Kapola Trader EA promises successful trading without any losses. The vendor claims that this winning FX robot is fully automated to generate consistent monthly profits. This ATS is a set-and-forget system that does not require constant monitoring. It works on five major currency pairs and uses indicators and market price info for profitable and safe orders.

To purchase this expert advisor, you need to select from the three available packages namely Bronze ($99), Silver ($149), and Gold ($249). Features included in the packages are lifetime access, 24/7 support, free updates, and 1/2/4 real and demo MT4 licenses based on the chosen package. A 30-day money-back guarantee is present.

Is Kapola Trader EA good?

The vendor claims that the FX EA can generate money easily by identifying profitable orders adeptly. Our evaluation of the various aspects of the ATS reveals that while the system has verified trading results, it indicates a high drawdown and big lot sizes that signify a high-risk approach. Further, the system lacks vendor transparency.

Features of Kapola Trader EA

Some of the key features of this FX robot that makes it stand apart from its competitors as per the vendor are:

- It is simple and easy to set up. You need to download and run the software without any complicated processes or functions.

- The FX robot uses advanced methods to ensure winning trades while handling risks smartly resulting in minimal losses.

- It can generate steady returns on autopilot without the requirement to monitor it continuously.

- It works on the EURUSD, NZDUSD, USDJPY, AUDUSD, and GBPUSD pairs.

- The FX EA uses the 15-minute timeframe.

| Trading Terminals | MT4 |

| Strategy | Bollinger Bands |

| Timeframe | M15 |

| Price | $99, $149, $249 |

| Money Refund | 30 days |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Kapola Trader EA use?

As per the vendor, the FX EA uses the Bollinger Bands Profit approach. The approach involves the use of Bollinger Bands to find the winning entries. It also evaluates the existing market price info for identifying accurate entries that result in maximum profits. For exits, the FX robot uses moving average and CCI indicators. It also uses a trailing stop for securing profits.

Backtesting vs live trading results

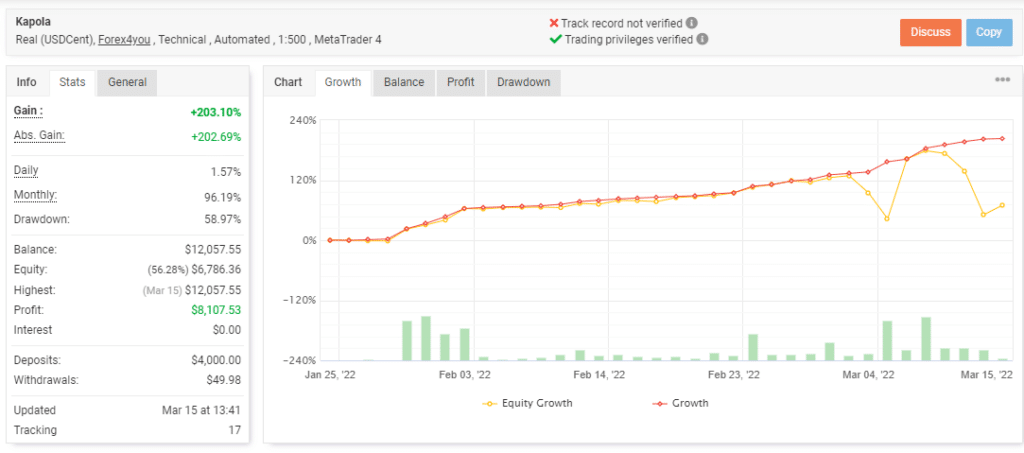

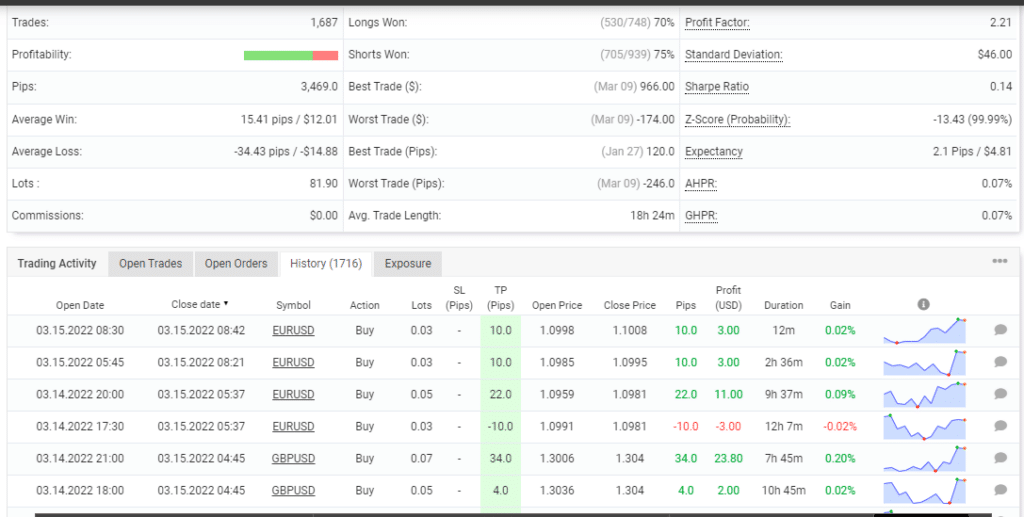

No backtesting results are present for the FX EA. However, the vendor provides a real USD Cent account that has verified trading privileges by the myfxbook site and an unverified track record. Here are screenshots of the account:

From the above stats, we can see that a total profit of 203.14% is generated for an initial deposit of $4000. For the account that started on January 25, 2022, the daily profit is 1.57% and the monthly profit is 96.19%. From the growth curve, we can see the profits have increased at a fast rate. However, due to the small sample size, the results are random and cannot predict a similar future performance.

A drawdown of 58.97% is present which is very high denoting a risky approach. A total of 1,687 trades have been executed with 73% profitability and a profit factor of 2.21. The lot size ranges from 0.03 to 0.05. We find the frequency of trades is very high and the big lot size indicates a risky approach. The big drawdown and high profits for the small sample size denote a random result that cannot be used to predict the effectiveness of the system.

The core team

Other than the website domain showing 2022 registration, there are no details of the vendor present on the official site. We could not find details of the company, its founding year, developer team, location address, phone number, etc. Support is via an online contact form.