Crypto arbitrage allows you to take part in crypto even without market analysis. As a trader, you will monitor the prices of digital coins on different platforms, find discrepancies, and take action.

Trading robots have found their way into the crypto market in recent times. Now you can utilize a robot to take arbitrage transactions on your behalf. As of January 2022, crypto exchange giant Binance offers more or less 20 crypto arbitrage robots to traders.

The concept of trading while you sleep, is now possible in crypto. Because you can find free bots on your platform, it appears trading now is more accessible than before. The question is, “Are these bots profitable?” You can use paid versions if you want higher-quality bots and have the means. However, trading with a premium bot will not guarantee your trade success.

Let’s explore the effectiveness of crypto trading bots. You will also learn what arbitrage bots are, why you should use them, how to use them, and what risks you should be aware of.

Understanding crypto arbitrage robots

Crypto bots are software programs that perform certain functions based on the algorithm defined by the programmer. These bots will check if specific conditions exist and execute actions such as opening buy and sell transactions. Keep in mind that trading with these programs will not automatically reduce risks, protect from losses, or increase profits. They are simply tools that implement the inputs of the user. You can let them do the trading while you do something else.

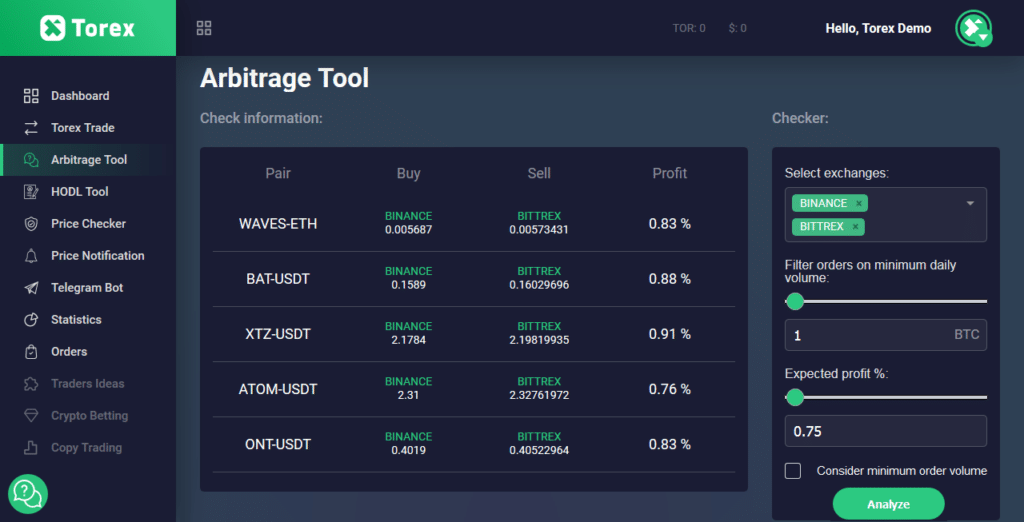

Crypto robots vary, and one popular type is the arbitrage robot. As the name implies, the arbitrage robot monitors prices between exchanges to find discrepancies. Once found, the bot will initiate trades, normally a buy in one platform and a sell in another platform. The image below shows a robot looking for trades; however, a crypto bot is a program running on your trading platform. Because crypto prices can change rather quickly, a bot that works fast can defeat slow exchanges to update their quotes.

Why use crypto arbitrage robots?

Although crypto arbitrage is generally regarded as a low-risk trading approach, it works only when the condition is right. If the condition is not optimal, it might fail. Implementing crypto arbitrage manually is extremely difficult. You must be able to react quickly once you spot a price deviation between two exchanges for a specific asset. Another issue is a potential delay in transaction processing, primarily due to heavy trading volume. Furthermore, you might not have enough time to watch your screen and look for opportunities.

For the above reasons, crypto arbitrage robots came to life. You can let the bot do the things you normally do as a trader, such as finding price discrepancies and executing trades. The concept of using crypto arbitrage robots is fascinating, but they are not a holy grail. They pose a different set of challenges that you must be aware of.

How to use crypto arbitrage robots?

You can buy paid crypto bots or use free programs at your discretion. At present, paid versions are rather costly. Before you download or purchase a bot, make sure you understand what hardware and software are needed to run it smoothly. Crypto bots are indeed helpful if you seek a hands-off trading approach. However, robots usually work in the condition for which they are designed. Make sure you know how to use a bot you contemplate using.

For example, you must set up your accounts properly in two crypto exchanges. You may face losses if you configure your accounts or the bot incorrectly. Make sure that your accounts have enough balance between handling the trading volume determined by the bot. Depending on the bot used, you might need to manually execute a trade or let the robot do it for you.

Crypto arbitrage approaches

You can use various approaches when doing crypto arbitrage. Three popular approaches are outlined below:

- Cross-exchange arbitrage

As the name implies, you will apply arbitrage in multiple exchanges. This means purchasing digital coins in one exchange and selling them in another exchange.

- Spatial arbitrage

This method works similarly to the previous approach. The difference lies in the location of the exchanges. This means, for example, that you will buy crypto in an exchange located in Singapore and sell it in an exchange in America.

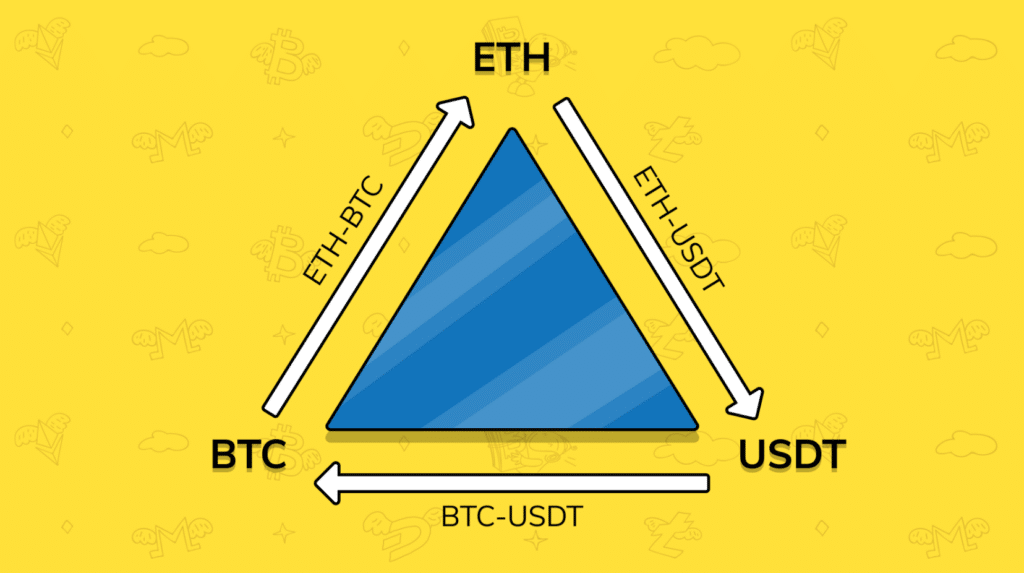

- Triangular arbitrage

This approach is quite different from the previous two methods. Here you apply triangular arbitrage in one exchange. However, you will do so using three crypto assets. For example, you can buy BTC/USDT, buy ETH/BTC, and sell ETH/USDT in that sequence. This series of transactions brings you back to USDT.

Risks of crypto arbitrage robots

Regarding profitability, crypto arbitrage robots generate minimal returns even when working in the optimum condition, which means that you could lose money if you misuse the bot. Also, many of these bots are poorly designed. Take note that many brokers provide crypto arbitrage robots for free. If that sounds disturbing, it is. Do you think they will design the robots to make you profitable?

This is not to say you cannot succeed in arbitrage trading using bots. Opportunities may come and go fast. However, it will require a lot of thought, research, and testing. Because markets are like living beings, they do not behave the same way all the time. They are constantly changing. Therefore, you must watch your favorite assets closely and then tweak the settings accordingly.

Final thoughts

We can compare it with the foreign exchange market since the crypto market is new, like automated crypto trading itself. Trading with robots in the currency market is downright dangerous. The probability of losing your capital is higher than the chance of making money.

Typically, traders use their robots in forex, which they might have purchased or downloaded online. On the other hand, crypto brokers often provide free robots to traders right on the platform. That makes automated trading in crypto riskier. Do not think for a second that your broker has your trading welfare in mind when it offers the free tool. Use the tool at your own risk.