Gaining future financial security and independence is the aim of every individual. Investing in stocks or other financial securities is an excellent option to ensure economic freedom and counter inflation.

On average, the suitable investment can bestow around 7-10% annual return to the investors. Due to the rising awareness, investors have been adopting many strategies with improved characteristics. For instance, value investing is one of the most lucrative investment techniques that generate significantly high rewards.

Graham Benjamin introduced the concept of value investing in his publication “The Intelligent Investor” back in 1949. Moreover, one of the most famed contemporary investors, Warren Buffett, also utilizes value and growth investing features.

Let’s discussed the attributes of such investing and how to select value stocks.

What is value investing?

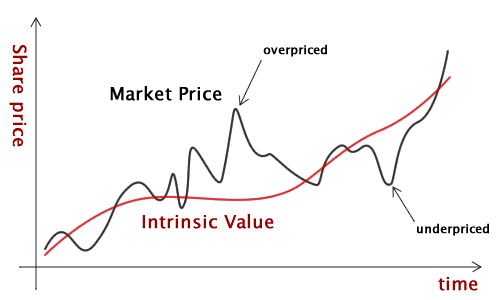

It refers to buying “undervalued” stocks that seem to be available at less than their actual or intrinsic value. Market participants invest in stocks that display a tremendous inherent potential, but for some reason, trading at less than their original value.

Value investing allows market participants to purchase stocks at discounted prices, maximizing profits.

For instance, a value investor would buy a company’s stock at $50, believing that this price does not reflect the firm’s intrinsic value that could reach $100. They would aim to profit from the “gap” between the present and actual value of a stock share.

What are the features such investing?

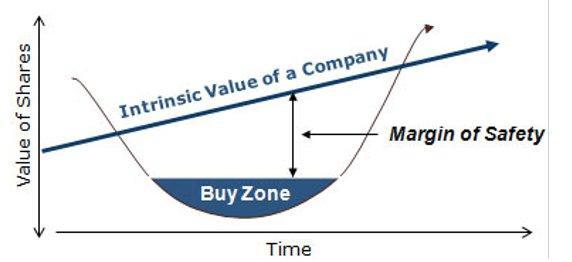

The margin of safety is the critical factor of this investing type that focuses on reducing the probability of losses and enhancing the profitability chance. Value investors believe in this risk management principle and buy stocks at not more than two-thirds of their true value.

Safety margin gives investors a bright chance of profiting by selling such stocks at the right time. Similarly, there is a minimized loss possibility even if the stock does not well-perform as expected.

Markets are not always efficient and are prone to public sentiments and biases. Value investors presume that a stock price does not always reflect a company’s intrinsic value due to various conditions. The traders can immaturely engage in panic selling and buying in case of disappointing news, earnings announcements, poor economic conditions, or the popularity bubble of some stocks.

Moreover, these investors usually do not follow the herd mentality and go against the ongoing trends. They base their decisions on only the inherent value of stocks and do not buy in-trend, overly-priced stocks.

In addition, tolerance and resilience are the pre-requisites of value investing. Value stocks do not provide instant profits and require a significant amount of time to generate considerable gains.

How to choose value stocks?

Investors consider various factors and metrics to evaluate the inherent potential of stocks and ascertain their valuation.

Some of the most commonly examined metrics are:

Price-to-earnings

The P/E ratio presents the relation between a company’s share prices to its earnings per share. A low P/E signifies that a share’s price does not reflect all the earnings, indicating its undervaluation.

Price-to-book

A P/B ratio compares a company’s share prices to its book value. A lower stock price than the company’s assets indicates the undervaluation of relevant stock.

Free cash flow

It refers to the amount of free cash left after the company’s expenditures and all other capital requirements. A good cash flow indicates a corporation’s capability to invest in the future, pay debts and distribute dividends.

In addition, investors also analyze other fundamental factors and financial conditions of a company such as its earnings data, historical record, the scope of its industry, market competitiveness, and annual revenue for determining the valuation of the relevant stock.

What are the qualities of good value stocks?

Such assets exhibit various qualities that make them attractive investment options. In addition, investors prefer value stocks of companies with a solid foundation and successful track record. Such stock has a reasonable profit history without any major variations.

According to Graham Benjamin, the father of value investing, high-risk and high-reward stocks like junk bonds, start-up companies, and small-cap shares are unsuitable for value investing.

Look for stocks with promising prospects, reduced volatility, and a stable revenue generation record.

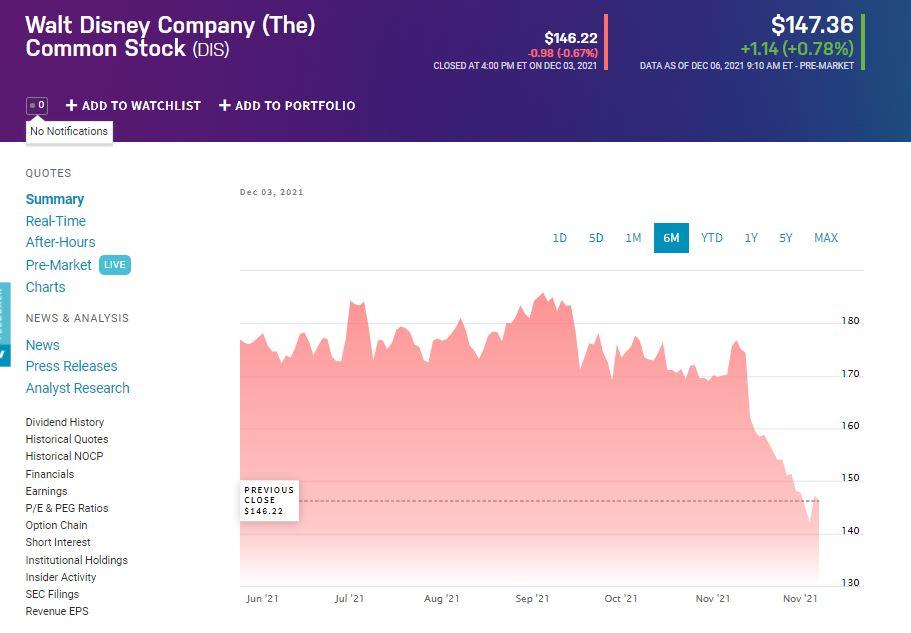

For example, Walt Disney stock (DIS) is currently posing as a good value stock due to a significant pullback from its all-time high price. The stock has retraced more than 20% from its recent high.

Walt Disney is an entertainment media and parks or products company. The company’s studio operations slowed down recently, along with a reduction in sales. However, this brand has a solid potential to recover from its challenges and resume its upward trend.

How to do correct value investing?

Portfolio diversification is critical to remain profitable in the long run. Invest in diverse stocks, mutual funds, bonds, and assets to avoid over-dependence on one sector.

Moreover, as a value investor, you need to refrain from swaying with the market craze and trending excitement. Keep your focus on the stocks’ fundamentals and examine its growth potential objectively.

One of the essential aspects of value investing is to avoid the “value traps.” Value traps are investment options that appear cheap and offer good buying opportunities but are misleading. They are stocks of the cyclical or new-tech companies that undergo a sudden boom but have a non-innovative framework and lack the competitive ability.

Good value investing requires the commitment and expertise to decipher its financial conditions and forecast its future outlook.

Pros & cons

Value investing is a lucrative domain but has certain limitations as well. Let us have a look at some of its pros and cons.

| Pros | Cons |

| Strategic profits Value investing capitalizes on stocks trading at less than their intrinsic value, providing a high-profit potential. | Difficult and complex selection Value investors need to do a detailed fundamental analysis and extensive research on the company’s financial data before investing. |

| Low risk and volatility Value stocks exhibit less risk and volatility as compared to trendy stocks. | Investing against the trend Generally, value investors go against the prevailing trend that can be stressful and straining if the market does not reverse. |

| Independent of market noise Value investors can rest easy after prudently investing in good value stocks, avoiding market noise or sentiment. | Requires long-term waiting Value investors wait for a long time to witness the results, but all their patience could turn worthless if the stock value does not increase with time. |

Final thoughts

Value investing necessitates a specific skill level and knowledge to analyze the value stocks efficiently. Moreover, there is no defined or clear-cut formula to separate good value stocks as every investor can reach a unique conclusion.

Therefore, the correct studying of metrics and market knowledge is essential to profit from this high reward strategy. However, a value investor needs to be less emotional and have the patience to wait for the gains confidently; and not withdraw the investments on the first sign of a bleak situation.