Dynamic Pro Scalper is compatible with all MT4 brokers and uses an additional trading system that can add or remove averaging and martingale strategies. Traders can use it on MAC and windows based operating systems while enabling email and mobile notifications. To understand the product’s performance, we will review it in our article and provide a verdict on the purchase decision at the end.

Pricing

The developer provides the EA for an asking price of $129 for 1 real and 2 demo accounts. There is a 60-day money-back guarantee available.

Is the Dynamic Pro Scalper good?

Dynamic Pro Scalper uses aggressive grid and martingale strategies, which can be fatal when the market trends in one direction. Traders have to be careful while using the EA.

Features of Dynamic Pro Scalper

The algorithm has the following features:

- It is a fully automated system with money management

- The EA has a high spread protection within the EA

- It has a broker protection system in place

- The algorithm comes with lifetime support

| Trading Terminals | MT4 |

| Strategy | Martingale and Grid |

| Timeframe | N/A |

| Price | $129 |

| Money Refund | 60 day |

| Recommended Deposit | $100 |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Dynamic Pro Scalper use?

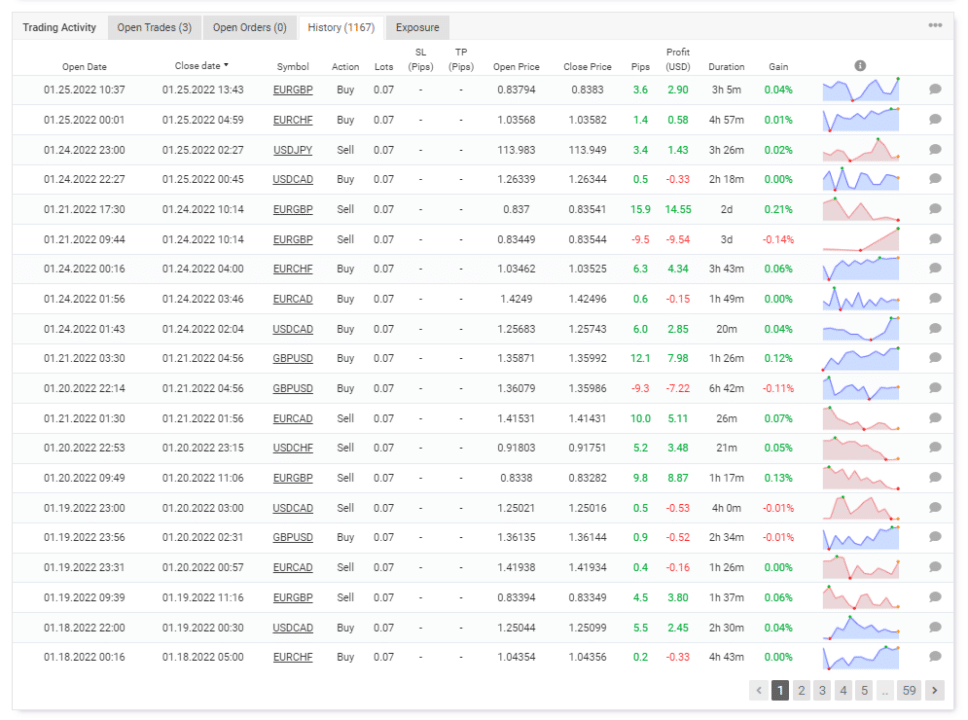

The developer states that the robot trades on multiple currency pairs and scalps the Asian markets. Traders can enable the grid and martingale system to recover their losses. From the trading history present on the live records, we can observe the use of averaging with an average trade duration of 12 hours and 38 minutes. The algorithm closes trades with a small profit of 1-10 pips in most cases.

Backtesting vs live trading results

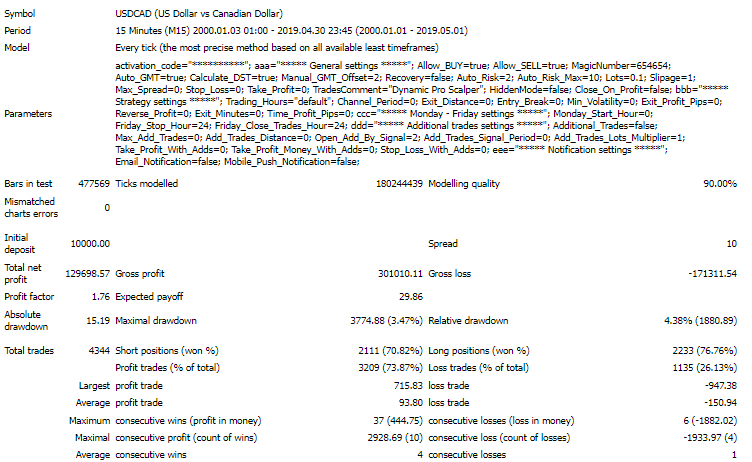

Backtesting statistics are available from 2000 until 2019, during which the robot had a maximum drawdown of 4.38% and turned $10000 amount into $129698.57. It had a winning rate of 73.87%, with a profit factor of 1.76. The average amount of profitable trades was $93.8, while losing deals were $150.94. There were a total of 4344 trades executed for this period.

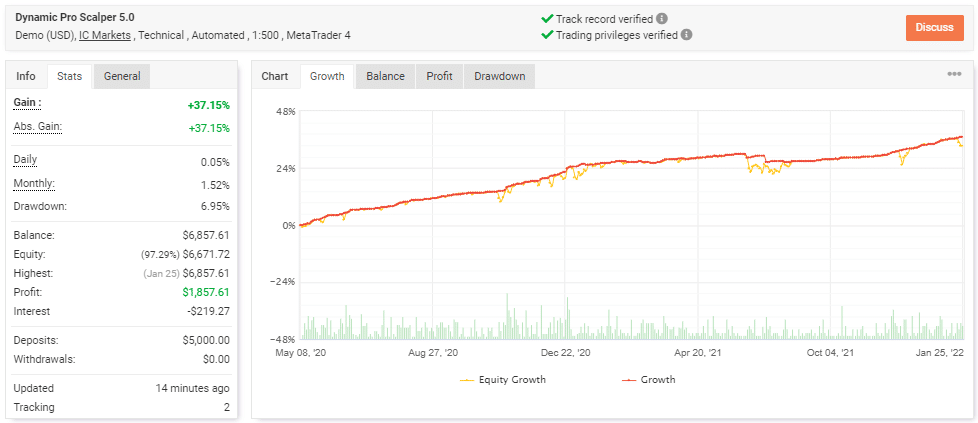

Verified trading records are available on Myfxbook. We have a performance from May 08, 2020, till the current date. The robot makes an average monthly gain of 1.52% for the duration with a drawdown value of 6.95%. This provides us with a poor risk-reward ratio of 6:1 and highlights that the robot loses $6 to make $1.

With a winning rate of 64%, the algorithm had a profit factor of 2.04. In a total of 1166 trades, the total gain was 37.15%, where the best execution turned in $64.1, and the worst was -$72.47.

The core team

The developers do not share any information regarding their trading experience in the markets. They only state that they have been in the financial industry for 12 years and have multiple members in their team.

Automated Forex Tools only have two reviews present on Forex Peace Army, which are not enough to deduce the general viewpoint of traders. An investor says that he has tried one of the systems from the company, and it has an average performance so far.