Aerospace and defense stocks are respectively desirable to many financial investors. It is an essential sector with increasing demand, so some company stocks already have billions of dollars in the market cap of this industry. Some uprising company stocks may be potent to make investments for a certain period.

However, investing in any asset requires identifying skills and having a particular level of knowledge. It is not wise to invest in any asset without knowing this sector’s leading companies or stocks.

This article will introduce you to the top five aerospace and defense stocks for profit-making in 2022.

What are aerospace and defense stocks?

The aerospace and defense companies consist of manufacturers who develop aircraft and spacecraft for commercial and military aircraft, missiles, tanks alongside other weapon-related pieces of equipment. These companies also develop engine parts, aircraft engines, rotors, propellers, and landing gears.

In contrast, other factories may be specialized in building armed vehicles or particles. Accessories and firearms cover approximately 60% of the revenue of the airspace and defense industry, while the other 40% comes from ammunition.

A small number of large firms dominate this industry, influencing the price levels in some cases. Generally, these companies design, builts, and provide services to their clients. This sector continues to face international competition challenges in the commercial area.

The top five best aerospace and defense stocks in 2022

The top best A&D stocks to invest in 2022 are:

- Lockheed Martin (LMT)

- Honeywell International (HON)

- General Dynamics (GD)

- Airbus (EADSY)

- Boeing (BA)

Let’s take a quick look at these stocks

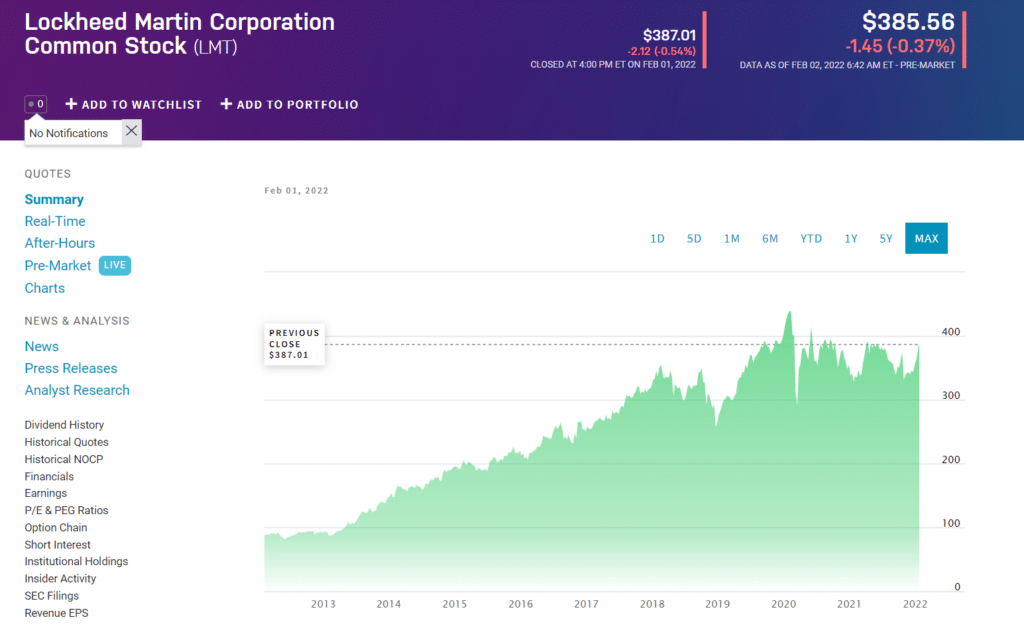

1. Lockheed Martin (LMT)

Price: $385.56

Lockheed Martin is one of the largest military contractors that manage and develop several iconic fighter jets, including the F-35 Lightning II, the ultra-advanced F-22 Raptor, and the F-16 Fighting Falcon.

It is an American defense, airspace, information security, arms, and technology corporation with worldwide interests with approximately 110,000 employees worldwide as of Jan 2020. The market cap of this company stock is $107.065B with a beta (5-Y monthly) value of 0.93. Meanwhile, the PE ratio and EPS are 17.27 and 22.76. Top holders of this company’s stocks are institutions and mutual funds.

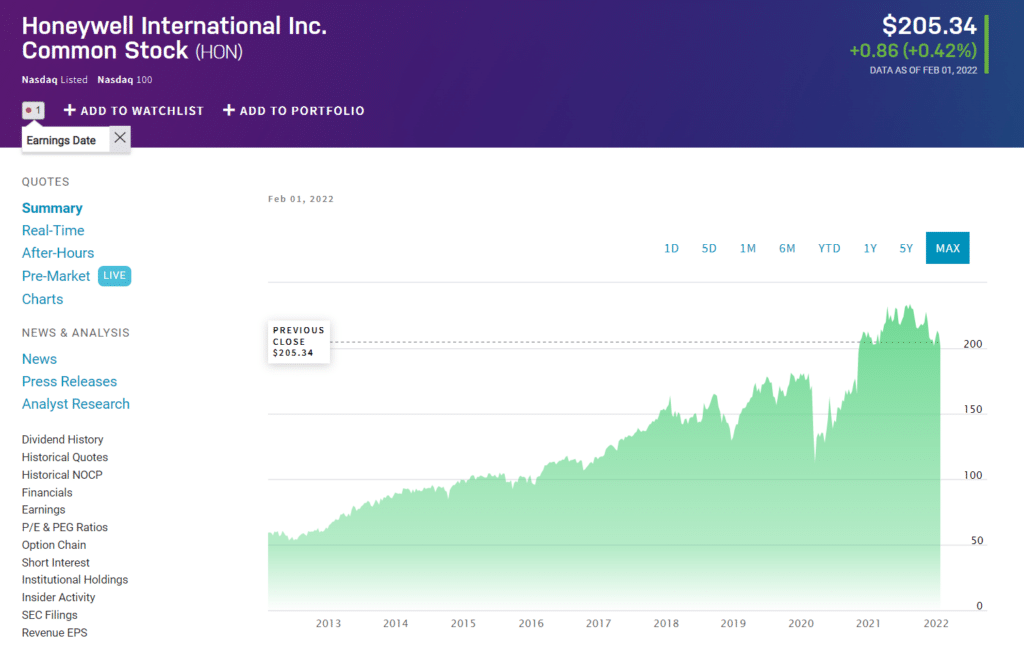

2. Honeywell International Inc. (HON)

Price: $205.34

Honeywell International Inc. is a publicly-traded American software-industrial company that offers industry solutions to automotive and aerospace services and products. This company is specialized in sensing and security technologies for buildings and homes, turbochargers control, energy-efficient products and solutions for homes, process technology for refining and petrochemicals, businesses, specialty chemicals, and transportation.

The founder of this company is Mark C. Honeywell, and the foundation year is 1906. It has approximately 103,000 employees. This company stock has a market cap of $139.055B with a beta (5-Y monthly) value of 1.17. Meanwhile, the PE ratio and EPS are respectively 26.00 and 7.77. Nearly 2,684 institutions worldwide hold shares of this company.

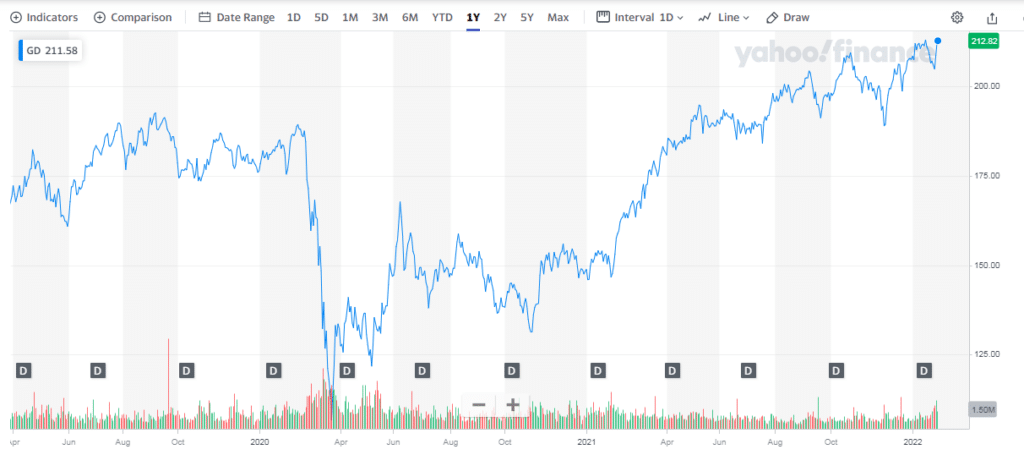

3. General Dynamics (GD)

Price: $212.82

GD is a publicly-traded aerospace and defense company that involves the provision of rockets, tanks, missiles, warships, submarines, fighters, and electronics to all military services. It operates by following some segments such as combat systems, information technology, aerospace, and marine systems. It provides critical systems for the F-35 Lightning II.

Moreover, it is incredibly diverse, featuring a maritime division specializing in oil tankers, nuclear-powered submarines, and dry cargo carriers. It was the 5th largest defense contractor company in the US and 6th most significant globally according to sales data.

The foundation date of this company is February 21, 1952. General Dynamics has 104,000 employees as of 2020 data. This company stock has a market cap of $59.083B with a beta (5-Y monthly) value of 1.09. Meanwhile, the PE ratio and EPS are respectively 18.43 and 11.55. The number of institutions holding this company’s shares is 1,596.

4. Airbus (EADSY)

Price: $31.06

Airbus SE is a designer, manufacturer, and distributor of aerospace products and solutions in the Netherlands and internationally. It operates by following three segments: Airbus Defence and Space, Airbus Helicopters, and Airbus Commercial Aircraft.

Airbus Commercial Aircraft offers a full range of aircraft, starting from the narrow-body (130-200 seats) A320 series to a bigger A350-1000 vast body. Airbus Defence and Space division supplies governments with military hardware, including aerial tankers, fighter aircraft (Eurofighter), and transport aircraft.

Airbus helicopters division manufactures turbine helicopters for the parapublic and civil markets. The foundation date of this company is July 10, 2000, which now operates with 127,814 employees. This company stock has a market cap of 98.325B with a beta (5-Y monthly) value of 1.96. Meanwhile, the PE ratio and EPS are respectively 21.09 and 1.48. The number of institutions holding this company’s shares is 40.

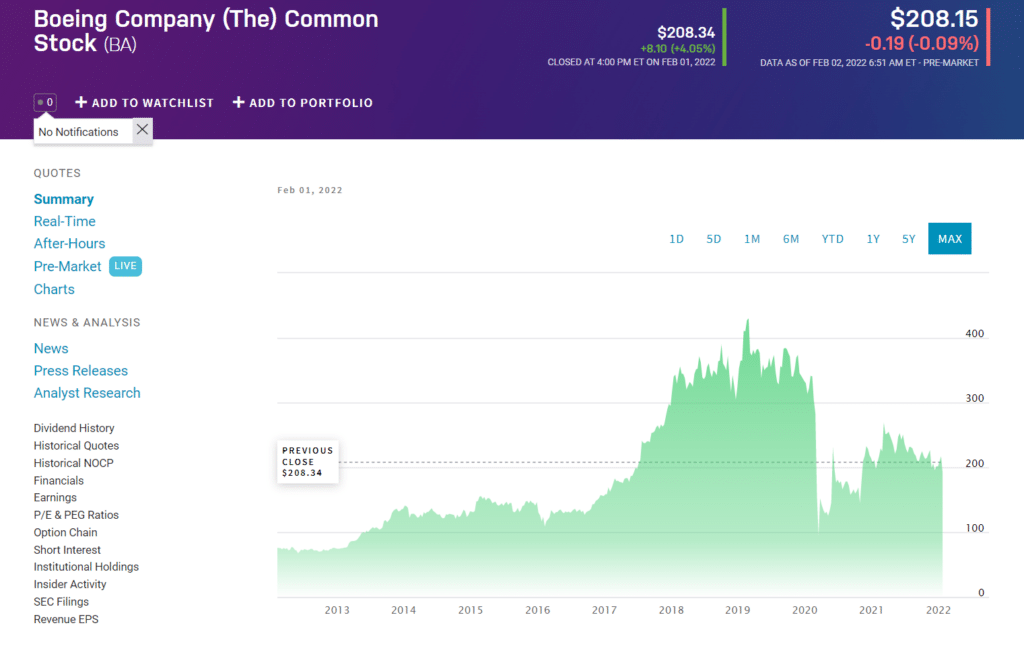

5. Boeing (BA)

Price: $208.15

The Boeing Company is an American multinational corporation that manufactures, designs, and sells airplanes, rockets, telecommunications equipment, rotorcraft, satellites, and missiles worldwide. It also provides product support services and leasing. This company stock price suffered due to the recent Covid-19 pandemic.

The stock price fell to near $98 from a peak near $344 during that period. This company has 141,014 employees. This company stock has a market cap of 112.23B with a beta (5-Y monthly) value of 1.51. The foundation date of Boeing is July 15, 1916.

Pros & cons

| Pros | Cons |

| This sector has considerable growth. | It provides no guarantee of growth as other manufacturing sectors. |

| Stocks of this sector allow having considerable earning. | Several political and fundamental factors affect the company stock prices in this sector. |

| You can invest from anywhere in the world. | The stock prices can affect by business variables. |

Final thought

Finally, this sector was indeed booming under the Donald Trump administration. Then the Covid-19 pandemic came up, so this sector suffered through it. Now it’s been on a bounce-back on the track. Although air travel is not booming after the pandemic, there is room to grow. Observe company profile, performance, historical data, and check geopolitical factors before investing in any of these stocks.