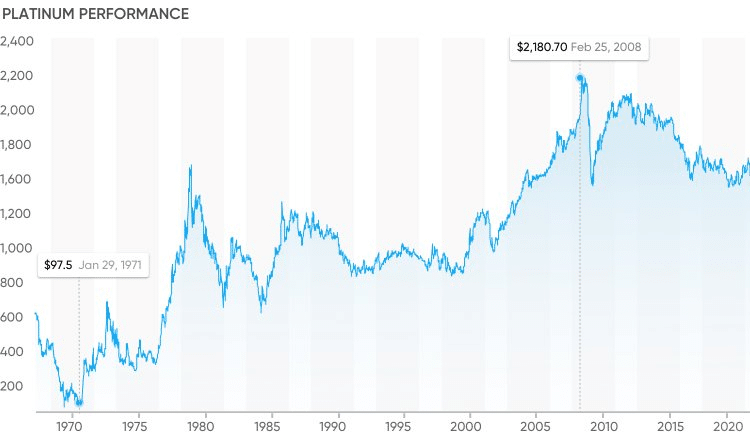

As the underlying asset, Platinum options are contracts with Platinum futures. If the holder of a Platinum option chooses to enter into a long position or short position, they do so at market prices. As a result, Platinum may be a better investment than gold.

In 2021, Platinum prices may regain some strength if gold prices continue to rise without a break. According to WPIC, production of minerals should resume in 2021 but still fall short of the average annual supply from 2015 through 2019. In addition, option expiration will occur after market close so that this opportunity will expire.

So, should we invest in Platinum? Let’s explore more about such options in this guide.

Exchanges of Platinum options

The New York Mercantile Exchange (NYMEX) offers Platinum option contracts for trading. The NYMEX Platinum option values are listed in Dollars and cents per Ounce, while the underlying futures contracts are traded in lots of 50 Troy Ounces of Platinum.

Options: puts and calls

Option types are calls and puts. Buyers of Platinum call options are optimistic about its prices. Therefore, instead of buying Platinum put options, traders who predict Platinum prices will drop may purchase Platinum call options.

Options trading is not limited to the purchase of calls or puts. Option selling is a common strategy among professional traders. By simultaneously buying and selling options, traders can develop more advanced options trading strategies known as spreads.

Platinum futures vs. Platinum options

Platinum options offer advantages over purchasing the underlying Platinum futures directly, such as extra leverage and the ability to minimize possible liabilities.

Extra leverage

As an option buyer, you are gaining additional leverage since you often pay a lower premium than required to open a position in the underlying Platinum future.

Minimize potential losses

Since Platinum options only offer the right to hold the underlying Platinum futures position, potential losses will only be limited to the option price.

Flexibility

In addition to options, futures can also be used for a range of initiatives based on individual risk assessments, investment timescales, cost concerns, and views on underlying instability.

The fundamentals of Platinum futures trading

Platinum consumers and producers can control Platinum market risks by trading Platinum futures. Using a short hedge, Platinum producers can ensure a high selling price for their products. Platinum consumers, however, can secure a purchasing price for these commodities through a long hedge.

A Platinum futures contract is purchased by investors when they anticipate Platinum will increase in price. Speculators like Platinum futures because they can profit from good price swings when Platinum is in demand. They accept the risks that hedgers avoid.

Typically, call options are not exercised to realize profits. However, an option position in the market can be closed by selling a call option in a sell-to-close transaction. If the option is still valid before expiration, any remaining value will be included in the profits from the sale.

Platinum futures hedging against rising Platinum prices

Businesses who need to buy large amounts of Platinum might take a position in the futures market to protect themselves against increasing Platinum pricing.

These businesses can use a strategy known as a long hedge to tie in a price for a supply of Platinum that they will need ahead. To execute the long hedge, the business operator must purchase enough Platinum futures to cover the value of Platinum.

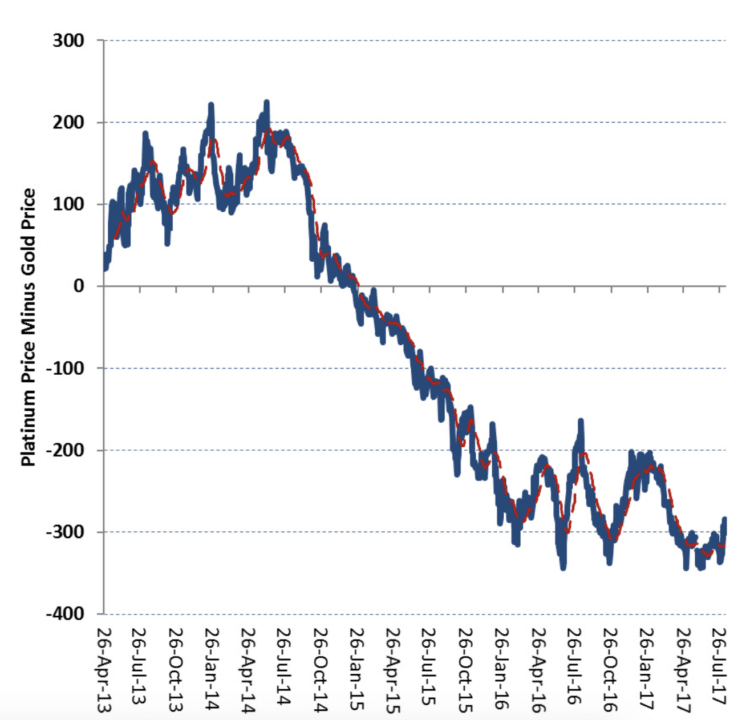

Gold vs. Platinum

“Trading in Platinum is similar to investing in any other precious metal, such as gold, silver, or copper,” said Josh Simpson, a financial advisor at Lake Advisory Group. “The distinction between Platinum and the rest is that Platinum is uncommon.” Platinum is approximately 30 times rarer than gold due to its low percentage in the Earth’s crust, according to the WPIC.

South Africa and Russia supply the largest portion of Platinum. “Because so much of the availability originates from two nations, their good governance affects the price of the metal as well,” Simpson argues. “The lower the price, the more stable their governments are.”

Due to its limited supply, there are both advantages and disadvantages of investing in Platinum. It mainly depends on what is going on globally. For example, demand for Platinum grew in the fourth quarter of 2020 as the world economy recovered from the crisis.

Meanwhile, Platinum supply has been reduced due to an operation at a key South African refinery. This led the price of Platinum to rise in the quarter while the price of gold decreased. This pattern continued into 2021 when the price of this metal rose by more than 20% while gold fell by 15%.

Platinum investing pros & cons

| Pros | Cons |

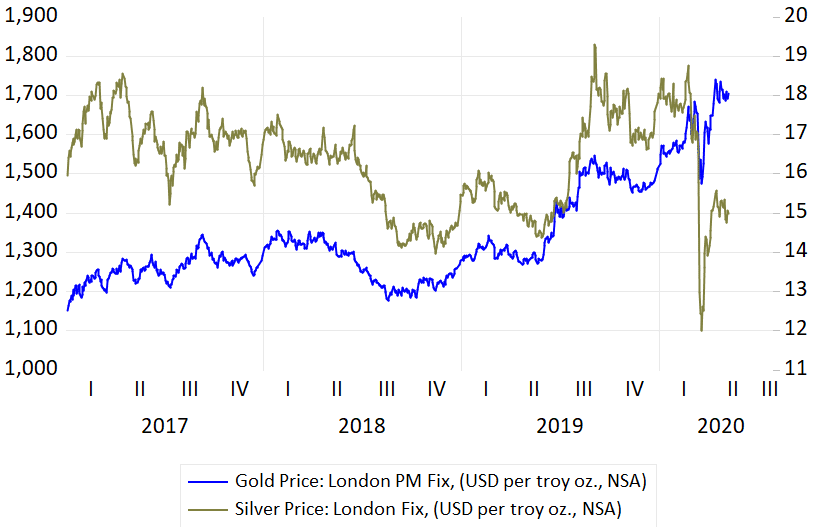

| Some believe that Platinum will be a better option soon than gold. However, silver and gold prices are rising because investors frequently flock to these two precious metals during times of economic crisis. | Investing in Platinum carries its own set of risks. Due to the capital demands, mining precious metal is costly. When nickel is mined, it is commonly found. The price is more variable and often greater than any other precious metal. However, Platinum’s rarity contributes to some of its risks. |

| Platinum prices are fairly stable as compared with gold. It means that conservative traders may go for Platinum trading with lower risk. | The huge Platinum mining activities and deposits are owned by only two countries: South Africa and Russia. This might lead to cartel formation, and given the ongoing labor problems in South Africa’s mines, this could lead to shutdowns and strikes, both of which would put upward pressure on pricing. |

A trade does not need a huge amount to start trading Platinum options. Hence, a trader can start by paying just a small premium to enjoy significant profits. | There aren’t many Platinum stocks or ETFs either. There are, however, futures and options contracts for Platinum, which involve the standard risks associated with such derivatives. |

Final thoughts

Platinum offers diversification opportunities for individual investors. Gold and Platinum are not reliable anti-cyclical metals. Sometimes it’s counter-cyclical, but sometimes it’s cyclical as well.

The Platinum mining scenario and financial indicators both play a role. The price of Platinum fluctuates since it is a commodity. Hedging against inflation or using it for speculative purposes is possible. Investing in Platinum can be done in many ways, including real Platinum, futures, and options markets.