The hotel industry received a critical hit by the Covid-19 devastation, i.e., worldwide lockdowns, travel restrictions, and shut down of leisure activities. However, this sector has incredibly recoiled and become one of the most valued sectors with the calming pandemic effects and re-initiation of everyday life activities.

According to Statista, the global hotel and resort industry showed a consistent increase in its market size and peaked at $1.47 trillion in 2019. Though 2020 was the worst year for the hotel industry, the exceptional recovery rate of 35% from 2020 to 2021 points to this platform’s promising prospects and intrinsic potential.

So, are you interested in learning about the opportunities and methods by which you can benefit from the recovery and growth of this sector? Read this account to learn about the top five hotel stocks and their statistics to acquire quick profits.

What are hotel stocks?

The hotel industry incorporates companies that supply accommodation, lodgings, and related services. This industry is a sub-section of the broader hospitality industry, including food and dining, tourism and traveling, and entertainment activities.

Hotel stocks are the shares of hotel management companies, different from hotel REITs. These shares allow the investors to benefit from this industry’s development and growth.

Top five hotel stocks to invest

After the termination of global lockdowns and constraints, the hotel industry has attained its previous upward momentum. Analysts and professionals are hopeful about the sector’s valuation increment due to great pent-up potential.

Here, we have discussed the top five hotel stocks you can invest in to generate significant profits.

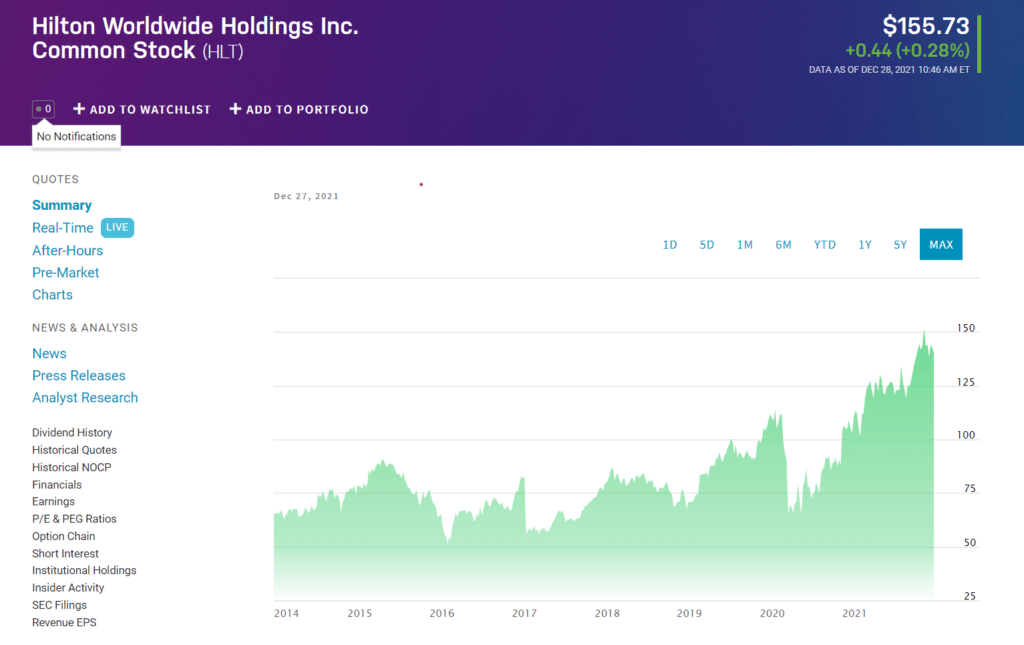

1. Hilton Worldwide Holdings Inc (HLT)

Price: $155.73

Hilton Worldwide Holdings Inc is an American multinational company that manages, operates, leases, and owns various hotels and resorts under different brand names.

The company has been operational since 1919 and has expanded its approach to North, South, and Central America, Europe, Africa, and the Asia Pacific. According to the year-end report (2020), Hilton Inc oversees more than 6000 facilities in around 119 countries.

Hilton Inc. has a market capitalization of 39.2 billion and 278 million shares outstanding. The business reported a revenue generation of 2.05 billion in the last 12 months, with a remarkable quarterly revenue growth rate of 93%.

The Corona turmoil badly hit this hotel chain; however, the recovery has been swift, with the P/E ratio standing at 1084.

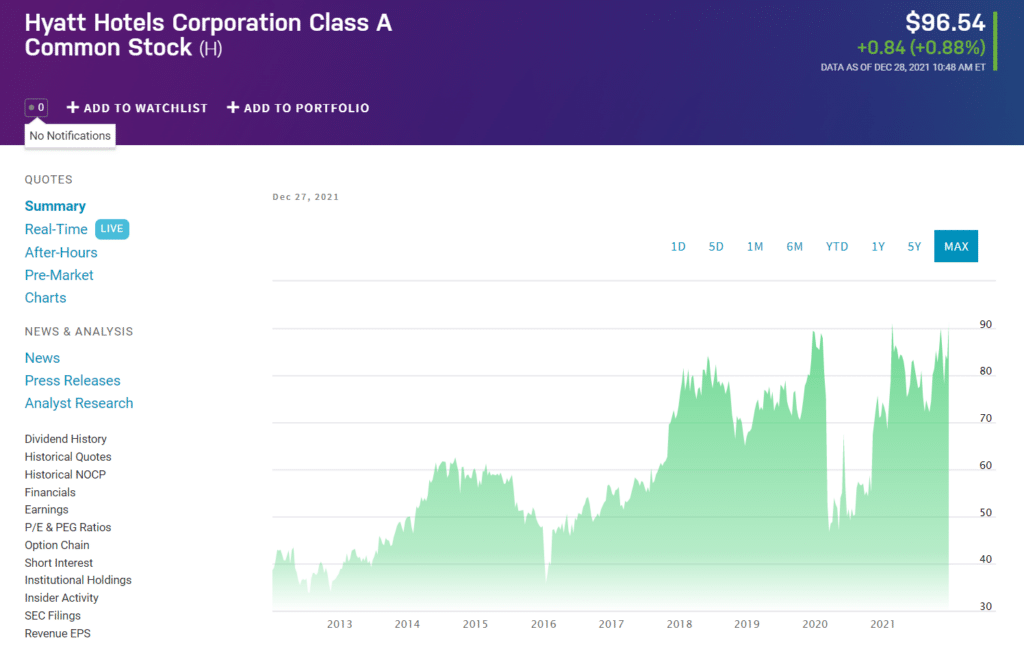

2. Hyatt Hotels Corp (H)

Price: $96.54

Hyatt Hotels Corp is a Chicago-based multinational hospitality company specializing in franchising, managing, and operating various properties. It works through four segments and handles luxury hotels, resorts, vacation houses, and condominium units.

Currently, the Hyatt Group is the administrator of around 1000 properties worldwide under numerous brand names like Miraval, Hyatt Zilara, Hyatt Regency, Thompson Hotels, and many more.

The company has a market capitalization of 9.19 billion with approximately 50 million outstanding shares. The latest gross profit (ttm) stands at 88 million with a trailing P/E ratio of 22.4.

During 2020 the corporation’s value and revenue went downhill due to the pandemic commotion; however, its valuation has powerfully rebounded, showing a quarterly revenue growth (YOY) of 199.2%.

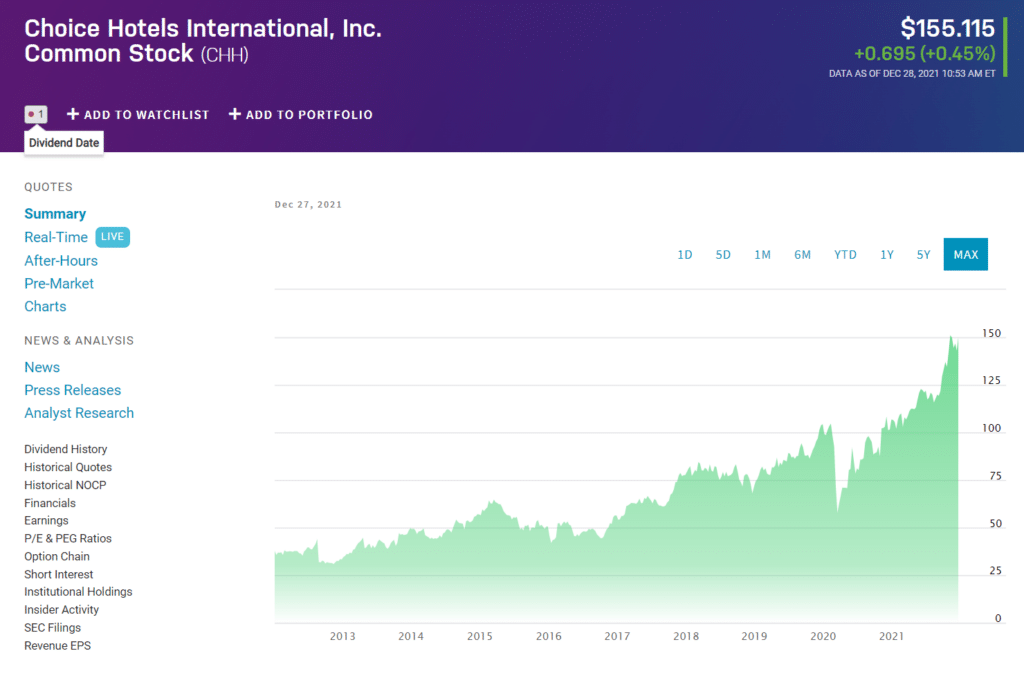

3. Choice Hotels International Inc (CHH)

Price: $155.11

Choice Hotels International Inc. is a US-based company that is a major hotel franchisor globally. It is one of the leading global hotel chains and manages & franchises various properties, including suites, inns, hotels, and lodges.

Moreover, it operates in around 50 states and 40 countries under the brand names like Econo Lodge, MainStay Suites, Cambria Hotels, and many more.

CHH price chart

Choice Hotels Inc. has a market capitalization of 7.96 billion with around 55 million outstanding shares. The company’s latest income statement displays a revenue generation of 978 million and revenue per share of 17.68.

Like other cyclical stocks, the Choice Hotel’s stock value faced a severe impact by the pandemic turbulence; however, the company manifested a swift rebound and surpassed the pre-pandemic all-time high with a great margin.

4. Marriott International Inc. (MAR)

Price: $166.97

Marriott International Inc is an American multinational company that manages and licenses hotels and fractional properties worldwide. Currently, the organization has more than 7500 properties in 138 counties under 30 brand names such as Marriott Hotels, Delta Hotels, The Ritz Carlton, and many more.

Marriott Inc. has a market capitalization of 48.9 billion with around 325 million outstanding shares. The company has shown an incredible quarterly revenue growth rate of 114.2% and 2.85 billion in the last year’s revenue generation. The P/E ratio and profit margin stand at 105.77% and 16.38%, respectively.

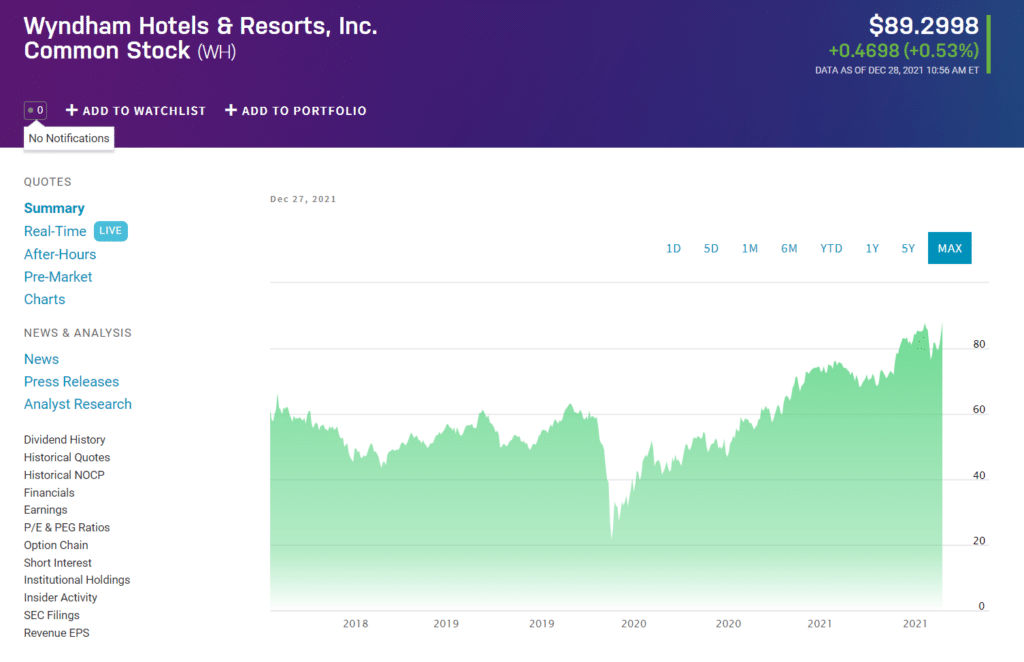

5. Wyndham Hotels & Resorts Inc. (WH)

Price: $89.29

Wyndham Hotels & Resorts Inc. is a New Jersey-based company that operates through two primary branches, i.e., Hotel Franchising and Hotel Management. The company is one of the largest global franchisors in the hotel industry and reports more than 9000 hotels in 95 countries.

Its’ famous brand names are Days Inn, Travelodge, Ramada Encore, Wyndham Grand, and many more.

Wyndham Inc. has a market capitalization of 7.55 billion with above 90 million shares outstanding. The revenue was approximately 1.1 billion in the past year, showing quarterly revenue growth of 47.80%.

The company’s share prices have excelled pre-pandemic levels, manifesting the increasing demand and prosperity of the hotel industry.

Pros & cons

Let us look at the various advantages and challenges of investing in hotel sector stocks.

| Pros | Cons |

| •Revival and growth potential The hotel industry carries an inherent demand and capability to recover from negative performance. | •Volatility risk Hotel stocks come under cyclical stocks that show high volatility, making them unfit as a stable investment option. |

| •Enhanced profit rates Hotel stocks can give relatively high returns due to enhanced liquidity and volatility. | •Low performance in a recession phase Poor economic conditions highly impact these stocks’ performance, more than the average decline rate. |

| •Pent-up demand The hotels and resorts industry has an excessive repressed demand that can translate into the booming of this sector. | •Not suitable for long-term investment Long-term holding of these stocks may lead to loss of all the profits if the market suddenly goes downhill. |

Final thoughts

Though the hotel industry’s revenues and occupancy fell dramatically due to Covid-19 restrictions and lockdowns, the recovery has been phenomenal, with revenue growth rates ranging from 100% to 300%. Investors who entered this arena when the stocks prices were at the bottom have benefited magnificently from the revival wave.

Nonetheless, the growth potential is still there due to the massive suppressed demand related to the leisure and hoteling sector. Correspondingly, hotel stocks and ETFs are excellent investment products for investors to procure quick profits; however, it is prudent to conduct necessary homework and analysis before diving into this sphere.