An investment strategy known as crypto arbitrage takes advantage of small price fluctuations between digital assets traded on several exchanges or marketplaces. The most basic kind of such trading is purchasing a digital asset on one exchange and selling it immediately on another at a greater price.

This implies employing a low-risk or non-risky method to generate money. You don’t have to be an experienced investor with a substantial investment portfolio to begin arbitrage trading using this strategy.

What is arbitrage trading?

It is a mainstay of traditional financial markets long before the emergence of the crypto market. Despite this, there seems to be a more considerable enthusiasm in the crypto sector for arbitrage opportunities.

Crypto markets tend to be more volatile than conventional financial markets, which may be why this happens. As a result, it’s safe to assume that the value of a crypto asset will change dramatically over time.

Arbitrage traders gain significantly from price disparities since crypto assets are traded across the globe on hundreds of exchanges at all hours of the day and night. A sequence of transactions would be necessary for a trader to benefit from a price gap between two or more exchanges.

Let’s imagine the price of a Bitcoin on Coinbase is $60,000, and the price of a BTC on Kraken is $60,200. The $200 price difference between Coinbase and Kraken might be exploited by crypto arbitrageurs who buy BTC on Coinbase and sell it on Kraken.

Why does it have low risk?

Compared to day traders, arbitrage traders don’t have to predict future BTC prices or conduct deals that may take many hours or even days to make money.

Traders who spot arbitrage opportunities and take advantage of them do so to achieve a defined profit rather than gauging market sentiments or relying on other predictive pricing approaches. As a result, arbitrage deals may be initiated and terminated in seconds or minutes, depending on the resources available to traders.

Such trading style has a reduced risk than other methods as it does not generally entail predictive research. In addition, these market participants only have to execute transactions that take a few minutes, which decreases their exposure to trading risk.

How to trade using the strategy?

Let’s take a look at the example of trade setups.

Bullish trade setup

Here’s how to trade a bullish setup.

Entry

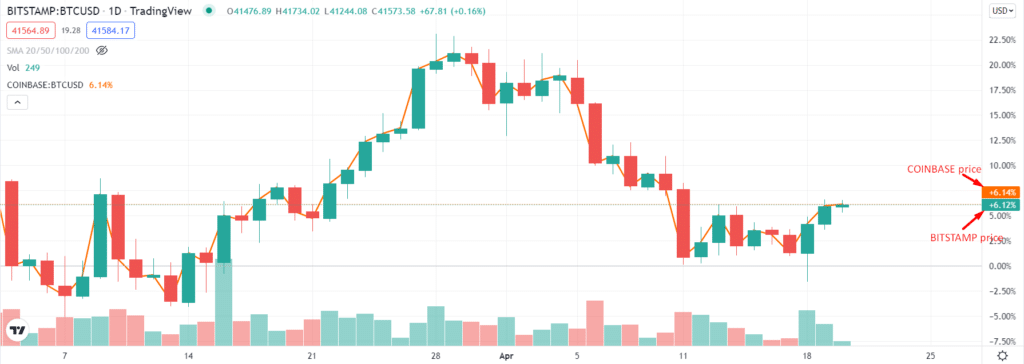

Enter long position on BITSTAMP and short on COINBASE as the price difference between the two is 0.02%. The long order should be on the cheaper side.

Stop loss

If the difference between the price of two exchanges results in a negative float of 1%, it’s better to exit the positions.

Take profit

Exit the positions if the price difference results in a positive float of 1%.

Bearish trade setup

Here’s how to trade a bearish setup.

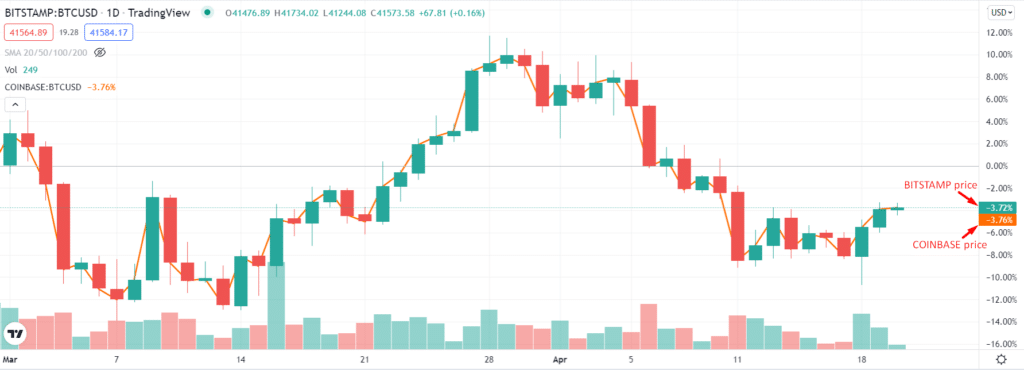

Entry

Enter a long position on COINBASE and a short on BITSTAMP as the price difference between the two is 0.04%. The short order should be on the higher side.

Stop loss

If the difference between the price of two exchanges results in a negative float of 1%, it’s better to exit the positions.

Take profit

Exit the positions if the price difference results in a positive float of 1%.

How to make $500 per day with this strategy?

Let’s look at how to arbitrage BTC, the initial crypto.

Simple arbitrage

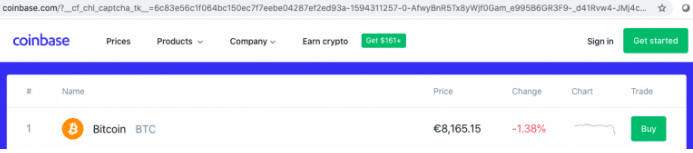

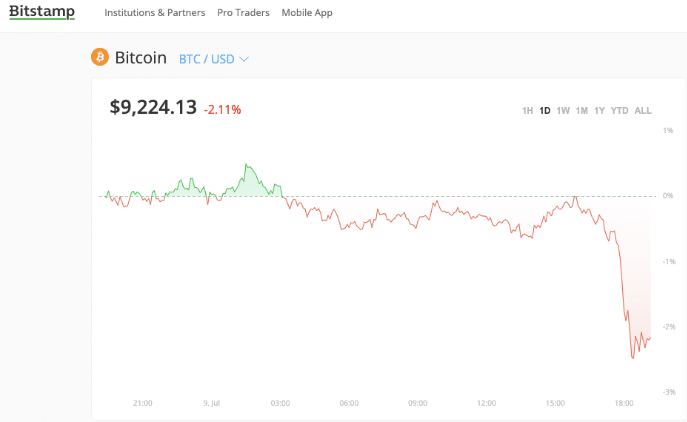

The two exchanges we’ll examine are Bitstamp and Coinbase. Bitstamp’s Bitcoin price is $9,224.13, whereas CoinBase’s is $8,165.15. As can be seen, there is a $1,059 discrepancy between the two estimates.

The first step is to assume you spent $8,165.15 for a hundred bitcoins on Bitstamp. Therefore, the total cost is $816,150 — deposit Coinbase.com.

On Coinbase, sell 100 BTC for $9,224.13. Since you’ve made $924,130 from the deal Bitstamp.

From $924,130, subtract $816,150 to arrive at $816,150. A total of $107,980 has been added to your account. Please remember that you may be charged a fee for deposits and withdrawals.

BTC triangular arbitrage

Consider that we’re trading on a single platform. We’ll look at three well-known cryptos. Bitcoin, Ethereum, and BNB are the three most popular cryptos. As the name suggests, the main principle of triangle trading is to get back the exact coin you started with.

It’s all about Bitcoin here. All three pairs’ bid and ask prices must be calculated to determine how much money may be made via triangle arbitrage. It’s 462,963, BTC/BNB exchange rates are 462,963, BTC/ETH 48,9809 and BTC/USDT 148,94 respectively, and BNB/USDT 15,37. There is no BNB/ETH exchange rate; we need to include the USDT rate.

Here we are; what do we have? We will convert 1 BTC to ETH using a bid price of 48.809 ETH. Consequently, the amount in ETH and BNB would be converted to USDT and BNB. Let’s finish up by converting 472.9747 BNB to 1 BTC. Almost one-quarter of one percent is your profit.

Calculator

We looked at simple calculations that didn’t include costs in the prior scenario. However, traders should be aware that commissions may significantly diminish profits. A program or platform that correctly assesses all processes and indicates profit is ideal.

If traders still choose to do their calculations, they are free to do so.

Final thoughts

What makes this trading style so appealing is the abundance of software that can automate identifying and trading price discrepancies across different crypto exchanges for novice market participants and more experienced investors alike. If you’re looking for a low-risk way to make money trading without doing anything yourself, check out Arbismart, Pionex, etc.