XFXea is an FX Robot that claims to provide regular profits irrespective of market fluctuation. As per the vendor, this FX EA is designed with special algorithms and calculations that ensure no loss period. This automated system does not use dangerous methods like Martingale to ensure minimal risk is present. To purchase this expert advisor, you need to pay $260. The price includes a lifetime license, two supported pairs, a user guide, an MT4 and MT5 version, free updates, and 24/7 support. A 30-day money-back guarantee is present for the FX robot.

Is XFXea good?

The vendor provides verified trading results and backtests for this FX EA. While the claims of regular profits look appealing, a closer look at the trading stats reveals a risky approach. Further, there is a lack of vendor transparency which makes us suspicious of the reliability of this product. While the EA is not overpriced, the drawbacks make it not worth the price.

Features of XFXea

There is very little info provided on the official site. The info on the strategy, features, trading stats, etc. are found on the home page. From the details present, here are the features of this FX robot:

- The automated system works on the AUDUSD and the EURUSD pairs.

- It trades regularly and ensures successful trading without any long periods of loss.

- The FX robot does not use the Martingale method, which is considered a high-risk approach.

- Live trading stats verified by the myfxbook site are present for this FX EA.

| Trading Terminals | MT4, MT5 |

| Strategy | Range-based |

| Timeframe | H1 |

| Price | $260 |

| Money Refund | 30 days |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does XFXea use?

The vendor provides a vague explanation of the approach used by this FX EA. Special transaction algorithms and calculations used by the system ensure there are no loss periods. In the case of losses, the ATS covers the losses with its special algorithm. It evaluates a specific number of bars for entry point assessment and forms a range using which it decides on the entries. We find the explanation is insufficient and does not disclose the info on the strategy.

Backtesting vs live trading results

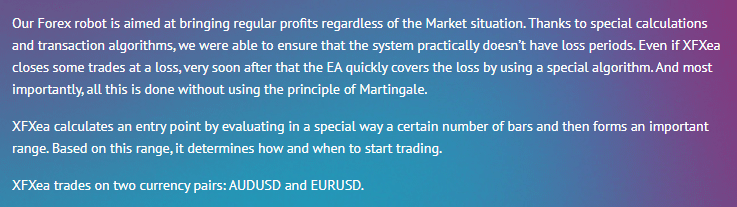

Backtests are present for this FX EA on the official site. Here is a backtesting report for the AUDUSD pair that shows stats for the testing done from 2014 up to 2019.

From the above report, we can see a total net profit of 86748970 was generated for an initial deposit of $5000. For a total of 974 trades, the maximal drawdown for the account was sky-high – 59.89%. Profitability of 68.89% and a profit factor of 2.06 were present for the account. From the high drawdown value, it is clear that the system used a risky approach.

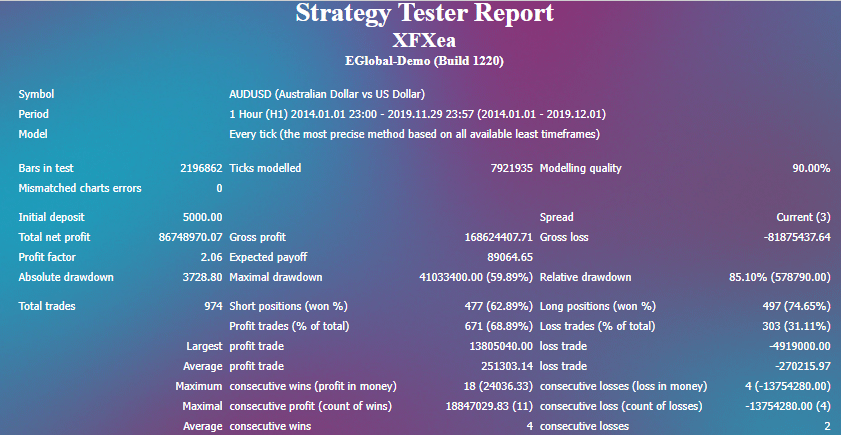

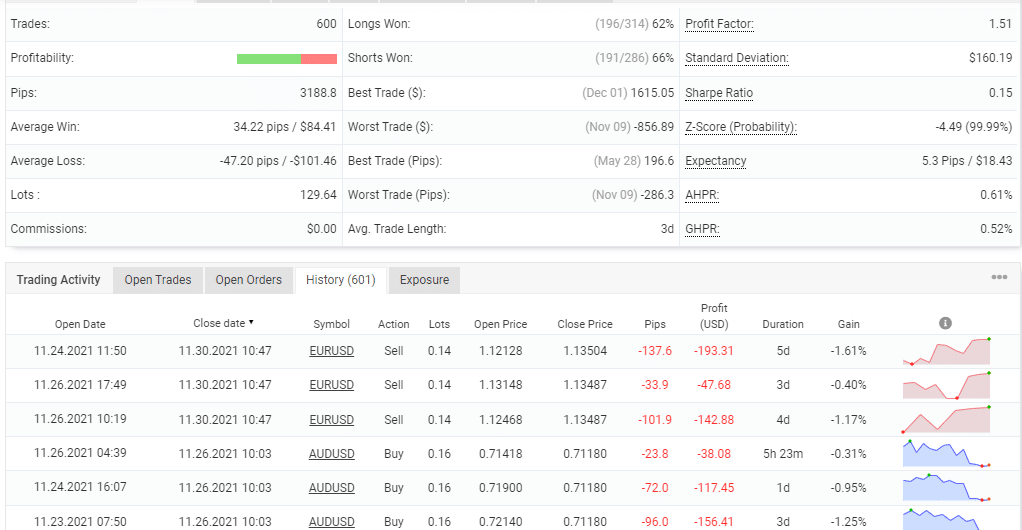

Real trading results verified by the Myfxbook site are present for this FX EA. Here is a real USD Cent account trading under the Robot Forex broker on the MT4 platform.

From the trading stats, we find that the total returns of the system are 2213.62% and an absolute profit of 1531.73%. The difference between the two values indicates a risky approach and poor performance. Other stats include a daily profit of 0.27 and a monthly profit of 8.39%. A drawdown of 53.37% is present.

For the account that started in September 2018, a total of 600 trades have been executed with a profitability of 64% and a profit factor of 1.51%. From the trading history, we can see varying lot sizes are used ranging from 0.14 up to 0.36. The big and unfixed lot sizes, the high drawdown, and the difference between the absolute and total returns indicate a high-risk approach. Moreover, we would like to see a better accuracy rate of at least 80% or above.

The core team

Other than the mention of the website being powered by the Forex Store group, we could not find info on the vendor. Details like the founding year, developer team, their expertise and experience, location address, and phone number are not present. The absence of vendor info raises a red flag for this EA.