As crypto becomes more familiar with each passing day and more people are getting involved, the curiosity for various terms increases. One such term is “slippage.”

Not knowing slippage can dent your investments in a highly unpredictable market like crypto. But it is not just risky for a trader. You can use it to your advantage if you’re knowledgeable about it.

This guide will discuss slippage and how you can trade with it.

What is the slippage trading method in crypto?

It is quite common when trading cryptos; it is the price difference when a trader submits a trade and confirms that trade. As the crypto market is volatile, the price changes quite quickly, so the price you want to sell or buy can change when the trade is complete.

So, slippage is the difference between the price you wanted to sell or buy and the transaction price. Two events can cause it: a shift in the bid/ask spread between the time when you place the trade and the time it is filled.

Slippage can be divided into two classes, positive and negative, which can significantly affect trading and the strategies used. Some crypto platforms permit you to set the rate of your order exchange that you think are reasonable slippage costs for you. If the exchange value surpasses the slippage limit, the trade will not happen.

How to trade using the slippage trading method?

It occurs in all markets, including stocks, forex, and crypto. However, it is particularly significant in crypto due to the asset class’s extreme volatility.

Slippage happens in volatile circumstances. Why? Because the cost at which the exchange executes changes significantly from the price at which you entered the trade. In other words, slippage in crypto can result in a large gain or a large loss for traders depending on the market’s movement.

The trader anticipates inducing the cost they enter the exchange at, but their trade executes at a completely different cost due to wild swings in the price.

It also happens when there is a deficiency of liquidity. For example, a few cryptos don’t get traders’ attention because they are less prevalent than big fish like BTC and ETH.

Due to that, the spread between the lowest and highest asking prices is wide, causing sensational changes in the cost all of a sudden. A low liquid asset implies it cannot be effectively changed over to cash, thus making them less popular cryptocurrencies illiquid to some extent as there are no continuous buyers. Lack of liquidity can cause critical slippage since, with limited exchanges, the number of inquiring costs will also be few.

Now that you know about market slippage, its’ time to talk about the bullish and bearish trade setups.

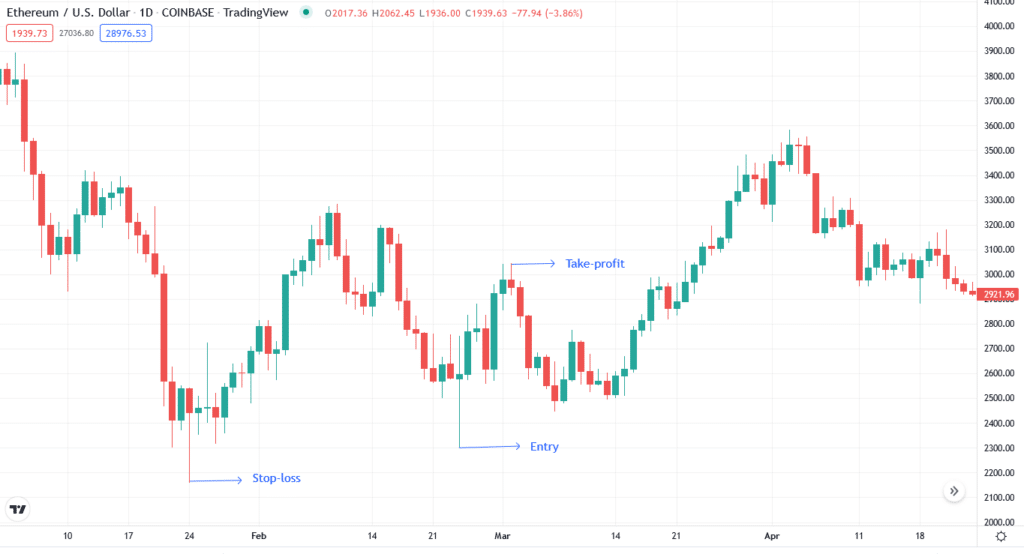

Bullish trade setup

The first thing you need to do for the bullish setup is to identify a positive slippage. Slippage is good for a buy order when the actual price is lower than projected, providing traders with a better buying rate.

Entry

Once you identify the positive slippage, you can enter the trade. But, of course, it’s always good to wait for the trend to continue and enter the trade.

Stop loss

You can place the stop-loss at the recent low from the entry point.

Take profit

For setting TP, you can look at the recent high level.

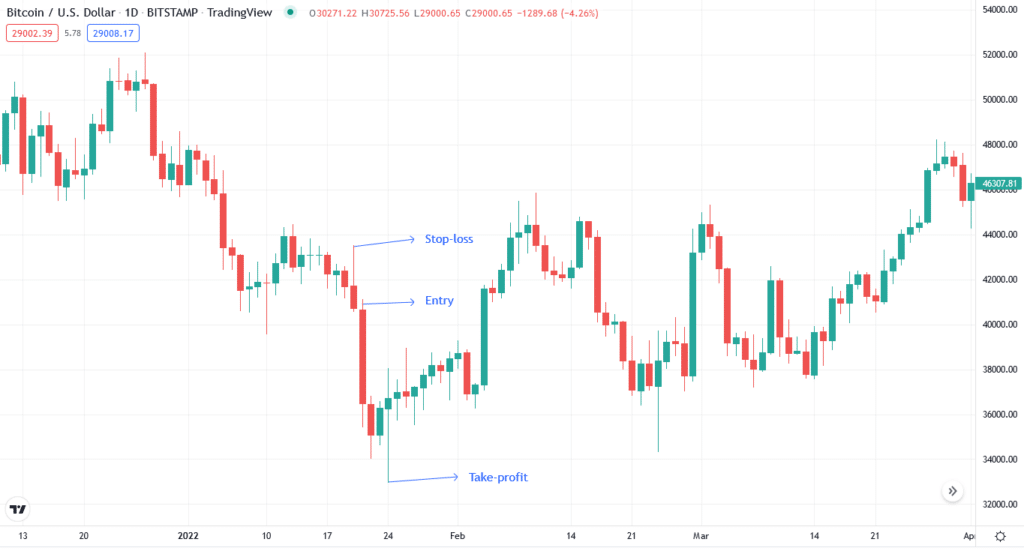

Bearish trade setup

For a bearish trade setup, it’s important to identify a negative slippage. Slippage benefits a sell order when the actual price exceeds predicted, allowing traders to profit more from short positions.

Entry

Once you identify the negative, you must enter the trade. Then, wait for the price action to continue its path and enter the trade.

Stop loss

You can place a stop-loss near the recent high from the entry point.

Take profit

For TP, you can set it at a recent high from the entry point.

How to manage risks?

The easiest way to manage risk when trading with slippage is to use a limit order rather than a market order. It is because market orders execute quickly, implying that the price will vary while your order processes in an illiquid market.

When you make a limit order, you have already specified the maximum price you are willing to pay. Thus instead of experiencing slippage, your order may take longer to fulfill or may not be fulfilled.

As part of their market order mechanism, most crypto brokers have a slippage tolerance control. Investors can choose how much slippage they are ready to accept, and the broker will only complete orders that fall within that tolerance.

If the liquidity or price tolerance exceeds the threshold, the order is not completed. To protect themselves against volatility on any particular trading day, most traders set the tolerance to 0.10% or less.

How to make $500 per day with this strategy?

No crypto can continue to appreciate without encountering a setback sooner or later. Investors trying to make a quick buck may benefit by placing a short or long trade. Slippages can occur anytime, so choosing popular coins like BTC or ETH is wise.

To minimize the effects of slippage, monitor volume, set your limits, and don’t trade during volatile periods.

Final thoughts

Slippage may be a joint event for crypto traders when the desired cost does not meet your expected cost when doing an exchange. For this reason, market participants must continuously be mindful of possible trade slippages.