioned to gain now that air travel is recovering to pre-pandemic levels.

LUV price forecast 2022

LUV has a median target of $48.20, with a high estimate of $50.30 and a low estimate of $46.71. The median forecast is a 4.75% increase over the current price of $45.01

LUV price forecast 2025

The stock price of LUV can reach $56.94 by 2025. This price prediction represents a 23.75% gain over the current price of $46.01.

Walt Disney (DIS)

The Walt Disney theme parks are among the world’s most popular holiday spots.

Summary

While many travel firms rely entirely on travel demand to generate revenue, Disney is more robust. Aside from tourism, the corporation generates revenue through television, movies, streaming content, and products.

These multiple revenue sources are one of the reasons why many investors see Disney as one of the best stocks to own.

DIS price forecast 2022

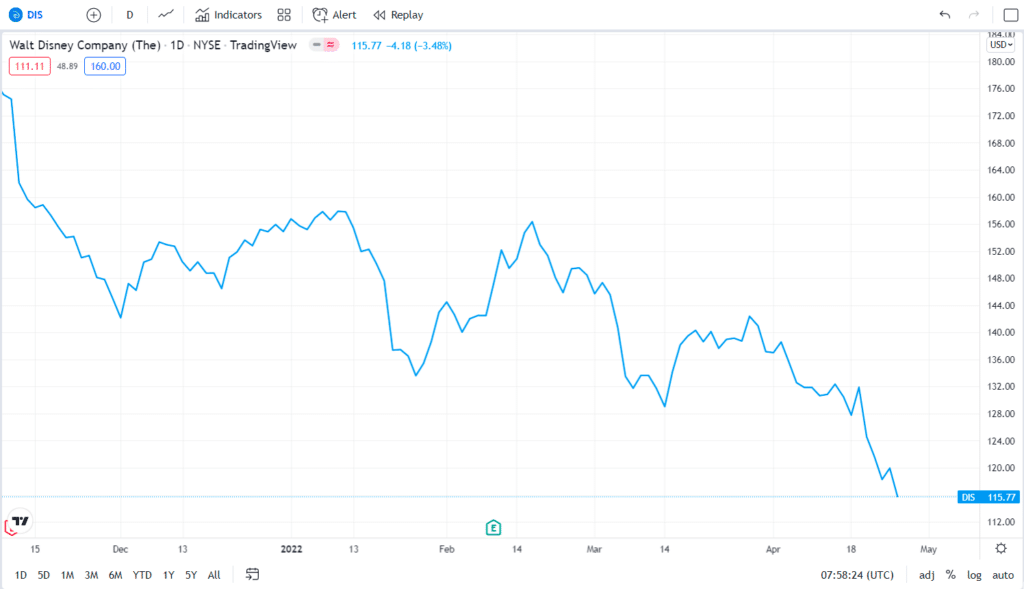

DIS has a median target of $127.41, with a high estimate of $145.12 and a low estimate of $118.04. The median forecast is a 7.73% increase over the current price of $115.26.

DIS price forecast 2025

The stock price of DIS can reach $200 by 2025. This price prediction represents a 69.11% gain over the current price of $118.26.

Pros & cons

| Pros | Cons |

| The travel industry generates a lot of revenue, and the stocks see massive investment. | Such stocks haven’t been performing well for the past two years. |

| These stocks are best for buy-and-hold. | They are not good for short-term trading. |

| They provide good diversification in an asset portfolio. | It will take some time for these assets to recover to pre-pandemic levels. |

Final thoughts

The growth of travel stocks will depend on how the sector will perform over the few months. However, as the world moves on from the pandemic, travel is one of the hottest buying-and-hold sectors.