On November 26, 2021, Bitcoin and cryptocurrency prices plummeted as Black Friday’s shopping event kicked up, along with stock markets worldwide, which fell on new worries of a new Covid-19 variant. Cryptos began 2022 with a bang, giving up a big amount of the previous year’s earnings.

Bitcoin plunged more than 40% from its all-time highs in late January. While prices have partly steadied, the market’s downward trajectory has stoked some fears of a crypto meltdown.

In this guide, we’ll break down what could be the next black Friday crypto crash.

Can you make real money with Black Friday crypto crash?

When cryptocurrency’s price falls, many people will buy even more. As a result, the average price they bought that coin falls. When you seem to have invested less on a coin, its price does not have to rise as high for you to benefit. It’s important to note that if you can’t tell if the dip is a brief decline or the start of a downtrend, it’s not a smart idea to buy.

How to earn with Black Friday crypto crash?

Taking a long-term view is an excellent technique to avoid panic selling when prices fall. If you want to hold for the next five to ten years, you are more likely to conduct a thorough analysis before investing. And it’s easy to perceive a market meltdown as part of the crypto’s volatility.

Furthermore, cryptos are becoming more commonly recognized as a means of payment, resulting in greater price stability in the future. As the use cases for Bitcoin become apparent, more individuals regard it as a safe store of wealth.

How to start Black Friday crypto crash?

When you hear about cryptos that have grown over 1,000% in a year, it’s tempting to get carried away believing that you will experience similar profits. However, just a few cryptos earned those returns last year. The critical rule of trading in a risky asset class like cryptos is only to risk what you can afford to lose.

When did the crypto price drop on Black Friday?

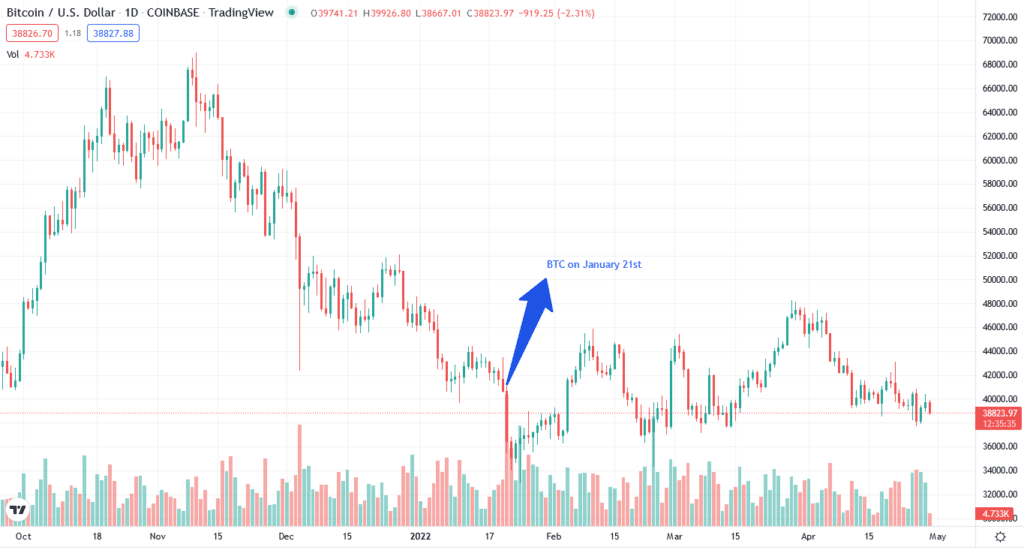

On January 21, 2022, we experienced a Black Friday. Within 24 hours, the crypto market cap fell by $205 billion. The main market indexes likewise collapsed and were amid a correction at the time. The overall market capitalization of all cryptocurrencies has fallen to roughly $1.7 trillion, down from nearly $3 trillion in early November.

In addition, BTC prices fell from over $41,000 on Thursday to around $36,000 on Friday, losing nearly half of their value since early November, when they peaked at more than $67,000.

Cryptos did fall earlier this year, but it is not the first time this has happened. For example, between May and the end of July 2021, the same market decreased by 52%. The market then plummeted by 38% in November 2021.

What’s causing the Black Friday drop?

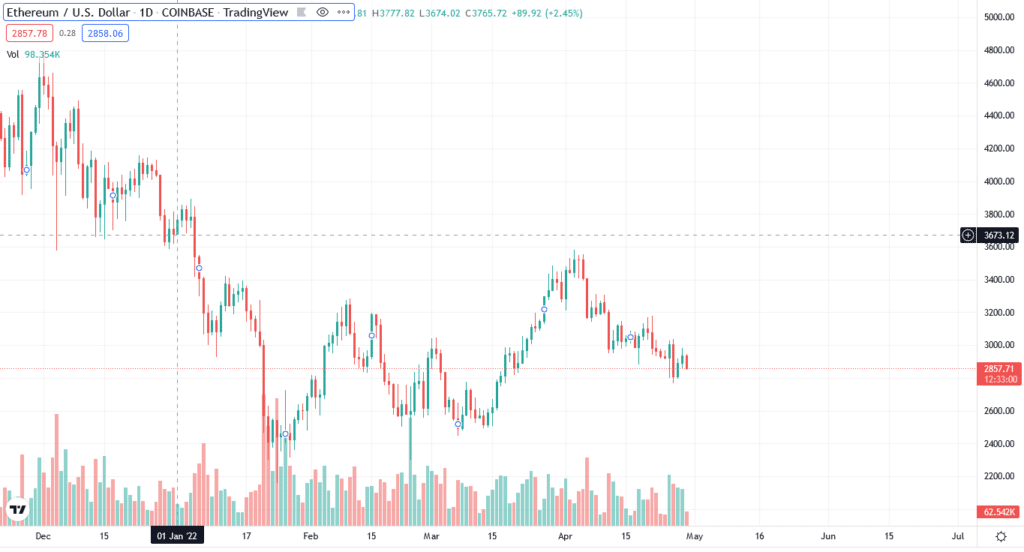

Cryptocurrencies have had a difficult start to the year. Since January 1, the overall market cap has dropped by more than $300 million. The crash has been fueled mostly by record prices and the conflict in Ukraine. Most popular assets, such as Bitcoin and Ethereum, have shed 9% and 20% of their value.

The recent slowdown in an industry with unparalleled expansion during the pandemic hints that the whole market’s light may be fading. Tesla’s choice to a breakaway by accepting BTC as payment was one of the causes of the crypto crash. In addition, the value of the cryptocurrency market continues to fall amid China’s crackdown.

China’s prohibitions prohibited banks and financial organizations from providing clients with cryptocurrency-related services. China has also issued a warning against speculative trading, which has led some users to believe that another crypto meltdown is on the way.

The most recent pressure wave on cryptos began in April 2022, when Federal Reserve Chair Jerome Powell warned that the central bank would likely hike interest rates by a significant half-point at its next meeting to combat historically high inflation.

When could be the next Black Friday crypto crash?

The rise and fall of cryptos have recently resembled a roller-coaster ride. Unfortunately, when it comes to investing, there are no guarantees. Crypto may fall just as swiftly as it might rise.

Traders and investors are looking at the several factors:

- Crackdowns in nations such as China

- Global calls for more regulation

- Environmental issues

- Crypto pricing is purely speculative

- Global inflation

Further regulation is viewed as a risk to crypto’s decentralization, influencing pricing. However, given its volatile character, it is feasible that Bitcoin will regain momentum in the future. However, no one has a crystal ball. Thus it is hard to predict whether Bitcoin will fall in the future.

Russia’s Crypto Ban

The Bank of Russia recommended a ban on Bitcoin mining and other crypto businesses in January 2022. However, in February 2022, it overturned its ruling. The central bank now considers a regulated and restricted cryptocurrency framework necessary. The Russian Ministry of Finance is also interested in regulating cryptocurrency.

The Bank of Russia has often said that the circulation and usage of cryptocurrencies pose significant dangers to the stability of the Russian Federation’s high-risk financial system. Sanctions imposed on Russia in response to the country’s invasion of Ukraine may stifle the growth of its crypto industry. Many people are afraid that Russia may use its natural resources to perform crypto mining to avoid sanctions.

Final thought

Even though the crypto market plummeted drastically in 2022, fans and early-bird crypto traders have not withdrawn their assets because they are focused on the more excellent picture. Crypto breakdowns happen all the time, but not all of them recover. Extensive research is one of the most acceptable methods to take advantage of them.