The method in which cryptos function differs from how conventional forms of currency do. Because they are entirely digital, no actual money is to be exchanged. Instead, each network maintains a “blockchain,” which is a record of all transactions on the network.

The two most often used methods for validating network transactions are proofs of work (PoW) and proofs of stake (PoS). Even though the company was founded on a PoW network, many networks are now moving to a PoS network. The MIT Technology Review selected PoS as one of the top ten breakthrough technologies of 2022, while the European Union came close to outlawing PoW.

What is decentralization in the crypto world?

In the context of cryptocurrency, decentralization refers to blockchain systems. It does not rely on a single point of control. If there isn’t one controlling authority, it might indicate that the system is more neutral and safe. As a result, blockchain technology provides an additional layer of protection.

Reasons why not every cryptocurrency is decentralized?

One argument is that just because they utilize the same technology doesn’t mean they should all create the same product. The focal point of each coin is unique. In the case of Bitcoin, for example, the goal is to maintain decentralization at all costs, and this goal guides every change. Even if Bitcoin is censorship-resistant and everyone may use it, altcoins like Ripple focus on being centralized and working with banks to accept their projects and earn from their contracts with the banks.

It’s also possible to have total control over oversupply, coding, and the currency’s future by creating a centralized system. This is usually done to make money.

We face challenges that need centralization during this period of rapid expansion for blockchain technology and cryptocurrencies. Ripple, for example, is more easily adopted by banks and major enterprises due to its centralized nature.

Centralization may help disperse trust and make a single person responsible when introducing new technology like this, which can be highly advantageous. Because blockchain technology may be used in various ways, it doesn’t necessarily need to be decentralized to work.

What are consensus mechanisms?

Authenticating transactions across many network nodes is referred to as “consensus.” Consensus mechanisms are necessary for cryptocurrency networks to maintain the integrity and validity of their blockchains or ledgers. The majority of the network reviews each transaction in the ledger to guarantee that it does not include any erroneous or fraudulent transactions since a single authority does not control the ledger.

Consensus mechanism types

Verification is a breeze with a centralized payment network like PayPal or Venmo. A single authority maintains custody of the ledger, acting as a trusted third party in verifying or clearing transactions. On these networks, you can’t “spend twice.”

However, a person can attempt to insert multiple copies of transactions into the blockchain before the next block is added to a cryptocurrency network since a digital currency lacks a central authority that verifies transactions.

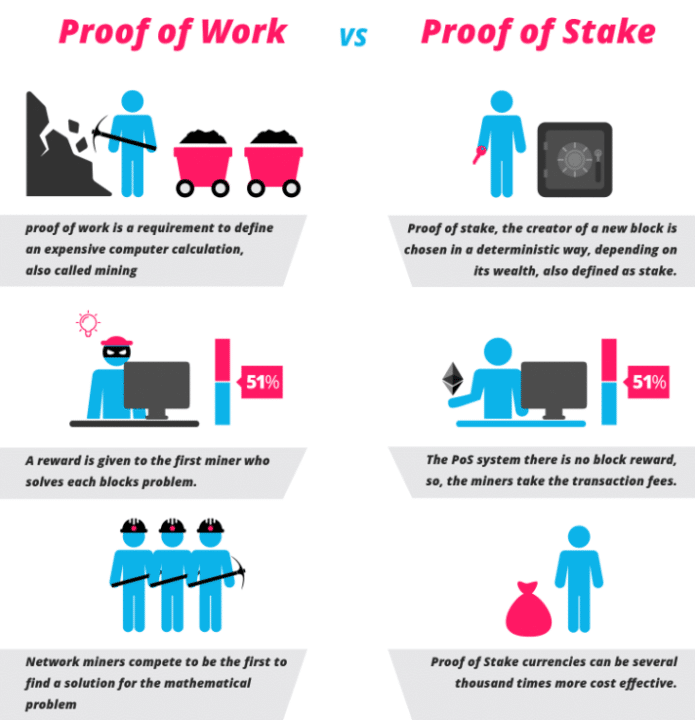

Proof-of-work

In 2009, Satoshi Nakamoto developed PoW as the consensus mechanism for Bitcoin, the first cryptocurrency network. Proof-of-work (PoW) is the only way for the Bitcoin network to operate.

So, what is Proof-of-Work, and how does it work? By signing the transaction with his private key and transmitting it through the recipient’s public key, a user may transfer Bitcoins from one Bitcoin address to another. To keep the Bitcoin network up-to-date, every ten minutes or so, a new block of transactions is uploaded.

The blocks are made via mining. Many Bitcoin miners compete for each block by using processing power to solve a cryptographic challenge that requires energy. A block of confirmed transactions is inserted into the chain and becomes a permanent record upon solving the problem. Miners are paid in bitcoins for their hard work.

Mining is referred to as “the labor” in “Proof-of-Job.” The processing capacity of the miners is put to use to “prove” the network’s existence. With PoW, no central authority is required since a record of all verified transactions is kept in perpetuity.

Proof-of-stake

Proof-of-stake, an alternative to PoW, was presented in 2013. Two networks are using it: Cardano and Solana. Vitalik Buterin, the Ethereum network’s creator, is an outspoken advocate of PoS as a consensus technique and has stated his intention to move the network away from PoW soon.

While PoW relies only on miners’ efforts, PoS compels network participants to “stake,” or lock up, their crypto assets in exchange for becoming blockchain validators. Validators are chosen at random by the network to verify the blockchain. Instead of mining, “validators” validate the network with their “stake,” akin to a PoW miner.

Downtime and duplicate signing are two things that the PoS network would rather not have. To penalize poor players, PoS uses a “slashing” system. Invalid blocks, inactivity on the network, and failure to sign transactions may result in the “slashing” of validators’ stakes.

Tradeoffs between PoW and PoS

PoS networks consume far less energy than PoW networks since there aren’t as many computers “trying” to solve a cryptographic issue simultaneously and using a significant amount of power. According to some, PoS’s reduced energy needs for agreement are a positive aspect of the protocol. To top it off, since PoS networks don’t need many computers to attain consensus, they may potentially process transactions at a greater rate.

Despite this, there are several drawbacks to PoS. In general, cryptocurrencies are marketed as “decentralized. Yet, networks that employ PoS consensus algorithms are drawn into a process that grows away from any real decentralization.

In a proof-of-stake system, the more coins you own, the more sway you have in voting, and those who own coins are also the ones who stake them to earn more. By increasing their staking amount, they can continue to grow their power over time forever, as they don’t have to invest resources to stake coins. In other words, a network’s dominance tends to lead to further domination.

Consequently, the management of PoS networks mimics the administration of a centralized enterprise rather than a decentralized currency. The existing fiat system may be compared to an unelected corporate board in terms of monetary networks.

PoS networks, like PoW networks, have their own set of technical issues. However, when compared to PoS, the PoW methodology only takes around 100 lines.

“Excessive duplicate transactions” are to blame for the Solana network’s frequent outages, the most recent of which lasted almost 48 hours. Furthermore, for a Solana validator to operate, it must be housed in a data center, affecting network speed while impeding security. Although PoS networks do not prioritize throughput, they exploit high throughput to set themselves apart from the competition (Solana vs Cardano). This means that decentralization and security are sacrificed in favor of speed in PoS networks.

Final thoughts

The popularity of crypto is currently exceeding the adoption of the internet. However, for “Crypto” to thrive, it must be linked to the money and financial markets.

PoW is more secure, decentralized, and battle-tested than PoS, using more energy. The inherent and considerable costs between the two consensus processes should be considered by policymakers debating whether or not to outlaw PoW or believe that PoS can easily replace it.

Distinct cryptocurrency networks have varying degrees of decentralization and trust. Each network serves a different purpose for its users. The decentralization, efficiency, and security of a cryptocurrency network are directly correlated to the consensus technique.