The online trading world is rapidly expanding, and many individuals are desperately looking for an alternative source of income.

Depositing from your local bank to any forex broker that does not support your country is frustrating. Many brokers offer flexible payment solutions; however, they lack the crypto wallet service, and their safety and security systems are not up to scratch. Still, the concept of crypto and decentralization has eliminated this issue to a large scale.

In addition, individuals are looking for fast-paced solutions such as flexible and swift payment options. One such payment method is cryptocurrencies, which allow you to exchange funds in a few minutes.

Five Best forex broker that accepts crypto deposit

We, therefore, screened many brokers and shortlisted them to the top five that accept cryptocurrencies as a form of payment.

1. TechBerry

TechBerry is a global social Forex broker providing automated trading services since 2015 with no country restrictions. It offers the greatest insurance policy, with up to 100% recovery for your losses. Your funds are insured by FIDC bank, making it a reliable platform.

TechBerry proposes gains of 11.2% and partners with over 50 licensed financial institutions regulated by top authorities like Cysec, NFA, IIROC, FCA, ASIC, MAS, etc. It uses very efficient AI to monitor data from 100,000 accounts to design a profitable trading strategy, executed automatically.

Members of TechBerry can monitor real-time trade results on the website, including the current win rate and live trades. It is available in various subscription packages such as Green, Silver, Gold, Platinum, Diamond, and Infinite. Service fees, loss reimbursement, minimum deposit, and real-time trade monitoring differ depending on your pricing plan.

TechBerry allows traders to double their capital each year by compounding the profits.

Pros

- There is a free trial applicable for two weeks.

- It has monthly gains of 11.2%.

- Low-priced multiple subscription plans.

- Utilizes efficient AI for developing the best trading strategy.

Cons

- No information on the applied strategy.

2. TP Global FX

TP Global is a forex and CFD broker and was established in 2018. TP Global’s vision is to offer the best trading conditions to their clients by utilizing the best Ai/ML trading experience.

The broker allows access to a wide array of markets, uses advanced technology to enable a seamless trading experience, and has award-winning support services.

You can trade currency pairs, CFDs in commodities, indices, and metals. TP Global allows access to all financial markets via the popular MT4 and MT5 platforms. They have multiple account options for you to choose from. The options available for you are:

- Standard

- Pro

- Institutional

Each account type has a defined set of benefits to suit your affordability and trading needs. The minimum required deposit is $20 for the standard accounts. Funding is possible via the TP Global client dashboard. The leverage 500:1 makes it realistic and also helps traders to over-leverage. TP Global gives their IB clients promotions from time to time, allowing them to learn and earn at the same time.

They offer flexible methods of payment, which include cryptocurrencies and Bankwire. The broker accepts Bitcoin and Tether cryptocurrencies as payment options and offers many other benefits like partnership programs, educational resources, and copy trading.

Furthermore, their support staff is available to answer queries 24 hours, five days a week. You can reach them via email, phone, or chat service.

Pros

- Access to multiple financial assets

- Low minimum deposit required

- Access trading via MT4 and MT5

- Popular copy trading feature

- Accepts Bitcoin and Tether as payment methods

Cons

- No credit/debit cards are accepted

- Offshore regulation

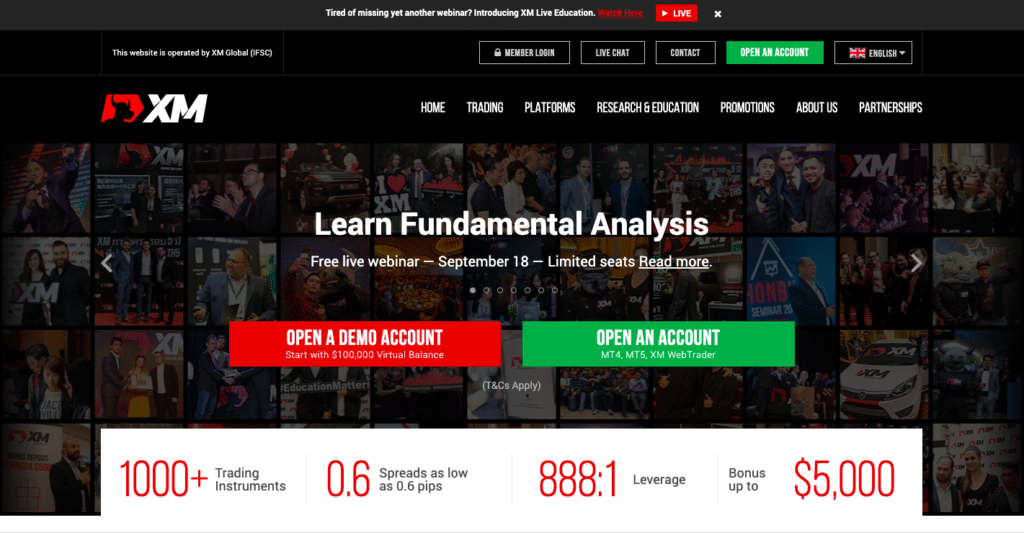

3. XM

XM is second on the list for a reason; it has been in existence since 2009. XM is a globally well-known broker for its services. XM currently has 50,000,00 clients since it was started.

XM has 1000+ trading instruments with a spread as low as 0.6 with 888:1 leverage. The broker also provides a bonus of up to $5000. The XM Group is licensed by ASIC in Australia, CySEC in Cyprus, the IFSC in Belize, and the DFSA.

The broker also provided you with a personal manager. The best part of opening an account in XM is the knowledge centre. XM does technical analysis webinars from time to time to help their clients excel in trading.

XM is one such broker that takes deposits in crypto, making it easier for clients all across the globe.

Pros

- Start with a virtual balance of $100,000

- Wide variety of trading instruments

- Accepts crypto payments

- Low spread and high leverage

Cons

- Limited product portfolio

- Average forex and stock index CFD fees

- No investor protection for non-EU clients

4. RoboForex

RoboForex is a forex and CFD broker who started operations in 2005. The broker’s list of assets includes currencies, stocks, indices, and cryptocurrencies.

The broker has five different account types: Prime, ECN, RTrader, Pro, and ProCent. The broker offers multiple platforms to access the markets. Trading is supported by MT4 and MT5, cTrader, and RTrader platforms. RTrader is a proprietary platform by RoboForex and can be downloaded as an application or accessed via a browser from any device.

The broker offers multiple trading tools like the economic calendar, so traders stay updated with the latest fundamental news. In addition, they have educational resources to assist novice traders. You can fund your account directly through the client portal. They offer numerous withdrawal and deposit methods. Furthermore, you can fund using cryptocurrencies.

RoboForex staff can be reached via phone, email, and chat services, and they assist clients in multiple languages.

Pros

- Wide variety of assets to trade

- Accepts crypto payments

- Cashback rebates

- Multilingual customer support

Cons

- It does not allow US citizens

- Offshore regulation

5. FXOpen

FXOpen is a veteran in the industry and has been operating since 2005. The broker offers forex trading in currencies, stocks, indices, commodities, and cryptocurrencies.

You can access the markets via MT4, MT5, and TickTrader. However, stocks can only be traded via TickTrader. And the MT5 platform does not support trading in cryptocurrencies.

FXOpen gives clients access to multiple account types:

- ECN

- STP

- Micro

- Crypto

- Demo

The broker has a cashback program, which is a refund in terms of promotions. The minimum cashback is $5, and the maximum is $1000. This is refunded to a commission account automatically.

The broker offers various funding methods, which include cryptocurrencies. They support crypto payment in Bitcoin, Bitcoin Cash, Litecoin, Emercoin, Ethereum, and Tether.

Pros

- Lucrative cashback program

- Multiple trading platforms

- Accepts various cryptocurrencies as payment

- The broker allows auto trading

Cons

- Hefty fees charged on Tether withdrawals

- Stocks are only tradeable via TickTrader

6. OlympTrade

OlympTrade is an international forex broker and has been in the financial markets since 2014. They offer the trade of 80 financial assets, including currencies, metals, stocks, and indices. In addition, they provide low spreads starting from zero pips.

The broker allows access to the markets via their proprietary web platform. The platform is compatible with Android and iOS devices. The broker also supports multiple languages for their international clients.

OlympTrade requires a minimum deposit of only $10. Furthermore, you can fund your account using these payment options: Visa, MasterCard, Bank Transfer, Skrill, Neteller, JCB, Union Pay, Perfect Money, Astro Pay, Tether, WebMoney, and Crypto-Wallet.

OlympTrade also offers an affiliate program for clients to earn an extra income from referrals.

Pros

- Affiliate program

- Accepts multiple payment methods, including crypto

- Low initial deposit required

- Cutting-edge trading platform

Cons

- Only access markets via OlympTrade platform

- The broker does not offer crypto trading

Final thoughts

Any trader needs to choose their broker after doing their research. Brokers are an essential part of anything else when it comes to trading. Traders must look for low or raw spread and average up to 400. Understand the terms spread and leverage plays an important role here.

Keeping your leverage low will help you maintain the risk management as over-leverage is harmful and can blow your account.

You always keep in mind how the broker takes the deposit and gives the withdrawal, as sometimes, it becomes hard to withdraw the funds if the broker is not legit.