While most investors and traders prefer to deal with stocks of well-reputed and large companies, some of the vibrant ones endeavor to benefit from penny stocks. These investors expect to exponentially increase their gains by buying a lot of cheap stocks.

However, the financial markets do not follow such straightforward patterns. Moreover, penny stocks are one of the most volatile and speculative stock types. Only a careful analysis and fundamental knowledge can indicate the promising stocks among thousands of worthless penny stocks.

In this article, we have reviewed the factors to consider when picking out the penny stocks and five stocks with a promising growth potential to buy in 2021/2022.

What are penny stocks?

Penny stocks are the shares of small companies and trade at less than $5. Major exchanges like NYSE and NASDAQ do not list most of these stocks. Usually, these stocks trade through an off-exchange, over-the-counter (OTC) market that involves decentralized deals.

As penny stocks belong to small business ventures, they have low trading volumes and liquidity. The bid-ask spreads are high with very few buyers, resulting in different prices from the actual price.

Moreover, as these companies do not trade on major exchanges, they exhibit less transparency about their financial data. Nonetheless, there are valuable penny stocks, but their selection requires sound financial knowledge and research skills.

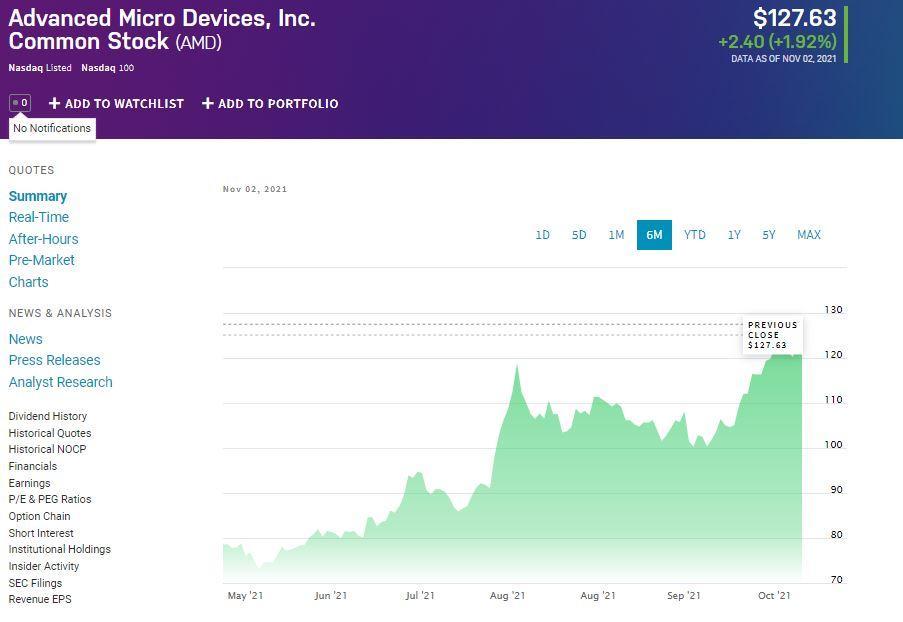

History has shown that some penny stocks displayed remarkable gains from their initial price. For example, Advanced Micro Devices (AMD), a semiconductor company, was a penny stock in 2015, trading at below $2. The stock demonstrated explosive growth, and as of November 2021, the stock share price is above $125.

How to trade penny stocks?

Most penny stocks are beneficial if you hold the positions over the long term. Investing or trading are games of patience, and it requires almost one to two years to determine the result of your decision.

Nowadays, due to the increasing popularity of penny stocks, most brokerage platforms allow penny stocks trading. You can start trading immediately by funding your account.

Fundamental analysis is comparatively more significant than technical indicators for trading penny stocks, as these stocks are illiquid with no major price levels and trends.

Therefore, carefully assess the sector and history of the company in which you want to invest. Some penny stocks are of small growing institutions that want to increase their capital. Others are the demoted ones from the major exchanges, on the brink of bankruptcy.

Moreover, penny stocks are volatile and show abrupt price swings. Though they offer the opportunity for high reward, it comes along with similar risks. Whether investing for a long-time or executing a fast day trade, you should place stop-loss limits to prevent losing all your money.

In addition, simulated or paper trading can help you get familiar with the penny stocks behavior, and you can gain experience without losing real money.

What to consider when trading penny stocks

The first factor to consider is the strength of a company’s shares structure. Avoid the companies with dilution chances, as dilution destroys the value of shares.

Next, you should conduct a thorough research about the company’s performance and its future projects. Assess whether the company is competitive, possesses growth potential and profitability chances.

Moreover, it is crucial to consider the number of outstanding shares and their price. Metrics such as P/E ratio and book value per share are excellent for determining a company’s accurate valuation.

Check the management and operating framework of a company to determine its potential. In addition, estimate your risk tolerance and be aware of frauds and price manipulation by scam companies.

Best penny stocks with the potential to 10x

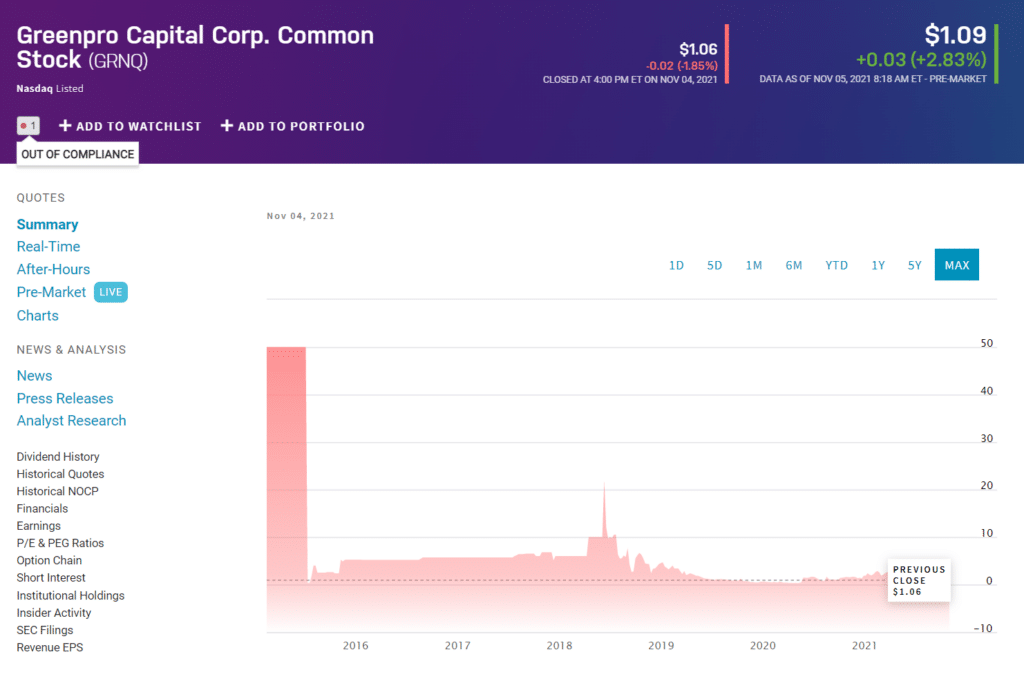

1. Greenpro Capital Corp. (GRNQ)

Current stock price: $1.09

Greenpro Capital Corp is a corporate advisory and business consulting company. Greenpro Corp began its operations in 2013 and also provides real estate rental and acquisition services. It primarily assists small and medium-sized businesses in China, Malaysia, and Hong Kong.

The company has a total market capitalization of 79.5 million with 67.7 million outstanding shares. GRNQ has a beta (a measure of volatility) of 0.11 and a price-to-sales ratio of 25.14. Currently, the stock is trading for $1.12.

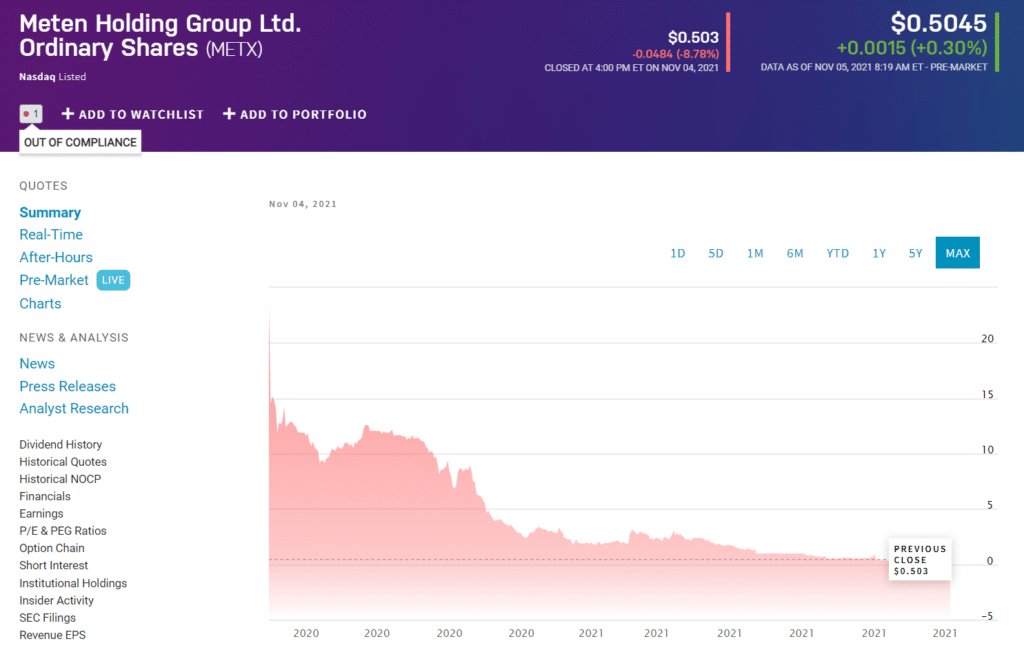

2. Meten Holding Group Ltd (METX)

Current stock price: $0.50

Meten Holding Group is a China-based company that provides English Language Training (ETL). It has more than 100 learning centers disturbed in various provinces. The company has been functional since 2006 and provides adult, junior, and overseas training courses.

Meta Holding Group has a market capitalization of 68.5 million with 130 million outstanding shares. METX has a beta of about 1.89 and a price-to-sales ratio (ttm) of 0.44. The current stock share price is $0.538.

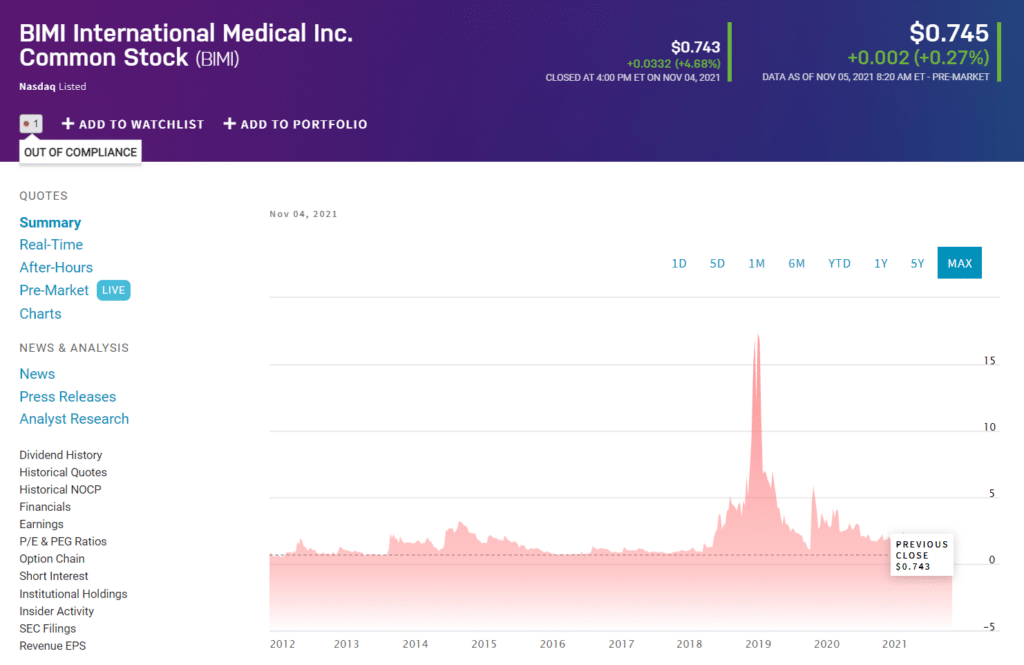

3. BIMI International Medicine Inc. (BIMI)

Current stock price: $0.74

BIMI International Medicine Inc. is a pharmaceutical retailer that distributes medical devices and healthcare products in China. The company has been operational since 2000 and specializes in health foods, supplements, drugs, and traditional Chinese medicines.

BIMI has a market cap of 25.1 million with a beta of -0.35. The shares outstanding are around 35 million with a price-to-sales ratio of 0.67. Currently, this stock is trading at $0.71.

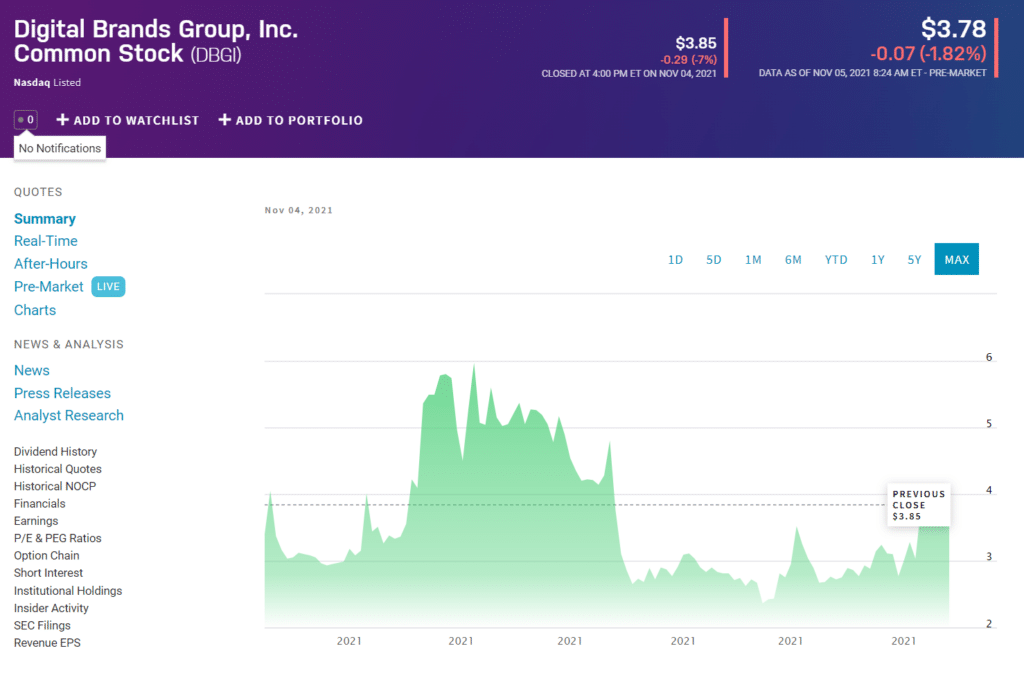

4. Digital Brands Group Inc. (DBGI)

Current stock price: $3.78

Digital Brands Group Inc deals with the sale of men’s and women’s apparel on a direct and wholesale basis. The company has its headquarters in Austin, Texas, and operates under various brand names.

DGBI has a total market capitalization of 44.5 million with 12.6 million outstanding shares. The beta is higher, i.e., above 2, and the price-to-sales ratio stands at 13.44. The stock share has a current price of $3.53.

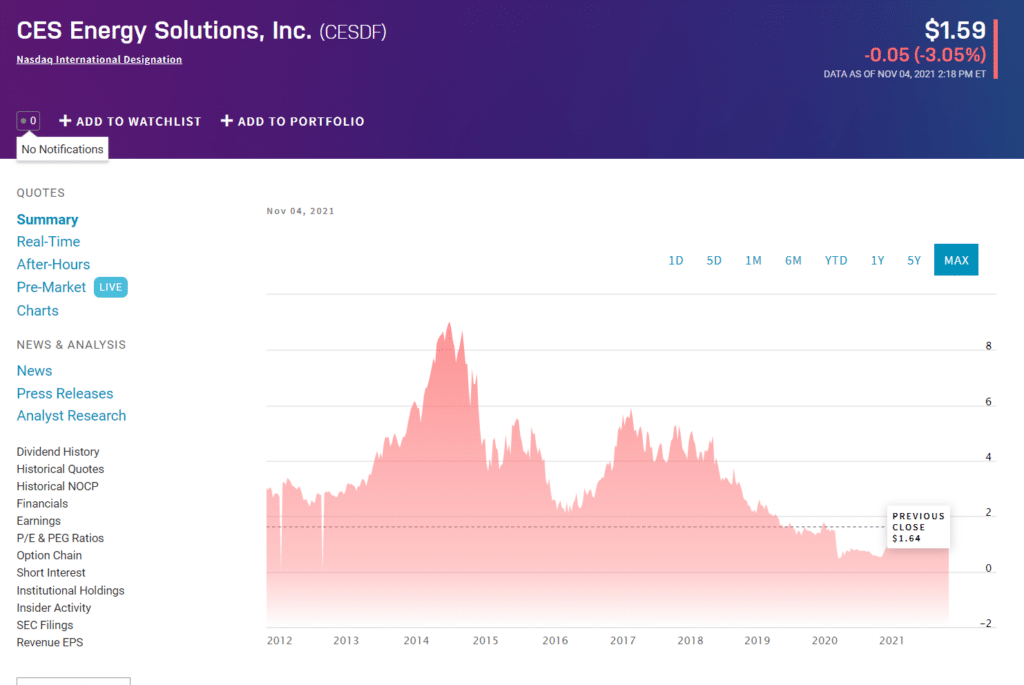

5. CES Energy Solutions, Inc. (CESDF)

Current stock price: $1.59

CES Energy Solutions specializes in producing chemical solutions, drilling fluid systems, and specialty chemicals for utilization in oil and gas markets. This Canada-based company also provides water management, oil and gas transport, and waste disposal services.

This company has a total market capitalization of 414.6 million with a net dividend yield of 3.152. CESDF has total outstanding shares of 255.64 million and a trailing P/E ratio of 13.7. Currently, its stock shares are trading at $1.622.

Pros & cons

| Pros | Cons |

| Significant upside potential Most penny stock companies are new and possess a remarkable growth potential depending on the sector and management system. | Lack of transparency There is very little information and data available for conducting in-depth research about a company’s financial condition. |

| Affordable and cheap stocks Investors can buy a large number of stocks at prices below $5. | Scam and fraud stocks These stocks are primarily illiquid with low trading volumes; therefore, it becomes easier for scammers to manipulate the price by pump and dump schemes. |

| Quick returns Penny stocks can provide you with quick and high returns due to their volatility. | Commission costs Most of these stocks are available on the OTC market and not on primary exchanges. Therefore, the commission costs and fees are higher than average. |

Final thoughts

Choosing a valuable penny stock requires a keen discerning eye with notable knowledge of the relevant sector. Penny stocks stand among the speculative stocks as they involve a certain amount of risk due to their uncertain patterns.

Nonetheless, these stocks attract investors due to their cost-effectiveness and enhanced ability to gain upward momentum. Moreover, with proper expertise and analysis, you can pick out the diamonds among the rough.