Aeron uses a combination of strategies to ensure maximum returns and minimum risk. This MT4 tool works on five currency pairs mainly and claims to make high profits from volatile and stable market conditions. You can purchase this FX robot for $230 which is applicable for the first 50 copies sold by the vendor. All subsequent copies will be available at $349. We could not find a money-back guarantee for the system which makes us doubt its reliability. While the vendor does not provide info on the year of the launch of the system, the website domain shows copyright registration is from 2016.

Is Aeron (Scalper+Grid) good?

In this review, we have analyzed various aspects of this FX robot including its approach, performance, and other characteristics. The vendor provides a real live account verified by the FXBlue site. From the stats, we find that the system is showing a huge loss. Further, there are no backtests present which makes it difficult to evaluate the strategy. While the price is on par with the market average, the lack of a refund makes us doubt its dependability.

Features of Aeron (Scalper+Grid)

Important features of this FX robot that make it competitive as per the vendor are:

- It works on the EURUSD, CADJPY, EURJPY, USDJPY, and AUDCAD currency pairs.

- The M1 timeframe is recommended by the vendor.

- This ATS executes 5 to 10 trades per day and the frequency depends on the broker and the spread value.

- It uses TP and SL for each position.

- The FX EA uses equity risk management allowing you to choose the risk percentage.

We could not find info on the recommended deposit to use for this FX EA. For the leverage, the vendor recommends the use of any leverage.

| Trading Terminals | MT4 |

| Strategy | Scalper, Grid |

| Timeframe | M1 |

| Price | $230 |

| Money Refund | N/A |

| Recommended Deposit | N/A |

| Recommended Leverage | Any |

| Money Management | Yes |

| Customer Reviews | Bad (2 out of 5 ratings based on 11 reviews on FPA) |

What strategy does Aeron use?

The scalping and grid methods are used by this FX EA. While the former uses frequent trades of short-term duration earning small profits for each order, the latter uses sideways and trending conditions. With the grid method, the EA uses hedging and placing buy and sell orders alternately.

As per the vendor, the system can generate maximum and consistent profits with low risk through the combined strategies. Since the scalping method is a short-term strategy, it requires constant attention, which is taken care of by the automation provided by the software. Further, the EA will automatically use the Grid method if the other strategy fails.

Backtesting vs live trading results

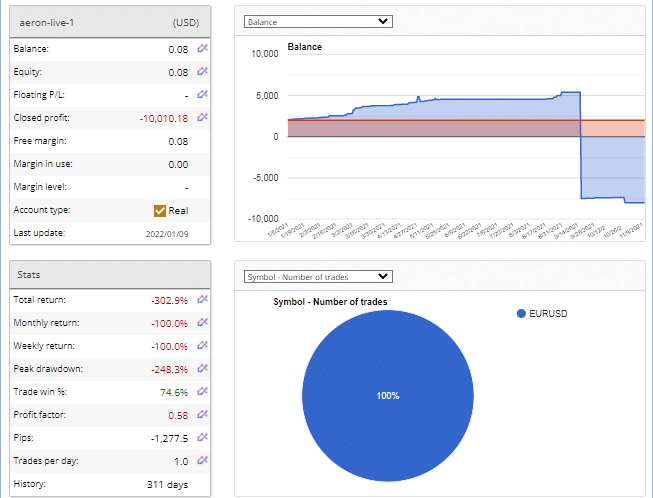

No backtesting results are present for the system. Although the strategy is explained by the vendor, the presence of backtests helps to know the approach and its efficacy. The lack of results makes it difficult to do a thorough evaluation. However, the vendor provides a live real USD account verified by the FXBlue site. Here is a screenshot of the trading result:

From the above stats, we can see the account has generated a loss of -302.9%. The weekly and monthly losses are -100% each. A peak drawdown of -248,3% is present. Profitability is 74.6% and the profit factor is 0.58. From the results, we can see that the account is performing poorly.

The core team

We could not find info about the company, the developer team, their location, and contact details. For support, the vendor provides an online contact form and an FAQ section. There are no other methods like live chat, phone number, etc. available for support. The absence of company details shows a lack of vendor transparency.