Stock traders know that some trading hours are more active than others, even though the US stock market is technically open every day from 9:30 AM to 4 PM EST.

These windows of opportunity are known as ‘power hours’ by traders. It is subjective to determine power hours.

Even day traders who only trade a few hours every day may choose to pay attention to the first hour of the trading session. In this article, the power hour stock is the topic of our discussion.

Find out the best five of these below.

Can you make real money with power hour stocks?

You might be wondering, “Can I make money or lose money during a power hour trading session?” The answer is unfortunately not conclusive. A trader’s risk level is already high, and trading during power hours only makes it more so.

It would be best to caution when dealing with power hour trading, as this risk can sometimes result in high profits.

You may benefit from power hour trading if:

- Prepare yourself for substantial financial losses.

- Profits from short-term speculation are the most important thing to you.

- With your time and resources, you can fully devote yourself to trading.

- If you trade, you will be able to make informed, analytical decisions.

How to earn with power hour stocks?

As a first step, you borrow the stock from the company whose price anticipates to decline. After that, you wait for the price to drop to the lowest possible level. After that, you sell the property at the lowest possible price. It will credit your account with the money you earned. Once you’ve paid your fees and the lender back, that amount is automatically subtracted or paid back.

Your investment pays off without you investing any money.

Regularly trading power hour stocks will also let you make a lot of profits. But be careful when dealing regularly. It makes it very dangerous to trade because the difficulty is so underrated.

How to start making money with power hour stocks?

In the end, trading can take place over various time frames. This time can vary depending on the day and is known as a power hour. Therefore, a significant spike or a lot of volatility will not always be present in end-of-day trading.

There tends to be the lowest trading volume at the end of the day. Conversely, Friday and Monday are the busiest trading days since traders want to enter or exit positions before the market closes.

Therefore, it is essential to understand how power hours work. Within two hours after the close of the market, end-of-day trading typically takes place.

Knowing when is the best time to trade stocks is vital. Therefore, your profit potential will be more significant.

Best five power hour stocks

Here are the top five power hour stocks to consider and HODL in 2022.

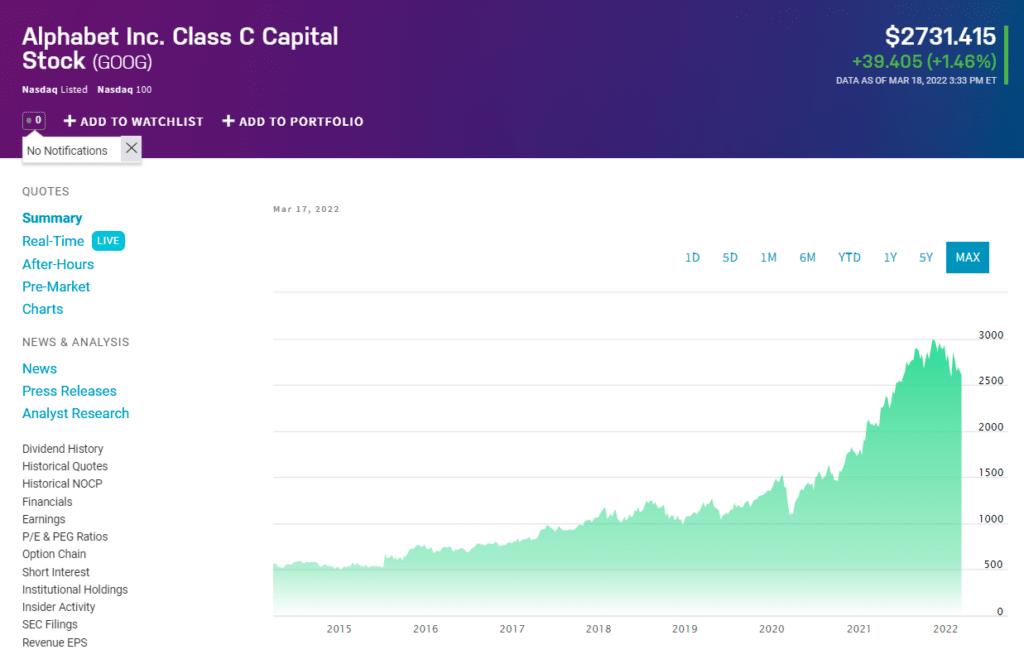

Alphabet (GOOG)

Summary

Alphabet, a global tech giant, will be our first stop. Google Cloud and Google Services are among the services the company offers. The company also has a strong presence in the AV sector, which some people may not realize. For example, Waymo, which began more than a decade ago as part of Google’s self-driving car project, has become the autonomous vehicle segment.

Price forecast 2022

The analysts offering 12-month price forecasts for Alphabet Inc have a median target of 3,500.00, with a high estimate of 3,900.00 and a low estimate of 3,150.00. The median estimate represents a +33.90% increase from the last price of 2,613.88. It has outperformed key competitors recently, but market conditions and valuations remain a concern.

Price forecast 2025

The algorithmic forecasting service gives an optimistic Alphabet stock price prediction for 2025. It seems that Alphabet stock more than double over the next three years to $5,798.89

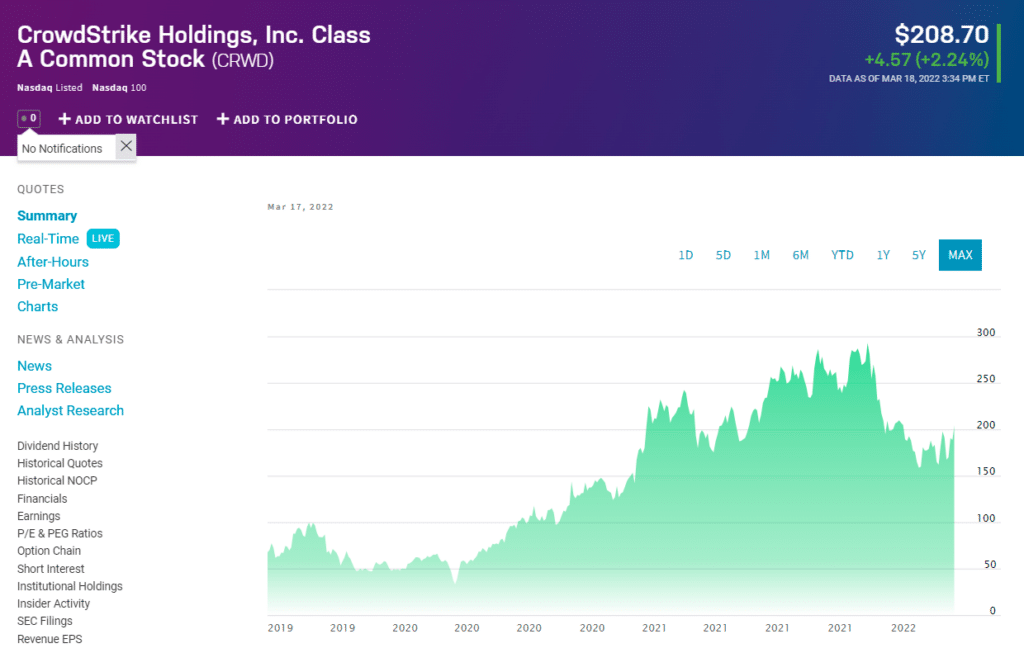

CrowdStrike Holdings Inc. (CRWD)

Summary

During the global Covid-19 pandemic, the company is continuously booming in the lucrative cloud security business. Know that it protects you from cyber-attacks if you aren’t familiar with its services. Now, you can understand why it has been increasing.

Price forecast 2022

The analysts offer 12-month price forecasts for CrowdStrike Holdings Inc have a median target of 257.00, with a high estimate of 340.00 and a low estimate of 212.00. The median estimate represents a +34.99% increase from the last price of 190.38. Its growth is because cybersecurity is a large and growing opportunity that CrowdStrike is tapping into.

Price forecast 2025

The weighted average target price per CrowdStrike Holdings share in 2025 will be 169.41. In 2025, the positive dynamics for shares will prevail, with possible volatility of 11.818%.

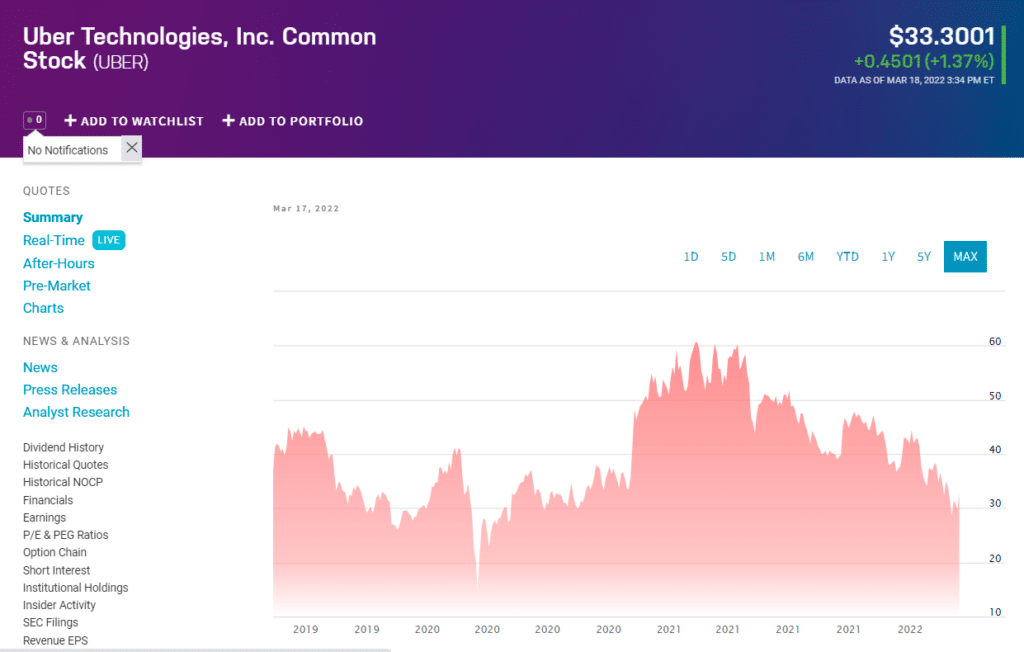

Uber Technologies (UBER)

Summary

Finally, we have the transportation service provider, Uber. It connects consumers to ridesharing, food delivery, merchants, and public transportation networks. There are three segments of the firm: mobility, delivery, and freight.

Price forecast 2022

In 2022, we expect that Uber Technologies Inc will have a median target of 62.00, with a high estimate of 80.00 and a low estimate of 28.00. The median estimate represents a +97.77% increase from the last price of 31.35. One of the reasons that Uber has increased is that it doesn’t have the same overhead expenses as traditional cab companies

Price forecast 2025

In 2025, we expect the target price per Uber share will be 34.06. In 2025, the positive dynamics for shares will prevail with possible monthly volatility of 9.820%.

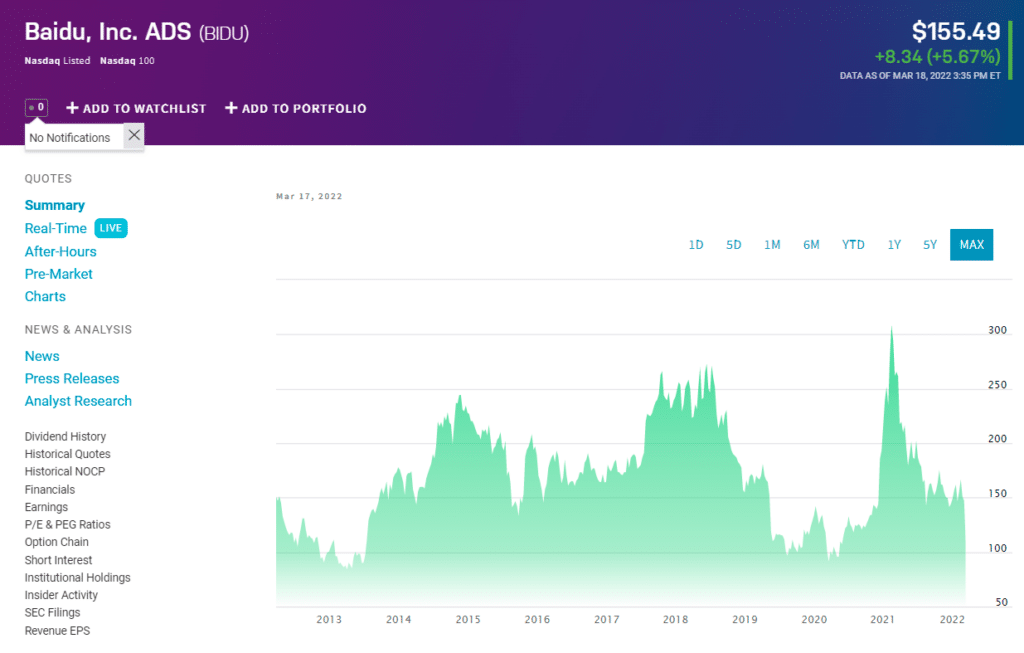

Baidu (BIDU)

Summary

Baidu is another name to watch right now in the young AV space. Essentially, Baidu is a Chinese search engine company. Baidu allows you to search the internet for information, such as webpages, news, images, and much more, just like Google. Baidu has been advancing its Intelligent Driving solutions and AV solutions in recent months.

Price prediction 2022

In 2022, we anticipate that Baidu Inc will reach an average price target of $218.64, with a high estimate of 329.51 and a low estimate of $121.98. The median estimate represents a +84.21% increase from the last price of $118.69. However, like others in Chinese tech, Baidu faces short-term growth headwinds, higher costs, and increased investment amid a shifting regulatory landscape in China. This includes increased competition from rivals.

Price prediction 2025

In 2025, we expect the price to reach $264.64 for one BIDU. Throughout 2025, the BIDU price is likely to get a maximum level of $275.56 and an average of $253.17.

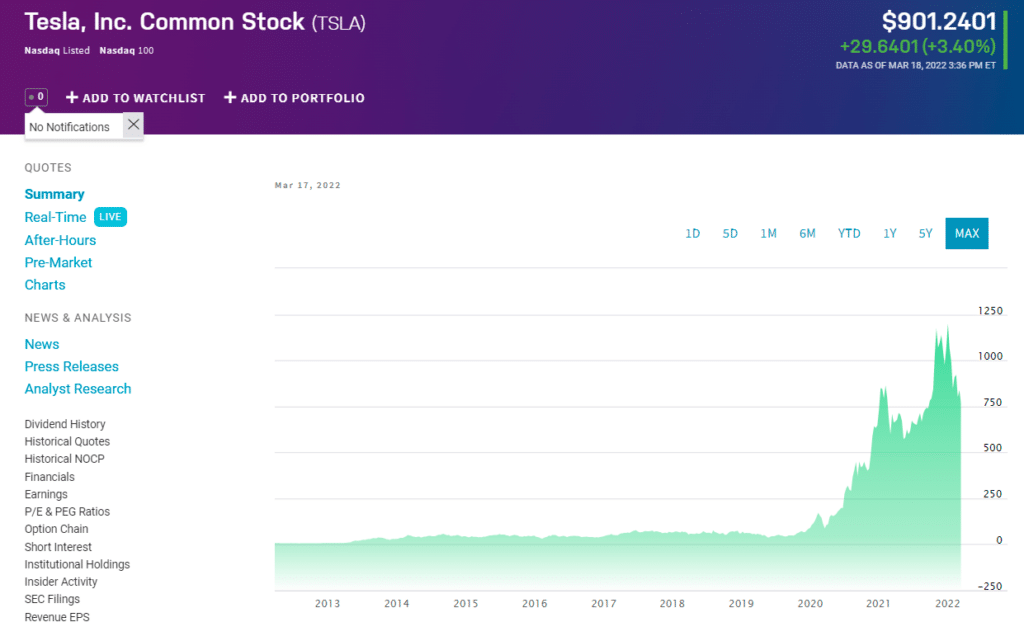

Tesla (TSLA)

Summary

Tesla is famous for what? Well, who hasn’t heard of Tesla or its CEO?

The company’s first electric sports car, the Tesla Roadster, captured the world’s attention in 2008. We can see how quickly batteries are changing people’s lifestyles despite being just a battery company at the end of the day.

Price forecast 2022

The stock is trading at $856, about 25% below its highest level this year. The most optimistic analysts expect Tesla to end the year at more than $1,500, while the pessimists expect it to be below $500.

Price forecast 2025

We expect that TSLA shares will be significantly higher than where they are today by 2025. At the time, the company will be highly profitable as the world moves to electric cars. At the beginning of 2025, the opening price will be $2,168.610. The closing price of it will be $2,539.390. Volatility will stay in the usual range.

Final thoughts

Almost any stock can make an excellent power hour investment. It helps, however, to be trading stocks in thriving industries. Technology or cannabis, for example. Aside from recent earnings reports, it would help to keep an eye on news regarding the company. Whenever possible, find pieces of information before the significant press gets them.

You will probably have the edge over other day traders by taking this approach. Plan your strategy and follow it. Set personal goals for your trading during power hours. Be reasonable in your dreams, however.