The crypto market is notorious for its volatility; however, it is an ideal market for scalpers. Those who are not afraid of risky strategies and invest most of their time analyzing market fluctuations prefer scalping over swing trading.

This guide will talk about the aggressive scalping crypto strategy and how you can take advantage of it.

What is scalping in crypto?

Scalping is a trading strategy based on earning from minor price fluctuations and flipping quickly. It is a tight escape route since one major loss might wipe out the plenty of modest growth the trader has achieved.

A trader adopts a scalping strategy to profit at a minimal price daily. When these little earnings from each trade compound up, it might add up to a significant sum. Unlike longer-term events, scalp traders focus largely on short-term events that cause greater interest in assets owing to some news.

Scalp trading is not for everyone and requires a thorough grasp of the market.

If you want to apply the scalping strategy, you must be quick. Scalpers must respond quickly to capitalize on short-term volatility measured in minutes or seconds. Scalpers can continuously profit in this manner over long periods.

To profit from minor price changes as a scalp trader, just select cryptos with more volatility. You may reduce risks and get rapid returns by taking advantage of relatively small price differentials across cryptos.

How to trade using the scalp trading method?

In this method, a trader creates his trading strategy to maximize profit by applying some fundamental trading ideas. You can achieve it by observing trends and market analysis in the shortest period. This period can typically range from an average of 5 to 10 minutes.

It can be further categorized into manual and automatic scalp trading. A trader must-watch market actions and constantly observe trades to have complete control over manual crypto. It also requires a sharp mind for when to open and cancel a position to benefit from an exchange.

For an automated trade, the scalpers construct their strategy to support their techniques using a software system or trading tool that bets even when the traders are not on the screen. This system minimizes the risks of loss and helps generate profits.

Now that you know about the scalping strategy, it’s time to put it into action.

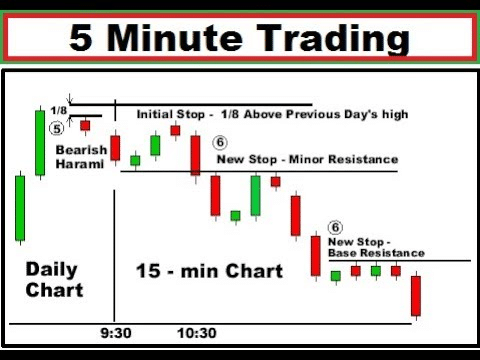

The 5-minute trading strategy

Each trader develops a unique trading method to maximize profits. However, some fundamental trading concepts are shared and employed by all traders. As the trader has little time for fundamental market analysis, the scalping strategy is based on real-time technical analysis.

The five-minute strategy looks for a movement burst. First, traders use two technical indicators:

- 9-period exponential moving average (EMA)

- moving average convergence divergence (MACD)

EMA functions to determine trend while MACD help to predict momentum.

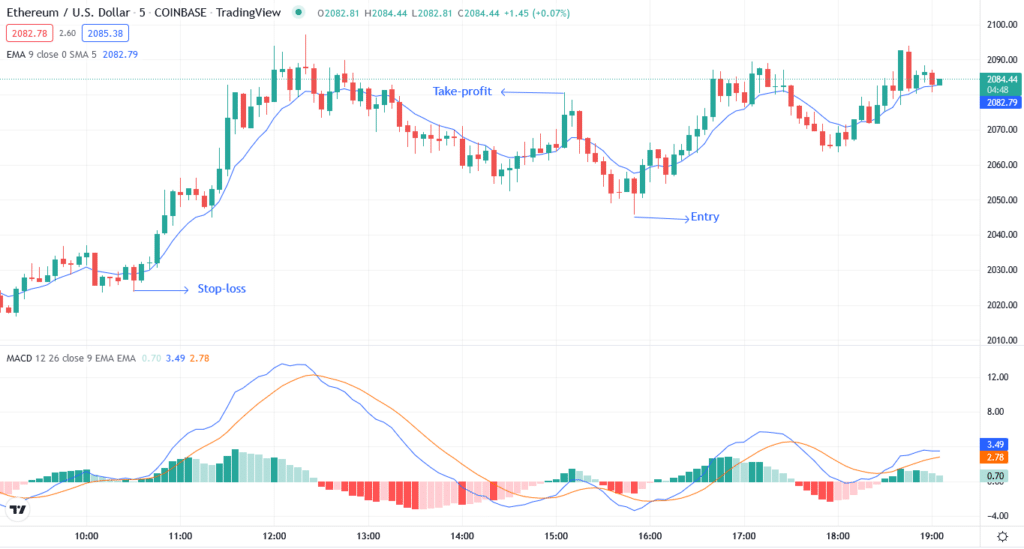

Bullish trade setup

To find the bullish trade setup, we will use the 9-period EMA and MACD. For finding the bullish trade setup, the MACD must be below the zero-line, and the price should be below the 9-period EMA.

Entry

You need to enter after the two indicators satisfy the conditions mentioned above. It’s best to wait for the price action to continue its path and then enter the trade.

Stop loss

You can place a stop-loss near the recent low from the entry point.

Take profit

For TP, you can place it near the recent high or when the price moves above the EMA.

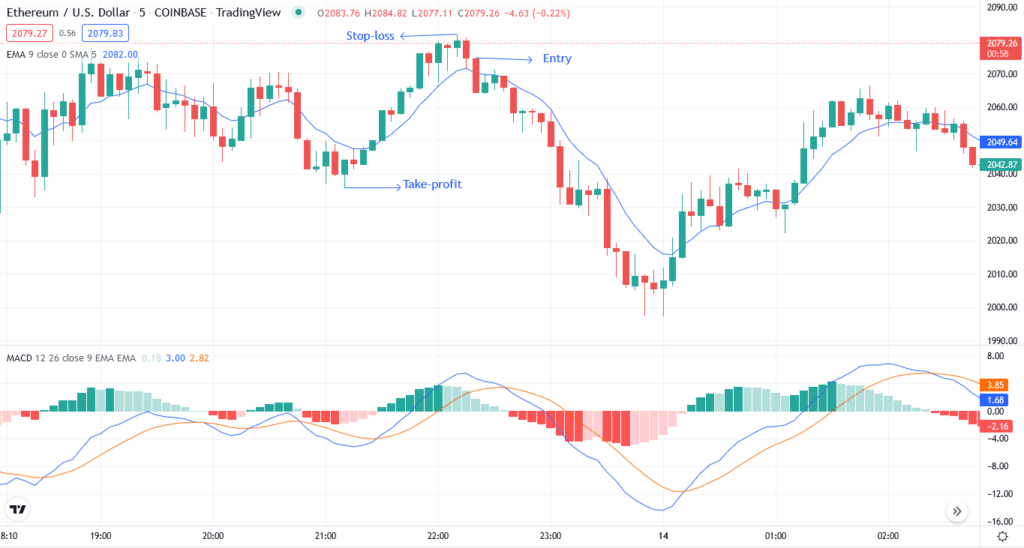

Bearish trade setup

To find the bearish trade setup, we’ll take help from our indicators. For finding the bearish trade setup, the MACD must be above the zero-line, and the price should be above the 9-period EMA.

Entry

You need to enter after the two indicators satisfy the conditions mentioned above. It’s best to wait for the price action to continue its path and then enter the trade.

Stop loss

You can place a stop-loss near the recent high from the entry point.

Take profit

For TP, you can place it near the recent low or when the price moves below the EMA.

How to manage risks?

Before starting a trade, you need to apply risk management strategies. Therefore, the most crucial lesson scalpers must learn there is risk management.

The choice of managing risk could have a more significant impact on your account than deciding where to place your entry orders or even what time scale to trade on. The first step in risk management is determining a critical degree of assistance and rigidity.

The following are the risk management strategies:

- Stop at a 5% loss

A stop-loss order is supposed to minimize a shareholder’s loss on an undesirable step in a full-time position. You don’t have to analyze your assets daily when using a stop-loss order. Traders are often advised to stop trading if the amount of loss crosses 5% of the amount.

- 1% rule

Even though nobody wants to lose money on their fund, it is unavoidable in scalping. As a result, having a risk management strategy before initiating a transaction is critical.

While setting a stop loss is critical, traders should also remember the 1% rule. It indicates that traders must never invest over 1% of their checking account balance in a single trading strategy. To put it another way, if you have a $10,000 account, you must never risk upwards of $100 on any single position.

Final thought

The scalping trading method isn’t a novel trading strategy, but it’s one that many current traders implement. Scalpers must be willing to accept small wins and focus solely on the next trade. It may appear simple on paper, but scalping strategies will devour traders who aren’t experienced enough to manage their emotions.