Forex Enigma is an FX robot that is designed to work on the MT4 platform. It uses multiple strategies to ensure profitability. This ATS uses an automated analytical system that can provide you with high returns without any effort on your part.

To purchase this FX EA, you need to choose from the three packages available namely, the basic, standard, and professional package. The cost ranges from $149 up to $249.

An unlimited number of demo accounts, automated trading software, free support, free upgrades, and a 30-day money-back guarantee are the features provided with the package. Real accounts are provided and the number of accounts depends on the package you choose.

Is Forex Enigma good?

From our analysis of this FX EA, we find that the system shows poor performance and a lack of vendor transparency. Although the vendor provides verified results and backtests, the MT4 tool is not worth the price due to the ineffective approach and the absence of vendor transparency.

Features of Forex Enigma

There is not much info present concerning the features, recommendations, settings, and other characteristics of this FX Robot. From the info available on the official site, here are the main features of this MT4 tool:

- The FX EA uses a programmed analytical system and an automated approach.

- This EA works 24/5 looking for profitable opportunities so you don’t miss any profitable trade.

- It can work on a single FX pair or multiple pairs and uses the H1 timeframe.

- The various innovations in the system ensure you get stable profits each month.

- Recommended deposit for this system is $1000 for the standard and $10 for the cent account.

- For the leverage, the vendor recommends leverage of 1:100 or higher.

| Trading Terminals | MT4 |

| Strategy | Scalp, Trend, and Half Grid |

| Timeframe | H1 |

| Price | $149 – $249 |

| Money Refund | 30 days |

| Recommended Deposit | $1000 |

| Recommended Leverage | 1:100 and higher |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Forex Enigma use?

As per the vendor info, this FX EA uses the scalping, trend, and half grid methods. A news filter is also present for effectiveness. The MT4 tool uses a programmed analysis along with the strategies. After you set the limits, scales, and other parameters, the system handles all the trading. There is no further explanation of the approach. We find the explanation vague which raises doubts regarding the reliability of this FX EA.

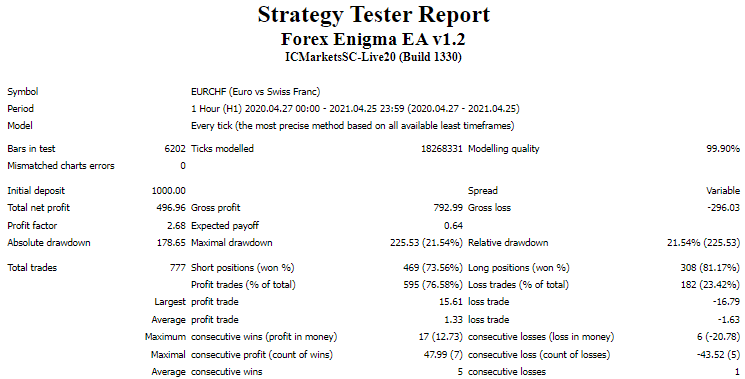

Backtesting vs live trading results

From the above report, we can see the test was done on the EURCHF pair using the one-hour timeframe from April 2020 up to April 2021. For an initial deposit of 1000, the total profit generated by the EA was 496.96 for a total of 777 trades. Profitability of 76.58% and a profit factor of 2.68 were present. The maximum drawdown for the account was 21.54%. From the results, we can see that the drawdown is high indicating a risky approach. Further, the profits are also very low.

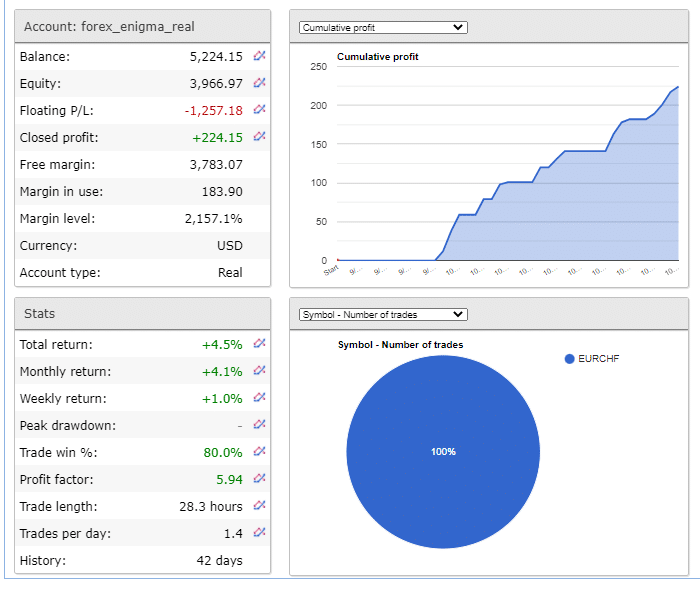

A live trading result verified by the FXBlue site is also provided by the vendor. Here is a screenshot of the result.

From the above trading stats, we find the real USD account had a total return of 4.5% and a monthly return of 4.1%. For a total of 42 trading days, the profit factor is5.94 and profitability is 80%. The closed profit for the system is $224.15.

From the results, we can see that the profits are not high indicating an ineffective strategy and poor performance. Comparing the backtesting results with real trading stats, we can see the performance is similar indicating the below-average performance of the EA.

The core team

We could not find info on the company, the developer team, their experience, location, contact details, etc. The lack of info raises a red flag for this FX EA.