Ohlsen Trading is a trading solution that provides signals from their master accounts. We’d like to note that service has been existing from April 2021. This means nothing special. The presentation includes a few explanations about how this service can be used. So, we decided to take a closer look at them.

There’s a free package available that includes up to 12% monthly profits, signals 24/5, automatic trading, we are allowed to work on demo accounts, no hidden fees. The paid one costs $30 monthly. We can receive the same and a permission to work on real accounts. There is no refund policy applied.

Is Ohlsen Trading good?

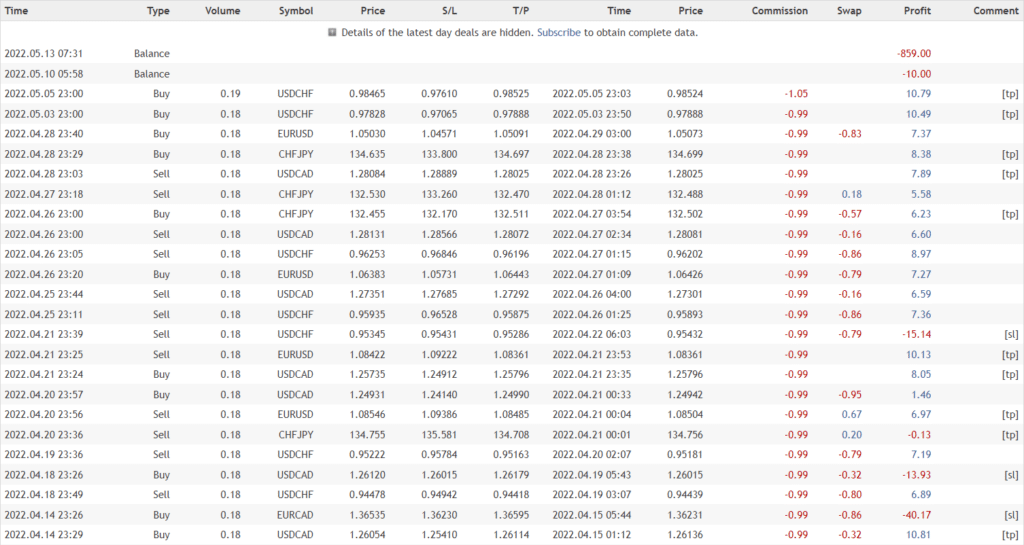

Trading results show that the system doesn’t work stable. For 6 months of trading activity the system could generate only 136 EUR of profit.

Features of Ohlsen Trading

Let’s talk about features and other details that are explained in the presentation. For your comfort, we systemized them into the following list:

- We have all available information split in four short blocks of information: Extraordinary Results, a 30-day Trial, No Work Required, and Great Pricing.

- We should use the signals on the brokers like: IC Markets, Pepperstone, Dukascopy, Vantage, and Tickmill.

- The system prefers working at night.

- It works based on the technical indicator data received from a terminal.

- An average win is 6 pips when an average loss is 85 pips.

- The stop loss decreases by a number of pips every five minutes. In this way, the robot minimizes the risk of having a large stop-loss.

- The robot requires it to be used on a VPS service.

- It can self update automatically to perform better.

- During the high impact news it trades with halved lot sizes.

- We have to trade with a 0.1 lot on $1000 accounts.

- The previous default risks were 0.06 per $1000.

- It doesn’t work with JPY-pairs either.

- That’s all about the system and what we have to expect.

| Trading Terminals | N/A |

| Strategy | N/A |

| Timeframe | N/A |

| Price | $30 |

| Money Refund | N/A |

| Recommended Deposit | $1000 |

| Recommended Leverage | N/A |

| Money Management | N/A |

| Customer Reviews | Yes |

What strategy does Ohlsen Trading use?

- We don’t know details about strategies.

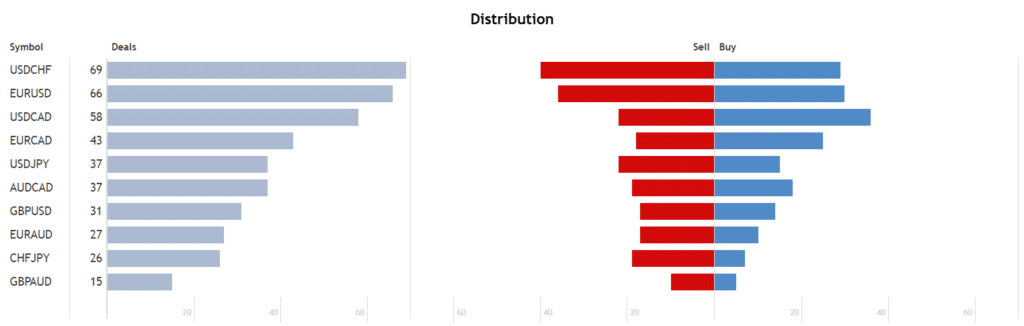

- The system work with EURCAD, EURUSD, USDCHF, and USDCAD.

- The time frames aren’t mentioned.

Backtesting vs live trading results

We have no backtest reports provided in the presentation. It’s a con because we neither details about its trading strategies but also how well they were tested on the real tick data before being released.

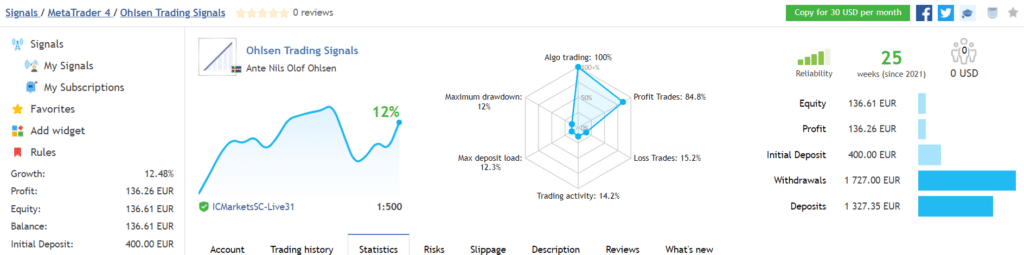

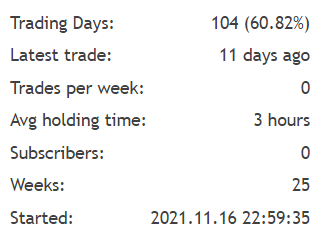

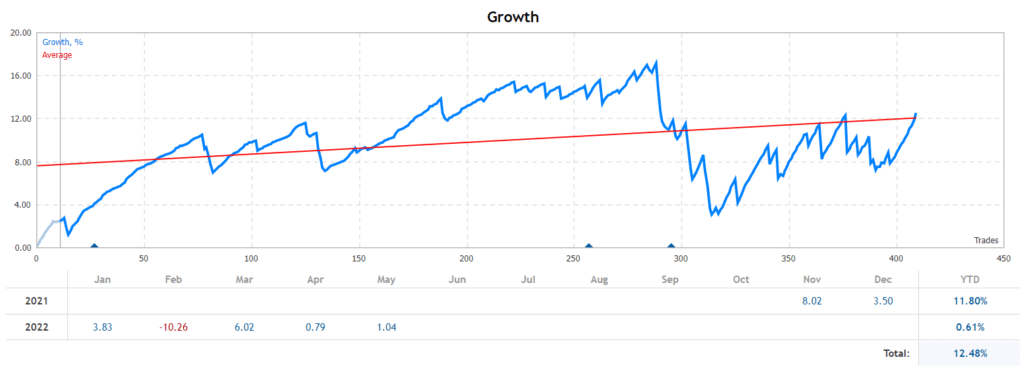

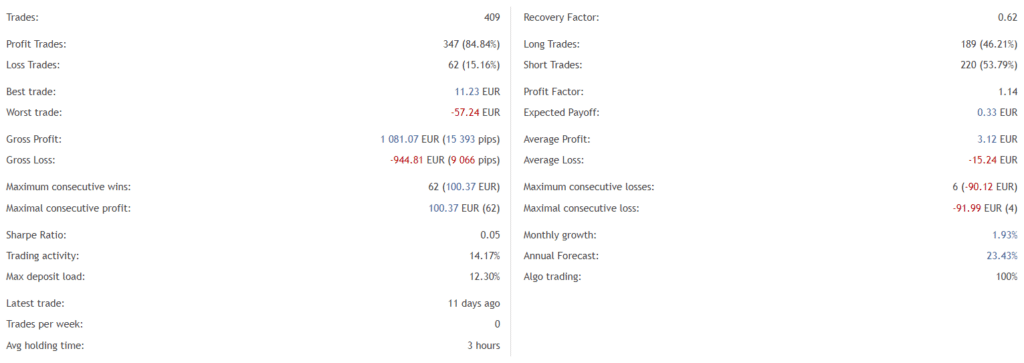

The developers deliver signals through the MQL5 functionality. The system works on an IC Markets real account with 1:500 leverage. The maximal drawdown is 12% when the maximum deposit load is 12.3%.The win rate is 84.8%. It manages a 400 EUR account where there’s 12.58% gain generated.

An average trade frequency is low. The system keeps orders on the market for three hours.

The robot can’t grow consistently and predictable.

The last order was closed two weeks ago and the account was withdrawn.

The robot closed 409 deals. The best trade is 11.23 EUR when the worst trade is -57.24 EUR. It has a low recovery factor (0.62) and low profit factor (1.14) too. An expected monthly growth is 1.93%.

The most traded pair is USDCHF with 69 deals closed.

The core team

Ohlsentrading runs a profile on Trustpilot. There are only two reviews published that formed a 3.8/5 rate.

We can’t be sure that these reviews are from real clients because they haven’t written any testimonials on Trustpilot before.