Cryptocurrency is passing on another year by attracting more investors and traders, making the total crypto market worth $2.27T.

This year we have seen many new projects and advancements in technology in the crypto space. We saw Facebook changing its name to Metaverse as the rise of web3.0 and tokens like Sibhu Inu had seen enormous growth in a short period.

After all these, you must be hearing about Crypto Winter arriving soon. Do you want to know what it is and is what to Do During Crypto Winter?

If yes, read this article and know it all before it arrives.

Crypto Winter: what does it mean?

Unlike the name suggests, Crypto Winter has nothing to do with any winter or any climate season for that matter. It is a hot but not a new market tradition; it is just what crypto investors call a possible market crash before the end of 2021. One of the examples can be the price downfall that happens in summer 2021.

Crypto Winter is a market phase when the prices of almost all cryptocurrencies fall down strongly below a usual bullish movement. The whole crypto market sees a drastic downfall and then be in that state for a long time.

The market then goes into a downtrend followed by a sideways movement before there is a breakout, and the market again slowly goes up.

Crypto Winters during 2013-2020

December 2013: dip -50%

2013 December was not a good phase for all cryptos, especially Bitcoin. The market lost almost 50% of its value overnight because China banned Bitcoin at the end of that year. Till today, China’s relationship with crypto is on the dark side, and the country continues to pressure new restrictions.

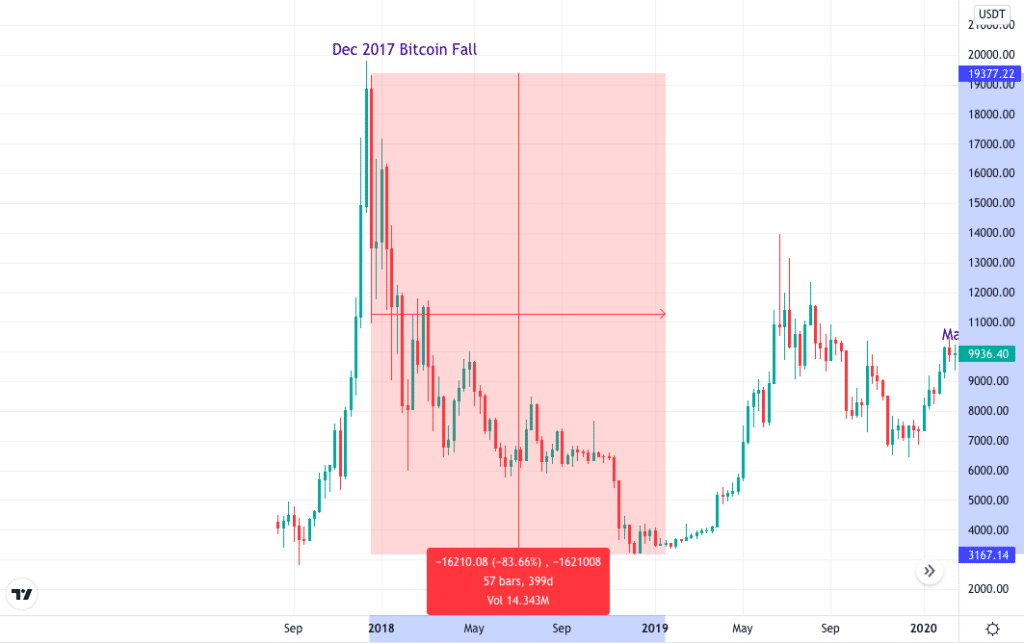

December 2017-December 2018: -84%

2017 is still considered the most deadly time of crypto. Early in 2017, Bitcoin broke all the records and went near $20,000. But then, on Dec. 27, it shredded half of the up move and came crashing and landed below $12,000. In 2018, there were major hacks in Korea and Japan and rumors traveling like the fire of countries planning to ban Bitcoin.

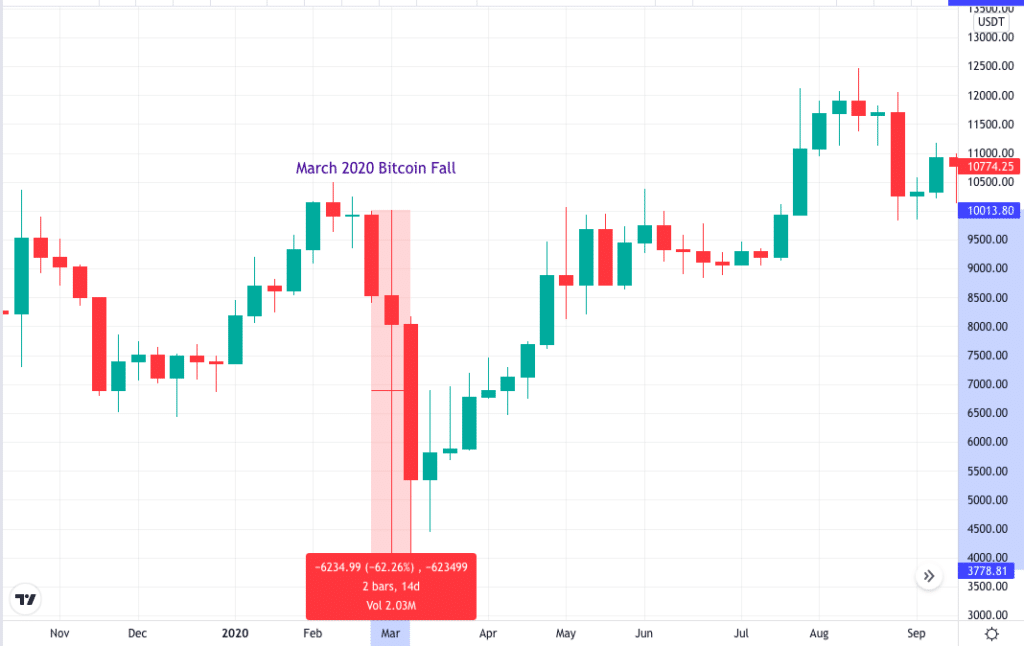

March 2020: -50%

Covid-19 seemed to be never-ending and the pandemic affected every single industry. The market crashed in march 2020, and even Bitcoin did not go safe and crashed, shredding half of its value in two days. Over a month, it fell from above $10,000 in February to below $4,000 in March.

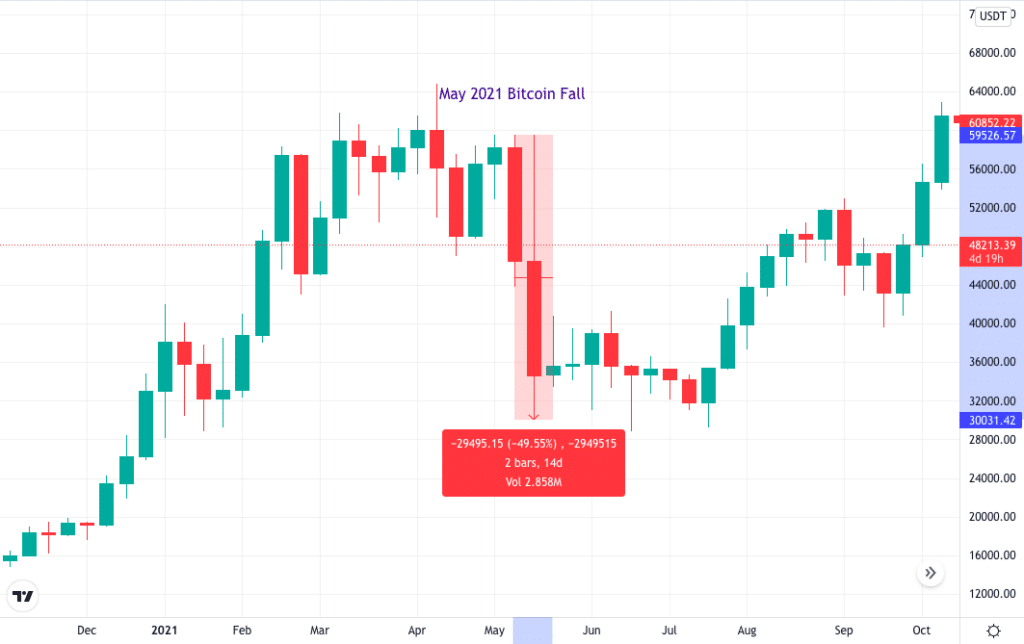

May 2021: -53%

Bitcoin in mid-2021 showed a significant rise in its value and sat at $64,000. Then, in a flash, $1 trillion in value was wiped off the global crypto market in a single week. The richest man, Elon Musk, shared his vision of accepting Bitcoin as a payment mode, followed by China again putting hurdles in the crypto industry and talking about Bitcoin mining not being allowed.

Has the Crypto Winter 2022 arrived?

There are many discussions and debates in the crypto community about if the Crypto Winter is here and how much worse it could be. Still, there is a lot of clarity needed to conclude if this Crypto Winter would be like 2018, where the price of Bitcoin fell by about 65 percent during the month from Jan. 6 to Feb. 6, 2018. Other cryptocurrencies also saw a massive cut in their price.

Jason Deane, an analyst at Quantum Economics, says it does not seem a beginning of the so-called Crypto Winter. Still, reactions to the various decisions taken around the whole crypto-verse and these patterns will correct themselves over time.

On the other hand, Quantum Economics founder and portfolio manager. Mati Greenspan said there wouldn’t be any crypto downfall because there is a lot of utility, adoption, and diversification in 2021 compared to the 2018 market phase. Also, the market move and big bulls are more vital than they used to be in 2018.

What to do during a Crypto Winter?

As with any other financial market, the crypto market also works on the law of supply and demand and a few push and pull factors, i.e., the value increases when the demand increases and vice-versa. Few of the other

Few true crypto investors choose their cryptos by believing in the technology by looking into their underlying solutions. They go through a bunch of work like reading the white papers, understanding the technology and fundamentals, the purpose, and the tokenomics with its use case.

Investors who believe they have done their research and invested in the right coin can hold them long-term and use the dip to accumulate more coins in their portfolio. This will lead to averaging the cost if bought at the higher prices earlier.

Those who have invested in certain coins at a much lower price can come out of the market after a considerable profit to play safe and wait for new investment opportunities in the crypto market.

Best coins and tokens for holding during Crypto Winter

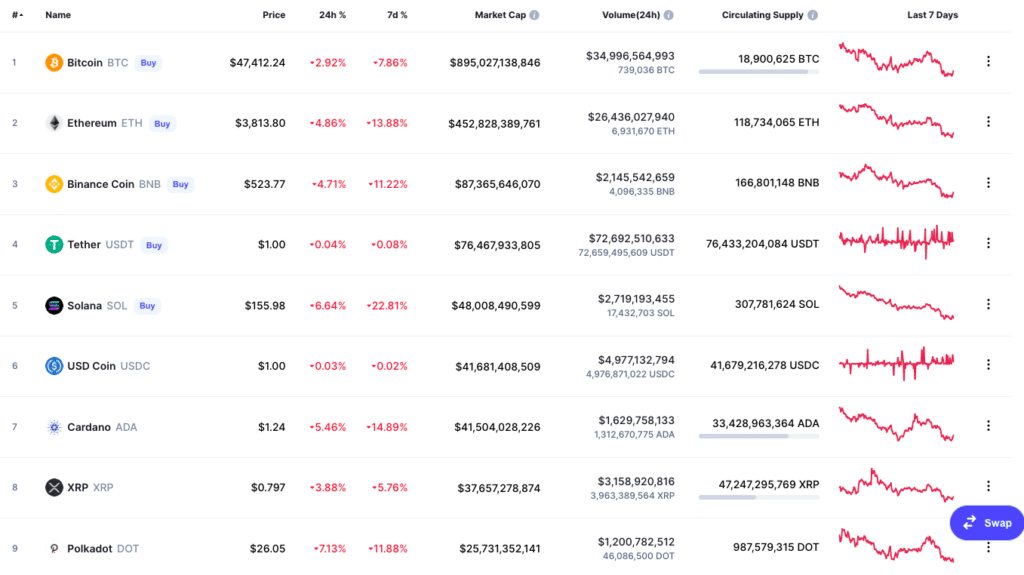

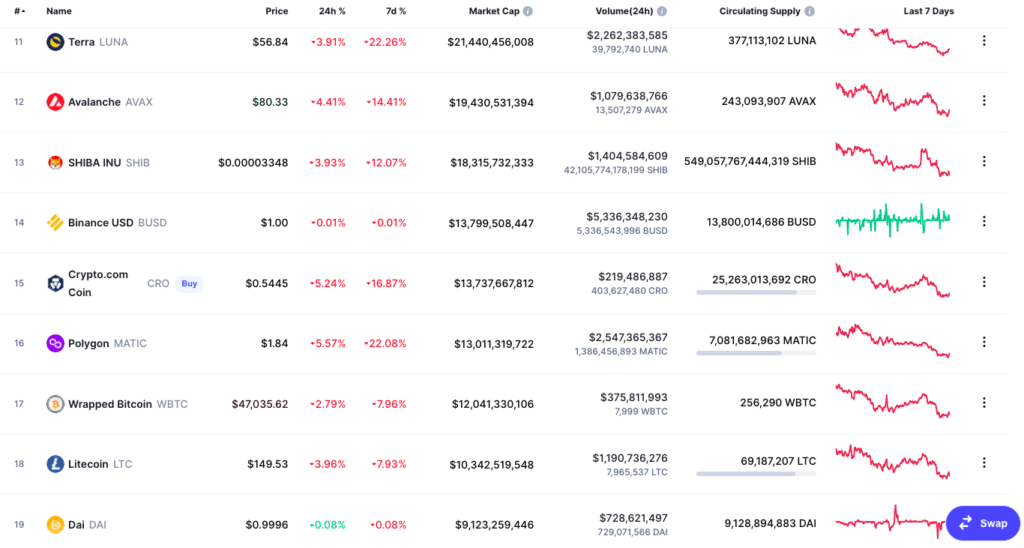

There is no single name to this question, as the answer needs a lot of studies and research. But a good place to start is the top 20 most-traded cryptocurrencies. Most traded crypto simply shows that people are holding them and have something that is worth holding and trading.

It can be easy even for you to decide on some notable coins from these top 20 lists that would survive in the crash if it happens.

Talking about BTC, it is the first cryptocurrency and dominates the crypto market by 42%. It is fast emerging as a store of value. Ethereum, on the other hand, gave the decentralized world the platform to carry out Dapp and smart contract processes. It also supports third-party NFT platform developers.

Binance Coin weights its exchange behind it, while Solana is becoming integral to the DeFi sector. Avalanche is the latest blockchain emerging and gives several gaming and metaverse projects opportunities. MANA is native to Decentraland’s Metaverse games; Monero is accepted as payment on the darknet.

Terra’s LUNA manages its stable coins, Uniswap and Polygon make new kinds of transactions possible, and so on.

Crypto Winter end

Those with low-risk tolerance may find that now is a wise time to devote more time towards learning about the coins they have in their portfolio. That would help identify what would yield slim profits, what is expected to dip further, and for instance, whether now is the right time to buy more of Bitcoin, which is approaching its next halving.

By the time Crypto Winter hits and ends, the market will start rising, and you will be able to average the amount in your portfolio if you buy those real use-case coins when the market crashes.