Best FX Networks boasts to be an expert advisor with positive dynamics. The successful orders of the robot outnumber unprofitable entries. As per the vendor, this is a 100% automated system that can be easily set up. To buy this EA, you need to choose from the three packages present: Business ($129), Standard ($149), and Premium ($169). Common features in the packages include automated trading, free upgrades, support, and a lifelong license. The packages differ in the number of demo and real accounts they offer. Although the robot was developed in 2020, it was launched in 2021 after it was tested using backtests and forward testing.

Is Best FX Networks good?

The vendor provides verified results and backtests for the FX EA. While the price is not expensive when compared to the market average, there is no money-back guarantee. Further, from real trading stats, we can see the system uses a high-risk approach.

Features of Best FX Networks

Some of the key features that make this FX EA stand apart from its competitors are:

- It uses easy setting parameters and an inbuilt magic number.

- You need not disconnect the EA during the release of important news events.

- It does not use the scalping or averaging methods.

- It can work with all types of brokers and supports ECN, Micro, Cent, and STP accounts.

- The FX EA uses automatic risk adjustment.

- As per the vendor, the FX robot uses special algorithms for entries and exits.

| Trading Terminals | MT4 |

| Strategy | Fundamental and technical analysis |

| Timeframe | N/A |

| Price | $129-$169 |

| Money Refund | N/A |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does Best FX Networks use?

According to the vendor, this system does not use scalping or averaging methods. Instead, it uses a neural network based-technical analysis. It blends different trading strategies to form a comprehensive system that works with the help of neural network technology. The vendor states that the neural system is beneficial as it helps the EA to continue learning by comparing the predictions with the data fed to it continuously by the neural network. Further, the technology also blends technical and fundamental info enabling the robot to find new patterns and apply them to elicit accurate results.

Backtesting vs live trading results

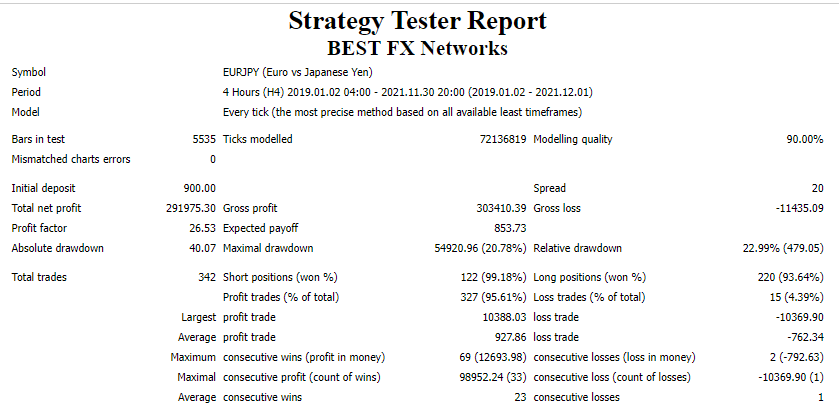

A backtesting report is present for this FX EA with the test done on the EURJPY pair using the H4 timeframe. The backtest executed from 2019 to 2021 uses a modeling quality of 90%. For an initial deposit of 900, a total net profit of 291975.30 was generated. For a total of 342 trades, the profitability was 95.61% and the profit factor was 26.53. The maximum drawdown was 20.78%. From the results, we can see the profits are high and drawdown is low indicating good performance and low risk. However, backtesting results cannot predict a similar performance in real trading results.

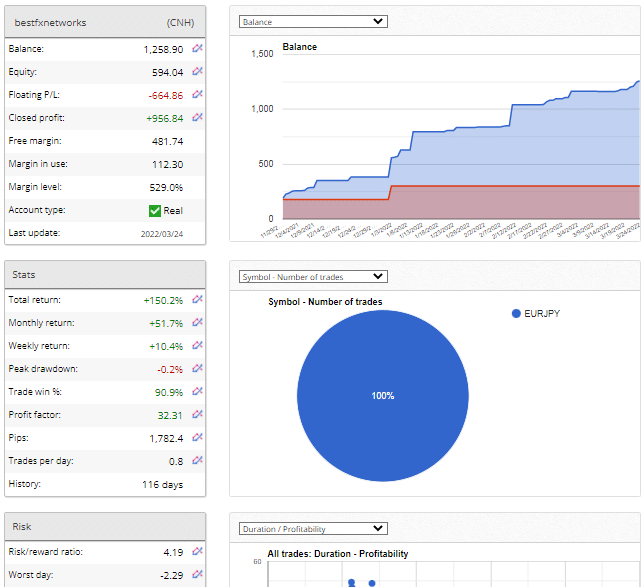

The vendor provides a real CNH account started in November 2021 with an initial deposit of 180. A total return of 150.2% is present. The monthly and weekly returns are 51.7% and 10.4% respectively. Profitability is 90.9% and the profit factor is 32.31. A risk to reward ratio of 4.19 is present. From the results, we can see the profits are high but the high risk/reward ratio indicates a high risk is present. Further, the sample size is small so it is difficult to evaluate the performance. Comparing the backtesting stats with real trading, we find profits are high in both results, but the risk is higher in real trading.

The core team

Other than mentioning that the company comprises a team of traders and software developers, we could not find further details. There is no info on the founding year, the location address, the experience of developers and their expertise, and other relevant info.