Every sector and asset class has a specific behavioral pattern in the financial markets. Understanding the various intrinsic factors related to stocks and funds is essential to maximize returns from investment or trading.

Precious metals, like gold, have long remained the investors’ center of interest for securing their investments during unfavorable economic conditions and turmoil. Investors can trade or invest in this commodity in several forms, such as physical metal, mutual funds, stocks, ETFs, and futures or options derivatives.

So, are you thinking about investing in gold stocks as your safe backup? Then, read this article to understand various attributes concerning gold stocks and the best gold stocks to buy in 2021-2022.

What are gold stocks?

They are the stock shares of companies that focus on the gold industry. They can be gold mining companies that extract and sell gold. Or they can be gold royalty/streaming companies that make contracts with the mining companies to obtain a percentage of their future sales and revenue.

The value of gold stocks correlates with the yellow metal prices. However, the returns of gold stocks do not solely depend on the gold prices. Many additional aspects like the company’s earnings, management system, yearly returns, and scope of projects also affect the gold-stock prices.

In addition, gold stocks can deliver higher gains and surpass the physical metal gains when the gold price is on an uptrend. It is because the profitability and operational sphere of companies can level up remarkably in these affirmative conditions.

How to trade gold stocks?

The choice between trading or investing in gold stocks depends on the future goals of individuals. Gold stock traders prefer fast returns as they actively trade by speculating the commodity prices. It is important to note that the gold-stock price action significantly corresponds to physical metal price movement.

You need to understand the impact of supply/demand and inflation/deflation on gold price movements for trading gold stocks. In addition, you must consider crowd psychology, panic, and greed that can aggressively move the market.

Utilization of technical analysis and knowledge of past trends and major gold price levels can lead to profitable trading decisions. It would be best to comprehend the movements and patterns of major institutional traders, banks, and long-term players to secure your trades from their stopping-out strategies.

Moreover, it would be beneficial to perform a fundamental analysis of the gold stock company’s production costs, quarterly or yearly revenue, and project progression.

What to consider when buying gold stocks?

Investors and traders should consider various factors before buying gold stocks. These stocks are dependent on gold prices as well as the company’s functionality. To ensure its diversified serviceability, you should see the operational area of a company’s projects and mining activities.

Furthermore, look for companies with stable production and large reserves — research their past revenue reports and balance sheets. In addition, gold stocks with substantial market capitalization and large trading volumes have promising chances to generate steady profits.

Moreover, search for companies with reasonable all-in-sustaining costs (AISC). This indicator incorporates all expenditures in its ambit and provides a clear picture of net costs.

Best gold stocks to buy in 2021/2022

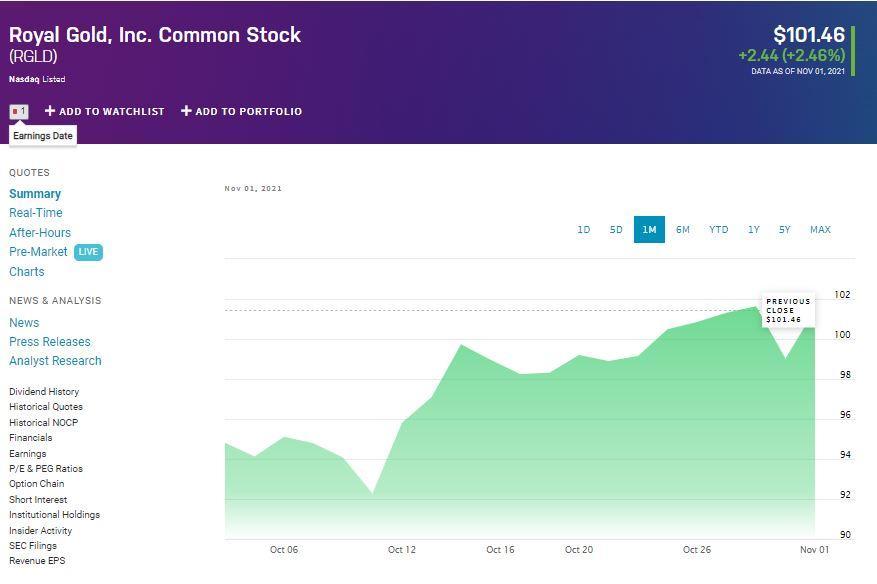

1. Equinox Gold Corp. (EQX)

Current stock price: $7.17

It is a Canada-based mining company that acquires gold and silver deposits. The company has been functional since 2007 and carries out its operations in the Americas. It has seven operating mines with solid growth potential.

EQX is a value-gold stock that has a market capitalization of $2.53 billion. The price-to-earnings ratio stands at 5.14, with a one-year price target of 11 USD. As of November 2021, the current earnings per share is $1.46. Currently, the stock is trading at $7.50.

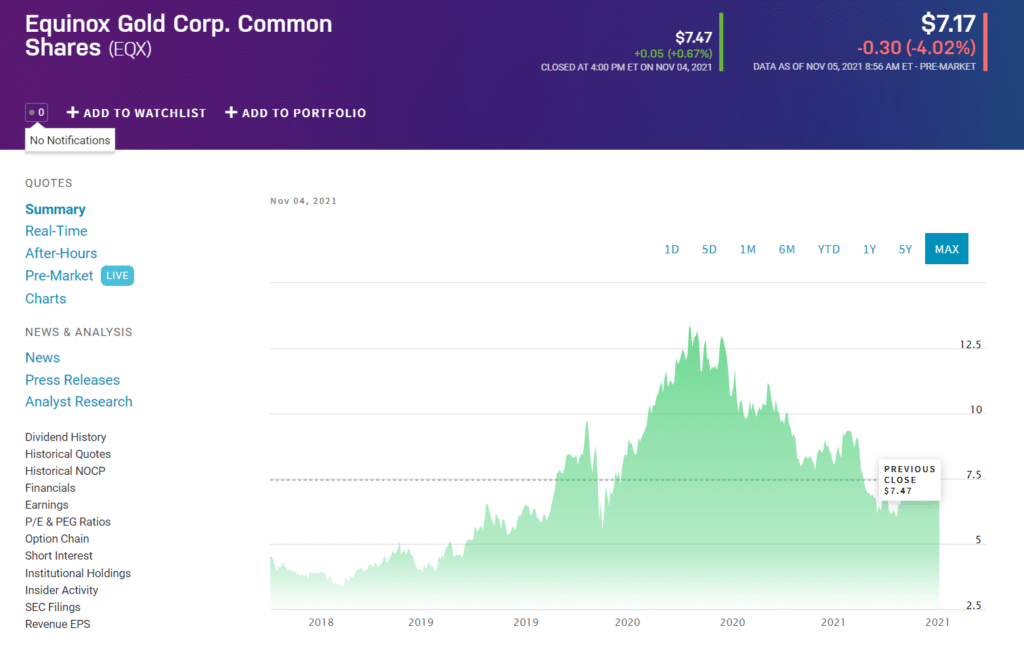

2. Newmont Corporation (NEM)

Current stock price: $54.89

Newmont Corporation is the world’s largest gold mining and exploration company headquartered in Denver, Colorado. The company has been operational since 1921 with reported gold reserves of above 90 million ounces. Moreover, it has widespread projects in various countries, including the US, Australia, Canada, Chile, etc.

NEM has a market capitalization of $43.3 billion with a price-to-earnings ratio of 21.40. The company pays out dividends, and the annualized dividend is about $2.20. The earnings per share (TTM) stand at $2.53. Currently, Newmont’s shares are trading for $54.30.

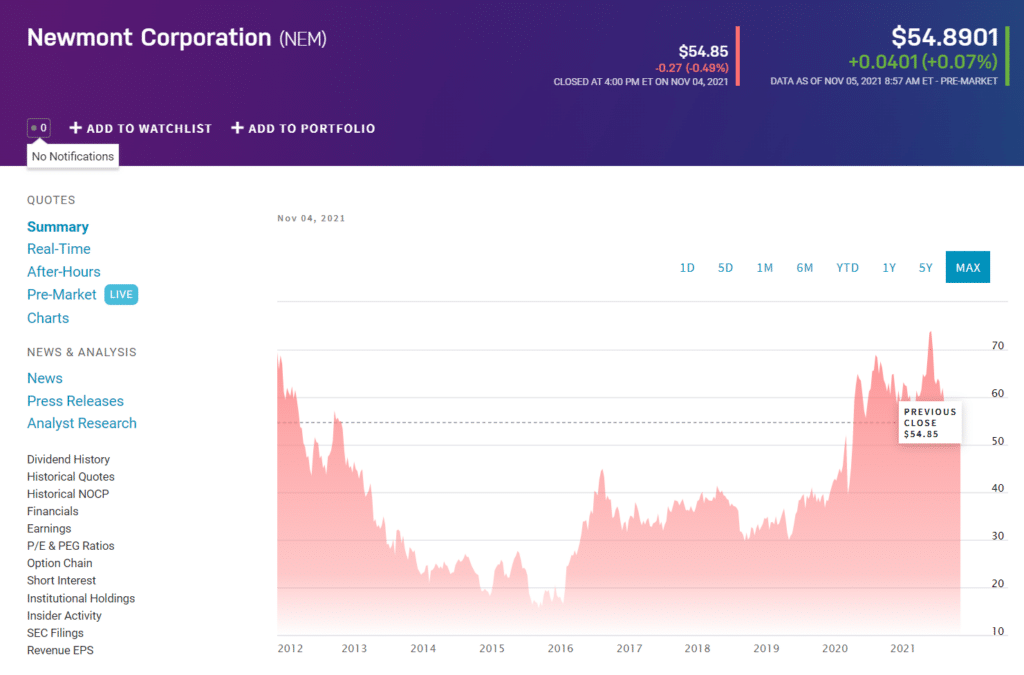

3. Wheaton Precious Metals Corp (WPM)

Current stock price: $40.42

Wheaton Precious Metals Corp is a streaming and royalty company that distributes precious metals worldwide. The company has agreements with 24 operating mines and eight developmental projects. Wheaton Corp began its operations in 2004 with headquarters in Vancouver, Canada.

WPM has a market capitalization of $17.9 billion with a price-to-earnings ratio of 28.27. Currently, the shares are trading at $39.86 and have a one-year target of $55. The forward dividend yield stands around $0.06 (1.51%), with earning per share of $1.41.

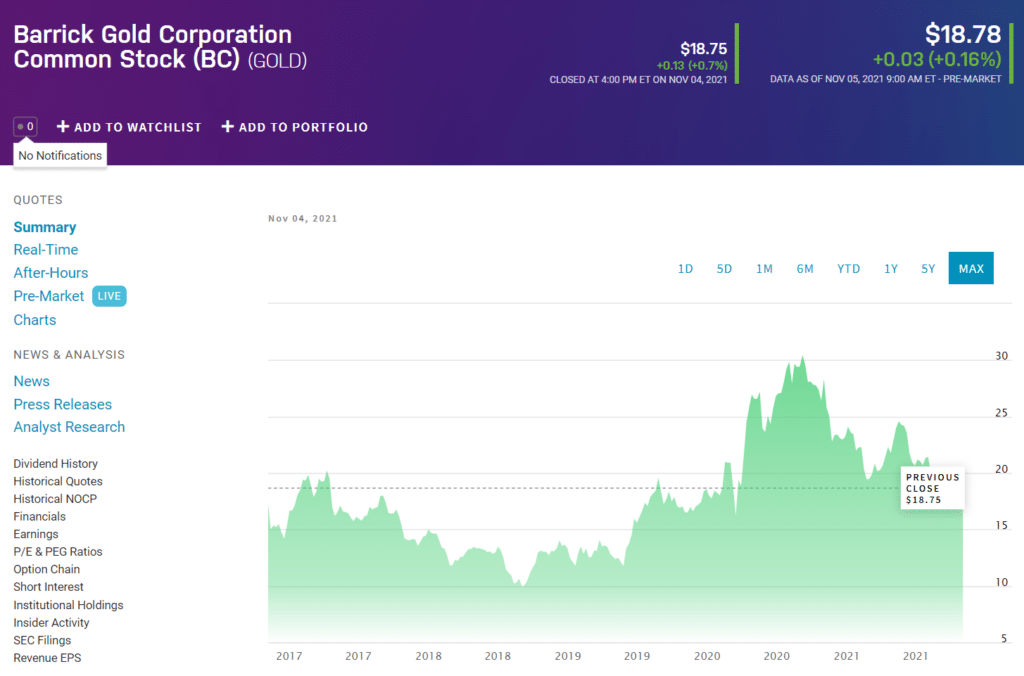

4. Barrick Gold Corporation (GOLD)

Current stock price: $18.78

Barrick Gold Corporation is a gold mining and production company that works in large mining areas with excessive resources. It has a broad operational base in several countries, including Canada, Congo, and the US. Barrick Corporation has been operative since 1983, with its headquarters in Toronto, Canada.

GOLD has a total market capitalization of $38.8 billion with a price-to-earnings ratio of 13.01. The earnings per share are $1.41, and the latest annualized dividend was about $0.36. Currently, the stock share price is $18.48$ with a one-year target of $27.

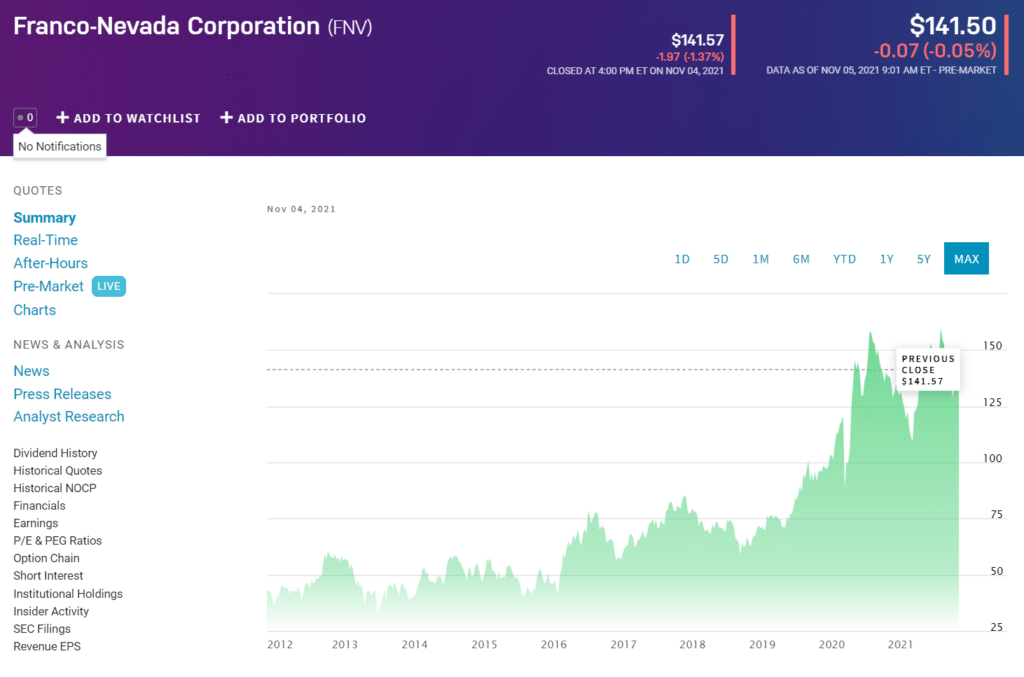

5. Franco Nevada Corporation (FNV)

Current stock price: $141.50

Franco Nevada Corporation is a Canada-based royalty and streaming company related to precious metals and energy resources. It generates 70% of its revenue from agreements with gold mining companies. Furthermore, FNV has a broad operational base in different countries, including the US, Canada, Europe, and Africa.

The company has a total market capitalization of $27.2 billion, and its earnings per share stand at $3.55. The latest annualized dividend was $1.20. Currently, FNV is trading at $142.68 with a one-year target of $57.70.

Pros & cons of gold stocks

| Pros | Cons |

| Hedging Investors prefer gold stocks as they are an ideal hedge against inflation. | Dependent on company performance Gold stock prices depend on the relevant company’s productivity. It can decline if the company encounters fiscal and operational challenges. |

| Dividend payments Most gold mining and royalty companies pay out dividends that form a considerable portion of investors’ income. | High volatility The gold stock market is volatile and shows strong price fluctuations exhibiting risk for short-term traders. |

| Stable industry Gold has a well-established reputation as a valuable metal that can withstand any economic downturn. Correspondingly, gold-stock companies are stable with positive future outlooks. | Prone to market sentiments Crowd psychology heavily influences the gold stock market. Fear sentiment can result in the undervaluation of stock shares. |

Final thoughts

Gold has historical records of retaining its remarkable value over times of economic ups and downs. Investing in the gold industry has become further compelling due to the availability of various gold stocks, ETFs, and mutual funds aside from the physical metal.

The most profitable gold-stock shares are from gold mining and streaming companies with stable records. Hence, you can maximize gains by dealing with stocks of companies with low debt levels, consistent cash flows, and cost-effective projects.