By definition, foreign exchange or FX refers to the process of converting one currency into another one. You will do this transaction if you intend to do business with someone or an entity locally or internationally, trade the market, or travel abroad.

Once you trade forex, you have participated in the biggest market in the world, which is already a $6.6 trillion industry. This is the amount of money being traded daily in this market.

This article presents the three types of FX markets and their major players to give you an idea of whom you are trading against in this business arena. Later you will learn why many traders gravitate toward forex, which is the gist of this thesis.

Types of FX markets

You might have thought there is only one way to trade forex. This is not true at all. Three types of FX markets exist.

Spot market

The market that is likely familiar to you is the spot market. Most familiar to many, the spot market is the biggest FX market. The qualifier “spot” means that you can do purchase and sale transactions on the spot, that is, at the prevailing market price.

In the past, it was smaller in size than the futures and forward markets. However, when the number of forex brokerage firms grew, and electronic trading became a norm and available, the spot market surpassed the other two markets in trading volume.

Forward market

You can trade forward contracts in the forward market. A forward contract is an agreement between two parties that agree to deliver or receive a currency at a specific price and a future date. You can use a forward contract as a hedging tool to customize in terms of amount and delivery date.

One significant advantage of a forward contract is that it does not require you to pay upfront by allocating a margin or deposit.

Futures market

You can trade futures contracts in the futures market. A futures contract is an agreement between parties to either buy or sell a currency at a specific volume, time, and date. You can trade such a contract in a futures exchange. A futures contract is a little different from a forward contract. A futures contract is publicly traded, standardized or not customizable, and secured against losses.

Who trades forex?

The FX has lots of participants. You can put them into different groups, as you will see below.

Big commercial banks

Significant trading volumes go in and out of the interbank market, which is the playground of big banks. However, small banks can also do business in this market. Banks interact in the interbank market and trade currencies between one another, and they conduct such transactions electronically. Banks conduct forex transactions on behalf of their clients and participate in speculative trading to take advantage of price fluctuations.

Central banks

Supervising states’ currency and monetary systems, central banks play a crucial role in the FX market. Because of their mandate and authority, they have the power to influence and even control the exchange rates of their currencies by implementing measures and policies such as interest rate decisions, quantitative easing, etc. They can set a ceiling and floor to the prices of their currencies.

Hedge funds and fund managers

Next in size to big banks and central banks are the hedge funds and fund managers. The last one trades large amounts of currencies for their clients, which can be private institutions or individuals.

Multinational corporations

So the international companies operating in the import and export industry conduct FX transactions to facilitate buying and selling products and services. They move currencies from one country to the next in the course of doing business.

Retail traders

They make up the smallest group of participants in terms of the trading volume. However, the number of retail traders is constantly growing as more and more people learn about trading. Anyone can participate in this business, even with small capital, as long as he has the needed equipment and internet connectivity.

The forex trading advantage

Nowadays, a lot of traders flock toward forex trading for good reasons. The FX market offers a lot of benefits to the trader. Below are some reasons why forex is better than other markets.

Ability to buy and sell

From the beginning, being able to short currency pairs has always been possible. In FX, you can buy and sell trades at any time and may make money whichever direction of the price will go next. In the stock market, you have to buy stocks first before selling them to realize profits. Of course, other markets allow you to go short using contracts for differences. Therefore, in FX, you can make money when markets go up and when markets go down.

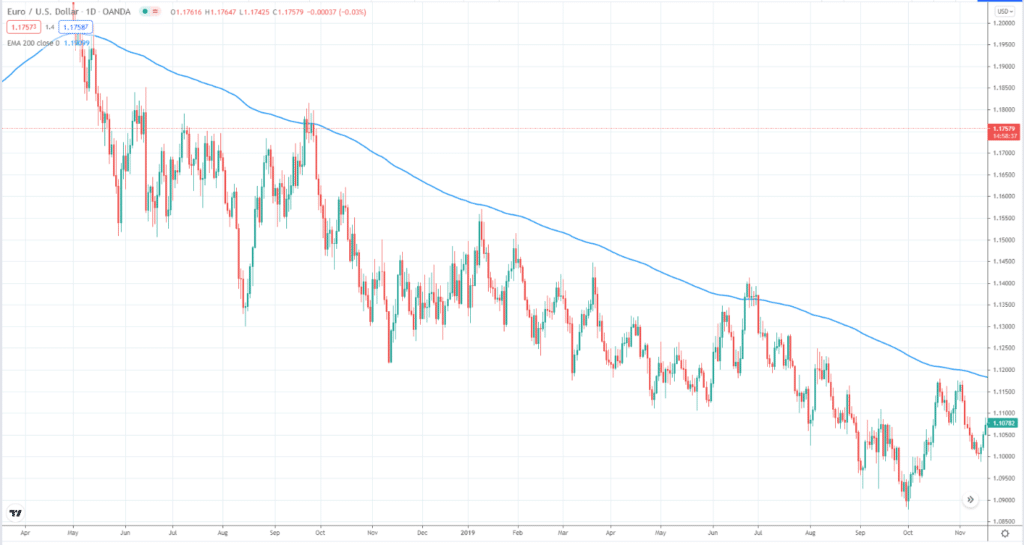

Above is the daily chart of EUR/USD. This chart shows an extended bearish market. During these times, it is best to take short positions rather than long positions. That is why you can still trade forex even if markets are going down, as it was in the case of the Covid-2019 pandemic.

Flexible trading hours

You can trade FX at any time of the day during weekdays. This is because you conduct trading transactions over the counter and directly with another party. Meanwhile, the stock market is open about eight hours during weekdays. Wherever you may be in the world, there is always an active session you can trade.

High liquidity

Without a doubt, forex is the most liquid market in existence. This means that there is a huge number of buyers and sellers present in the market at any time looking for opportunities to trade the market. Right now, the forex market is a $6.6 trillion industry, and most transactions are done for speculative trading.

Leverage

Because of leverage, you can open a small account and take a relatively big position. The bigger the leverage, the smaller margin you will need from your account to open positions. This allows you to trade multiple assets at the same time. Just be aware of the risk involved in leveraged accounts. If you expose your account to too much risk, you might lose your entire capital quickly.

Hedging

You can use hedging to protect your open positions in the face of expected market volatility, such as during news announcements. With hedging, you can lock your negative floating profit during turbulent times and wait until the market has stabilized and gives you a clear direction.

The above graphic shows the daily chart of AUD/USD. If you have taken a long trade, but high-impact news is coming, you can use a sell stop order to protect the trade. This way, you will not lose money as opposed to using protective stops. You can add a trade later if you see a good setup and the market is already calm.

Final thoughts

Forex trading is indeed an exciting venture. Of course, the FX market is a ferocious beast that is very hard to tame. It will take time before you can get a sense of it and trade with its rhythm. If you have ambitions and you have patience and discipline, trading might be for you.

Be aware of the risks and traps inherent in forex trading and find a way to protect yourself from them. Also, you will trade against other traders, banks, institutions, and even your broker. In the final analysis, your worst enemy in FX trading is not the other market players, figuratively speaking, but yourself. Therefore, your success or failure in forex trading is entirely up to you.