BF Scalper Pro is an expert advisor that uses an advanced exit logic for limiting the drawdown and boosting system efficiency. As per the vendor, this is an improved version of the BF-Scalper EA. This FX EA works on multiple currency pairs and uses an ATR-based SL calculating algorithm. You can buy this ATS for $117. The package includes one real account and 3 demo accounts. A 60-day money-back guarantee is present for the account.

Is BF Scalper Pro good?

As per the vendor, this FX EA uses reasonable TP and SL settings and promises a low drawdown. But from the risky strategy and the absence of vendor transparency that this system reveals, we find the product is not worth the money.

Features of BF Scalper Pro

According to the vendor, the key features found in this system that give it a competitive edge are:

- Use of simple trading logic with reasonable SL and TP settings in addition to an algorithm that is ATR-based.

- Use of advanced news and volatility filters.

- Protection from a high spread, slippage, and broker.

- An improved exit logic.

The vendor recommends the use of the M15 timeframe. We could not find info on the leverage, minimum deposit, etc. The main currency pairs the system works on are USDCHF, EURUSD, GBPUSD, EURAUD, EURCHF, EURCAD, GBPCAD, USDCAD, and USDJPY. However, the default settings are mainly for the GBPUSD pair. As per the vendor the FX EA works on brokers using 4 or 5-digit quotes.

| Trading Terminals | MT4, MT5 |

| Strategy | Scalper + Martingale + Grid Combo |

| Timeframe | M15 |

| Price | $117 |

| Money Refund | 60 days |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

| Customer Reviews | N/A |

What strategy does BF Scalper Pro use?

According to the vendor, the newer version of the EA uses the Grid system for ensuring higher profits and to make it less dependent on broker conditions. However, the grid method is an optional one and can be used separately or with the Martingale method for aggressive trading. The use of the Grid and Martingale methods makes the approach risky. But the vendor claims that this EA uses a low-risk approach with its ATR-based SL calculating algorithm.

Backtesting vs live trading results

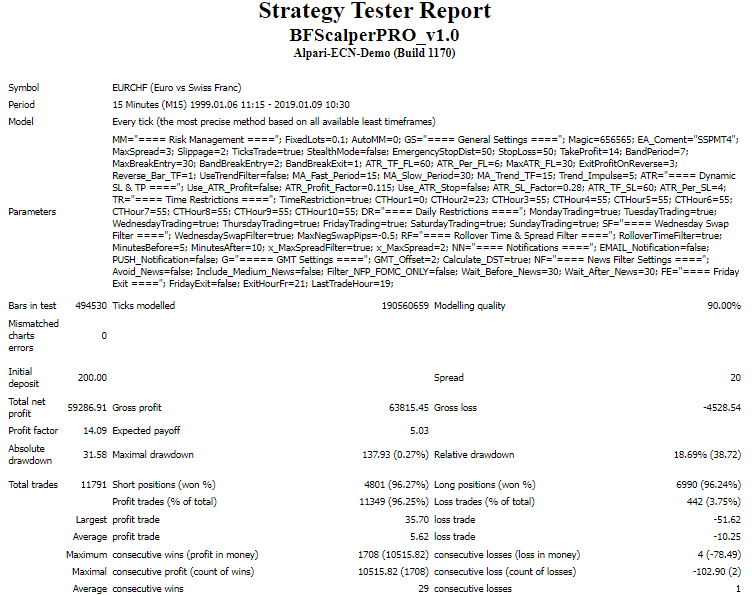

A few backtesting reports are present on the official site. Here is one of the strategy tester reports for this FX EA.

From the above report, we can see that the backtesting was done for the EURCHF pair using the M15 timeframe. For an initial deposit of 200, the net profit generated for the account was 59286.91. Profitability of 96.25% and a profit factor of 14.09% were present indicating a decent performance. The maximum drawdown for the account was 0.27%. A 90.00% modeling quality was used for the test which is not sufficient for finding details like the slippage, spread, commissions, etc.

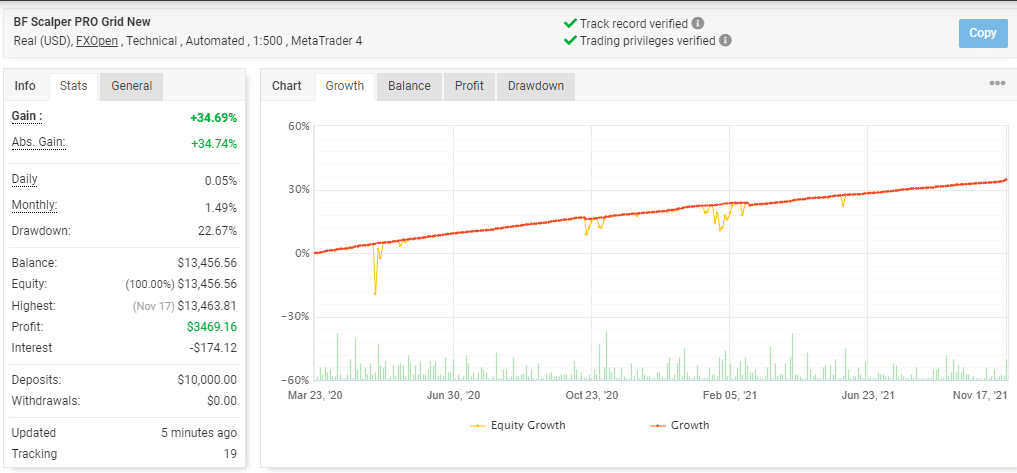

The vendor provides a verified live trading result for this FX robot. Here is the real USD account using the FXOpen broker with the leverage of 1:500 on the MT4 platform.

From the above trading stats, we can see the account that started in March 2020, reveals a total gain of 34.69% and an absolute profit of a similar value. The daily and monthly profits are 1.49% and 0.05% respectively. A drawdown of 22.67% is present for the account, which indicates a risky approach.

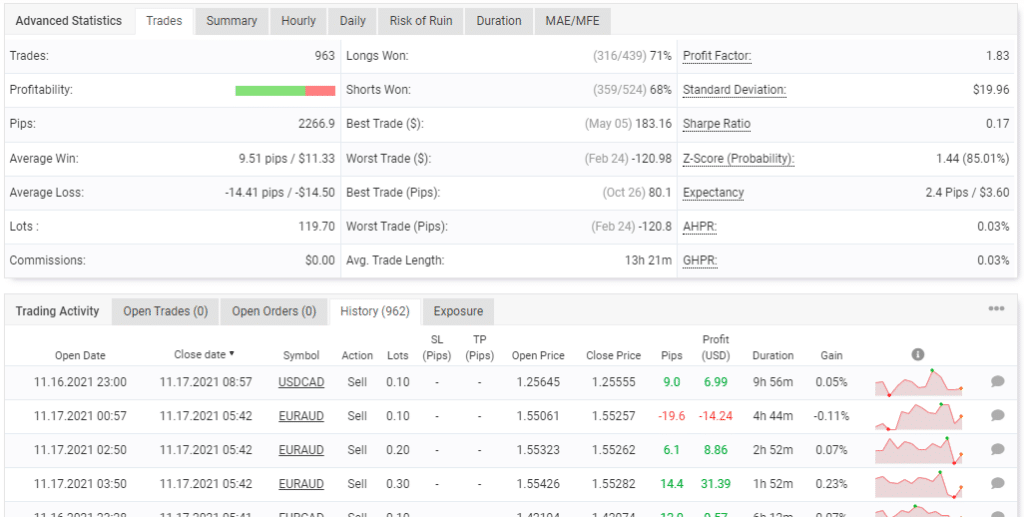

For a deposit of $10,000, a total of 963 trades have been executed with a profitability of 70% and a profit factor of 1.83. From the trading history, we can see the lot size used varies from 0.10 up to 0.30. The high drawdown and varying lot size show a risky approach. Further, comparing the results with the backtests shows that the performance is not as good as seen in the backtesting.

The core team

FXautomater is the company promoting this FX robot. The company is dedicated to creating fully automated FX trading tools. Its developer team has over 50 years of combined trading experience. There is no info on the founding year, the developer team, their skills, a location address, or phone number. The lack of vendor info shows this is not a reliable system.