Day trading is the market activity in which the trader buys and sells assets such as FX pairs, stocks, and ETFs before the day ends. But this activity is not limited to those kinds of assets. For example, even when options are not a traditional asset, you can trade them in secondary markets and apply the same strategy with stocks or forex pairs.

This type of trading allows you to manage with contracts of 100 shares with less money than you would need to invest in the stock market. Here we will explain all about this profitable practice and how you can apply it right.

What is a day trading options strategy?

With such options strategies, market participants enter and exit positions during the same trading session to take advantage of price fluctuation during the trading session.

Trading options usually makes sense to lock profits you make from buying options or to minimize losses.

On the other hand, day trading is risky because you are trying to profit from an asset that loses value every day due to time decay. That means that the appreciation of the option needs to be enough to make up for the losses the time decay provokes on the contract.

How to use a day trading options strategy?

To trade options successfully, you need to follow some rules that will make your move profitable.

First, you need to buy contracts that are in the money. Most options traders don’t want to exercise the option. Instead, they want to trade the right to buy a stock at a higher price than the option strike price or to sell a stock at a lower price than the strike price.

The other important thing is to trade options one or two weeks before the expiration date. Options whose expiration dates are far away don’t have high trading volume and liquidity.

In contrast, options in the money and near the expiration date are more attractive because they are cheaper due to the impact of the time decay, and they have high trading volume and liquidity, which means that you could get a better deal for your option contract.

Bullish setup

It consists of buying an option contract when the stocks are rising if you purchase a call option.

Where to enter?

You want to enter only in options that are already in the money and one or two weeks away from the expiration date so you can have a high open interest.

Where to put the stop-loss?

Trading options is a race against time, and your asset is depreciating at a constant rate. Therefore, you need to quickly identify lost trades, so rules like setting stop-loss at 1% are useful, so you must strictly follow them.

Where to take profit?

Day trading is about making small earnings fast. There are a lot of elements going against you in the trade. So, at the moment you see a profit, you must take it.

Bearish setup

The bearish setup for an option contract is to buy the put option contract when the stock price is falling.

Where to enter?

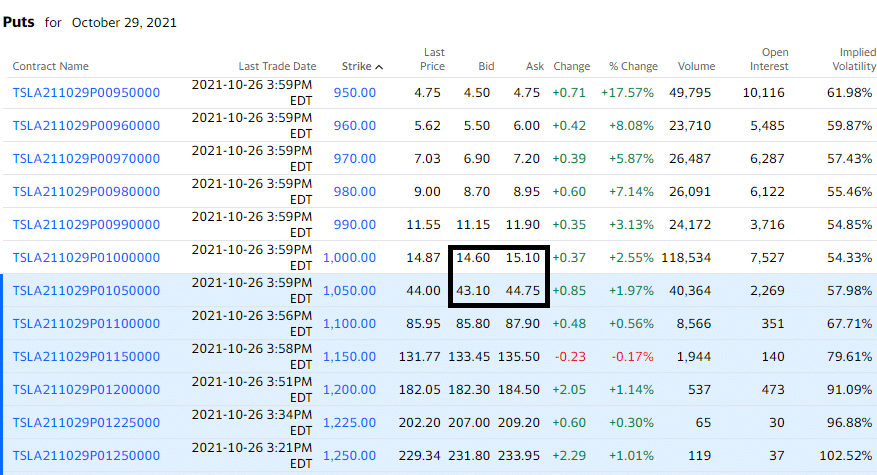

Once the price of the shares is below the strike price, if the expiration date is less than two weeks away, you enter the position.

Where to put the stop-loss?

The contract will gain value because it will give you the possibility of selling stocks at a higher price than the market price. Time decay, liquidity, and commissions work against you, so as soon as you see losses exceeding 1%, get out of the trade.

Where to take profit?

When you enter this type of position, your return should be small but constant. A good target is to get a 2% or 3% return per trade.

Pros & cons of day trading options

Day trading options are risky because time decay is making contracts lose value every day. However, there are several advantages to this activity. Let’s take a look at the main pros and cons of day trading options.

| Pros | Cons |

| Leverage When you trade options, you only need to put down the cost of the premium. But you are moving a considerably larger amount of money. The premium is just a fraction of what the underlying stock costs, but it is enough to allow you to trade at least one contract of 100 shares. This way, leverage could multiply your earnings if you use it wisely. | Time decay It is a factor that makes your profit-making riskier because it depreciates the value of the options each day. That doesn’t happen with other assets because their other assets don’t have expiration dates. |

| Low risk Contrary to other kinds of assets where leverage is a double-edged sword that can make huge profits, it could also ruin your account and leave you with debt. You don’t have that risk when you trade options since your loss is limited to the premium you paid. | It needs big appreciation to be profitable Since options depreciate by nature with time. To profit from day trading with options, the stocks need to revalue enough, so the increment can significantly impact the option contract. In that sense, the delta needs to be as close as possible. |

| Stocks at a better price You can always change your mind and exercise the option; that way, you can buy stocks at a better price than the one you could get in the market. | Low liquidity The options market doesn’t have as many offers as other markets, so it is not easy to buy or sell options. That affects your trades because you are in a race against time decay, so you need to let go of your option at the right time before time decay erases your profit. But also, low liquidity causes a greater spread between the bid and ask price, so your earnings need to be even more significant to compensate for time decay and spread losses. |

Final thoughts

Trading options is an excellent way to trade stocks without investing the same amount of money required to buy stock. It is a good choice for those who find the stock market simpler to understand but don’t have the money to invest in it. However, although the risk is generally limited to the premiums, options are losing value, so you need to be aware of the probabilities.