The Fund Trader promises to earn high-yield returns for traders using 18 different currency pairs, Gold included. As per the vendor, the EA also refrains from using dangerous strategies like martingale, grid, or hedging. This serves to reduce trading risks and losses. The system has been around for 5+ years now, and is currently available at $297 if paid quarterly or $597 annually.

Is The Fund Trader Pro good?

The EA comes with some interesting features, including recommendations, free updates, a refund policy, etc. Still, its price is high and may trade dangerously in the live market, putting your investment at an increased risk of loss.

Features of The Fund Trader

| Trading Terminals | MT4 |

| Strategy | Technical and fundamental analyses, Semi-automated/multi-phase software |

| Timeframe | N/A |

| Price | $297/quarterly or $597/year |

| Money Refund | 30 days |

| Recommended Deposit | $500 |

| Recommended Leverage | N/A |

| Money management | N/A |

| Customer reviews | N/A |

Some of the other features of the EA are listed below:

- It provides customer support and free updates.

- The system includes good recommendations.

- It is fully automated and easy to use.

What strategy does The Fund Trader use?

This EA is claimed to implement a dualistic approach to the markets. It begins by evaluating the technical and fundamental levels of every supported currency pair in the market. The goal is to ascertain the direction of trades and suitable entry points. After completing the first process, proprietary, semi-automated/multi-phase software is employed to monitor and apply a predefined exit for every order. An average trade can last between 5 and 24 hours.

Backtesting vs live trading results

There are no backtest results to show us how the system behaves on historical data. It is possible that the developer didn’t backtest his strategy before launching it to the market.

Lucky for us, live trading statistics are available on Myfxbook. Let’s see the outcomes it generates here:

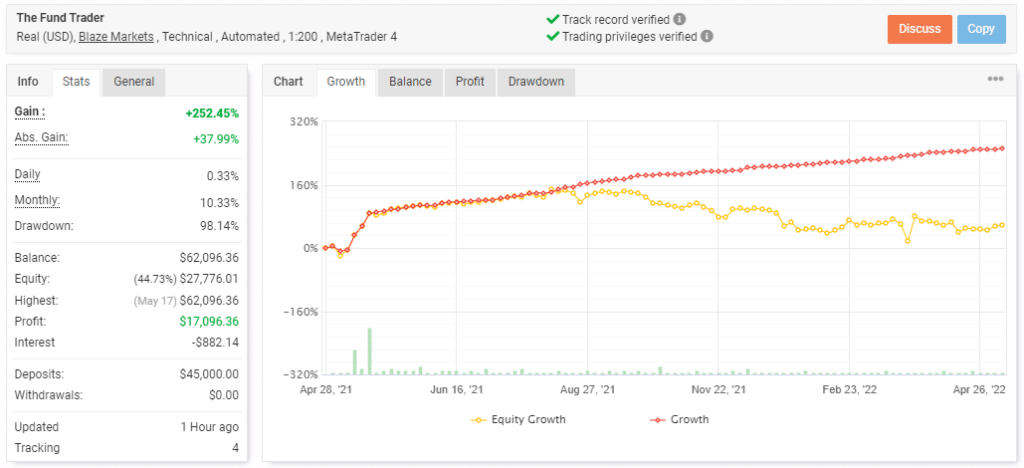

At the moment, The Fund Trader is managing a real USD account on Myfxbook. It started off with a balance of $45000, which has grown to $62096.36 following the $17096.36 profit made by the EA. The daily and monthly profits are 0.33% and 10.33%, respectively. Trading risks are very high as 98.14% of the capital has been decimated.

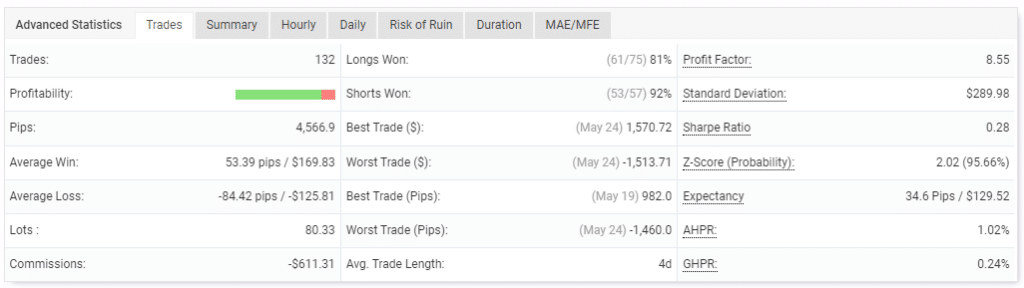

The system has conducted 132 trades in the 1+ year it has traded live. Clearly, it doesn’t place orders regularly. As such, it can hold a position for up to 4 days. The success rates for the long (81%) and the short (92%) positions are quite good, and so is the profit factor of 8.55. However, the average win (53.39 pips) is lesser than the average loss (-84.42 pips).

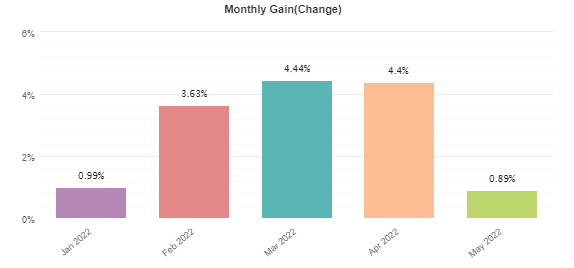

March and April had the highest profitability rates.

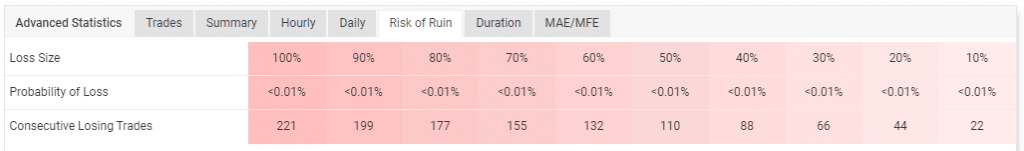

The account is still safe from being wiped out.

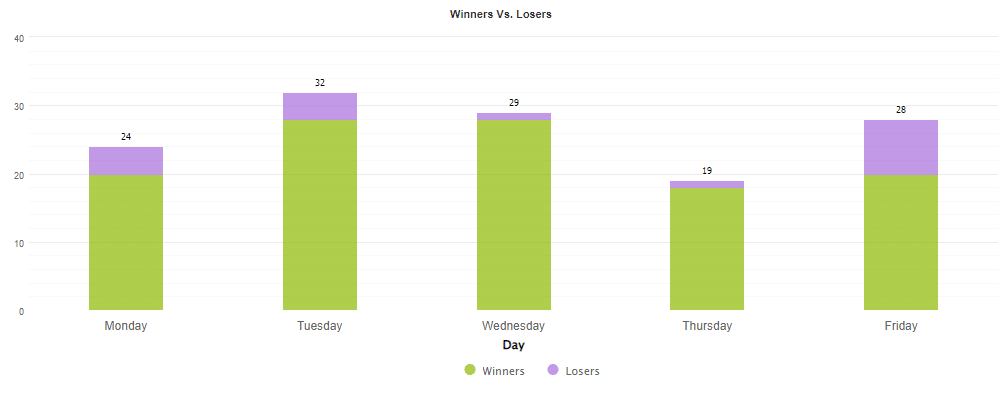

Tuesday and Wednesday are among the busiest periods of the week.

The core team

The Fund Trader was developed by Gordon Francis. He is a full-time trader and an employee at the LeapFX Company, which has also produced EAs like DynaScalp, Funnel Trader, Stealth Trader, Automic Trader, etc. Mr. Gordon was formerly employed by a Forex proprietary firm based in London. He claims to have made the firm millions of dollars before leaving.