Trading options buy the right to buy or sell shares when the stock price reaches a certain level. However, this is not always the best choice. The buyer does not exercise most options. Instead, they trade them to lock the earnings instead of keeping the stocks. There are many reasons why this is a more innovative strategy than exercising the option.

For example, once the call option buyer can profit from the option, that trader may think that the risk of getting those stocks won’t pay off in the long term. The most he can do with it is to get the profit the trade of the option will give him.

These strategies help traders to make profits every year, and they can help you too. Keep reading to learn how to get the most out of the options trading and decide which option you should keep and which ones don’t.

What is the option expiration day?

It defines the exact moment at which an option contract is declared worthless.

To fully understand the expiration date of an option contract, you need to be clear about what an option is about. When someone buys an option, that person is purchasing the right to buy or sell stocks once the strike price is reached during an established time frame. The expiration date defines the duration of that period. So, to exercise the options, the stock needs to get to the strike price level before the option expires.

It’s not hard to understand that the further the expiration date, the more likely the stock reaches the strike price. Therefore, the premium someone must pay for the option is higher. So, the expiration date is one factor that more heavily influences the cost of an option contract.

Top three must-know traps to avoid during a volatile time

In theory, options trading is an activity that has only two important events: when you buy the option when you execute it. However, you can keep trading the option at any time before the expiration date. This allows both writers and buyers to manage their risk even after they are involved in the trade. Let’s see three ways in which you can avoid traps when options trading.

Don’t exercise your long option

Exercising your long position means that you are buying the underlying asset, and that seems to be the purpose of the whole thing, but you need to understand that buying the stocks also implies a risk in the long term. Nothing assures you.

If you trade the option instead of getting the stocks, you get the money and avoid all the risk involved in purchasing the stock. Also, once you exercise the option, the broker charges you with some fees you can avoid by trading the option.

Sometimes you could even get more money from options trading than trading the underlying. For example, if the value of the stocks reaches the strike price and keeps trending at half of the period, the option’s price is very high since you’ll be selling the possibility of buying an asset at a lower price.

Let’s think about a stock that costs $50 at the beginning of the period, and the strike price is $55, and the premium is $3. If by half the period the price is $60, by exercising the option, the profit would be the difference in prices minus the premium. But, since the cost of the stocks is expected to keep rising, the value of the option is now $7.

If the trader decides to sell the option, his total profit would be $4 per share instead of $2 by buying the stocks.

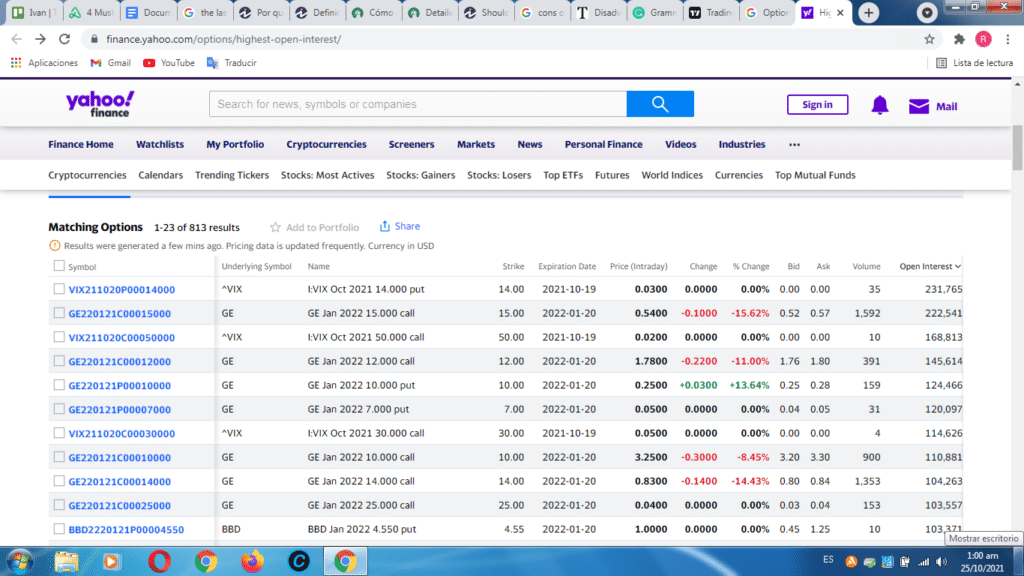

Check option open interest

Open interest defines the number of active contracts. So taking a look at that number could signify an advantage for you. It gives you information about the liquidity of an option. When there is no liquidity, it means that there is no secondary market for the option.

On the other hand, high liquidity increases the chances of getting a good deal on your option. So, checking the open option interest is a great tool to decide if trading the option is worth it and when.

Don’t hold positions to the last minute

The fact that you bought options contracts doesn’t mean that you have to exercise it. Remember that what you are trading with options are rights to purchase or sell assets. So, it is not the asset itself that is worth it. It is right.

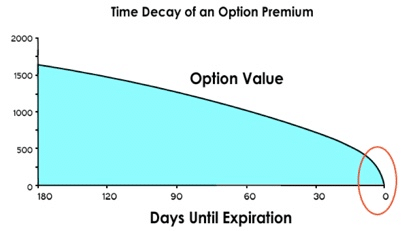

That right loses value with time. That phenomenon is called time decay. The closer you get to the expiration date without the stocks reaching the strike price, the lower the stock price.

A common mistake when trading, not only options but all kinds of assets, is to hold on to the trade, hoping that you can recover the money you invested in the end.

Managing risk is mainly what differentiates a successful trader from the rest, and part of that is knowing when a trade is a lost cause.

Pros & cons

You need to evaluate all the possible outcomes of a trader before making any decision. That’s why here we are giving you the advantages and disadvantages.

| Pros | Cons |

| Investment Such trading doesn’t mean that you need the total money to buy or sell the underlying. The minimum amount required to trade options is the premium, so the investment is lower than stock trading. | Time decay If you buy an option, the price goes against you. Each day, your option’s value decreases, making trading it before the expiration date harder since you can recover less money each day. |

| Risk management The risk is much lower in options trading due to the nature of the market. The secondary market allows you to get out of bad trades if things don’t go as expected. And if you are in the buyer’s position, the risk is always limited to the premium paid. | Not available for all the stock The options market is not as big as the stock market. There are no options for all the stocks, so you have to choose among those the market offers. |

| Strategies Options trading is one of the markets with more efficient strategies. Some of them can even give stable incomes with a minimum risk. | Commissions and fees They are not low in options trading and compared to stock investment. The rates are not very attractive. |

Final thoughts

It is not limited to the execution of the option once the stock hits the strike price. Instead, there are many techniques designed to trade options themselves and profit consistently from that. By trading options instead of executing them, even if they are good stocks, you are locking your earnings and avoiding the risk of owning an asset that can fall no matter how good you think it is.