News trading has become a reliable method, as forex trading news and economic news are easy to find. In addition, most broker and financial websites provide immediate news releases so that investors can open a position. As a result, it has become a way to make quick money from trading where market participants don’t have to wait a long to see the price moving.

News trading is tricky, and it needs close attention to the news and price action together. Otherwise, a single move might blow up your trading account at any time. Therefore, making money from news trading requires a specific method with a risk management system.

The following section includes the complete news trading guide, where we will see how news comes in front of us and how to open trades from it.

What is the news trading strategy?

News trading is a process to make money from the price fluctuation during the news release. When news appears, the financial market reacts immediately, a sharp movement is seen. Therefore, it is often wise to sit in front of the market during the news event and make money instead of waiting all day for a good trading setup.

Economic events are pre-scheduled events visible in the economic calendar, and investors expect the price change based on the strength of the news. In that case, high-impact news has a higher impact on the price, and it can change 50 to 200 pips in a minute. In this process, investors should follow a strategy with proper risk management to make profits from the news trading and make money online.

How to determine news trading strategy?

There is no way to ignore following a trading strategy in news trading. No one knows how news is coming and how it would affect the market. Analysts from top-tiered firms anticipate the market movement based on their previous experience and price behavior. Therefore, the news trading system follows a method that includes risk management.

This section will see some steps that a trader should follow before starting a news trade.

Identify the market direction

The news should match the market direction. First, traders should identify the price to move up from a key support level to believe it is a strong buying trend. Otherwise, there is a possibility of rebounding and stop-loss hit. On the other hand, a stable decline from any significant resistance level is a bearish sign.

While making news trade, ensure that the news effect comes towards the broader market direction. Let’s have a look at the image below.

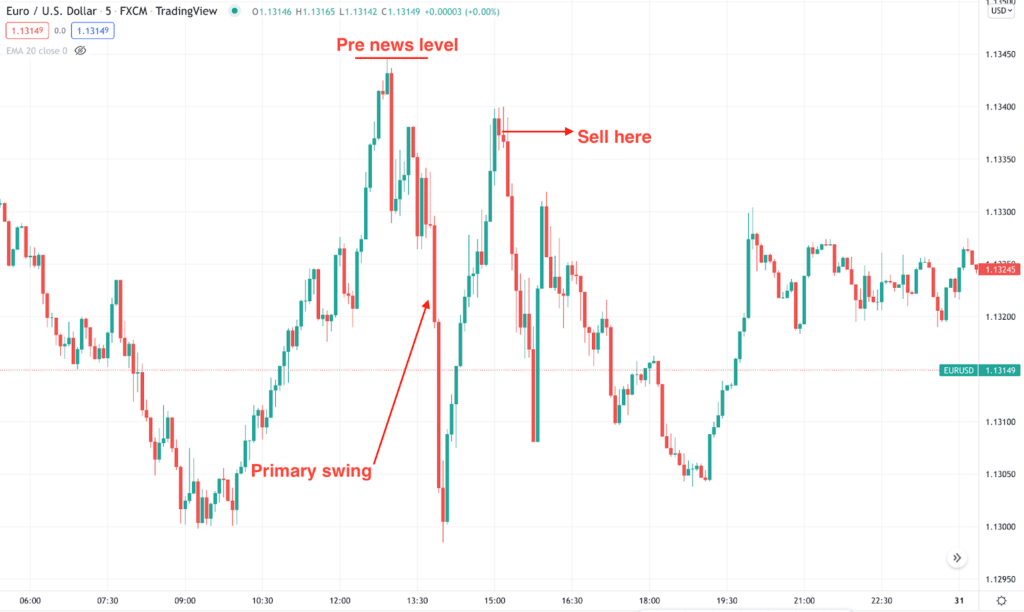

In this image, the EUR/USD price moves down where several swing lows are formed. Therefore, the primary aim of news trading is to follow the news when the result matches the bearish direction.

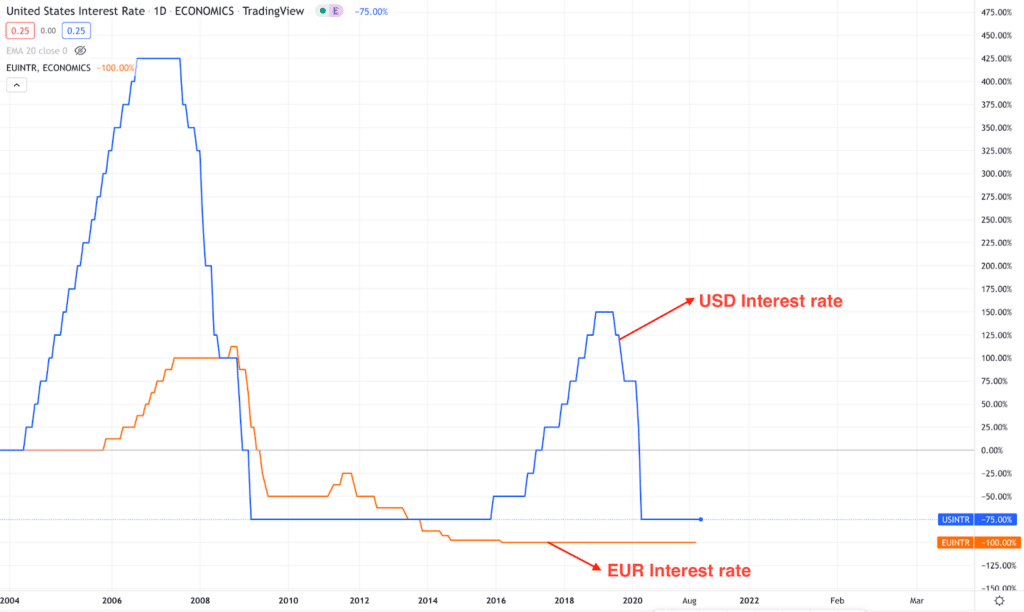

Besides, another approach is to identify the market direction using the fundamental indicator. Once the top four fundamental indicators — interest rate, CPI, retail sales, and unemployment show the same direction, we can open news trade on that side.

Wait for the primary swing

When an event occurs, the price is likely to react to the chart immediately. The first aim of this approach is to ignore the first wave and wait for a pullback.

News trading example

This section will see a practical example of news trading in the EUR/USD.

The above image shows that the USD interest rate is higher than the EUR while other economic indicators like employment and inflation are favorable to the USD. Therefore, we will open a chart during a news release and only open trade towards the USD.

The above image shows how the price shows an immediate selling pressure after the news release and provided a selling opportunity after a correction.

Bullish trade setup

We will see a buying setup using the news trading system in the bullish trade setup. Before that, investors should know the broader market direction should be bullish.

Entry

Before opening a buy trade, make sure to follow this direction:

- The broader market context is bullish based on price action and fundamental releases.

- If the news came towards buyers’ direction, wait for a pullback.

- Open a buy trade as soon as a bullish rejection candle appears in the 5M chart.

Stop loss

Set the SL below the pre-news level with some buffer.

Take profit

The first take profit should be 1:1 risk vs. reward, and the second take profit is based on near term levels.

Bearish trade setup

In the bearish trade setup, investors should know the broader market direction should be bearish.

Entry

Before opening a sell trade, make sure to follow this direction:

- The broader market context is bearish based on price action and fundamental releases.

- If the news came in sellers’ direction, wait for a pullback.

- Open a sell trade as soon as a bearish rejection candle appears in the 5M chart.

Stop loss

Set the SL above the pre-news level with some buffer.

Take profit

The first take profit should be 1:1 risk vs. reward, and the second take profit is based on near term levels.

Is the news trading strategy profitable?

The profitability of the ness trading system depends on how the market reacts to any economic event. Sometimes, the market moves to the opposite side of the news, which might be challenging for this system. In that case, it is essential to follow a strong money management system to avoid unexpected losses.

Pros & cons

| Pros | Cons |

| The news trading method is suitable for any currency pair. | News trading needs strong knowledge about technical and fundamental analysis. |

| It is a quick method to make money online. | Investors should monitor when news is released. |

| News trading works well with other technical indicators. | This method needs additional attention to trade management. |

Final thought

In news trading, investors can generate quick profits without holding the position for a long time. In that case, it would be a convenient method for all traders looking to make profits with solid risk management. However, the success in news trading depends on how investors manage their trades.