The world is going into an environmental revolution, which will change the way we consume energy faster than ever before. Unfortunately, this change will end some businesses and big companies that are facing difficult times. Still, those on the green side of the equation contribute to making a more sustainable world and making millions in the process.

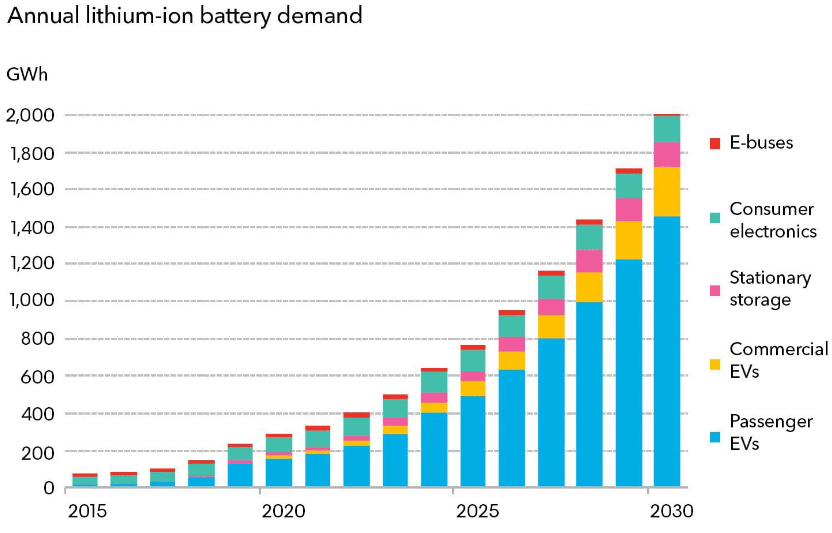

Electric cars are in the front line of this battle, and lithium batteries are key elements of EV’s to change the world. All the big car companies got on the EV train, and they are boosting the lithium market-making experts estimate that the demand will increase from 442.000 tons in 2020 to 1,5 million tons in 2030. The movement is making lithium companies grow at an accelerated rate, and investors couldn’t be happier about it.

The time to invest in lithium companies is right now. Learn which are the best lithium stocks to invest in during 2021/2022.

What are lithium stocks?

They are the shares of companies linked to the mining business, commercializing or processing lithium to create electric batteries for all kinds of devices like smartphones, smartwatches, laptops, and of course, electric vehicles.

The electric batteries used to be made of mercury, but the contaminating nature of the liquid metal moved the industry towards adopting lead batteries. The industry changed and started using lithium batteries in the last few years due to their efficiency, energy storage, and lightweight.

Making lithium batteries resulted in cheaper for the manufacturers. This also gave stability to the price of the devices since even the wider changes in lithium prices don’t heavily affect the product price.

Why buy lithium stocks?

For at least ten years, the world leaders agreed to move to a sustainable development model where the environment will center all economic decisions. Only in the past years, the presidency of Donald Trump represents a drawback to this decision. Still, since the former US president left office, the current president Joe Biden resumed the environmental agenda. As a result, the country joined the EU and other nations to meet the zero-emissions goal for 2050.

As you know, internal combustion engines are a big source of CO2 emissions, that is why all governments are pushing to make electric cars a viable solution as soon as possible.

Electric cars need electric batteries, and today there are no better alternatives than lithium-ion batteries.

The discussion about these batteries can be only centered on what kind of alloy is best to produce them. Recently Tesla’s CEO Elon Musk wrote that the company wants to use iron to replace nickel in the batteries but whatever the choice is, nobody is thinking about replacing the lithium, so the batteries of the future will be either lithium-nickel or lithium-Ion batteries.

How to buy lithium stocks?

In contrast to gold, silver, and other metals, you can not trade lithium as a commodity in the market. The best way to invest in lithium is by buying shares of companies related to the lithium market.

Lithium is a metal found in places far away from the economic centers, so the companies that mine the metals are sometimes national mining companies. The process of investing in lithium companies requires study and investigation. Here are five steps to invest in lithium companies.

Step 1. The broker account

To be able to invest in these companies, you need to open an investment account. However, the times where you needed to contact professional brokers from wall street are way behind, and now you can start investing from your computer.

And the options are many. You have different brokers from different countries with all kinds of deals, so you can choose the one that you think is best for you.

Of course, this also represents a tread to your assets. You can find anything online, and what you think real brokers may be a scam. Make sure you spend enough time researching what broker is best for you before you.

Step 2. The company

As stated above, you can not trade or invest in lithium as you do in some commodities. That’s why the best way to invest in lithium is to put your money in companies whose business is related to lithium.

We expect the price of lithium to grow in the next year, and also the volume of the demand will increase. So companies will benefit from this, but this doesn’t mean that all companies will perform equally well. Some will do better than others, and you need to study to find out where would be the best place to put your money.

Step 3. The ETF

Investing in companies could be very risky, we are sure that the lithium market will do great in the next few years, but that doesn’t mean that individual companies can outperform others or even that some could go bankrupt.

Since you can buy lithium as a commodity, the best way to invest in the market as a whole is through an ETF that invests in lithium companies.

Step 4. The risk

The key to being a successful investor is to minimize your losses. If you effectively manage your risk, the reward will come sooner or later, and the profit will only increase with time. So never put all the eggs in one basket, diversify your investment, and don’t forget to use risk managing tools like stop-loss levels.

Step 5. The checking

Yes, investing in lithium will pay off in the long term, but that doesn’t mean you will forget about the whole thing for the next ten years. The market is always changing, and new exciting companies are created every day. Also, the companies in which you put your money first could reach resistance levels or even fall. So you need to be aware of every movement to avoid losing your profit.

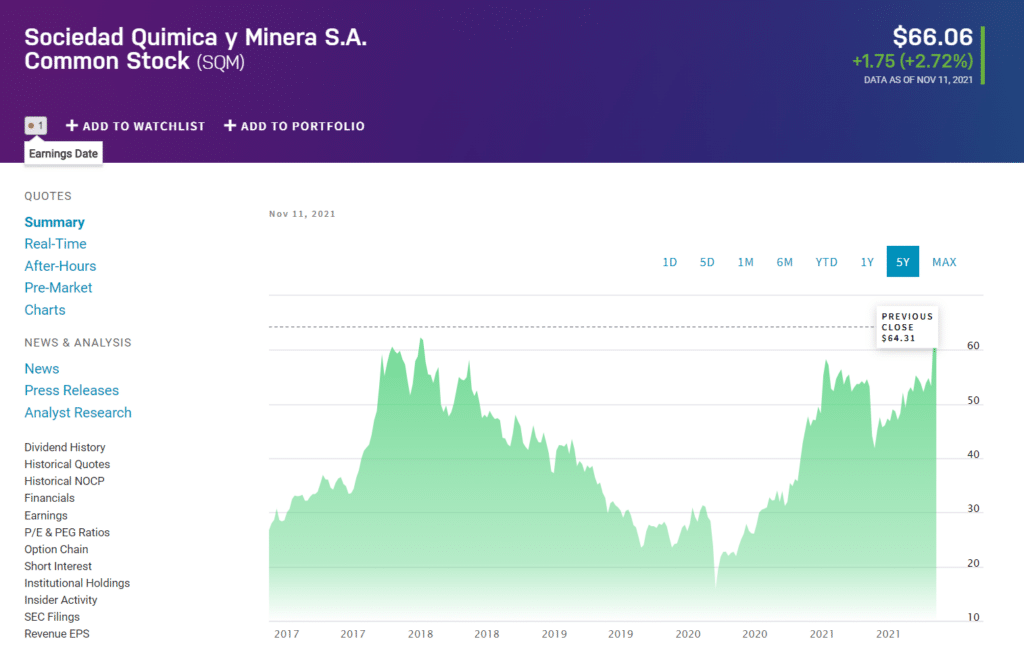

1. Sociedad Química y Minera de Chile S.A. (SQM)

Price: $66.06

EPS: 0.82

Market capitalization: $17.498B

The Chilean company is one of the big players in the lithium stage. The country has a long mining tradition, and they are prepared to benefit from the lithium boom. As a result, its stock price has been increasing since March. The prices are close to the highest point in history.

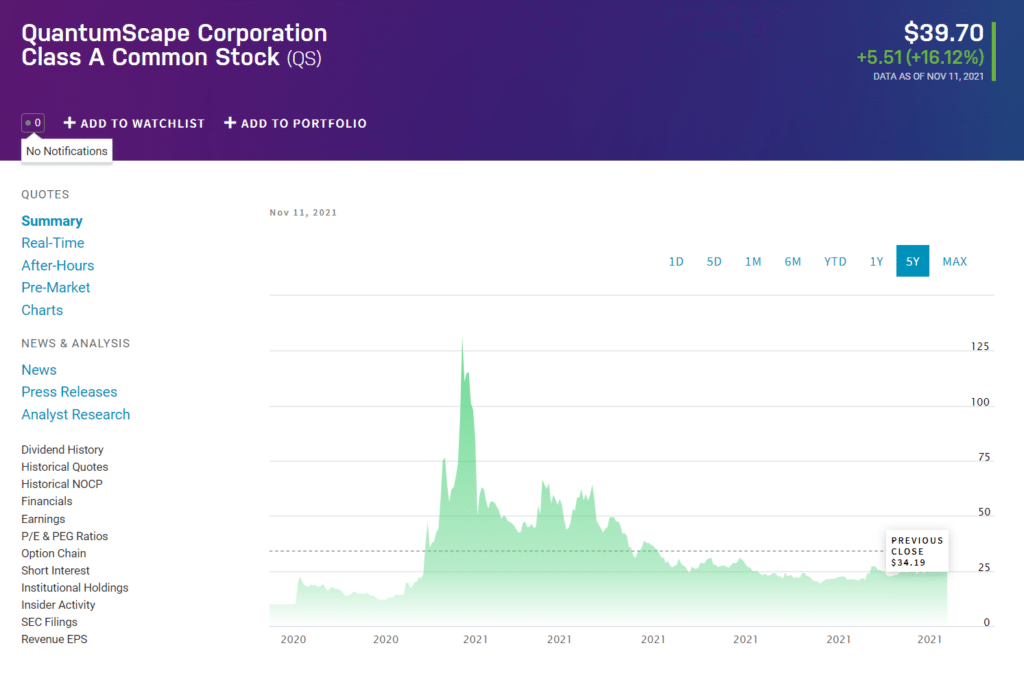

2. QuantumScape Corporation (QS)

Price: $39.70

EPS: -3.85

Market capitalization: $13.669 B

The company based in California was founded in 2010 and engages in developing lithium batteries for electric vehicles. After reaching its highest stock price in December 2020, shares have remained stable during 2021 at around $30. However, it is expected to grow in the future with the development of the market in the next few years.

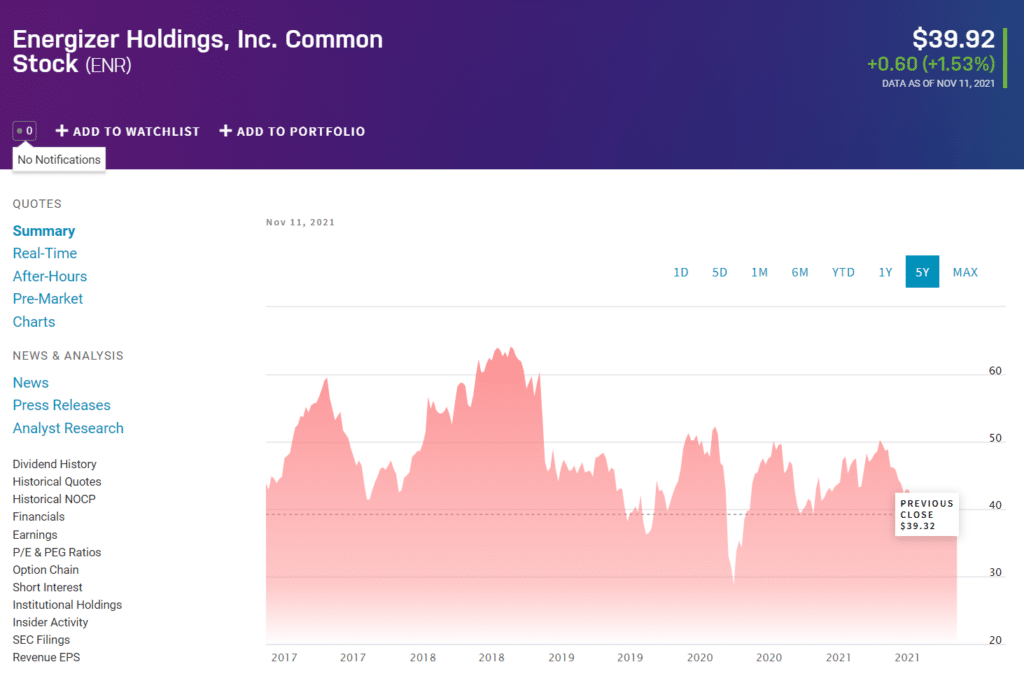

3. Energizer Holdings, Inc. (ENR)

Price: $39.92

EPS: 0.08

Market capitalization: $2.56 B

The known batteries company manufactures electric batteries, including lithium, alkaline, carbon size, and silver oxide. The company also has the additional advantage that it offers dividends to the shareholders.

Final thoughts

Lithium batteries are already in most electronic devices, and the race against climate change is only accelerating the development of lithium-batteries solutions. In addition, batteries are the key to making electric vehicles viable. Hence, all the companies are vying for the best contracts to supply the metal to the automobile sector.