FXZipper uses the scalping method for ensuring small but consistent profits. The vendor claims that this FX EA can earn up to 12 pips from each trade and the duration of the trades range from 15 minutes to a maximum of three hours. It works on 8 currency pairs and as per the vendor, the algorithm used by the system is universal enabling it to work on multiple pairs.

You can buy this FX robot for $345. The pricing includes a lifetime license for a demo or real account, user manual, regular updates, 24/7 friendly support, and compatibility with MT4 and MT5 platforms. A money-back guarantee of 30-days is present. When compared to the price of competitor systems in the market, we find this FX EA is expensive. While the vendor does not provide info on how long this EA has been on the FX market, we find the domain copyright is from 2020 to 2022. For support, an online contact form is present.

Is FXZipper good?

The vendor provides backtesting results and verified real trading stats for this FX robot. Our evaluation shows that trading can be risky with this EA due to the big lot sizes used. Further, the expensive prices and the lack of user reviews are downsides we noticed in this system.

Features of FXZipper

Some of the main features that the vendor focuses on for this ATS are:

- It uses a reliable scalping approach.

- Unique technologies are used by the system to ensure stable profits.

- Real live verified results are present.

- The FX robot is broker-friendly and not a toxic scalper.

- Universal algorithms in it enable it to work on multiple currency pairs.

- AUDUSD, USDCAD, AUDCAD, GBPCAD, GBPUSD, GBPAUD, EURCAD, and EURCHF are the currency pairs this FX EA works on.

| Trading Terminals | MT4, MT5 |

| Strategy | Scalping |

| Timeframe | M15 to H3 |

| Price | $345 |

| Money Refund | 30 days |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does FXZipper use?

This ATS uses the scalping approach. As per the vendor, the scalping method helps the EA to earn small profits consistently. It keeps orders open and closes them only in profit. It also has a feature where it opens a trade only when there is an opportunity to earn maximum profit and it deliberately misses a trade with low profit.

Backtesting vs live trading results

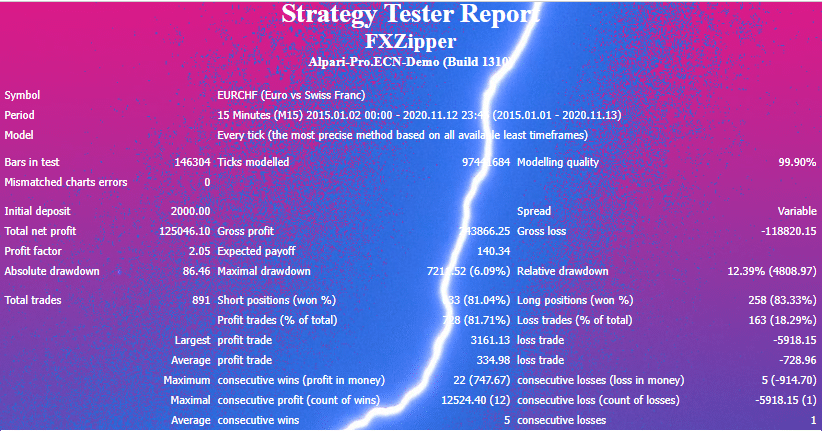

A few backtesting results are present for this FX robot. Here is one of the backtesting reports:

From the above report, we can see the backtesting was done on the EURCHF pair using the M15 timeframe from 2015 to 2020. For an initial deposit of 2000, the total net profit of 125046 was generated from a total of 891 trades. A profit factor of 2.05 and profitability of 81.71% was present. The maximal drawdown was 6.09%. From the results, we can see that the profits were high and the drawdown was low indicating an effective strategy.

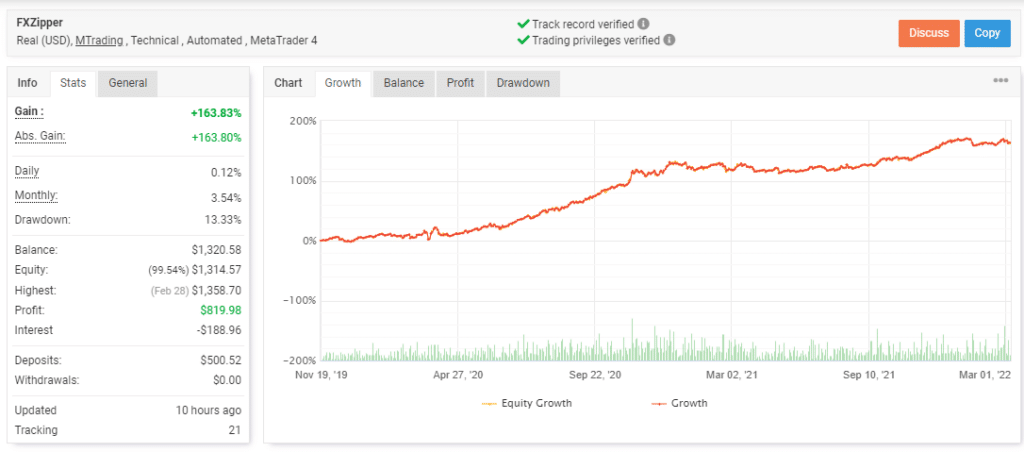

The vendor also provides a real-live trading result verified by the myfxbook site. Here are screenshots of the trading stats.

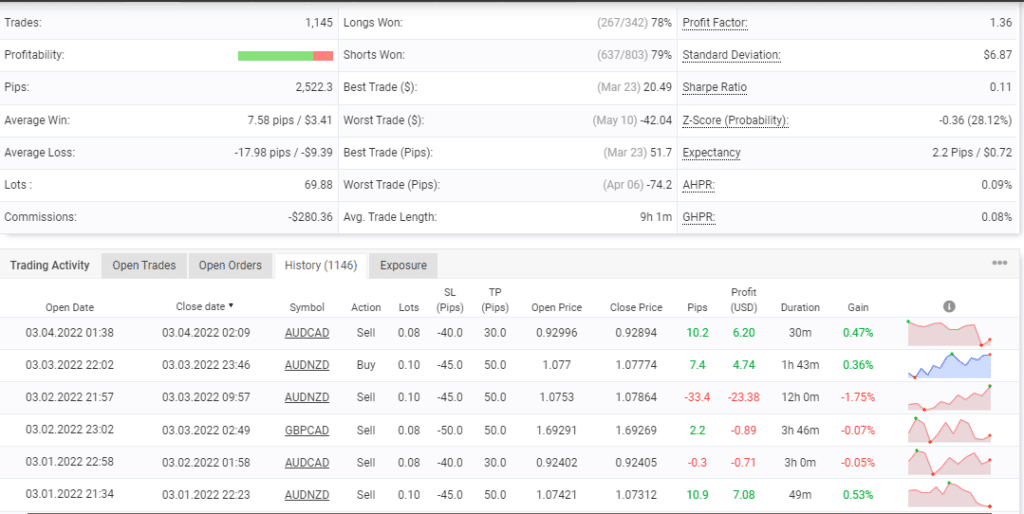

From the above stats, we can see the real USD account using automated trading on the MT4 platform was started in November 2019. A total profit of 163.83% and an absolute profit of a similar value were present for the account. The daily and monthly profits are 0.12% and 3.54% respectively. A drawdown of 13.33% is present. For a deposit of $500, the account has generated a profit of $819.98. We can see from the growth curve that the account has steadily increased. A total of 1145 trades have been executed with 79% profitability and a profit factor of 1.36. Lot sizes ranging from 0.02 to 0.13 are seen indicating risky money management. Comparing the backtesting result with real trading results we find the effective approach seen in the backtesting is not present in real trading stats.

The core team

We could not find details of the company like its founding year, location, team member info, phone number, etc. The vendor does not provide company info on the official site.