There are two main approaches to investing when it all boils down. You can either bet that security will increase in value or that it will depreciate. People who anticipate that security will advance in the future take a long position.

This means that they buy, for example, a stock, wait for it to become more valuable, and sell it later, with the difference between the selling and the buying price being the profit.

The short sellers take the opposite approach. They borrow a security from a brokerage and sell it at a current price. They also make a contract with the brokerage to buy back the security at a specified date for whatever the security price at the time may be. This is known as “covering the short.”

If the price of the bought security declines, the short seller makes a profit equal to the slide in price. If the security does better than it did on the day the short seller bought it, they lose the amount of money by which the security rose.

What is a short squeeze in stocks?

In simple terms, the short squeeze is a jump in price usually prompted by many short sellers closing out their positions and buying early the stocks they borrowed to minimize their losses.

Imagine a company you betted against suddenly doing better than what you anticipated. You decide to buy back the stock from the brokerage early, but other investors choose to do the same. You now stand to lose rather than profit from your short seller’s position.

The stock is already doing better than expected, and now there are swaths of people trying to buy the stocks simultaneously. Due to the higher demand for security, its price will surge even more. This will happen only due to the increase in demand. So not so many thanks to the firm’s underlying factors.

Examples of short squeezes

Let’s look at two famous short squeeze examples — Volkswagen in 2008 and GameStop in 2020.

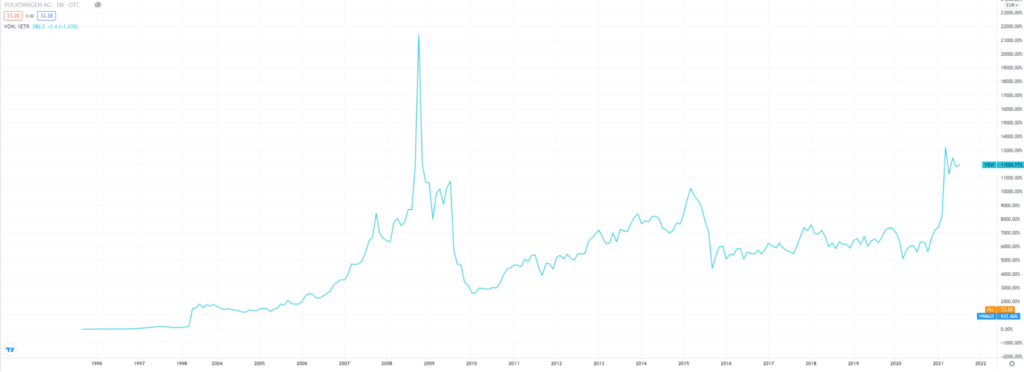

Volkswagen (VW) in 2008

Investors typically view shares of car manufacturers as cyclical stocks. This means that they usually correlate to the state of the economy. That’s why during the 2008 crisis, shares of carmakers were popular shorting candidates.

Volkswagen was already in a lot of debt even before the crisis began. With the financial turmoil hindering the entire auto industry, the German giant was even more appealing for the short-sellers.

At the same time, Porsche was increasing its stake in the company, raising its share in the German carmaker from 30% to 74% taking into account stocks and options.

While short-sellers operated under the assumption that 44% of the outstanding shares were available, Porsche released a statement letting the investors know that said percentage is drastically lower and even smaller than 1%.

The short-sellers then rushed to exit their positions, bringing the price of VW shares to over 1,000 euros and making the crisis-hit carmaker the most valuable company in the world for a little while. Short-sellers losses attributed to the VW squeeze of ’08 amounted to billions of dollars. After the frenzy, Volkswagen dropped more than 60% in just one week.

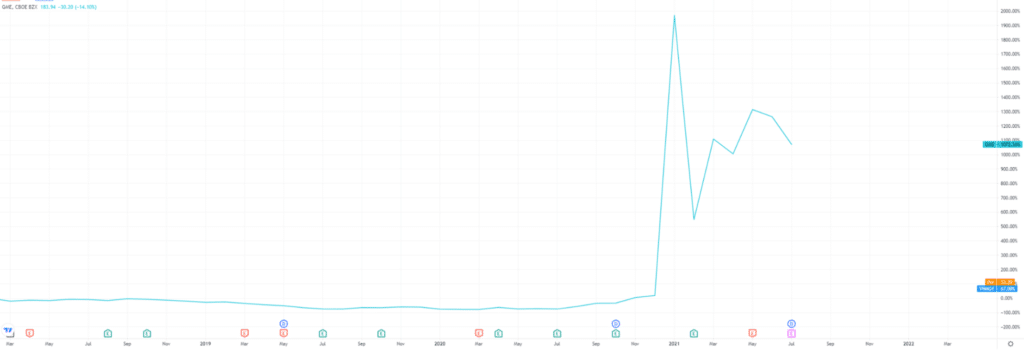

GameStop short squeeze in 2020

In 2020, Wall Street was extremely bearish regarding the gaming company GameStop. That means that some of the most prominent players on the stock market expected the company’s shares to drop. Due to the sentiment, people shorted more than 130% of GameStop’s available stocks.

Meanwhile, the company announced some optimistic news regarding the business model and unveiled changes in top management. The circumstances prompted a group of investors to work together to execute a short squeeze. They even explained their tactic to other users on Reddit in simple terms, allowing even more people to get in on the action, even though they had no experience in the world of trading whatsoever.

As a result, GameStop’s shares skyrocketed from $17.25 recorded before the surge to almost $500 after the squeeze, leaving the short-sellers in dire straits, struggling to cover their positions.

How to spot a short squeeze

There are a couple of factors that could hint at a possible future short squeeze.

- The first one is the number of company’s shares shorted at the moment. The greater the number, the higher the chances a short squeeze might occur.

- Another signal is if the shorted stocks account for at least 10% of the outstanding shares in free float. A good rule of thumb is to look for the companies that have five times the amount in shorted stocks compared to their daily average trading volume.

- Finally, you can make an educated guess that a short squeeze is in the cards if the number of shorted stocks rises unexpectedly over a couple of days or weeks.

Final thoughts

If you are new to investing, shorting can seem like the worst idea in the world if considered only via the examples mentioned. Of course, nothing is ever black & white, and we can say that many people increased their wealth by following this strategy.

The thing you have to keep in mind is that the risk-to-reward ratio of shorting is askew. While you can only lose what you spend in long-position trading, the potential losses are limitless for the short-sellers, as they correlate with the stock’s growth.

Before you decide to make a bet against any given company, be sure to check if the strategy is the right one for you. Try to determine if there are enough free-float stocks to cover your position if things go south.

While short-selling can be appealing and lucrative, to be honest, if you are not careful, you will find yourself up the creek without a paddle and fast.