The Forex market is a dynamic environment where there are new developments occurring on a frequent basis. There are so many factors influencing trading opportunities that it can be a huge challenge for the human mind to keep track of it all. For this reason, traders often take the help of expert advisors. To help you make informed decisions, we have listed some high-performance robots in today’s article.

Best Forex EAs that are worth paying for:

1. TechBerry

TechBerry offers over 10% gains/month with the ability to compound your profits over time. Subscribers can test out the platform through a free trial or choose one of the plans that start at $19. There are no risks while trading with TechBerry, as all the losses are absorbed with the help of FIDC-insured banks.

The social trading platform has a win rate of nearly 100%, which is made possible by collecting data from over 100K accounts and formulating a strategy.

| Pros | Cons |

|---|---|

| High win rate | Analyses MT4/MT5 accounts only |

| A risk-free social trading platform | No insight on trading strategies |

| Full transparency on live records | |

| Flexible subscription plans |

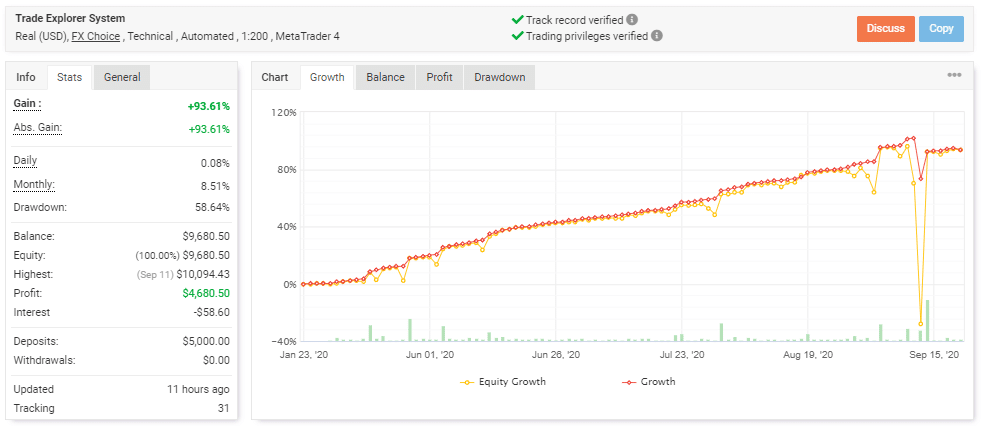

2. Trade Explorer

Trade Explorer trades on 27 different currency pairs with full automation and comes with multiple live records. The robot aims to generate passive income for traders by using dynamic trade management to maintain the risk-reward ratios.

From the live statistics, we can observe the use of a risky approach as the drawdown hangs at 58.64%, but EA manages to get out of it quickly. Traders can expect a total gain of 50% over a yearly or 8% each month.

| Pros | Cons |

|---|---|

| Beginner-friendly | No backtesting records |

| It comes with multiple live records | |

| 30 day money back guarantee |

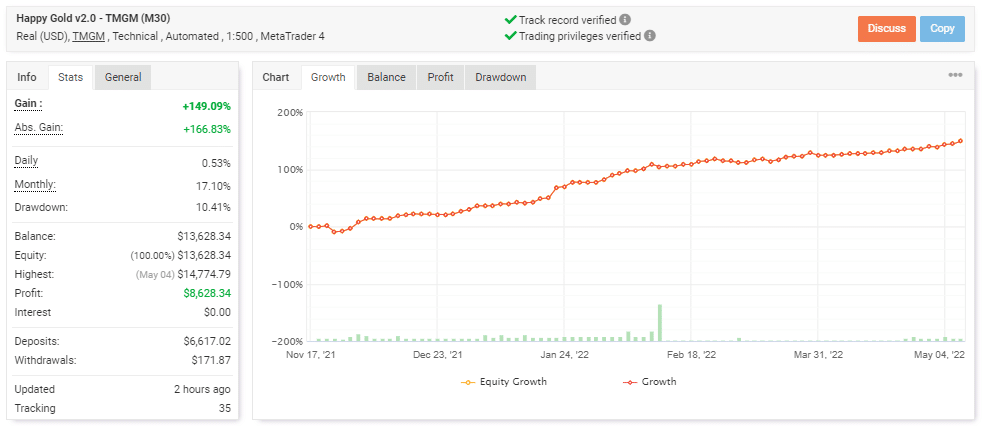

3. Happy Forex EAs Pack

Happy Forex offers a pack of 10 trading algorithms. Each follows a different trading strategy and comes with support for ECN brokers. The developers try and maintain transparency on both backtesting and live records. All the algorithms are fully automated and come with an exe executable file that automatically installs the EA on your MT4 platform.

Since November 17, 2021, the happy gold robot has sustained a monthly growth of 17.1%, with a drawdown of 10.41%. It had a decent win rate of 72% with a profit factor of 3.88.

| Pros | Cons |

|---|---|

| High win rate | Lack of vendor transparency |

| Multiple algorithms available with a single purchase | |

| Transparency on live and backtesting stats |

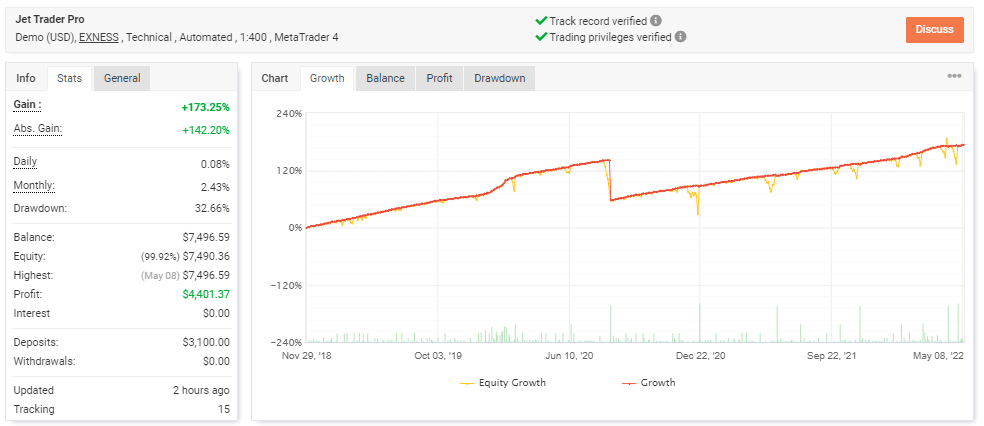

4. Jet Trader Pro

Jet Trader Pro is available for $697 that offers a lifetime license. The purchase comes with a 30-day money-back guarantee for peace of mind. The developers provide lifetime updates and hands-on support to help set up the system.

The live account shows that the system operates on a demo portfolio which does not include the effects of real market liquidity and slippage. The EA generates a total of 173.25%, with a drawdown of 32.66%.

| Pros | Cons |

|---|---|

| Good overall gain | A bit costly |

| Full support from the developer | |

| Does not require any manual configuration |

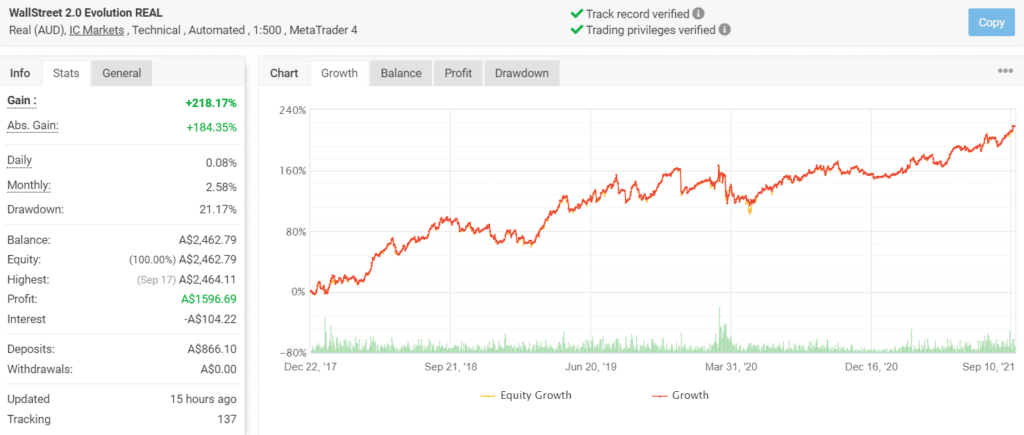

5. Forex Flex EA

Forex Flex is an NFA and FIFO compatible system with advanced features like currency filters, session filters, time filters, and hedging. It uses 12 different strategies involving indicators like EMA crosses, TDI, Bollinger Bands, ADR, Stochastic, RSI, and Momentum.

From the live statistics, we can tell that the robot takes a safe approach since the drawdown is quite low at 7.29%. This trading account has a healthy win rate of 66% and a high-profit factor of 2.48. The monthly gain of 7.16% is higher than most EAs.

| Pros | Cons |

|---|---|

| Low drawdown | Lack of vendor transparency |

| Multiple filters | |

| 12 different strategies |

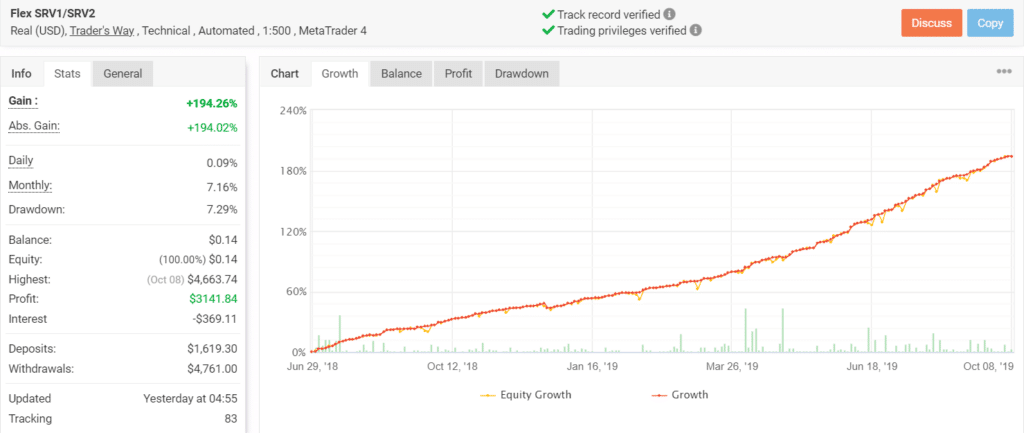

6. GPS Forex Robot

Built by experienced professionals, GPS Forex Robot allows you to start trading for as little as $250. It is available for just $149 and comes with a 60-day money-back guarantee. It uses a reversal strategy for trading the Forex market.

The live account for this robot has an incredible win rate of 94% even after placing 367 trades in total. It has a low drawdown of 5.54%, indicating a low risk of loss.

| Pros | Cons |

|---|---|

| Low drawdown | Lack of vendor transparency |

| 60-day money-back guarantee | |

| Affordable price |

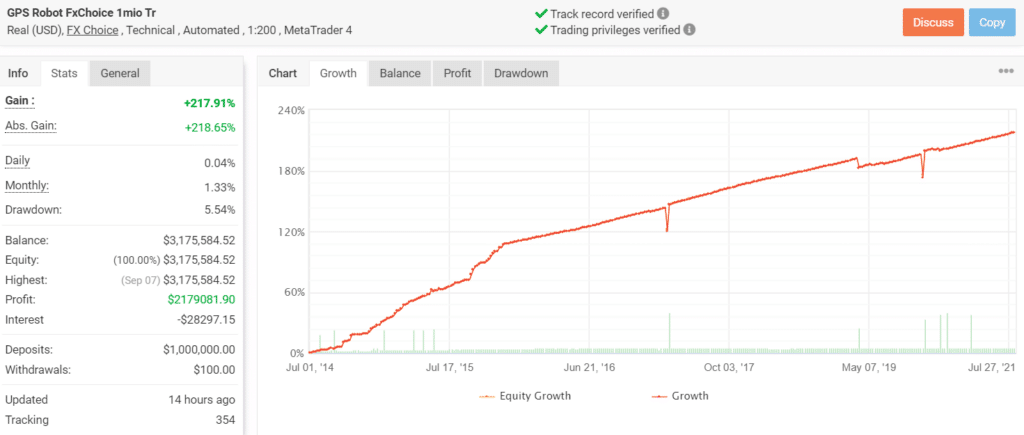

7. Wallstreet Forex Robot

This robot from the FXautomater team is compatible with multiple currency pairs. It has an efficient risk management feature and a broker protection system that prevents unscrupulous brokers from cheating you with negative slippage. The drawdown compensating algorithm prevents the account drawdown from going too high.

Since December 22, 2017, the robot has generated a total profit of A$1596.69 through this account. It has a high hit rate of 79% and a drawdown of 21.17%, which can be considered moderate.

| Pros | Cons |

|---|---|

| High win rate | Lack of strategy insight |

| Trades in 7 currency pairs | |

| Low minimum deposit of $100 |

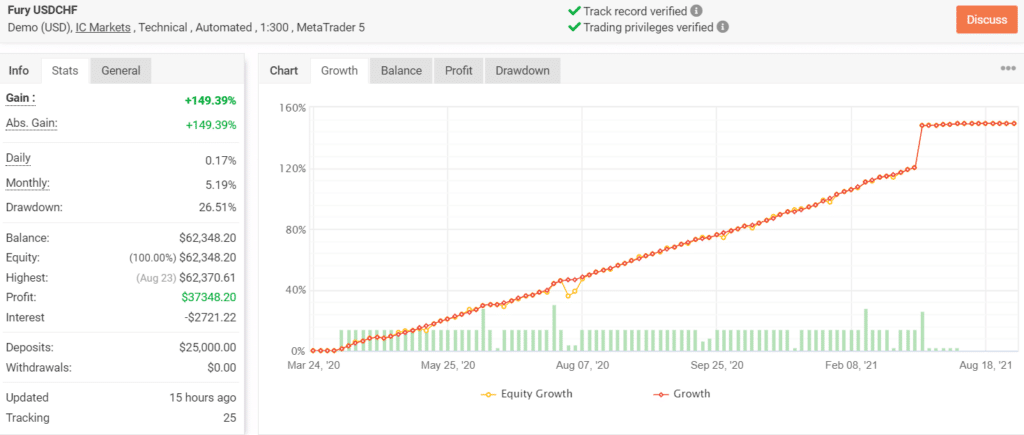

8. Forex Fury

Forex Fury has a money management functionality that allows for automatic calculation of the trading lots. It can operate on three different risk levels and trades in low-volatility markets using a range trading system.

This trading account has a win rate of 98%, which is quite remarkable. After placing 614 trades, it has generated a total profit of $37348.20. The drawdown of 26.51% is not too low, but it shouldn’t be an issue considering the high win rate.

| Pros | Cons |

|---|---|

| Money management | Lack of proper backtesting data |

| High profitability | |

| Long trading history |

9. Forex Steam

This robot uses steam retrace technology for securing wins and limiting losses. It has an advanced holiday filter and a spread filter that allows you to perfectly time your market entry. By purchasing the EA, you get access to 4 licenses. Unfortunately, this EA doesn’t have verified trading results on FXStat, FXBlue, or Myfxbook.

| Pros | Cons |

|---|---|

| 4 licenses | Lack of verified trading results |

| Money-management | |

| Available for only $117.99 |

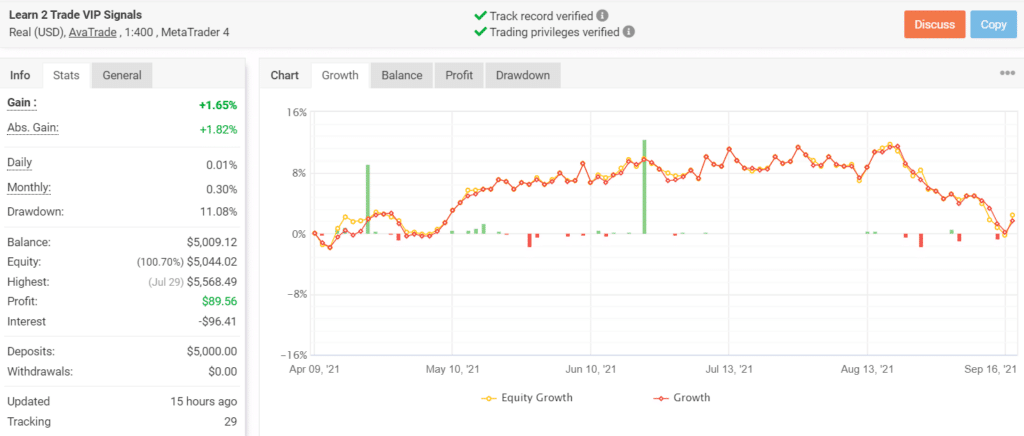

10. Learn 2 Trade

This is a Forex signal provider with a large community consisting of 15,000 traders. It sends 4-5 accurate signals every day based on 60 different oscillators. There are multiple affordable pricing plans for this service.

For this account, the system has a moderate win rate of 50%. Since it was launched recently, it is difficult to gauge the profitability accurately. The low drawdown of 11.08% tells us that it does not use a high-risk approach.

| Pros | Cons |

|---|---|

| Transparent vendor | Short trading history |

| Multiple pricing plans | |

| Signal analysis available |

What is an expert advisor?

Expert advisors are computer programs that automatically place trades in your stead. Since the Forex market remains active 24/7, it can be difficult to trade at all times manually. People with day jobs cannot possibly sit in front of a screen all day to monitor trading occasions. That is where EAs or robots come into the picture.

These systems use algorithms to analyze market patterns and track the price of different pairs. They work on the basis of instructions coded into them and notify you when there is a lucrative opportunity. You can pre-program them open and close trades based on certain conditions.

- Best Forex EAs that are worth paying for:

- What is an expert advisor?

- How can we use Forex EA?

- How do Forex expert advisors work?

- What are the pros and cons of Forex robots?

- What are the types of Forex EAs?

- How to start trading with expert advisors?

- Things to consider when choosing a Forex robot

- Do Forex robots really work?

- Best Forex Robots Verdict

How can we use Forex EA?

Before you use an EA for placing trades, you ought to test its performance using a demo account. No matter how impressive the trading performance of a robot is, it may not suit your trading style. Some robots work well for certain pairs while failing to generate profits for others. This is why it is vital to practice using virtual money in the beginning.

After purchasing a robot, you should attach it to a chart of a compatible timeframe. You can program certain systems to only trade during specific times to avoid high volatility periods.

How do Forex expert advisors work?

One of the principal functions of EAs is to automate the trading strategy. The developer codes the strategy into the system using the MLQ4 language. They create some “true and false” conditions based on which the robot makes its decisions. This way, it can decide when to initiate and exit trades.

Since the computational ability of EAs is much higher in comparison to human traders, they can run the most complex trading schemes with considerable ease. You can also instruct the EA to track specific pairs and to send you notifications when there are trading opportunities that fulfill your requirements.

What are the pros and cons of Forex robots?

Just because they automate the process doesn’t mean EAs can make you rich overnight. It is important to know the pros and cons of these systems before investing in them.

Forex EAs: Pros

Let’s look at the advantages of Forex robots:

Allows for disciplined trading

Traders often tend to make emotional decisions that lead to disastrous consequences. With robots, there is no chance of emotions influencing your decisions.

Executes trades faster

To capitalize on trading opportunities, you need to be proactive with your execution. You can spot trading occasions swiftly with the help of robots.

It saves time for traders

Often it is not possible to spend the entire day tracking the market. With EAs, you can reduce screen time.

Easier to perform historical tests

It is vital to test a trading strategy with archival data to know about the different performance factors. Robots can perform backtesting within a few minutes.

Forex EAs: Cons

The cons of Forex EAs are as follows:

Lack of information

Many vendors don’t reveal the technical details of their systems. When market conditions change, such systems can be ineffective.

Over-optimization

Some systems have impressive backtesting results due to over-optimization. However, they can fail in the live market.

Restricted to one pair

While some systems trade in several pairs, the majority of them deal in a specific pair. This enhances your exposure to market risk.

Technical faults are prevalent

Your trading might get affected when there is an internet issue or a power outage. Thus, you need to track the system regularly to make sure it’s working properly. Alternatively, you can use the VPS service to always keep your EA online.

What are the types of Forex EAs?

Here are some of the different types of robots available on the market:

- EUR/USD EAs: Since EUR/USD is a highly volatile pair, most traders find it easy to make profits off it. Every day around one-fourth of all Forex trades consist of this pair. This is why you will find several systems that are optimized for EUR/USD only.

- Moving Average EAs: Moving Averages are one of the best indicators for locating trading profit-making opportunities. You can use MA robots for analyzing trends and for smoothing the rapid price shifts for certain pairs.

- News Trading EAs: When financial institutions make major announcements, there are drastic changes in the value of pairs. News trading robots track such news and let you know how your trading strategy will be impacted.

- Scalping EAs: These robots try to take advantage of the minor differentials between pairs. They usually place several trades each day, generating small profits for each.

How to start trading with expert advisors?

If you wish to use an automated system for trading Forex, you have a couple of alternatives. Either you can buy a robot from a reputed vendor or program one yourself. For the latter, you need to be knowledgeable in MQL4. Building a robot also requires market knowledge and adequate trading experience.

Of course, many traders don’t possess such technical expertise, and they simply buy or rent a robot from a seller. There are hundreds of such systems available today, along with their live performance statistics. Prior to buying them, you can test these systems out with a demo account.

How to install Forex EAs?

Follow these steps for installing a robot:

Step 1

First, you need to develop your own robot or purchase it from a vendor. Then you should save it on your computer.

Step 2

Next, open your Metatrader trading platform and navigate to the Experts folder. Copy the robot file into this folder. You might need administrator rights for doing this.

Step 3

Run the Metatrader program and access the EA section located on the left side of your screen. Open a chart for a particular time frame and add the EA to it by dragging and dropping.

Step 4

At the end of step 3, you will receive a pop-up on our screen where your EA settings will be listed. You can modify the settings to suit your trading style. Once you are sure the alerts and settings are proper, you can proceed and start trading.

Things to consider when choosing a Forex robot

Here are a few things to consider before purchasing a robot:

- Verified statistics: A reliable EA must be supported by live results verified by third-party websites.

- Backtests: Every vendor must test their trading systems using archival data to see whether the system can deal with different market conditions.

- Strategy insight: The vendor must clearly explain the trading strategy used by the system. This helps you decide whether the robot is suitable for your trading style.

- Price: You should avoid systems that are overpriced and are not protected via refund policies.

- Vendor transparency: There should be adequate information about the vendor selling the robot.

Do Forex robots really work?

Yes, Forex robots work according to the instructions coded into them. Developers test these systems with archival data to see how the trading system would perform in a live trading scenario. These tests do not guarantee gains, however, and even the best robots can perform poorly if the market is unfavorable. The profitability of the robot thus depends on the logic they have been set up with.

Best Forex Robots Verdict

While all of the systems mentioned above have gotten rave reviews from traders worldwide, you have to decide which one would best suit your trading style. It is important to gather the maximum possible information about the robot before investing in it. Forex trading comes with its fair share of risks, so you should always purchase a system that has a long track record of profitable performance in the live market. It would be a good idea to test the robot on a demo account first to get a general idea of how it works.