Nickel-based products have been an essential component of our everyday lives since ancient times. Though this metal has primarily remained a fundamental raw material for stainless steel production, the recent boom of the nickel industry is attributable to its use in batteries.

Recently, the nickel sector has grasped the attention of investors due to the imminent shift of large corporations and businesses towards clean energy generation and electric vehicles production.

Nickel stock prices are likely to reflect this approaching transformation of the transportation and energy sector. AlixPartners forecasts that electric vehicles sales will comprise 24% of the total global vehicle sales in 2020 compared to the current 2%.

In this article, we have listed the top nickel stocks that have the potential to accommodate this advancement in the nickel industry.

What are nickel stocks?

Nickel stocks are the shares of companies involved in the mining, processing, and exploration of nickel metal. Base metal stocks, mutual funds, and ETFs represent an indirect way to invest in this sector.

In contrast to holding the physical metal, nickel stockholders can trade the shares on stock exchanges and benefit from the fluctuating prices. The prices and value of nickel stocks depend on various factors related to the parent companies and economic conditions.

Therefore, selecting a suitable nickel company for your investing ventures requires in-depth analysis and consideration of various aspects. Before investing, investors should research the roadmaps, historical performances, price-to-earnings ratio, yearly returns, and revenue generation of nickel stock companies.

Top five nickel stocks to invest

We have listed some of the nickel stocks with promising historical records and fundamentals.

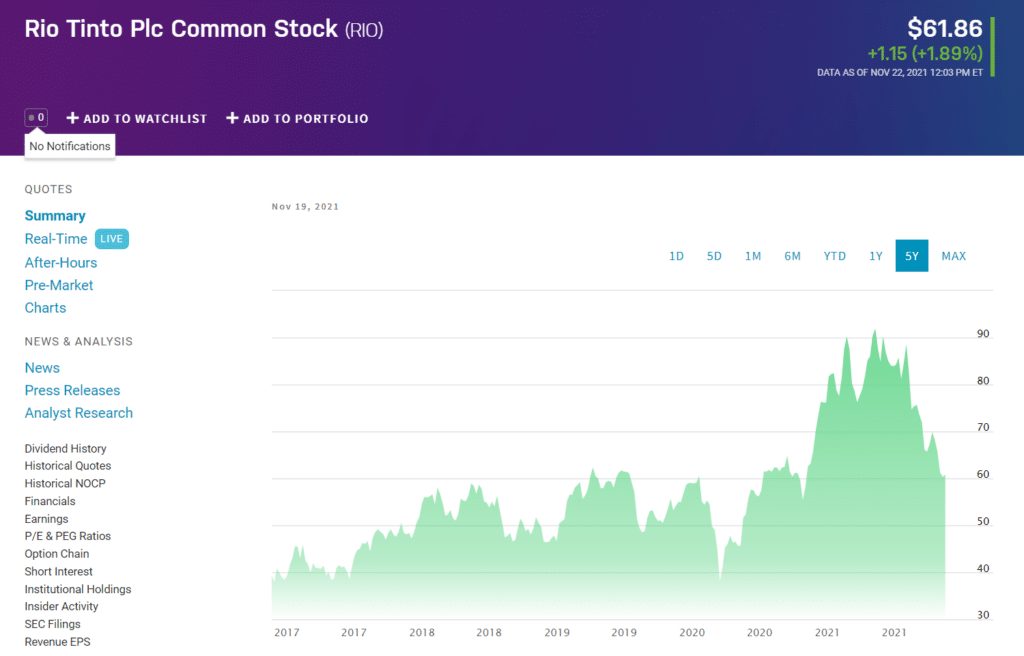

1. Rio Tinto Group (RIO)

Price: $60.76

Rio Tinto Group deals with the exploration and mining of several bases and precious metals, including diamond, gold, copper, nickel, and uranium. This London headquartered firm also owns various research facilities and monitors underground mines. Recently, Rio group has partnered with “Bluejay” to initiate a search for nickel ores across Finland.

The company has a market capitalization of almost 100 billion with 1.6 billion outstanding shares. RIO has a 5-year average dividend yield of 5.71, presenting a healthy payout ratio of 40.27%.

Moreover, the trailing 12 months return on assets and return on equity stand at 18.37% and 39.32%, respectively.

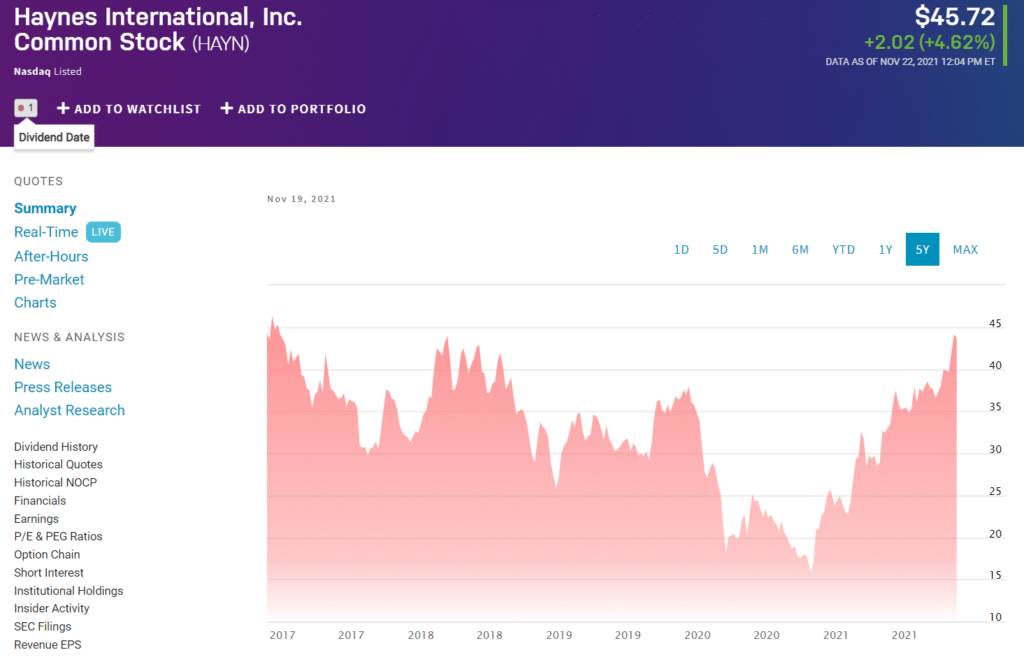

2. Haynes International, Inc. (HAYN)

Price: $42.50

Haynes International, Inc. specializes in the production and distribution of corrosion-resistant and high-temperature nickel and cobalt alloys internationally. Numerous companies utilize these alloys to manufacture gas turbine and jet engines, emission control plants, and industrial equipment.

Haynes Inc has been operational since 1912, with its headquarters in Kokomo, Indiana. The company has a total market capitalization of around 580 million and 12.6 million shares in circulation. The firm showed revenue of 320 million in the past year with a price-to-earnings ratio of 37.58.

HAYN is a good investment option as the company has shown quarterly revenue growth of more than 9% and distributes dividends among shareholders. Its 5-year average dividend yield stands at 2.88.

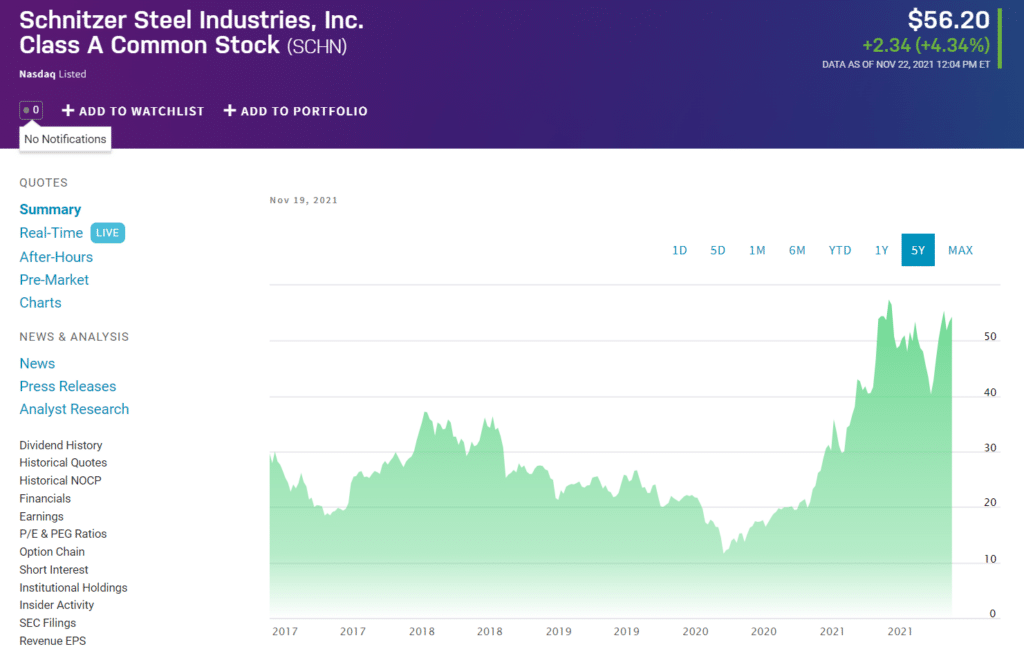

3. Schnitzer Steel Industries, Inc. (SCHN)

Price: $54.85

Schnitzer Steel Industries is a metal recycling company that also deals with the production of stainless steel. The company utilizes used equipment and parts, vehicles, machinery, and scraps to manufacture ferrous and non-ferrous products. Schnitzer Steel Inc. has been working since 1906, with its headquarters in Portland, Oregon.

Recently, the firm has gained significance concerning its nickel collection and recycling program that would contribute to the progress of the electric vehicles industry. The company has a market cap of 1.5 billion with above 27 million outstanding shares.

The dividend payout ratio of SCHN is around 13.25%, with a 5-year average dividend yield of 2.98. Currently, the trailing price to earnings ratio of Schnitzer Inc is about 9.72.

Moreover, the company showed a revenue generation of 2.76 billion in the last 12 months.

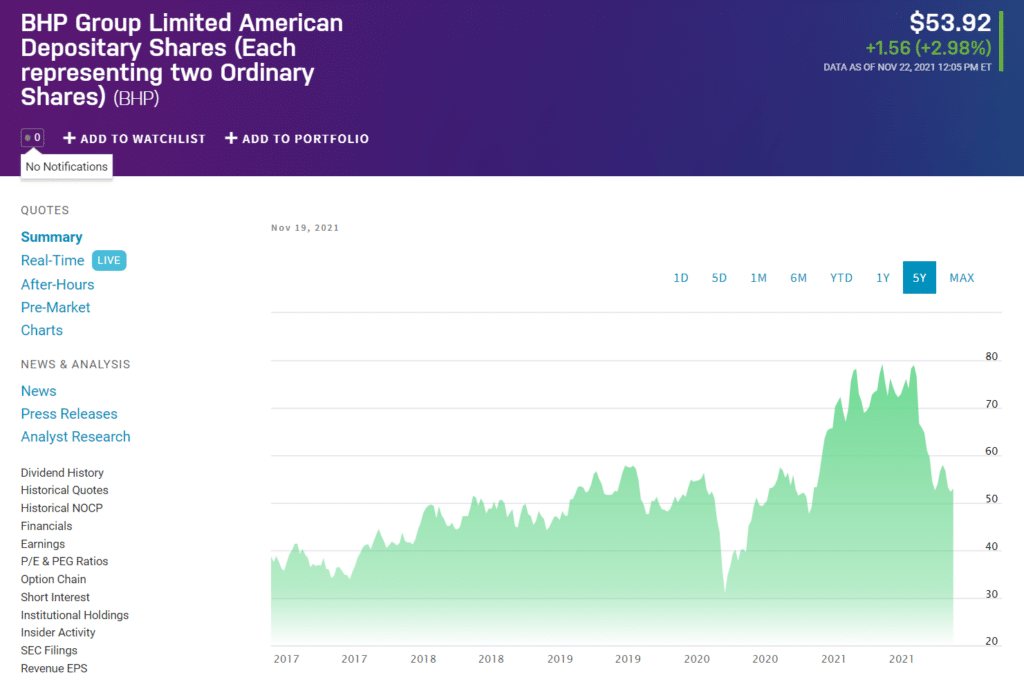

4. BHP Group (BHP)

Price: $52.77

BHP Group is one of the largest metals mining company, that engages in the production, exploration, mining, and smelting of silver, zinc, coal, nickel, and many other base and precious metals. This Australia-based company conducts operations in various regions, including Asia, Europe, and America.

BHP stocks trade on the NYSE stock exchange and have a market capitalization of 136 billion. The firm has reported quarterly revenue growth of 70.6 % and a trailing price-to-earnings ratio of 12.35.

BHP group has about 2.5 billion outstanding shares with a 24.22 revenue per share. In addition, the company distributes dividends to its shareholders and has a payout ratio of 69%.

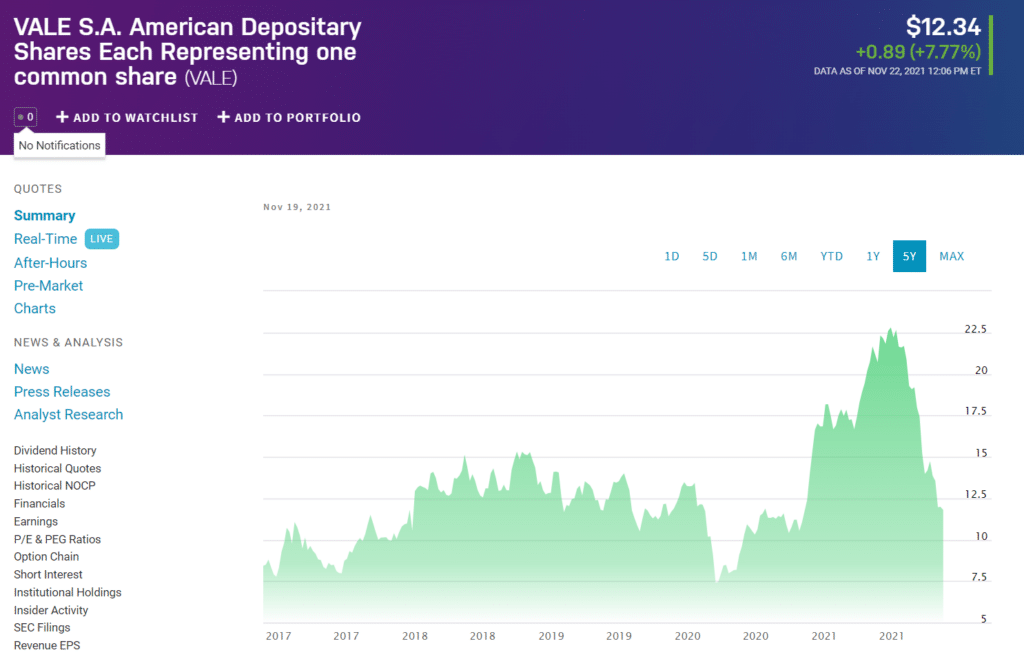

5. Vale S.A. (VALE)

Price: $12.12

Vale S.A. is one of the most famous companies expected to benefit from the nickel industry boom. This company has been operational since 1942 and specializes in supplying raw materials for steel manufacturing. Moreover, this Brazilian firm’s “Base metals segment” deals with the extraction and mining of nickel, copper, cobalt, and other base metals.

The total market capitalization of Vale S.A. is approximately 63 billion, with a circulating 5 billion shares. During the last 12 months, the company has generated more than 300 billion in revenue and displays a quarterly revenue growth of 14.4%. In addition, its trailing price-to-earnings ratio stands at 3.59.

The dividend payout ratio for VALE shareholders is about 77.2%. Moreover, the reported forward annual dividend yield is 22.32%.

Pros & cons

There are numerous benefits and limitations associated with the investment in nickel stocks. Some of them are as follows.

| Pros | Cons |

| Significant growth potential Nickel stocks have a great growth potential due to progressing EV industry. | Affected by company performance Despite increasing nickel value, nickel stocks price can decrease as it is dependent on the relative company’s conditions. |

| Hedge against inflation Investors can buy nickel stocks to counter inflation. | Prolonged time Generally, it can take many years or decades to procure significant profits from nickel stocks. |

| Liquidity Nickel stocks possess remarkable liquidity, and traders can buy or sell the stocks within a few minutes. | Market sentiment Market sentiments like fear can affect the prices of stocks resulting in undervaluation. |

Final thoughts

Due to the flourishing EV and renewable energy industries, the related metals and minerals can witness a surging demand. Being a fundamental part of lithium-ion batteries, nickel-metal and its stocks display a high probability of gaining upward momentum in the upcoming years.

Moreover, the recent statement of Elon Musk, CEO of Tesla, has also diverted investors’ attention towards the nickel sector. Nickel stocks can be a favorable addition to your portfolio; however, considering your goals and risk appetite is also necessary before making any investment decision.